-

FacebookDavesGoodsAsked on November 21, 2016 at 8:53 PM

I am running a business out of Washington State.

I accept the requirement to charge individuals State tax for Washington State (If their billing address is for Washington State).

I need clarity on how not to charge for Washington State Tax for individuals not located in Washington State, and reside in other states, or countries.If you already have an example of how to do this, please provide the reference.

Thank you.

Page URL: https://form.jotform.com/63247791980164 -

liyamReplied on November 21, 2016 at 10:59 PM

Hello FacebookDavesGoods,

You can set a State tax setting on your payment form. But take note that you will need to have an address field on your form in order to make use to set up taxes based on State.

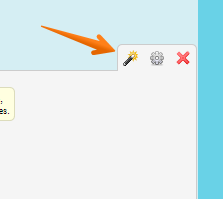

1) Edit your form

2) Open the payment field wizard (the window on how you add your products)

3) Under Tax, go down to Set Tax Options from a Location Field (this is where your payment wizard picks up your address field)

4) Select State/Province

5) Enter the information for tax rate per State that you want.

6) Once done, complete the wizard and save your form.

If you have questions, please let us know.

- Mobile Forms

- My Forms

- Templates

- Integrations

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

PayPal

Slack

Google Sheets

Mailchimp

Zoom

Dropbox

Google Calendar

Hubspot

Salesforce

- See more Integrations

- Products

- PRODUCTS

Form Builder

Jotform Enterprise

Jotform Apps

Store Builder

Jotform Tables

Jotform Inbox

Jotform Mobile App

Jotform Approvals

Report Builder

Smart PDF Forms

PDF Editor

Jotform Sign

Jotform for Salesforce Discover Now

- Support

- GET HELP

- Contact Support

- Help Center

- FAQ

- Dedicated Support

Get a dedicated support team with Jotform Enterprise.

Contact SalesDedicated Enterprise supportApply to Jotform Enterprise for a dedicated support team.

Apply Now - Professional ServicesExplore

- Enterprise

- Pricing