The two primary ways to accept online payments are through credit and debit cards, but you need to accept payments in all of the ways customers want to pay or risk losing sales (or donations, if you operate a nonprofit). For both consumers and sellers, ACH is an attractive alternative for making and accepting online payments.

If you aren’t accepting ACH payments already, now is a good time to start. ACH payments increased by 8.7 percent between the fourth quarters of 2017 and 2018, and the ACH Network reported its largest annual growth rate in 12 years in 2019.

ACH is the most well-established payment infrastructure in the United States. ACH payments are so common that your customers probably use this payment method already, even if they don’t recognize the term. Common electronic fund transfers made via the ACH Network include Direct Deposit for paychecks, e-check payments, and recurring bill payments deducted automatically from a checking account.

If you want to accept ACH payments, here’s what you need to know.

Pro Tip

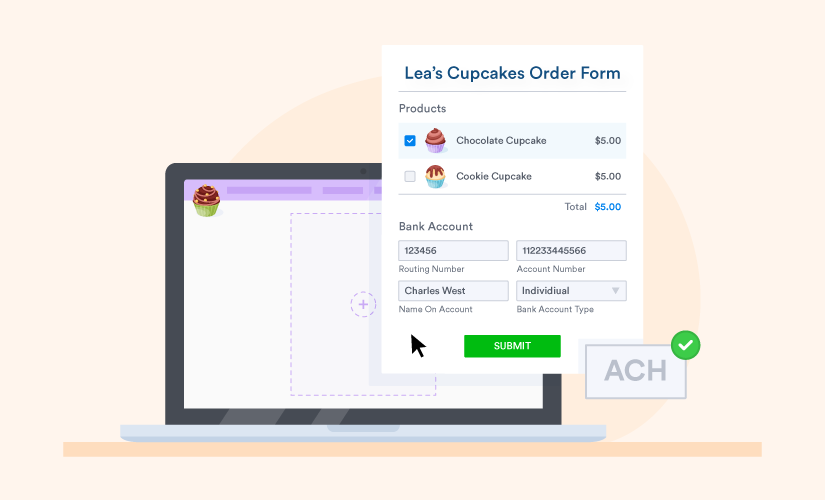

Did you know you can collect ACH payments online using Square and Stripe? Learn how to make a custom ACH form for your business and get paid fast!

What site operators need to accept ACH payments online

To start accepting ACH payments on your website, you need to do two things:

1. Set up a merchant account for your bank to interact with the ACH Network.

A merchant account is a specialized commercial bank account that allows sellers to accept credit and debit cards. Usually, but not always, a merchant account can also plug into the ACH Network, so be sure to choose a provider who is affiliated with the ACH network.2. Integrate an ACH-ready payment gateway into your site.

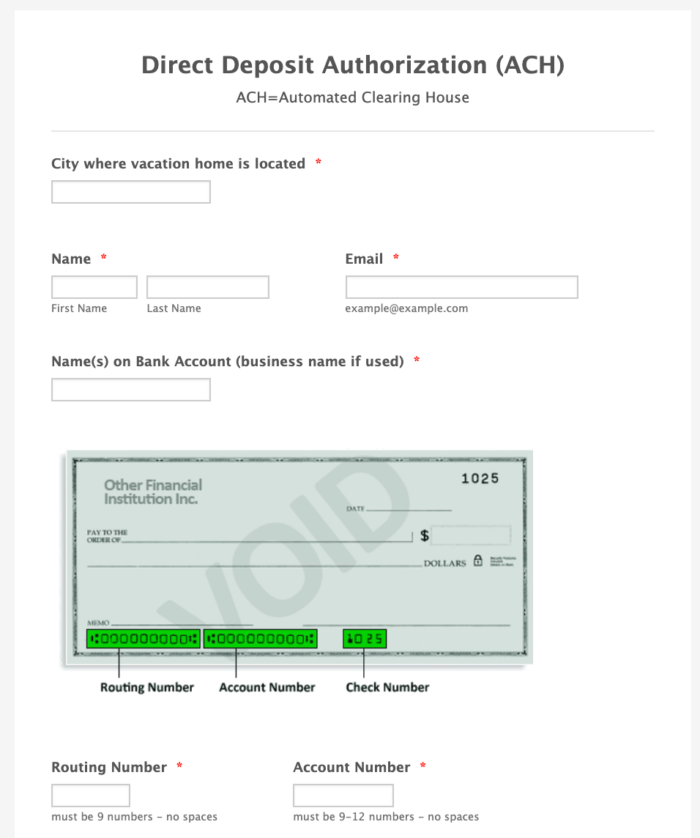

While your merchant account allows you to accept ACH payments, you still need a simple and safe payment gateway for customers to provide payment information. Payment gateways are software packages that integrate into your site or come pre-integrated on your e-commerce platform. They protect your customers’ financial information and transmit secure payment details to the payment processor.

Accepting ACH payments without an independent merchant account

Many leading payment gateway providers offer both merchant accounts and processing services. A few of the systems allow you to accept ACH payments through your website simply by checking the right boxes.

A few of the major payment gateways that accept ACH payments alongside credit and debit cards include Authorize.Net (through add-on service eCheck.Net), Stripe (with instant customer verification from Plaid), and BluePay. Some hybrid gateways, like Dwolla, only support ACH payments.

When choosing a payment gateway, ease of use for both you and your customers is key. With Jotform’s ACH integrations, customers can easily make ACH payments.

A successful ACH payment integration for a B2B company

Digital branding and design company Delt recently decided to abandon credit card payments in favor of ACH transactions. According to Matt McKenna, founder and head of design at Delt, this change saves the company about $400 per month in credit card processing fees.

Some Delt customers pay a fixed monthly fee, while others make one-time payments. The business uses two integrations to allow clients to pay online through the ACH Network, McKenna says.

“For our ongoing clients who pay us a fixed fee monthly, we use a combination of our accounting software, Xero, and a payment gateway that specializes in ACH payments, GoCardless,” McKenna says. “For clients not set up on autopay, we integrate a Stripe gateway that only accepts ACH payments into their project dashboard.”

If you’re ready to accept ACH payments in your online business, take McKenna’s story as encouragement that all you have to do is choose the right payment partners.

Send Comment:

2 Comments:

More than a year ago

Hi please I need your help I have website

My website name www.Ashley woodworking machine.com Ian looking to add. ACH payment tel my Customer can use to send me a payment or I need to add to to my Customer option tell him pay buy ACHpayment

More than a year ago

We are using Zoho Books for accounting . I have some customers requesting to pay by bank account. So I need to look into set up ACH processing. Ideally a customer can click a URL and send the payment to us, without my staff having to enter their bank account information, or risk data incompliance by us hosting customer bank account information.