Equating a virtual merchant with an online storefront is a gross oversimplification. A virtual merchant is much more than simply a digital business.

When you go through the proper process to become a virtual merchant, the end result is an online experience that allows customers to visit a fully stocked online store, easily browse the items on offer, and check out smoothly and easily — as well as get speedy order fulfillment.

The elements of a virtual merchant

The merchant account

Obtaining a merchant account is probably the most critical step because there isn’t much point in proceeding without one. A merchant account is a contract between a seller and a credit card processing company (sometimes referred to as the “acceptor” and the “merchant acquiring bank”).

An important thing to remember here is that this isn’t a contract to process the actual payment. What you’re purchasing is the customer’s ability to present their VISA card when they want to buy something and your ability to say, “Yes, we accept VISA here.” For this privilege, the virtual merchant pays a percentage of each transaction to the provider of the merchant account.

E-commerce capabilities

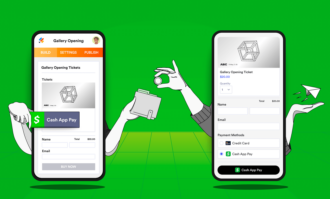

This is probably the broadest category in the virtual merchant process. Loosely defined, e-commerce capability is the ability to actually accept the payment for the goods or services a customer is purchasing.

You can get this capability through a service as simple as PayPal, as third-party and all-inclusive as Amazon Web Services, or as technically complex and customizable as building a solution yourself. For the purposes of this article, we’ll use the model of a small business that wants to set up a payment gateway.

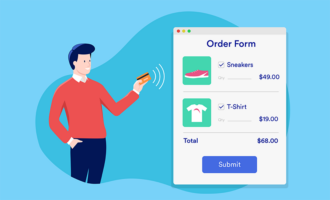

A payment gateway is a third-party service that authorizes credit card transactions. When a customer enters their credit or debit card information and presses the submit button, your site will send it to a payment gateway. The gateway forwards the information to the acquiring bank and then to the issuing credit card company. The credit card company will send a response that informs the vendor whether credit is available.

If the customer has available credit, the transaction goes through. Otherwise, the transaction is denied. Payment gateways can also offer services beyond online ordering — such as fraud detection and reporting features — which the provider may include with their package or offer as an à la carte service.

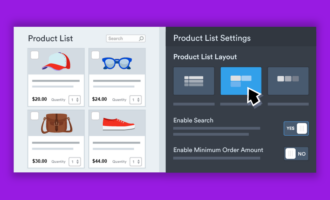

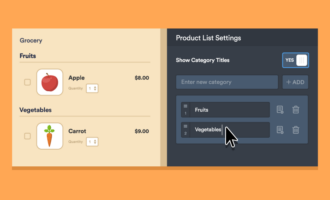

There are many third-party solutions that offer online payment capabilities. Jotform integrates with many of these providers, including PayPal and Authorize.Net. Jotform’s library of templates can help you accept orders and payments for anything from food and clothing to donations and services.

Order fulfillment

Once your customers select what they want to purchase and pay for it, you need a way to get the goods to them. As with e-commerce services, there are many options for order fulfillment, ranging from handling everything yourself to outsourcing the entire process — including warehousing your goods — to a third party. One of the benefits of using a payment provider like PayPal is that they work with companies like UPS and the United States Postal Service to offer services like postage processing.

On the other end of the spectrum, you can select a third-party route with a dropship service provider, which can take both storage and shipping off of your hands. Dropship providers integrate well with payment services such as Shopify and Amazon. For a fee, these providers can both store and ship your products for you, relieving you of a major headache.

Other considerations

While the merchant account, an e-commerce platform, and shipping cover the basics, there are other considerations to take into account in order to operate successfully as a virtual merchant.

Costs

The costs for virtual merchant services and related services depend heavily on how much you want to take on as the business owner.

Assuming the technical duties of building and deploying your own e-commerce site certainly means less cash outlay — especially if you have the programming knowledge to do it yourself instead of employing a developer — but it’s extremely time-consuming from both a development and maintenance standpoint.

Writing a check to a provider who can take that job off of your hands can be advantageous.

Customer outreach

Driving people to your website to get them to make purchases (customer acquisition) and keeping them engaged enough to come back (customer retention) is important. SEO and email are key ways of achieving this.

SEO will ensure that customers can find you when they’re looking for the products and services you sell. Once the customer purchases from your site, email can keep the customer engaged by communicating with them about their purchases as well as other things you sell that might interest them. You’ll also need to comply with legal requirements — such as those outlined in the CAN-SPAM Act when using email — so be sure to research those in advance.

Send Comment:

1 Comments:

More than a year ago

This is an interesting article on virtual merchants and the ways they can use Jotform to streamline their operations. It offers helpful information and tips on how virtual merchants can better manage their business with JotForm. Great read!