6 great small-business tax tips

As a small business owner or entrepreneur, you have to pour your heart and soul into your business plan, your customers, and your work.

But why not apply the same rigor to your taxes?

Yeah, we know taxes aren’t sexy — or even fun. They take up valuable time, and in some cases, they can be a real pain. But taking a professional approach to your taxes can have positive outcomes for your business that go beyond avoiding legal trouble.

It turns out many of those outcomes are central to the success of your business. Here are just a few of the biggest benefits you can see if you stay on top of your taxes in an organized way:

- You can save money.

- It frees up time for you to do what you love.

- It can reduce your stress levels.

- You’ll simplify a complicated process.

- Your tax-related data will be easily accessible.

While the general small business tax rate is between 10 and 37 percent, those rates and calculations can vary based on location and your business structure. And since you may be both a small business owner and one of its employees, you can get hit with tax liability both coming and going.

As a result, taxes present a business challenge — but they’re also a hidden opportunity.

Turning your small business taxes into an asset

We’ve compiled six small-business tax tips that will help you proactively take on tax season and potentially provide benefits for you and your business.

Collect and manage your tax information in an easier way

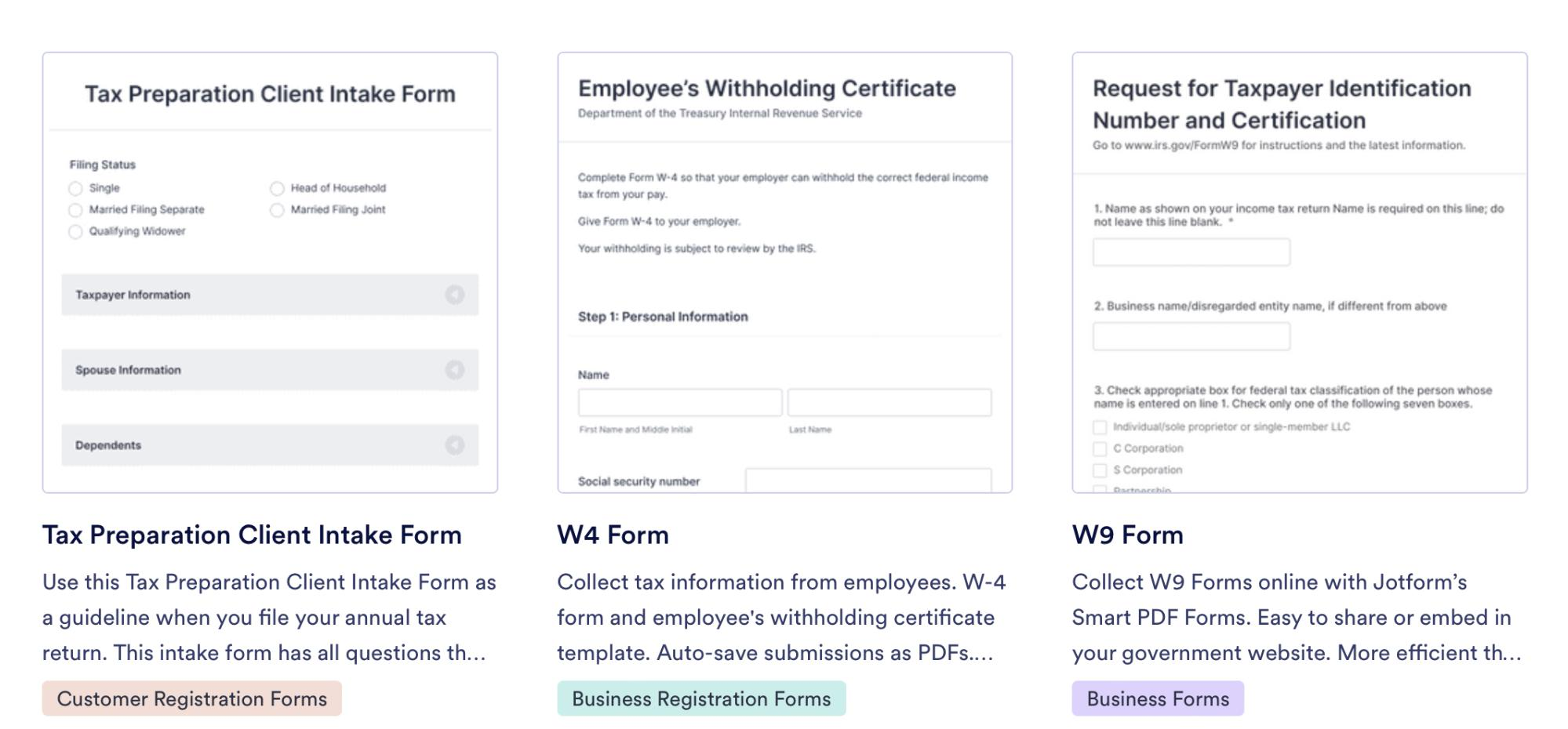

Jotform’s tax templates can help simplify tax season by turning your paper tax forms into digital ones.

Whether it’s a W-4 (employee withholding certificate), a 1040-ES (estimated tax on self-employment income not subject to withholding), or a 1040-SE (self-employment tax), simply use our Smart PDF Form templates to turn tax PDFs into online forms and back into PDFs again.

Doing so will allow you and those you work with to easily complete these records. Plus, you’ll be able to safely store data within Jotform and download PDFs to save for your records and future reference.

Reduce income tax with certain strategies and deductions

Here’s where you can really turn the ritual of doing taxes into an asset for your small business. You might be able to take advantage of little-known deductions and methods to reduce your taxes.

For example, now that things are beginning to open up after the pandemic, business owners who travel for work can deduct their business travel expenses. Also, we alluded to business structure earlier; depending on the situation, you may be better off setting up your business as an LLC instead of a corporation for tax reasons.

Consider and fully vet these options with experts before pulling any triggers, but if you can legally reduce your tax liability, your small business will benefit.

Save money with professional help

Using a tax professional — whether you go with a CPA, a tax attorney, or an enrolled agent — might come with some upfront costs, but a professional can save your business money year after year.

Tax professionals understand the pros and cons of different business structures and the kinds of deductions and tax strategies that put you in the best position. For example, a tax professional will know how to help your small business deduct charitable contributions or even student loan repayment assistance for employees.

Professional expertise can not only help your business through deductions (including a tax preparer’s fees), but if you ever have to deal with an audit, you’ll have organized and thorough tax records on hand.

Fine-tune payroll management

Whether you have a few employees or hundreds, you need to manage employment taxes accurately.

You’re required to withhold employment taxes from your employees’ wages so you can pay them on a particular cadence, whether that’s monthly, quarterly, or annually.

The good news? You can easily compute and collect the right amount, especially if you manage your employees’ W-4s with online forms. For instance, with Jotform Tables, the data from those submissions is automatically saved in a neat table, allowing you to perform calculations using formulas and lookups for connected data entries.

Stay as organized as possible

Whether you’re using a tax professional or going it alone, keeping a clean log of business receipts and accounting at the ready is critical.

Just as the kind of food you put in your body impacts your health, your taxes can only help your business if the information that goes into the forms you file is accurate. Spending time digitizing your tax forms and business receipts helps you reduce errors, minimize your dependence on paper, and keep all of your files at the ready.

Additionally, consider investing in a good accounting system. Detailed accounting helps you track transactions and summarize them into reports that help your preparer and inform your operational efficiency.

Use tax software as a backup

For a small fee (which is deductible anyway), you can set up a tax software program to handle or double-check your business taxes. Even if you’re getting professional tax help, it’s a good idea to double-check amounts and learn what you can about the nuances of your business taxes.

Taking the sting out of taxes

The last couple of years, in particular, have been hard on small businesses. It’s understandable that the last thing you want to deal with is taxes.

But if you give them the attention they need by getting professional assistance, maintaining complete records, and understanding various business deductions, you can make things a little easier for yourself and your business.

Send Comment: