Whether you’re launching a startup or turning your passion into a small business on Etsy, once your idea attracts customers, you need to give them an easy way to pay you.

PayPal has been a go-to payment processing solution for small to medium-sized business (SMB) owners because of its ease of use and ability to facilitate international transactions. But should you choose a personal account or a business account? Here, we break down differences between a PayPal business account vs personal account to help you decide which is best for you.

Pro Tip

Whether you use a PayPal personal account or business account, you can integrate PayPal with Jotform to seamlessly collect payments through your website.

PayPal business account vs personal account: The differences

A PayPal business account offers all the features of a PayPal personal account plus others that can help both budding professionals and already successful companies grow and scale.

Here are the key differences between the two types of PayPal accounts.

PayPal personal account

This type of account is ideal for sellers who plan to market their goods and services only occasionally or informally.

Personal accounts

- Are designed for online shopping and sending money to friends and family

- Can be used to sell goods and services in small amounts

- Offer less privacy, as buyers can see your full name

- Don’t allow you to accept as many forms of payment as business accounts

To set up a PayPal personal account, you need

- Full name

- Address

- Phone number

- Email address

- Debit or credit card information (optional)

- Checking account number and routing number (optional)

PayPal business account

PayPal business accounts offer a suite of services to everyone from freelancers to SMB owners who need a no-hassle, affordable payment processing solution.

Business accounts

- Offer invoicing, financing, third-party integrations, subscription payments, and in-person transactions

- Offer a point-of-sale system

- Integrate with websites to create a smooth e-commerce experience

- Allow account access for up to 200 employees

- Provide a suite of services, such as shipping, payment tracking, and e-commerce platform integrations

- Can be registered under a company name to protect privacy

Here’s what you need to set up a PayPal business account. Additional steps are required to accept credit cards.

- Account owner’s name and address

- Email address

- Business name and address

- Business customer service contact information

- Your social security number or your business’s tax identification number

- General business information (e.g., business type, keywords associated with your business, etc.)

- Bank name

- Business or personal bank account number

- Bank routing number

PayPal business account vs personal account: Pros and cons

Personal account pros

- No charge for transfers made from a linked bank account or PayPal Balance account

- No setup costs, monthly fees, or termination costs

- Quick way to make online purchases or send money

- Easy payment options for people who occasionally sell items online

- Free to transfer money from sales to a linked personal bank account. Or, pay a 1.75 percent fee (maximum of $25) to instantly transfer funds through a Visa debit card linked to your bank account.

Personal account cons

- PayPal charges fees for accepting debit and credit card payments online.

- Users selling goods and services online have limited access to merchant services.

- It can be difficult to separate business and personal transactions for tax purposes.

Business account pros

- No setup costs, monthly maintenance fees (for debit and credit card payments), or termination fees

- More privacy than a personal account, as you can register accounts under a company or business name

- Ability to collect payments via credit card from non-PayPal customers

- Access for up to 200 employees, with custom access levels for every user

- Ability to track payments and profits

- Live customer support

- Access to PayPal business tools and products, such as PayPal Checkout

- Sellers can collect and process payments in store via PayPal Zettle, PayPal’s point-of-sale system

Business account cons

- Merchants are charged fees for each purchase.

PayPal business account vs personal account: Fees

The best part about both types of account is that neither charge for setup, maintenance, or cancellation. PayPal only applies transaction fees when you sell your first item via your PayPal account. Apart from that, the fees for selling goods or services are the same for both types of accounts.

When you request payment with a personal account, you can specify whether the transaction is “for goods and services” or “friends and family.” If you choose goods and services, you’ll be charged the same merchant fees as a business account.

PayPal does provide incentives to those who want to casually sell products or services through a personal account. By setting up a seller profile on a personal account, you can get more visibility for your business. You’ll also be able to offer buyers purchase protection, which can build trust with customers.

Here’s the breakdown of fees for sending money to friends and family vs making commercial transactions with both business and personal accounts.

Receive funds from friends and family with a personal account

- Domestic: No fees for transferring from your PayPal balance or a bank account

- International: 5 percent plus an international fee of $0.09–$4.99

Receive funds for goods and services from personal accounts

- Domestic: 2.99 percent (plus a fixed fee for card payments)

- International: 4.49 percent, plus a fixed fee based on the currency

Sales from business accounts*

- Domestic: 2.99 percent, plus a fixed fee based on the currency

- International: 4.49 percent, plus a fixed fee based on the currency

*Transaction fees vary for merchants who use a PayPal QR code or PayPal in-store card reader, for 501(c)(3) organizations, and for micropayments.

Here’s a quick overview of seller transaction fees for a PayPal business account versus a personal account.

| PayPal Business Account | PayPal Personal Account (for goods and services transactions) | |

|---|---|---|

| Online payment made with a PayPal balance or bank account in the U.S. | 2.99 percent + $0.49 | 2.99 percent |

| Online payment made with a credit card or debit card in the U.S. | 2.99 percent + $0.49 | 2.99 percent + $0.49 |

| Online payment made from an international account or card** | 4.49 percent + fixed fee based on currency | 4.49 percent + fixed fee based on currency |

**Includes a 1.5 percent fee for any international commercial transaction.

Jotform’s PayPal integrations

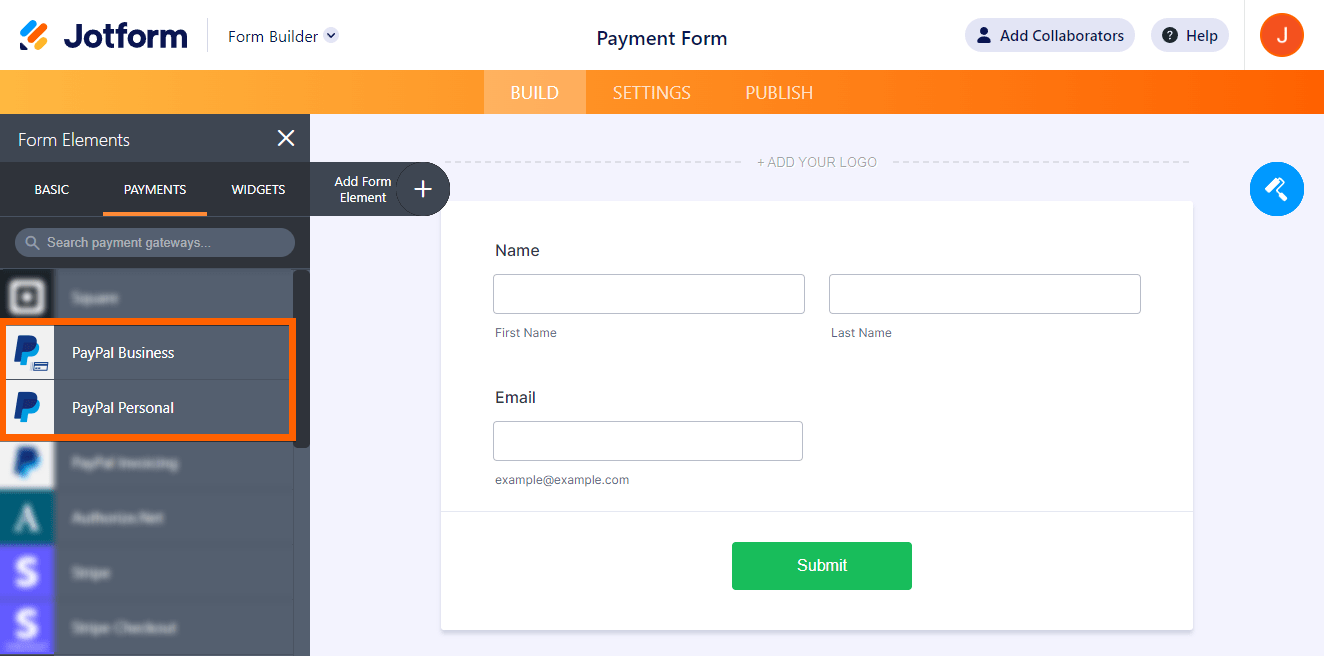

Whether you use a PayPal personal account or business account, you can integrate PayPal with Jotform to collect payments through a customized order form on your website. Jotform supports several PayPal account types, including business and personal. You can easily insert these payment gateways into your forms through our Form Builder’s Payments tab.

PayPal business account vs personal account with Jotform

PayPal Personal

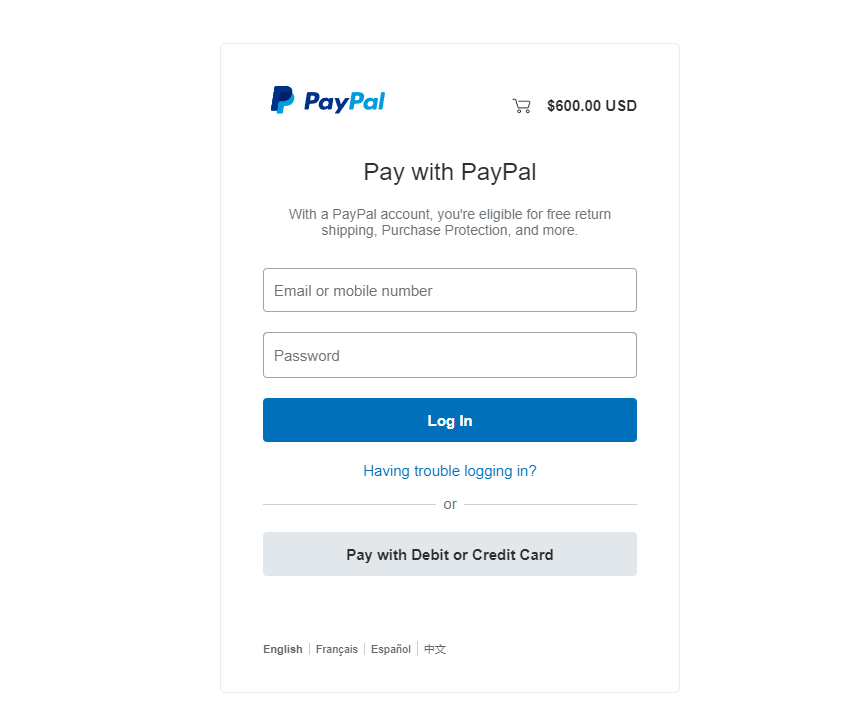

Your form will direct your customers to the secure PayPal payment page when they submit your form. They will have two options to pay:

- Log in and pay with their preferred payment method using PayPal

- Pay with debit or credit card (only if you enable PayPal Account Optional or guest checkout)

Notes

- PayPal Account Optional or guest checkout is only available in supported countries like the U.S., Canada, and the UK. If you created your account in one of these countries, click here to enable the account optional feature.

- If you did not enable guest payment/checkout or if you created your account outside of supported countries, your customers will see the Create Account button instead.

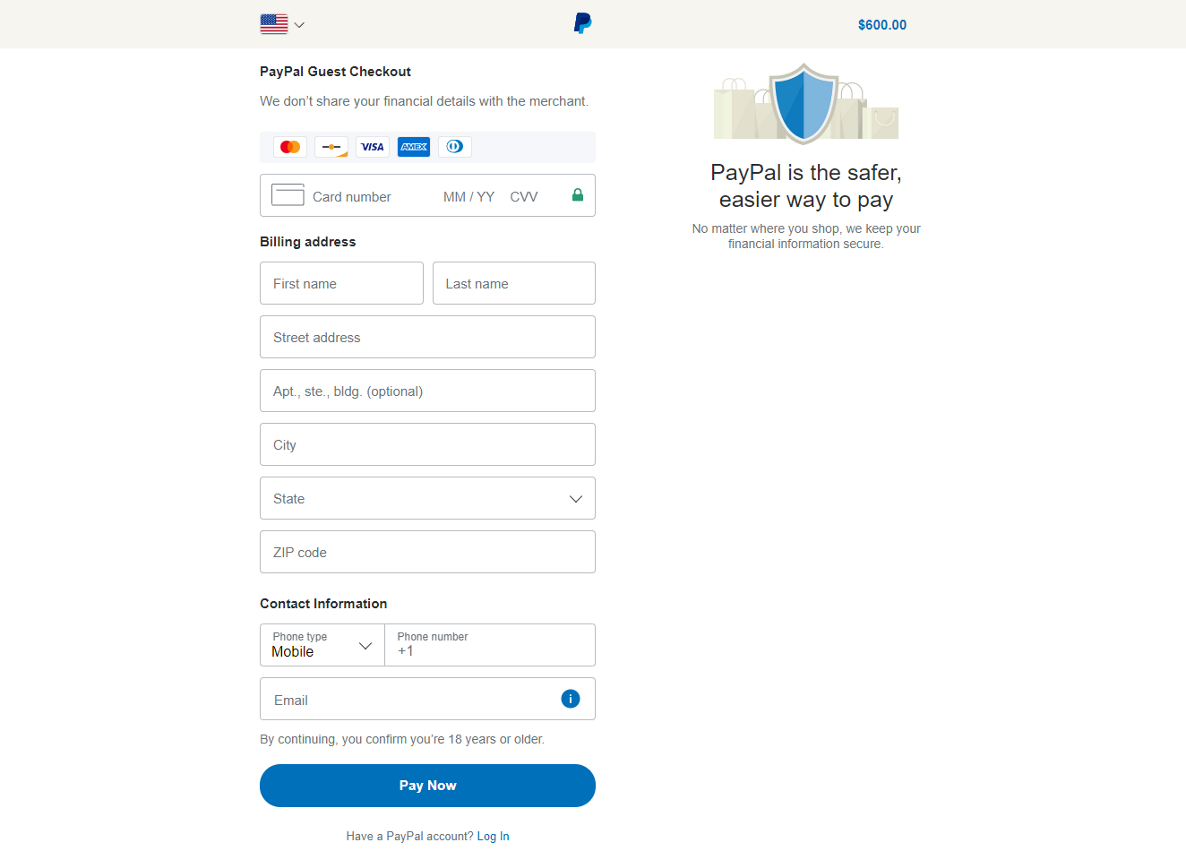

When your customers click the Pay with Debit or Credit Card button, a separate page will open where they can enter payment details. Here are demo forms you can try to see how this will look:

PayPal Business

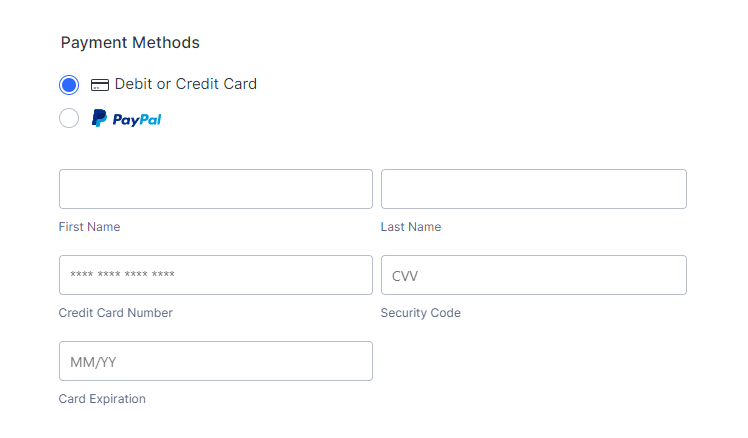

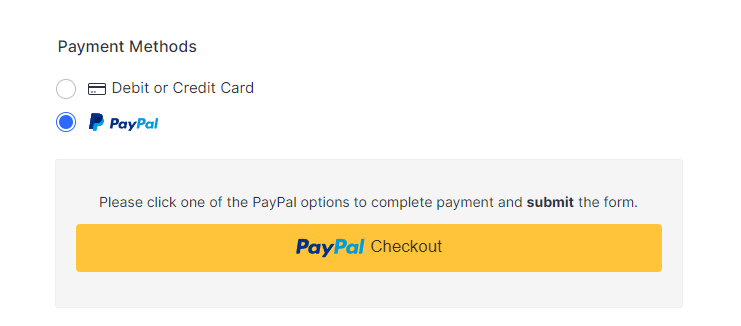

Using PayPal Business allows your customer to pay directly in the form instead of redirecting them to the PayPal payment page, providing a seamless checkout experience. Customers have two options: Debit or credit card or PayPal. If they choose the debit or credit card option, they must enter their card details as shown in the image below.

If they choose PayPal, they must click the PayPal Checkout button and then log in to their PayPal account to pay.

Note

PayPal may provide your customers with an alternative payment method (APM) based on their location.

Here’s a demo form for PayPal Business to preview the integration.

PayPal makes transactions simple and Jotform makes using PayPal quick and easy. No matter your needs, there is a PayPal account waiting for you to help your business take off.

Send Comment:

8 Comments:

160 days ago

How to get many by paypal ?

More than a year ago

Please my personal account me my is account accept and business

More than a year ago

One drawback of a PayPal Account (Personal) is that the buyer will see your full name on each purchase. What’s more, you won’t be able to accept as many forms of payment as you could with a business account (e.g., you can’t allow people to pay via invoicing) or take advantage of many of the other features a PayPal business account offers.

More than a year ago

The Pro's of Personal account says:

-There is no charge for transfers made from a linked bank account, PayPal Cash, or a balance from PayPal Cash Plus.

However, no where in the Business account there is mentioning about this. So, does it mean there is a charge in the business account, or not?

Thank You.

More than a year ago

Great article learn a lot it was simple and easy to understand, as i am trying to use paypal to receive money online through website. Thank you

More than a year ago

I'm planning to use my Personal account to sell my services, but I have a couple questions, please help.

1) Is there a limit to how many times I can sell? If so, how many transactions do I get?

2) Is there a limit to how much I can receive by selling? If so, how much?

More than a year ago

Great article! I do want to point out a couple of things though as I have recently been using PP exclusively when I sell as it offers both buyer AND seller protection. While using my personal account (trying to decide if a business account would better suit my needs), I am able to send out invoices to customers that include detailed info on item as well as being about to choose a shipping method and print the labels- all from a personal account. True, it does not give you as much privacy concerning some things (such as your name) however those are things that are not just exclusive to a business account.

More than a year ago

Business accounts cannot do Money Pools like personal can