Being financially responsible involves keeping track of a lot of numbers. And while we all would love the longest number to be our account balance, that’s not the case for most of us. The longest numbers we see on a check are usually ACH numbers or our account numbers. But how can you tell the difference between them?

ACH number vs account number

ACH number

ACH routing numbers are unique to banks and their branches. The ACH routing number facilitates the rapid transfer of money from one bank to another.

This number designates electronic transfers of typically small payments, such as utility bills, that may be made once or on a recurring basis. There are different types of transfers, each distinguished by a specific code.

ACH routing numbers are always nine digits long, and the first two digits often range from 61 to 72. This number may be the same routing number as the one on your checks, but they can be different, so you should verify with the bank or through your online banking portal before using it. The ACH routing number will typically be labeled as “electronic deposit” or “direct deposit.”

Pro Tip

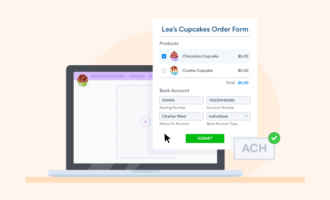

Did you know you can collect ACH payments online using Square and Stripe? Learn how to make a custom ACH form for your business and get paid fast!

Account number

You’re probably quite familiar with your bank account number. Every bank account has a unique account number, comparable to a customer ID or fingerprint. Account numbers are less standardized than ACH numbers, ranging from eight to 12 digits in most cases.

While you share the same ACH routing number (or numbers) as all the other customers at your bank, your account number is uniquely your own. Think of these numbers like the address where you live. The ACH routing number is like the city or town where you reside, while the account number is similar to the address of your house or apartment.

You may have several accounts, but each will have a unique account number. ACH numbers are public knowledge, while your account numbers remain private to you.

You can find both the ACH number of your bank and your account number on a check or in your online account. You need both numbers to set up electronic transactions, like having your paycheck directly deposited into your account or setting up your cable bill for autopay each month.

If you’re unsure which number is which, contact your bank to verify so you don’t make a costly mistake.

Send Comment:

4 Comments:

More than a year ago

Thank you!

More than a year ago

has also helped me a lot apart from your payment mode.

More than a year ago

I had a good ACH experience from OnlineCheckWriter software as it helps me to send ACH without any transaction fee.

More than a year ago

I need to get ACH payment number