Both businesses and consumers use the Automated Clearing House (ACH) payment network every day, often without realizing it. Typical ACH transactions include transferring money between bank accounts or scheduling an automated monthly withdrawal from your checking account to pay a recurring bill. The ACH network has simplified every sort of funds transfer.

Below we describe two distinct ACH transaction types, along with practical examples of each.

Direct deposit

An ACH direct deposit is when funds are deposited by a business or government entity into a recipient’s bank account. Direct deposits are used for a variety of purposes, but the most common is for payroll. Many employers process payroll and transfer funds into employees’ accounts via ACH direct deposit.

Federal and state tax refunds are often done with ACH transfers. The advantages of this became apparent with the stimulus checks sent to millions of American taxpayers to offset the economic downturn caused by the COVID-19 pandemic. People who normally receive tax refunds through direct deposit, which is synonymous with an ACH transfer, quickly received their stimulus money, while the people who receive their refund by check had to wait for weeks.

Companies that use ACH direct deposits for payroll typically opt to reimburse employees for out-of-pocket expenses in the same way. The employee files an expense report for their purchase, and the company then reimburses them through an ACH direct deposit.

Private and public pensions, including Social Security payments as well as payments from annuities that many people establish for retirement, are often made with ACH transfers.

Pro Tip

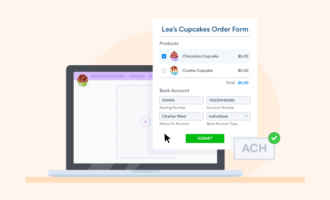

Did you know you can collect ACH payments online using Square and Stripe? Learn how to make a custom ACH form for your business and get paid fast!

Direct payment

Individuals and businesses use ACH direct payments to send money. An ACH direct payment can be processed as either a credit or debit transaction. Credit direct payments push funds into an account, while debit direct payments pull funds from an account.

Assume you have two bank accounts, each at a different bank. You’re making a credit direct payment when you go online to transfer funds from one bank to the other.

Most people have recurring bills — utilities, mortgage or rent, cable, internet, and so on — in the same amount each month. It’s common practice to simply pay the bill each month directly from a personal checking account. Each month, the bank pushes funds from your account into the account you have set up with the respective businesses. These are also considered credit direct payments.

While it feels the same to the person paying the bill, you can set up recurring payments with the businesses directly instead of through your bank. Each month, the business requests funds from your bank based on the account information you provide. These are debit direct payments, since the company is pulling funds from your account instead of your bank pushing funds to the companies.

The magic of ACH payments is that this entirely different process is just as seamless for the consumer and the company.

Send Comment: