The owners of small businesses like talking about payments. After all, payments represent money flowing in. Business owners get paid in many ways, including cash, checks, credit and debit cards, prepaid cards, and mobile wallets. ACH payments are one of the lesser-known payment methods, but this method has a number of great benefits.

ACH is the most commonly used mechanism for making payments and transferring funds electronically. In the first quarter of 2020 alone, there were more than 6.4 billion ACH transactions in the U.S.

This is important to keep in mind because even consumers without a credit card, or those who don’t use a mobile wallet, likely have bank accounts. Small businesses that accept ACH payments directly from a customer’s bank account can sell to this segment of the market.

Several small business owners who offer ACH as a payment option share their thoughts and stories about using this method below.

Pro Tip

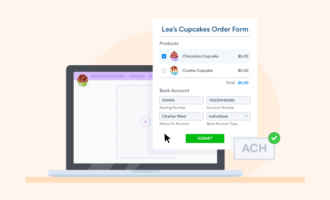

Did you know you can collect ACH payments online using Square and Stripe? Learn how to make a custom ACH form for your business and get paid fast!

Why small businesses use ACH payments

“Compared to other payment methods, I find ACH payments to be more secure because there is a clear digital trail to follow,” says Chad Otar, CEO of Lending Valley.

Imagine if a client pays with a check; it could get lost in the mail or arrive after the payment due date. Taking the ACH route with payment processing gives you greater peace of mind. “You can set it up and not worry about it. It’s a must-use at my company,” Otar says.

“When I get an email from a new or current client saying they want our banking information so they can pay invoices with ACH, I do a little celebration dance,” says Benjamin Walker, CEO of Transcription Outsourcing. He’s happy for two key reasons: It means one fewer check to take to the bank, and he won’t have to pay any credit card transaction charges.

For small businesses, every dollar counts. “We can put more money into marketing. Plus, we see our money from ACH faster than with credit cards. Can’t get much better than that,” Walker says.

CEO Dan Uyemura runs PushPress, a gym management platform. His clients are gyms that have many customers on recurring membership plans. Through the platform, the gyms can set up ACH payments to draw funds from customer bank accounts every month.

Uyemura admits that his general preference for small businesses is to take credit cards, despite the higher cost, but he concedes that ACH works well in contexts like gym memberships. “Gyms aren’t single-visit transactions, so you don’t have to worry about someone using the service and then not paying. You can easily address any payment issues when the person comes in.”

Mike Frederick, CEO of Flatirons Development, processes almost all of his company’s invoices using ACH. He also enjoys the low fees for using ACH. As his company often deals with large transactions, eliminating fees is a huge advantage. However, he does note one downside from his personal experience with the payment method: Funds availability for his business can sometimes lag.

“ACH can take more time to fully settle in my account when compared to wire transfers and even credit card processors,” he explains. “But ACH is still the more affordable choice, and that’s more important to me.”

Send Comment:

1 Comments:

More than a year ago

Informative article. Thanks for the useful share.