Every year, Americans all around the country scramble to identify, fill out, and submit the right tax forms for their specific life circumstances.

As those life circumstances change over time — an inevitability for most people — so do the types of forms you need to complete. It can be challenging to keep up with all the forms out there, but this article covers several common tax forms you should know about. (Be sure to bookmark this post so you can refer to it when it’s time to do taxes again!)

7 common tax forms

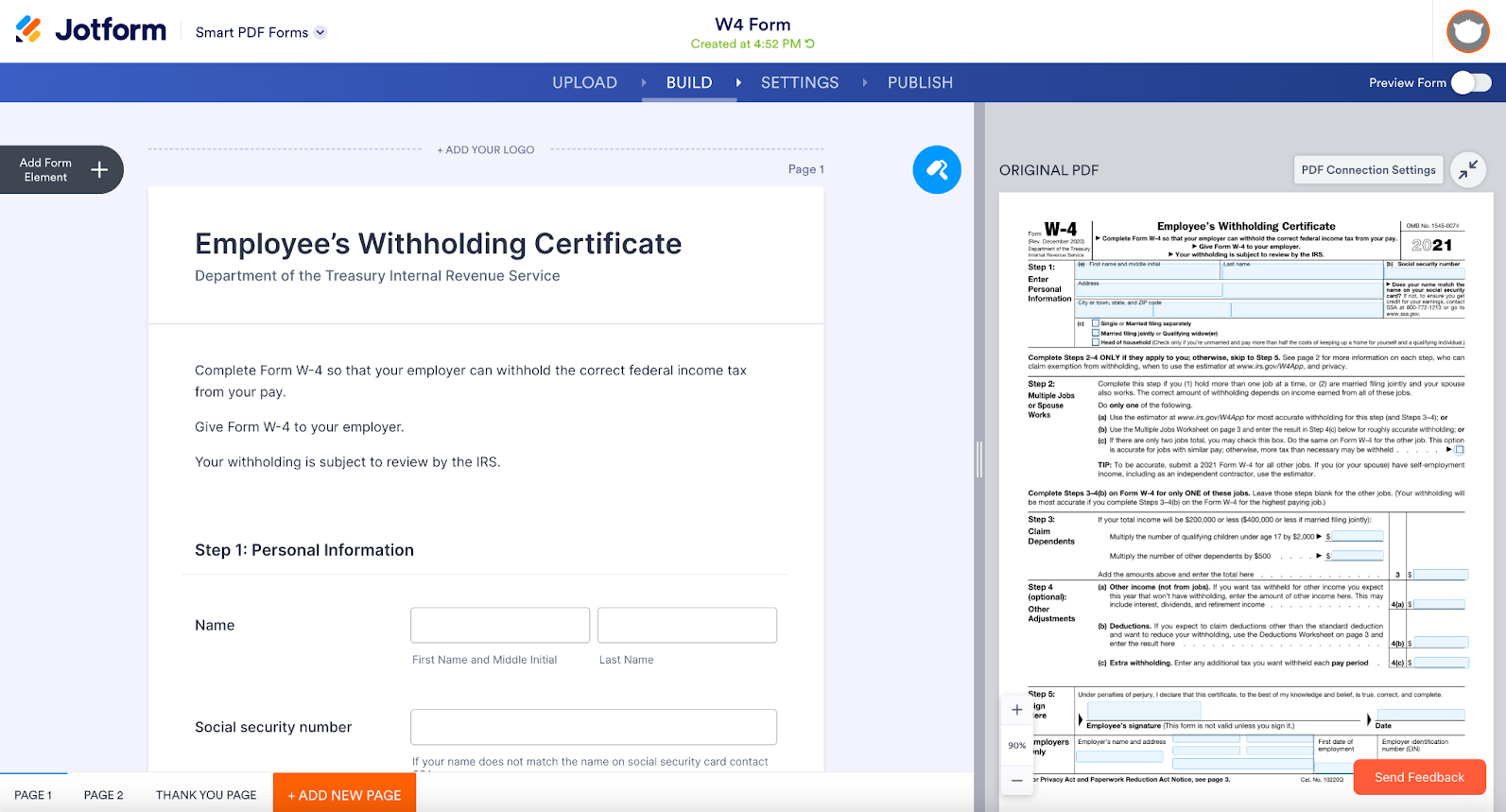

1. W-4 form

Nearly every American has seen a Form W-4 at some point. It’s one of the most widely used tax forms in the IRS’s arsenal. Form W-4, the Employee’s Withholding Certificate, is what employees use to formally communicate to their employers how much federal income tax to withhold from their paychecks. The form is short — it typically consists of four pages, and only two have any fields to enter data.

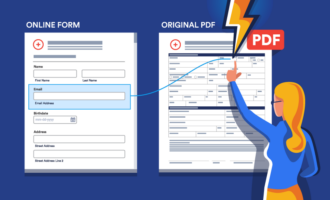

You can use Jotform, a powerful form builder, to send a simplified W-4 form to each of your employees, then easily collect and track the submissions. The form includes all the information required for the IRS’s official form, such as name, social security number, adjustments, and even a signature field. Employees’ responses will automatically populate a PDF of the official IRS form, which you can download for your records.

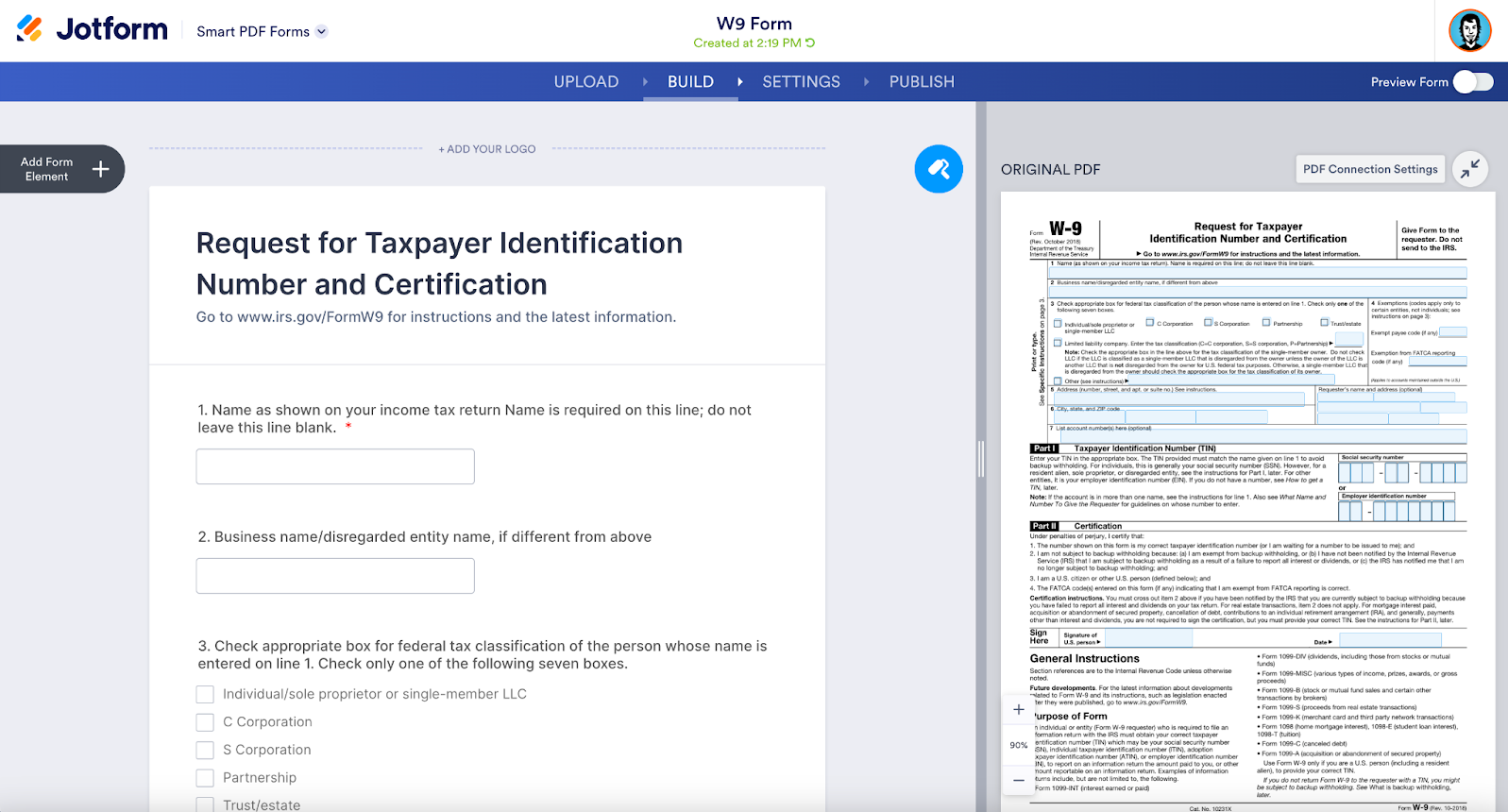

2. W-9 form

Another common tax form is Form W-9, the Request for Taxpayer Identification Number (TIN) and Certification. As its name implies, its purpose is to give people a way to inform various parties of their TIN, which is a necessity if those parties have interacted with you in certain ways and are required to report things such as

- Income they received from you

- Real estate transactions they conducted with you

- Mortgage interest they paid to you

- Acquisitions or abandonment of secured property belonging to you

- Cancelation of debt owed to you

- Contributions the employee made to an IRA you oversee

With Jotform’s W-9 generator you can immediately create and download your W-9 form or let employees or other appropriate parties to create their own W-9s and collect their TIN.

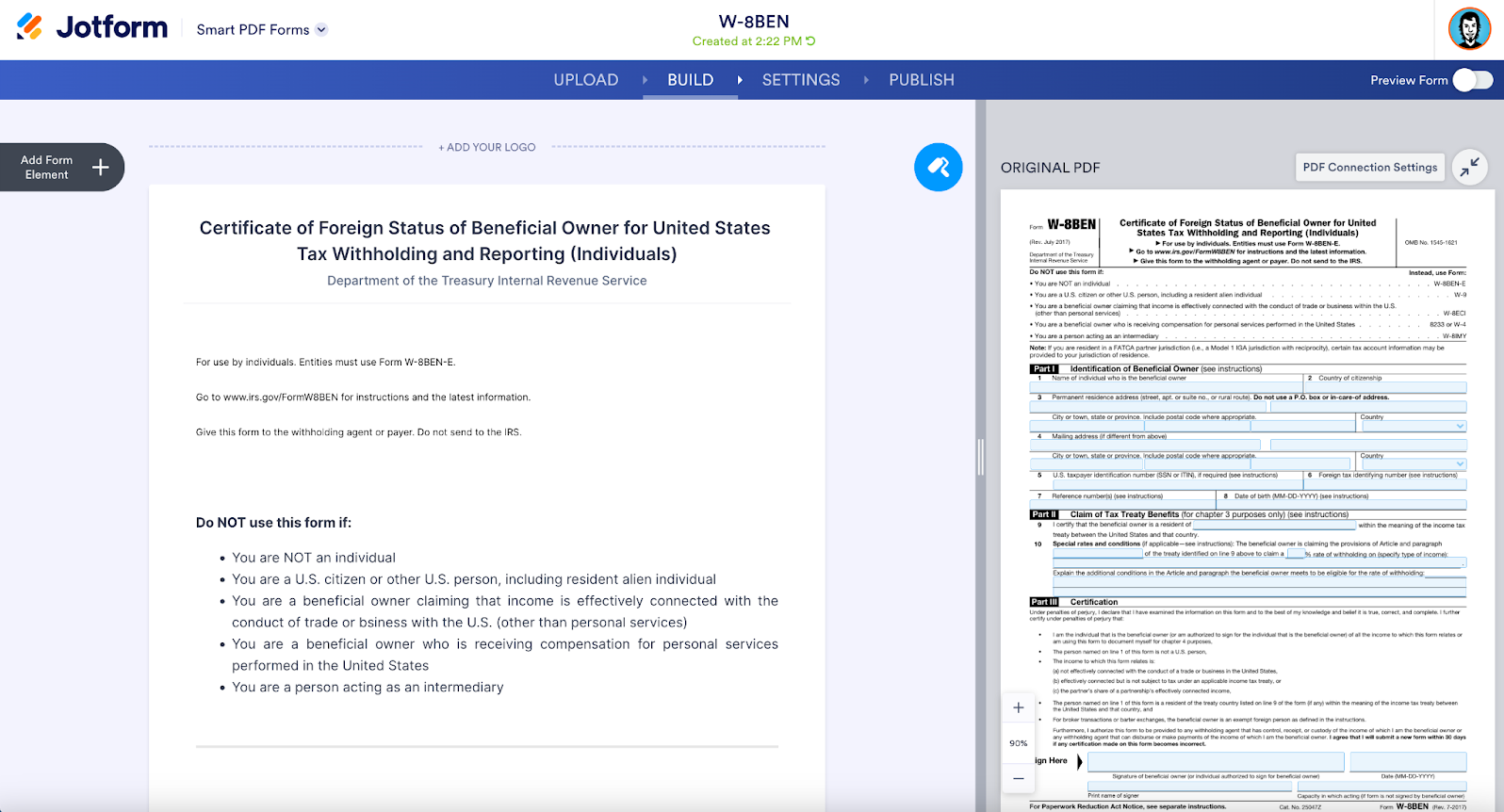

3. W-8BEN

According to the IRS, Form W-8BEN, the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) form, is for foreign people who’ve earned money that’s subject to withholding in the United States.

If you have foreign employees, use Jotform’s W-8BEN form to formally capture their certification of ownership over the money you pay them.

4. 1040

Form 1040, the U.S. Individual Income Tax Return, is one of the most common tax forms because everyone uses it — from employees to independent contractors — to file their annual income taxes.

Use Jotform’s ready-to-go 1040 form to make the filing process easy for your own tax return.

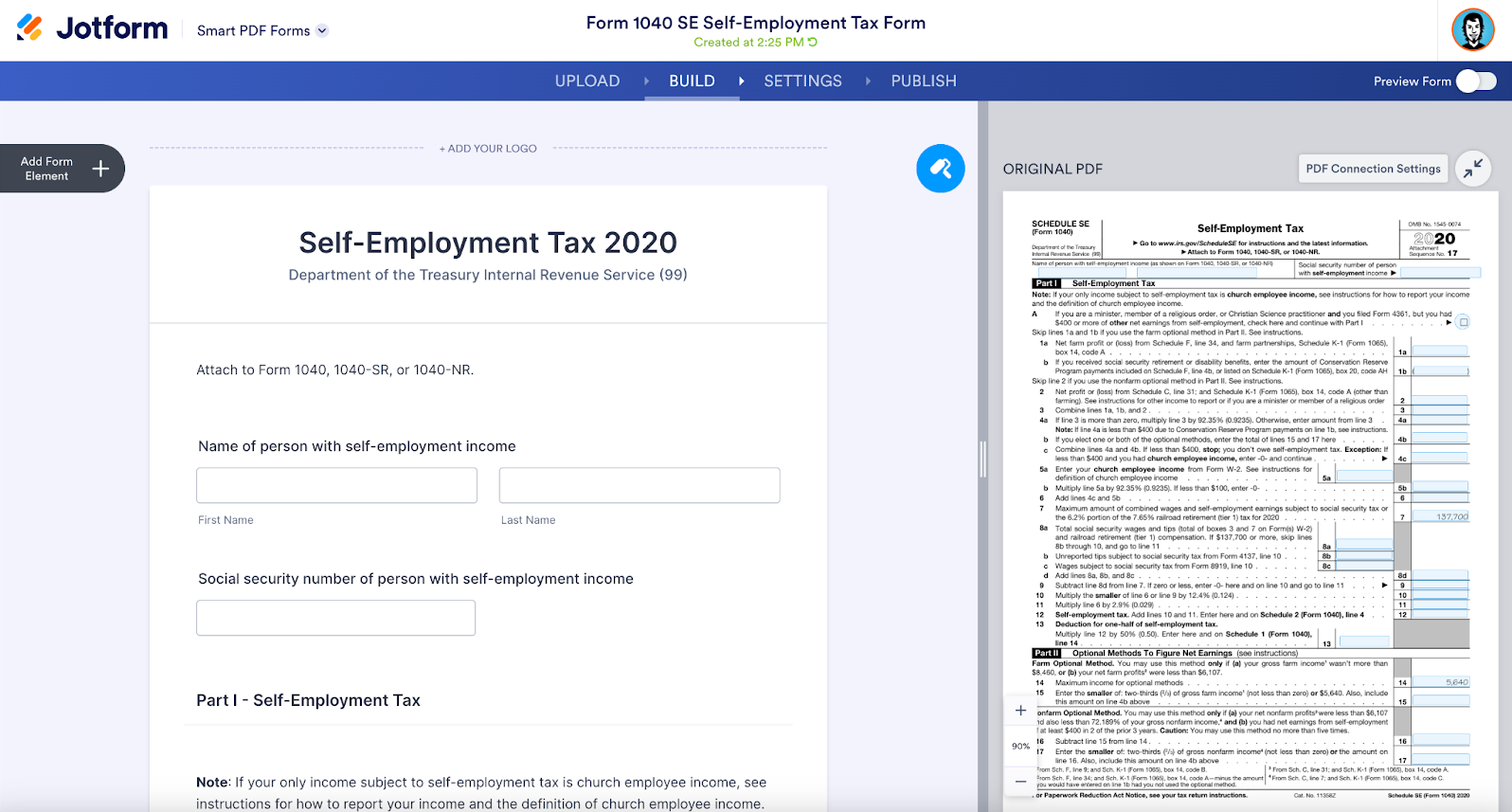

5. Schedule SE (1040)

Schedule SE (Form 1040) for Self-Employment Tax helps self-employed individuals figure out how much tax they owe on their net earnings — sales minus the various costs of doing business.

Jotform has a 1040 SE template that makes completing this form simple.

6. Form 4868

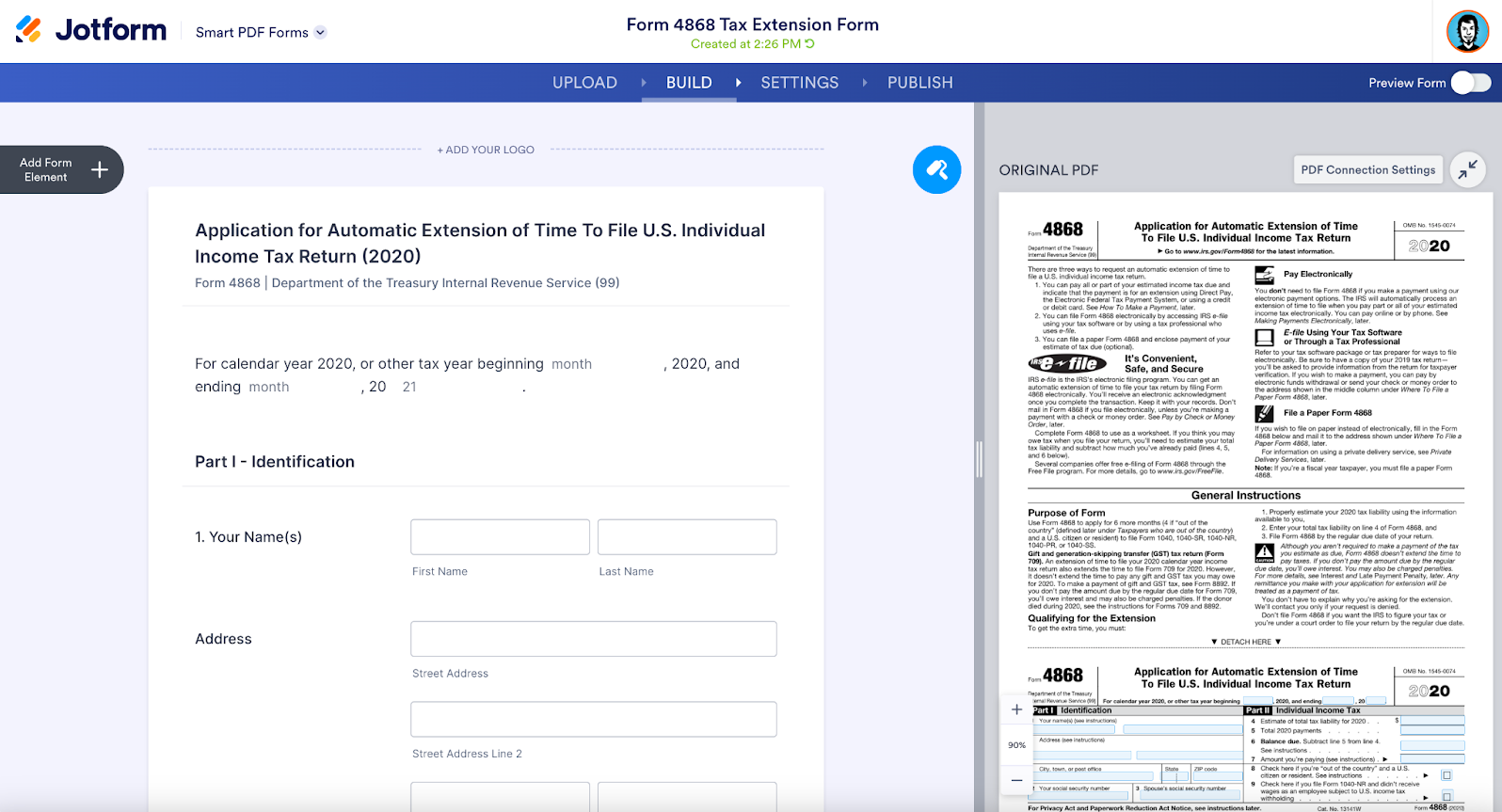

If you need more time to file your tax returns, you’ll want to fill out Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return form. The general extension is six months, though it’s advisable to always check with the IRS for the most accurate timeline each year.

You can use Jotform’s 4868 form to quickly enter the information the IRS needs to process your extension, such as contact information, social security number, and amount due.

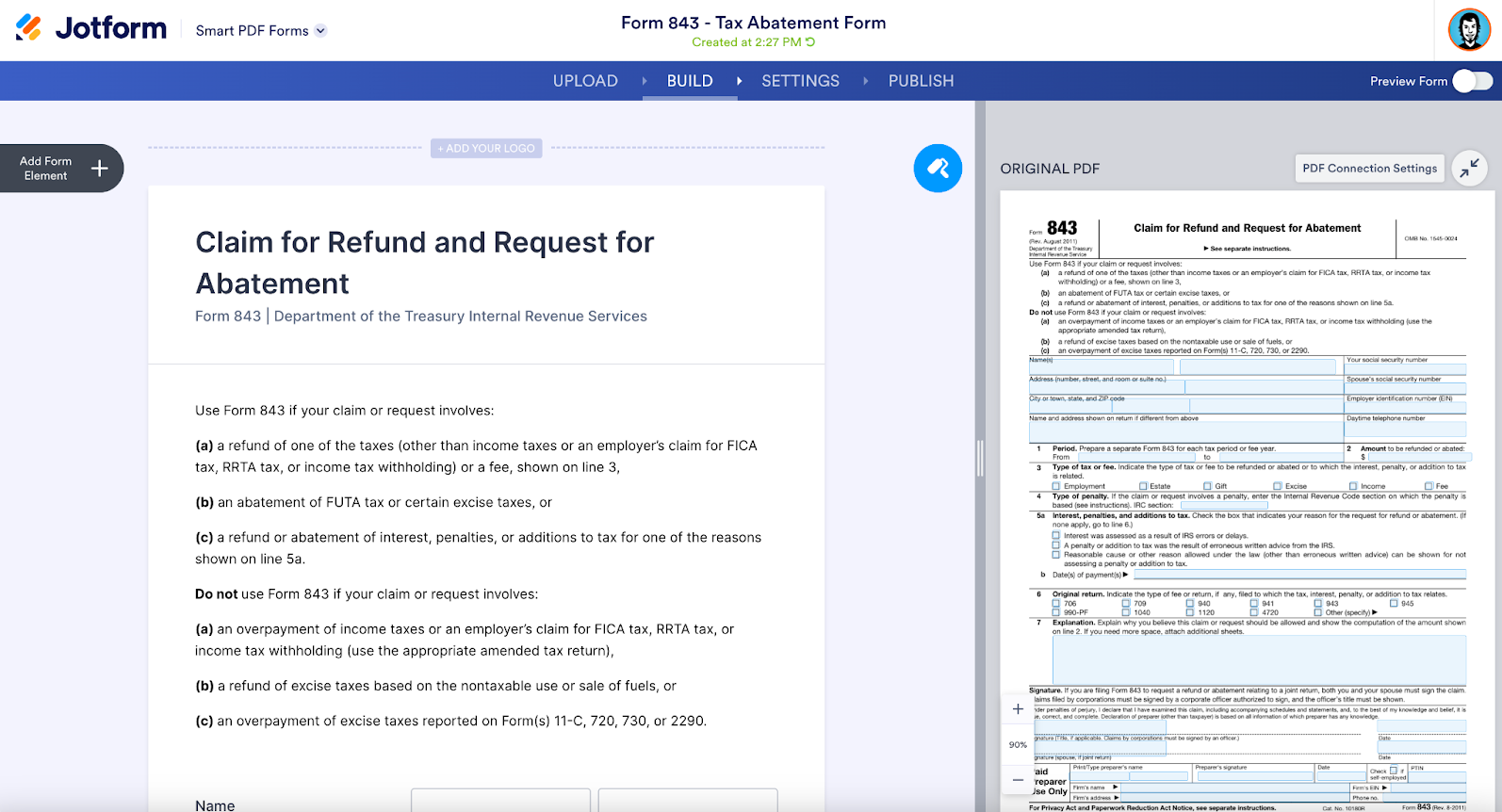

7. Form 843

Form 843, the Claim for Refund and Request for Abatement form, is used to claim a refund (other than income) for employment, estate, gift, or excise taxes or fees. It also allows taxpayers to request an abatement of the Federal Unemployment Tax Act (FUTA) tax, as well as interest, penalties, or additions to taxes caused by IRS errors or delays or erroneous written advice from the IRS.

Jotform has an 843 form that lists all the fields you need to complete in an easy-to-review format.

Common tax form completion made simple with Jotform

Powerful form builder Jotform has more than 40 tax form templates to make tax time less stressful for everyone, especially independent contractors and business owners who typically have multiple forms to complete.

Instead of hunting down individual forms on the IRS website and trying to figure out how to fill them out, use Jotform’s easy-to-use form format to streamline your data entry. Plus, you can take advantage of these features:

- E-signatures: Save time and avoid the hassle of getting physical signatures from your employees by enabling them to sign forms digitally.

- Inbox: Manage all your employee-submitted forms in one place instead of sifting through a large pile of papers on your desk.

- Security: Rest easy knowing all forms are encrypted and served across a protected 256-bit SSL connection.

Ready to tackle your taxes? Get started with a Jotform tax template today.

Photo by Christina @ wocintechchat.com on Unsplash

Send Comment: