When you’re preparing your taxes, you might need to fill out Form 8962. Completing this form online is convenient for many reasons, but you’ll need to know how to best access and edit this PDF. Luckily, there’s a simple way to do it.

Why IRS Form 8962 is important

If you paid health insurance premiums on Affordable Care Act insurance marketplace plans during the previous year, you could be eligible to get some of that money back with the Premium Tax Credit (PTC).

In most cases, you need to have been enrolled in a marketplace health insurance plan for at least one month. To claim the PTC, your household income can’t be more than four times the federal poverty line.

When you’ll need to fill out Form 8962

Your PTC won’t be issued automatically, so you’ll need to file Form 8962 when you file your tax form 1040 or 1040-NR. Form 8962 will calculate how much PTC you’re eligible for, and it could increase your tax refund. In contrast, it can also determine if you’ve received too much Advance Premium Tax Credit (APTC).

The APTC is a subsidy that helps make plans on the health insurance marketplace more affordable for low- and moderate-income families, reducing what you pay for monthly premiums.

This advance payment is calculated according to your income, and the federal government sends it directly to your insurance company. If your income changed during the year, you need to report that. If you don’t, your APTC might have been too high — which means you might be responsible for repayment of some of this subsidy.

Either way, it’s important to accurately file Form 8962.

When you file this form with your income tax return, you’ll have a few different options.

Your accountant or financial adviser may provide you with a paper copy of the form or ask you to fill out the form online. If you’re using tax preparation software, that software should have a link to an online Form 8962 that you can complete.

While working with an accountant or tax prep software can save you time, these options also cost money. If you’re preparing your taxes yourself, you’ll need to fill out this form on your own. Completing it online can help streamline the process.

How to fill out Form 8962 online

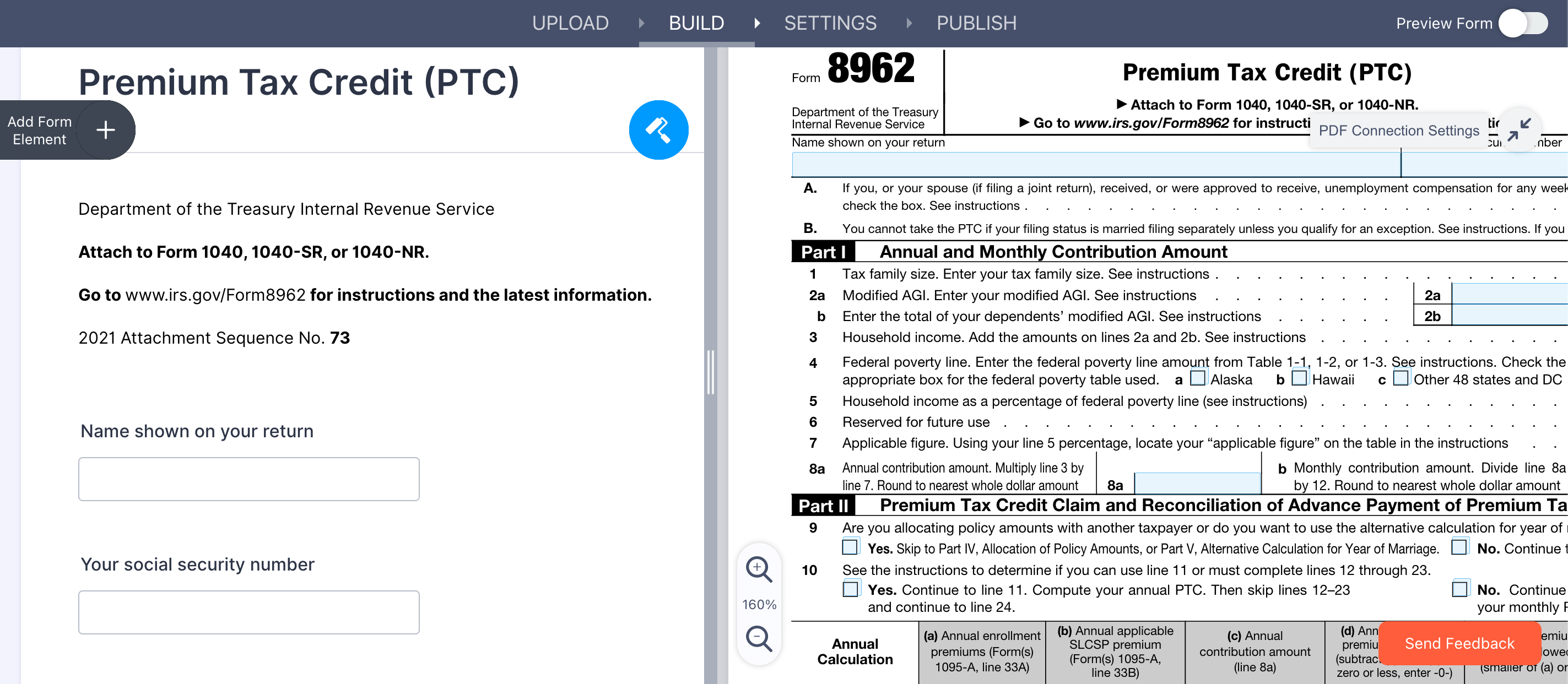

Filling out Form 8962 online is easy, thanks to Jotform. With Jotform Smart PDF Forms, you can easily upload the PDF of Form 8962 to the Smart PDF Forms tool, which will convert the PDF into an online form that you can complete.

Once you’ve filled out the form, you can even save it in its original PDF format. This makes it easy to digitally file and store your records, or you can email and upload the form as needed.

What information you’ll need to fill out Form 8962

Form 8962 has five parts. To streamline the process of completing the form, it’s best to familiarize yourself with the information required in each section. Here’s what you’ll need:

- Part I: annual and monthly contributions based on family size, household income, and adjusted gross income

- Part II: the APTC you’ve received and your monthly premium information

- Part III: calculations of APTC payments

- Part IV: policy amount allocation

- Part V: alternative calculation of the number of years you’ve been married

By gathering this information ahead of time, you’ll have everything you need to complete the form. You’ll find most of this information in Form 1095-A and your Form 1040.

How to digitize your tax forms

If you’ll be mailing in your tax documents, you can easily print a copy of your digital form to submit. Keep in mind that having digital records of your tax forms means you can easily revisit the forms and make edits if needed.

These digital records also create a great backup. If you back up your digital files to the cloud, you’ll have peace of mind knowing that, in the case of an event like a fire or flood, you won’t lose your tax records and other important documents.

Jotform also offers an assortment of other tax form templates, including the W-9 and W-4. These templates can make it easier to file your taxes without dealing with paper copies or scanning and digitizing files.

Creating digital copies of your tax documents doesn’t have to be difficult. Completing these forms digitally makes for neater inputs, allows you to easily correct any mistakes, and eliminates the chance you’ll smudge the forms while you work on them. You’ll be left with a clean finished copy, and you can easily make copies of those documents as you need to.

No matter how many forms you need to fill out, using a platform like Jotform can make the process easy and save you time. You’ll have well-organized, neat documents when you’re done.

Send Comment: