There’s nothing quite like buying something on the cheap, especially for smaller businesses that are just getting off the ground.

So it should come as good news that Square doesn’t charge you to open an account with them.

As an added benefit, Square doesn’t ask for any documentation before businesses activate an account, unlike more formal merchant accounts that often require businesses to submit bank statements or credit reports.

It doesn’t even cost a thing to access Square’s standard software and dashboard once everything’s up and running. That means you can use Square’s app and POS system — along with their sales, customer, and analytics portal — at no cost. In fact, there are no monthly or annual fees to use Square’s services, and you don’t have to pay anything if you want to cancel.

Still, like its payment processing counterparts, Square charges businesses a transaction fee on every electronic payment processed through their system.

This means that Square will deduct a small percentage of the total amount you charge customers, including taxes and tips, before the funds are deposited in your bank account. Square collects fees on individual transactions regardless of whether you swipe a customer card on the Square Reader, enter a client’s payment information manually on the Square Dashboard, or charge a subscriber a monthly fee online.

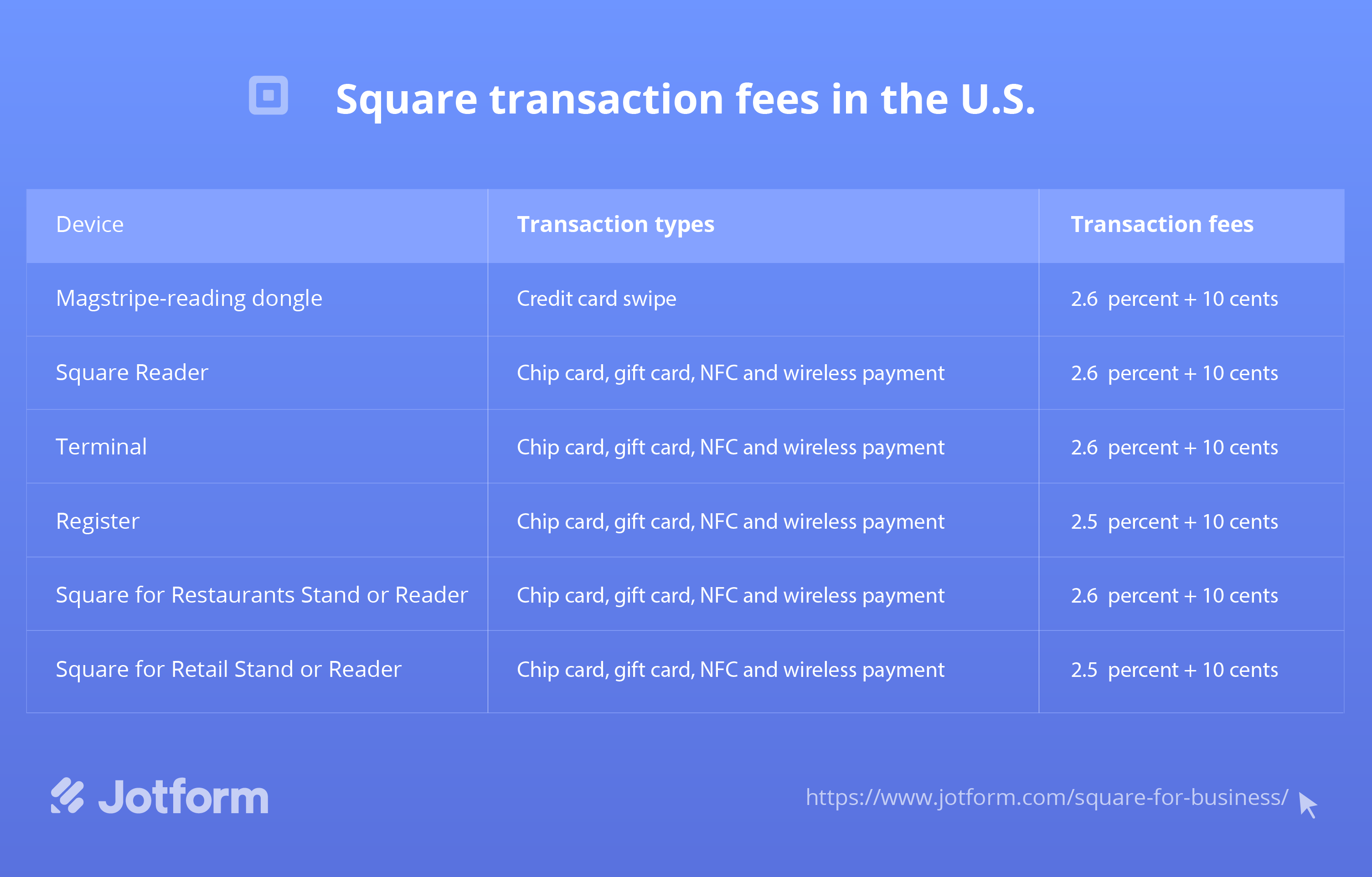

How much are Square’s transaction fees in the United States?

Square’s transaction fees largely depend on how payments are accepted.

For instance, Square charges a 2.6 percent fee, plus 10 cents, on each transaction for credit card payments that are dipped, tapped, or swiped on Square devices, such as those collected through their magstripe-reading dongle and Square Reader. The magstripe-reading dongle, however, is limited to credit card transactions, whereas Square Reader devices can accept chip card, gift card, NFC (contactless), and wireless payments.

By comparison, Square’s fees for individual transactions are 2.6 percent, plus 10 cents, when businesses use the payment processor’s Square Register or Square for Retail POS systems, which accept chip card, gift card, NFC (contactless), and wireless payments.

Although many of Square’s transaction fees are relatively similar, there’s one exception. Square will charge merchants a 3.5 percent fee, plus 15 cents, on the total amount — including taxes and tips — for transactions that don’t require a credit card and cardholder to be present when a payment is made.

Scenarios when cardholders and their cards don’t need to be present include

- Card-on-file transactions, where merchants are authorized to store a cardholder’s payment information and use it to bill cardholders for specific transactions. These transactions can be made using Square Invoices and Square’s Point of Sale app on a customized mobile application.

- Credit card payments that are manually entered into Square’s Virtual Terminal system.

Since credit card fees are built into Square’s processing fees, merchants don’t need to worry about additional charges from credit card companies.

Square also keeps rates the same for all of the credit card brands they accept, which includes any U.S.-issued card — along with most cards issued internationally, as long as they have a Visa, Mastercard, American Express, Discover, JCB, or UnionPay logo.

Square’s fees also apply to all types of businesses, including nonprofit organizations.

Did someone say free?

Jotform is partnering with Square to offer two special promotions for businesses that integrate their online forms with the payment processor’s services.

Regardless of whether you’re a new or existing Square customer, you can now accept up to 100 payments each month for free when you integrate Square into your online payment form in JotForm.

As an added bonus, new Square customers can get processing fees waived for up to $1,000 in card transactions made through a Square payment form in JotForm. This offer is good for your first 180 days as a new Square customer.

Once people fill out your form and submit it with their credit or debit card information, Square will process their payment and, once money is deposited into your account, reimburse the processing fees.

Since Jotform users who haven’t created a Square account can take advantage of both of these offers, there’s no better time than now to try out the payment processor’s services.

What does Square charge for online transactions?

As more people buy goods and services online, Square is keeping up with that demand by creating their own one-stop-shop platform, Square Online Store. This comprehensive e-commerce solution helps businesses manage vital stages in their e-commerce workflow, from building a website to collecting payments.

Square also curates integrations with other popular software tools that e-commerce businesses use.

Retailers, for instance, can use Jotform’s integration with Square to create professional-looking online order forms that can collect payments from customers and crucial order fulfillment details, such as size, color, quantity, and shipping preferences.

Physicians, doctors, and other medical professionals can use Jotform to create customizable HIPAA-friendly online forms that can securely collect protected health information and payments from patients. Case in point: San Francisco dentist Dr. Cynthia Brattesani allows patients to pay their bills online through Square using a Jotform payment form embedded on her website.

Regardless of how you integrate Square’s services into your online strategy, and whether you have a free or paid plan with other software solutions, Square will charge a 2.6 percent fee, plus 30 cents, on each transaction.

This fee applies to transactions processed by Square through integrations with Jotform, Acuity Scheduling, Wix, WooCommerce, and other software solutions listed in Square’s App Marketplace. It also applies to transactions made through Square Online Store.

How do Square’s fees vary by country?

Before delving into Square’s fees outside of the United States, it’s important to mention that the payment provider’s services are only available in the United Kingdom, Canada, Australia, and Japan.

In other words, Square can’t process debit or credit card payments for businesses outside of these countries. Square also can’t process debit or credit card payments for businesses in U.S. territories, including Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands. Credit or debit card transactions attempted outside of the country where a business’ Square account was activated won’t be processed as well.

Square processing fees vary by country and aren’t very easy to locate on the payment provider’s website. In fact, a detailed breakdown of processing fees by country isn’t very clear unless you stumble upon the technical documentation that Square provides for developers.

Much like Square’s processing fees in the U.S., rates generally vary depending on how businesses in Australia, Canada, Japan, and the United Kingdom accept payments.

Australia

Businesses in Australia are charged a 1.9 percent processing fee on each in-person transaction in which payment cards are tapped, dipped, or swiped on a Square Reader.

These same Australian businesses, however, pay a 2.2 percent fee on in-person transactions made without a Square Reader, such as recurring payments for subscriptions using a customer’s debit or credit card information on file.

This 2.2 percent fee also applies to payments that are entered manually into the Square Point of Sale app, made with Square Invoices, completed using Square’s Virtual Terminal, and submitted through Square eCommerce API, which allows businesses to accept credit and debit card payments from their website.

Meanwhile, a 1.6 percent fee applies to contactless payments, chip cards, and cards with magnetic strips that are processed through a Square Terminal.

Canada

Businesses in Canada are charged a 2.65 percent processing fee on each in-person transaction involving chip cards, cards with a magnetic stripe, prepaid gift cards, and contactless credit cards or devices.

This 2.65 percent fee also applies to in-person transactions in which cards with a magnetic stripe are swiped into Square’s Virtual Terminal system.

Square charges a 2.9 percent fee, plus 30 cents, on the total amount paid using Square Invoices, Square Online Store, and Square eCommerce API. This fee also applies to payments processed using Square Appointments’ no-show protection option, which allows businesses to charge customers or clients a fee if they don’t show up.

On the slightly higher end, a 3.4 percent processing fee, plus 15 cents, is applied to all card-on-file transactions, as well as card payments that are manually entered into a Square-supported device or Square’s Virtual Terminal.

An additional 10-cent fee is tacked onto each processed transaction involving Interac, the debit card service provider for Canada.

Japan

Businesses in Japan are charged a 3.25 percent processing fee on each in-person transaction involving Visa, Mastercard, American Express, Diners Club, and Discover card payments made through a Square Reader.

This 3.25 percent fee also applies to card-on-file transactions and payments made through Square Invoices using Visa, Mastercard, American Express, Diners Club, and Discover cards. The fee is slightly higher, at 3.95 percent, for card-on-file and Square Invoices transactions paid with JCB cards.

A 3.75 percent fee, meanwhile, is levied on each transaction made with Visa, Mastercard, and American Express cards on Square’s Virtual Terminal.

If businesses use Square’s e-commerce integrations or online payment APIs to collect payments on their website, a 3.6 percent processing fee will be added to Visa, Mastercard, and American Express card transactions.

United Kingdom

Businesses in the United Kingdom are charged a 1.75 percent processing fee on every in-person transaction using chip cards, cards with a magnetic stripe, prepaid gift cards, and contactless credit cards or devices.

In cases where payment cards and card holders don’t need to be physically present, Square will charge businesses a 2.5 percent processing fee, plus 25 cents on each transaction. This 2.5 percent fee, plus 25 cents applies to card-on-file transactions, any payments that are manually entered into a Square-supported device, and payments made through Square Invoices and Square Virtual Terminal.

Just so you know…

Square’s hardware, such as Square Reader and Square Register, can only be used in the country where it was purchased. This is because Square’s hardware must be tested and certified to comply with specific regulations in each country.

This means that you can’t buy Square’s hardware in one country and use it in another. For instance, a Square Reader bought in the U.S. won’t work in Japan, the United Kingdom, Canada, Australia, or Japan — you must buy Square’s hardware in the country where you want to collect payments.

You also can’t buy Square’s hardware and use it in a country where Square can’t process payments. For example, you can’t buy a Square Reader in the U.S. and use it to accept payments in Mexico.

Conclusion

Selecting an automated solution to seamlessly collect and process payments can be a difficult task that often comes down to three key considerations: cost, compatibility, and learning curve.

When all is said and done, Square’s fee structure varies depending on both where and how you’re collecting payments.

If you still have some lingering questions about how Square works, Jotform’s guide on Square for business will help.

Send Comment: