Square uses mobile technology to allow businesses (or artists or vendors or just about anyone) to accept credit card payments from their smartphones or tablets no matter where they are.

The more detailed answer to the question, “How does Square work?” depends a lot on the answer to another question: “How do you work?” One of the reasons it’s become so common for businesses of all sizes to use Square is that it’s a pretty adaptable system.

Here are just a couple of the ways Square can work:

For a vendor with a Square Reader for magstripe

Here’s how Square works for an individual vendor, like a grower selling produce at a farmers market:

- The vendor signs up with Square and requests a free Square Reader for magstripe.

- They download the Square Point of Sale app.

- The vendor plugs the small, magnetic stripe reader into their smartphone or tablet’s headphone jack or Lightning connector.

- When a customer wants to make a purchase, the vendor types in the amount due or selects items programmed into the Point of Sale app.

- A customer swipes the card through the reader.

- The customer signs the screen with their finger and requests their receipt be sent via email, text, or not at all.

- Funds appear in the vendor’s bank account in one to two business days or instantly if they choose that option for an extra 1 percent fee.

For a small business with a Square Register

This is one way Square works for a brick-and-mortar storefront like a coffee shop with a permanent location:

- The vendor signs up with Square and purchases a Square Register, which currently costs $999.

- They customize the Square Point of Sale app that comes on the register to meet their business’s needs, such as programming in a photo-based menu of the coffee shop’s drinks and other inventory. (They can add a barcode scanner, cash drawer, or receipt printer as accessories if needed.)

- When a customer wants to make a purchase, the vendor types in the amount due or selects items programmed into the Point of Sale app.

- The customer then inserts a chip card, swipes their card with a magnetic strip, or uses the NFC reader for a contactless payment. They can add a tip and sign on the screen.

- Funds appear in the vendor’s bank account in one to two business days or instantly if they choose that option for an extra 1 percent fee.

For a business accepting orders online and invoicing

Here’s how Square can work for a business that takes orders, like a bakery, you can take bakery orders and then invoices customers:

- The business owner signs up with Square.

- They add items to their item library via the Square Dashboard (optional).

- They create an invoice with the appropriate items via the Square Dashboard and send the invoice to the customer/client (optional).

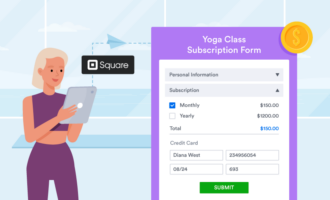

- Those who don’t opt to use the Square invoicing feature also have the option of simply keying in credit card information, user details, and amount information directly into the Square Virtual Terminal. Alternatively, it’s also possible to use a Square payment and order form to both process payment and capture customer information quickly and easily.

- Square processes the payment and deposits it into the business’s account.

- Funds appear in the vendor’s bank account in one to two business days or instantly if they choose that option for an extra 1 percent fee.

Send Comment: