Does tax season seem to sneak up on you every year, leaving you scrambling? For many people, the last-minute squeeze to get paperwork filed and payments made can be a frustrating experience, and a hard habit to break.

Knowing the income tax filing deadlines — and understanding the nuances related to self-employment and even tax extensions — can reduce your stress level considerably. It can also save you money, by avoiding the penalties and interest charges that come with missing the deadline.

If you’re hoping to have a smoother tax season this time around, you’re in the right place. We’ll answer all your deadline-related questions, including “When do you file taxes?”, “When do self-employed individuals file?”, “What are the penalties for missing a deadline?”, and more. And, as a bonus, we’ll introduce you to Jotform’s Tax Form Generator, which will help you glide through every tax season with ease.

Key tax filing deadlines in the U.S.

Let’s start with the most common question: When do you file taxes each year?

The answer: Most people and businesses need to file between late January and April 15, with April 15 being the absolute last day.

If April 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Your return is considered filed on time if your envelope is properly addressed, postmarked, and deposited in the mail by the due date.

The April 15 deadline applies to

- Most U.S. citizens (even if you live outside the U.S.) and permanent residents who work in the U.S. Note that you don’t need to file if your income is below a certain threshold — though in some cases filing might be to your advantage.

- Most businesses whose 12-month accounting period ends on December 31.

There are some exceptions to this deadline:

- Businesses whose accounting year ends at a time other than December 31 must file by day 15 of the fourth month after their fiscal year ends.

- Corporations with a fiscal tax year ending June 30 must file by the 15th day of the third month after the end of their tax year.

- Businesses organized as partnerships file an information return, Form 1065, which is due on the 15th day of the third month after the end of the partnership’s tax year (typically March 15).

Most states also collect income tax and have the same filing deadline as the federal government. (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax.) However, there are a few states that differ in their deadlines:

- Delaware: April 30

- Iowa: April 30

- Hawaii: April 20

- Virginia: May 1

- Louisiana: May 15

Tax filing dates for self-employed individuals

For those who are self-employed, tax filing looks a bit different. Independent contractors, gig workers, part-time business owners, and sole proprietors are all considered self-employed individuals. If you’re in this category, you still need to file an annual income tax return by the April 15 deadline.

What’s more, you must make estimated tax payments every quarter if you expect to owe at least $1,000 in tax when your return is filed. This means you’ll essentially pay most of your tax during the year, as you receive income, as opposed to paying it all in April.

Quarterly tax payments are due

- April 15 for income earned January 1 to March 31

- June 15 for income earned April 1 to May 31

- September 15 for income earned June 1 to August 31

- January 15 of the following year for income earned September 1 to December 31

Again, if these due dates fall on a Saturday, Sunday, or legal holiday, the payments are due the next business day.

Unlike traditional employees, who automatically have taxes deducted from every paycheck, self-employed individuals must plan for tax payments on their own. Making estimated tax payments helps you avoid under- or over-paying — and getting penalized by the Internal Revenue Service (IRS) as a result.

When to file taxes if you’re expecting a refund or owe taxes

Regardless of whether you’re expecting to receive a refund or pay a balance, the filing due dates above still apply.

No matter when you file, you’ll receive your refund as soon as the IRS is able to process it. According to the IRS website, you can usually expect your money within 21 days of filing for an e-filed return, or more than six weeks for returns sent by mail. It may take longer if your return needs corrections or extra review. You can check your refund’s status anytime using the IRS’s Where’s My Refund? tool.

If you know you owe tax, you still need to file by April 15 unless you get an extension (we’ll cover this in the next section). However, it’s important to note that, regardless of whether you get an extension or not, you must pay your taxes by the April 15 deadline.

Special situations that affect tax filing deadlines

If you know you won’t be able to file by April 15, request an extension from the IRS.

As long as they’re properly filed, most requests are automatically granted — extending the due date to October 15, no questions asked. The only circumstances that would warrant an additional extension beyond this date are if you’re serving in the military outside the U.S., or if you live and work outside the U.S. and Puerto Rico.

Remember, an extension doesn’t apply to the tax payment — only to the filing itself.

You can request an extension in one of two ways:

- Make your tax payment online and check the box to indicate that you’re paying as part of filing for an extension.

- Fill out Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, and submit it online or via mail. This form requires you to estimate your tax liability as accurately as possible and make the payment online or by phone, check, or money order.

Once you submit the request, you should receive acknowledgement from the IRS.

The IRS also frequently issues tax extensions — for both filing and payments — for people living in areas affected by natural disasters. For example, residents of southern California were given a six-month extension in 2025 to file federal individual and business tax returns and make tax payments as a result of the wildfires. In cases like these, you don’t have to file for an extension as it’s granted automatically. Check the IRS website for more information.

Penalties for missing tax filing deadlines

Income tax deadlines are serious business, with significant financial consequences for failing to file or pay on time.

- If you don’t file by the correct deadline, the IRS applies a penalty of 5 percent of the unpaid tax for each month or partial month the return is late, accruing to a maximum of 25 percent.

- If you don’t pay by the deadline, the penalty is 0.5 percent of the unpaid taxes for each month or part of a month the tax remains unpaid.

It’s important to note that the IRS charges interest on penalties, which could increase your balance significantly.

The IRS may consider reducing or removing late tax filing penalties if you can show you have reasonable cause for not meeting your tax obligations, such as a natural disaster, a death in the family, or technical issues that prevented electronic payment.

To pursue this option, follow the instructions on your penalty notice or call the IRS directly to plead your case. Have supporting documentation available if possible, and avoid laying blame on tax preparers or pleading ignorance to the IRS rules. Ultimately, you’re responsible for paying your taxes, so these elements are not likely to make a compelling argument.

If you can’t pay what you owe in full, apply for a payment plan — and make sure you still file on time. In this case, interest and some penalty charges (reduced to 0.25 percent) will continue to be added to the amount you owe until it is paid in full. However, this option is better than the alternative, which may include wage garnishment or seizure of assets.

Get your taxes in on time, every time, with Jotform’s Tax Form Generator

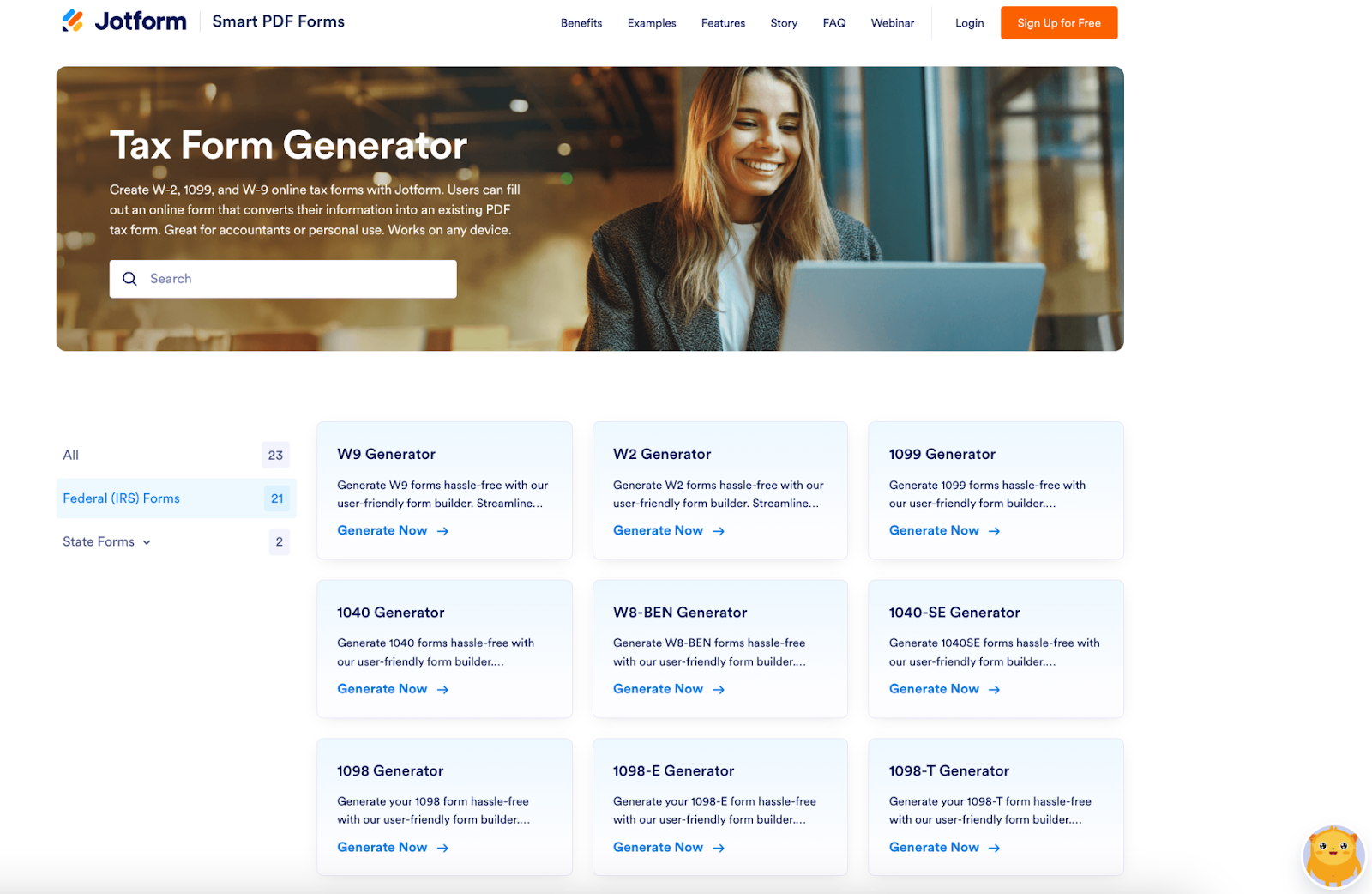

Anything you can do to simplify the tax filing process will be helpful in meeting that all-important deadline year after year. One tool that can make a big difference is Jotform’s Tax Form Generator.

This no-cost, easy-to-use online solution walks you through the necessary tax information for each of the relevant income tax forms and converts the data into a PDF tax form for immediate download.

Individuals can use it to complete the popular Form 1040, and businesses can use it to generate W-9s, 1099-NECs, W-2 forms, and more. Its drag-and-drop interface allows you to easily rearrange fields, split your tax form into multiple pages, and even add your logo and brand colors. You can also

- Collect one or more e-signatures.

- Share tax forms via a link or your website.

- Track tax data in Jotform Tables to stay organized.

- Calculate taxes automatically with form calculations.

Jotform’s Tax Form Generator works on any device — computers, tablets, and smartphones — so you can use it anytime, anywhere. It also protects your data with a 256-bit SSL connection and optional encryption.

If you’re looking for ways to simplify the tax documentation process, why not try Jotform’s Tax Form Generator? This could be the year you finally complete your taxes on time and without hassle.

Stay ahead this tax season

Whether the tax deadline is right around the corner for you or months away still, you now have all the information you need to file successfully this year.

Knowing what’s due when, and how to ask for an extension (even at the last minute), can help you avoid penalties. It’s always a good idea to keep your tax-related documents in one place throughout the year to stay organized, too. And if you’re still uncertain about your particular filing requirements, make sure you leave enough time to consult a tax professional in advance of the April 15 due date.

With a little preparation — and a clear understanding of the tax filing deadlines — you can turn tax season from a last-minute scramble into a smooth, stress-free finish.

This article is ideal for U.S. taxpayers who want clear, straightforward guidance on federal income tax deadlines. It’s especially helpful for individuals who often feel overwhelmed during tax season, including traditional employees, freelancers, gig workers, small business owners, and anyone who needs to track quarterly estimated payments.

Send Comment: