Some employees, such as sales or customer-support field staff, have to travel from one place to another during the ordinary course of their work. And that usually means they need a car to get their jobs done.

If you’re the boss, you can’t expect them to drive their own cars and bring you receipts to reimburse them for the gas. Your options are to provide a company car — which is costly for the company but a nice perk for the employee — or reimburse the employee a set sum for every mile they drive their own car for work.

While some employees do get a company car, it’s far more common for employers to reimburse staff for the miles they drive in their own cars at the rate determined by the Internal Revenue Service (IRS). This option is fair to the employee and is generally far less expensive for the employer, but it does require careful tracking and recordkeeping to maximize potential tax advantages.

In December 2020, the IRS issued — as it does around that time each year — the optional standard mileage rates for employees to calculate the deductible costs of using a car for business.

For 2021, the standard mileage rate for the use of a car (as well as vans, pickups, or panel trucks) is 56 cents per mile, a decrease of 1.5 cents from the rate for 2020. The IRS didn’t explain why the reimbursement declined, but the sharp decrease in gas prices caused by the pandemic likely influenced the change.

The IRS’s rate is a suggested amount, and companies can reimburse more or less for a number of reasons. However, if the employer reimburses less, the employee can deduct the difference from their taxable income, and if the employer pays them more, the employee adds that difference to their taxable income. That’s why most companies just reimburse for whatever the IRS determines to be the deductible per mile.

The mileage deduction is not just for on-the-job travel. Individuals can deduct 16 cents per mile they drive for medical purposes, such getting to and from doctor visits. People volunteering for charitable organizations can also deduct 14 cents per mile they drive in the course of their volunteer work. But they’ll have to keep the same kinds of records that businesses are required to submit to deduct the reimbursements they give employees for using their own cars.

The 56 cent per mile reimbursement is for more than just the cost of gas, even though that alone can be a big expense. With gas costing about $3 per gallon, driving a mile costs anywhere from 10–25 cents in gas alone, depending on how many miles per gallon the vehicle gets.

The reimbursement might seem like a windfall to an employee with a car that gets great mileage, but it all evens out (more or less) when it’s time to get new tires, pay for insurance, get a tune-up, and simply make the monthly car payment. The reimbursement has been a way to fairly compensate employees after the Tax Cuts and Jobs Act passed in 2017. The law reduced corporate tax rates but eliminated the option for individual taxpayers to claim an itemized deduction for unreimbursed employee travel expenses.

Pro Tip

Keep track of employee reimbursements with a powerful expense reimbursement spreadsheet from Jotform.

Creating an IRS-compliant “accountable” plan

Calculating the reimbursement to the employee is as simple as multiplying the miles logged by 56 cents. However, deducting the reimbursement from the employer’s federal taxes requires establishing an IRS-compliant reporting and recordkeeping system. IRS guidance refers to this as an “accountable” plan.

An IRS accountable plan requires employees to keep a log of where they’ve gone, the business purpose of the trip, and the number of miles they’ve driven, usually by recording odometer readings at the beginning and end of the trip. While the level of trust varies in different company cultures, that’s probably the exact same information employers will want before reimbursing the employee.

Keeping a detailed mileage log is the cornerstone of an accountable plan, which benefits both the company and the employee. Reimbursements made through an accountable plan are tax- deductible for the employer and tax-exempt for the employee.

Think of establishing an accountable plan for mileage reimbursements as sound bookkeeping and basic tax accounting. From the perspective of the IRS, legitimate business expenses that are properly documented are tax-deductible, but the opposite is also true. Reimbursements that aren’t for legitimate business purposes or don’t have proper documentation are treated as taxable income to employees.

Ultimately, accountable plans give employees a compelling reason to keep good records of their mileage and other expenses.

Establishing a smooth mileage reimbursement process

Let’s not kid ourselves — keeping mileage records is tedious, particularly for sales pros, service technicians, and other highly skilled workers who have to drive their cars to do their work. In fact, it would be hard to find anyone who enjoys doing it. But it’s important for everyone concerned — both the members of the team who are on the road and the company — that they properly document mileage.

A reimbursement system that doesn’t meet IRS standards runs the real risk of incurring a large, unexpected tax bill. The IRS stipulates in Publication 15 (Circular E) that “Payments to your employee for travel and other necessary expenses of your business under a nonaccountable plan are wages and are treated as supplemental wages and subject to the withholding and payment of income, social security, Medicare, and FUTA taxes.” A lax reimbursement plan could leave employees on the hook for taxes on reimbursements for what they’ve spent on travel.

An accountable plan that reimburses employees for valid mileage expenses — and gets the deduction that tax law allows — requires diligent recordkeeping.

First, the mileage must have a business connection. Your team members can typically satisfy this requirement by noting the destination and the reason for the trip (e.g., “service call at customer’s house” or “sales meeting with client”).

Second, they have to include proof (“substantiation”) that they accomplished something for the company. This can take many forms, but a signed work order or a receipt are two good examples.

Employees are required to return any excess amount paid above the legitimate business expense for nonbusiness or undocumented expenses.

Making mileage reporting easier

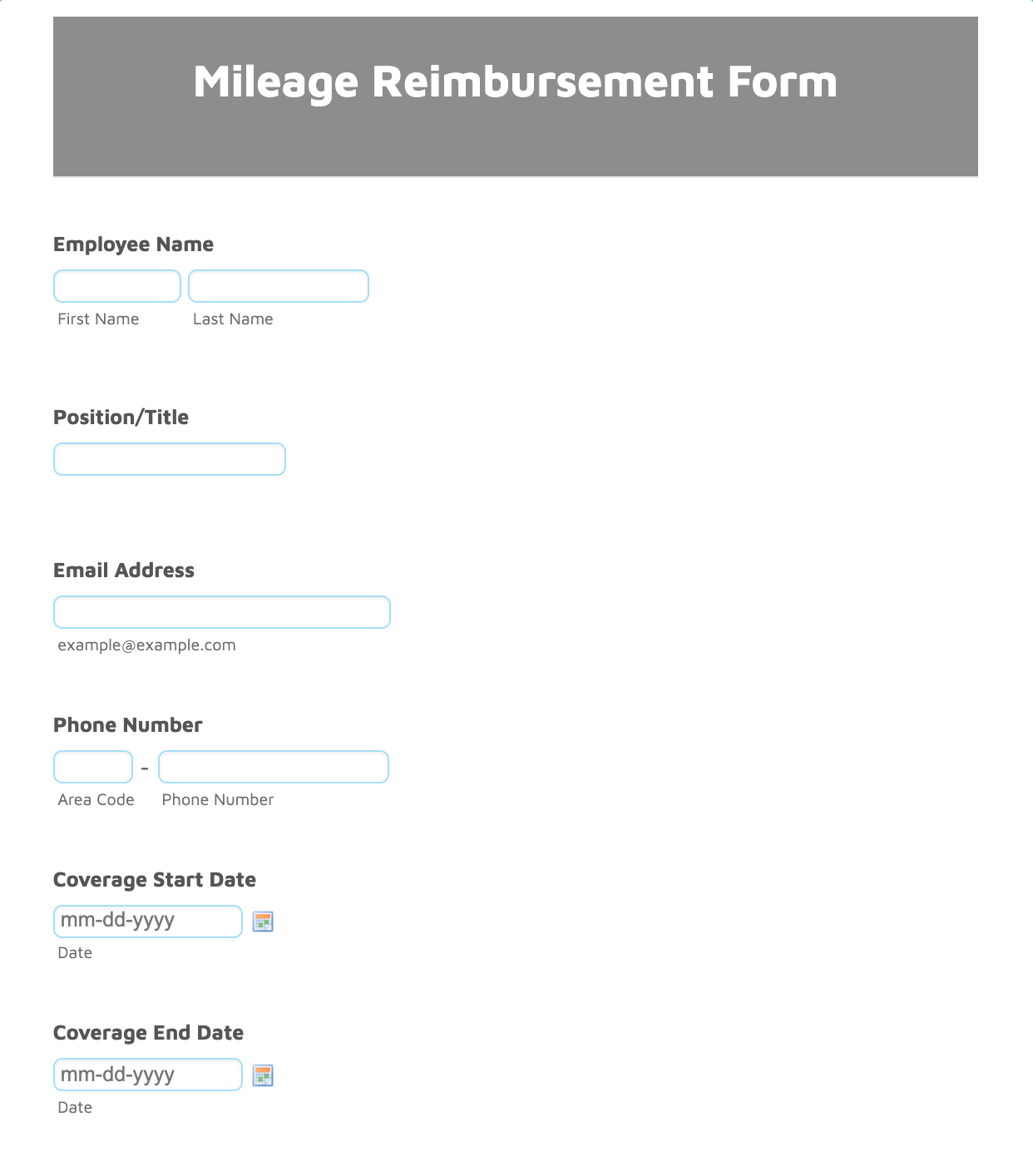

Obviously, the recordkeeping necessary for a valid mileage reimbursement program can create a burden for staff who log a lot of hours on the road. A good way to streamline the process is to have them track their mileage using a Jotform mileage reimbursement template customized for your business. The template contains fields for all necessary notations as well as for odometer readings, and it keeps a running tally, dramatically simplifying the process for your team.

Inflated mileage claims are among the most frequent triggers for an audit by the IRS — that’s because they’re among the most common forms of tax fraud. Padding the numbers by a few miles per day at 56 cents per mile really adds up over the course of a year.

While it’s common knowledge (and just plain common sense) that companies should keep a mileage log of where an employee drove, the total mileage, and the business purpose for the travel, not everyone realizes that if the IRS does audit the company, they’re likely to ask for third-party records to verify the total mileage.

IRS auditors have also been known to ask for maintenance records, such as for tune-ups and oil changes, that note the date and odometer reading. So always save receipts.

Determining if mileage is tax-deductible

Not every mile the boss is willing to reimburse an employee for driving is a legitimate, tax-deductible business expense. According to the IRS, the mileage driven must be both “ordinary” and “necessary” to the course of business.

This means the company can reimburse an employee who drives to the local office supply store to buy envelopes and toner cartridges for those miles, and the company can deduct that reimbursement. Office supplies are necessary, and buying them at an office supply store is certainly ordinary.

On the other hand, reimbursing mileage for a drive across town to everyone’s favorite pizza place (that doesn’t deliver) might be ordinary at your company, but it isn’t likely the IRS will consider it necessary (though it’s admittedly a judgment call). The basic rule for businesses is not to reimburse any mileage the IRS won’t accept as a legitimate tax deduction.

Improving your mileage reimbursement process

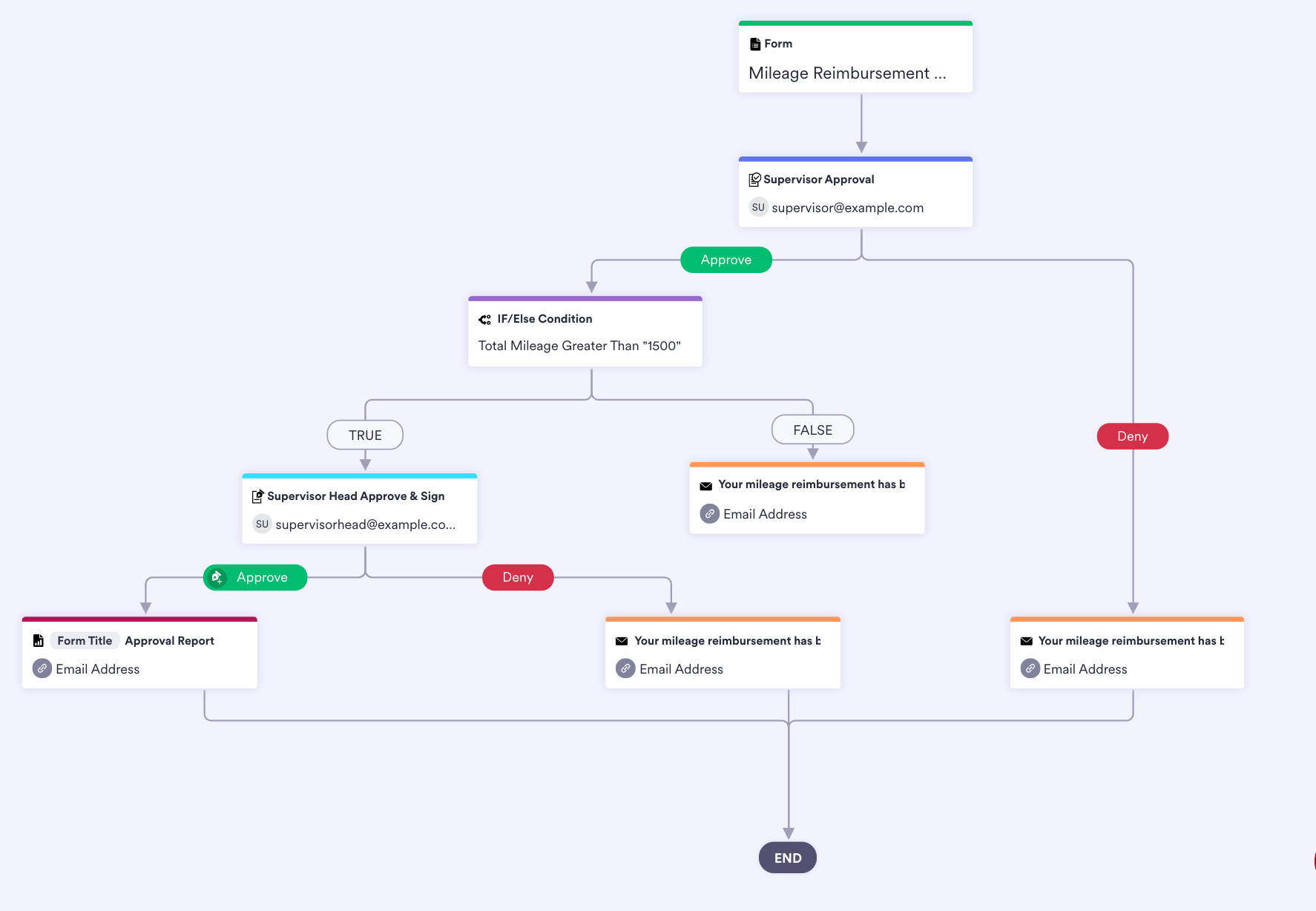

Once you have an efficient system for maintaining mileage logs, you need to establish an approval process to initiate actual payment of the reimbursements you owe. Designate the appropriate team leaders and middle managers who will need to sign off, and manage the workflow with a Jotform mileage reimbursement approval template.

Though it seems tedious, establishing an IRS-compliant mileage reimbursement system is both good business and your best defense against an IRS audit.

Send Comment: