The last thing people want to think about at the start of a new year is paying their taxes. That’s why, more often than not, the annual deadline creeps up on people. And then they stay up all night struggling to finish them on April 14.

Business owners who manage complex income and expense situations are often tempted to delay filing — and changing tax laws make the process all the more puzzling. Combine these laws with all the other elements business owners juggle daily, and you can see how doing taxes can become a time-consuming, stressful task.

Figuring out taxes on expenses is the biggest concern for employers. As they approach yet another tax deadline, many ask themselves, “Are employee reimbursements taxable?” Let’s dig into the answer.

What are taxable expenses?

In general, employers can write off business expenses that the IRS deems “ordinary and necessary” to running a company. An expense is ordinary when it’s “common and accepted” in an industry, such as advertising costs. “Necessary” adds the stipulation that expenses must also be “helpful and appropriate” for your business, such as home office expenses.

In some businesses, employees pay these ordinary and necessary expenses out of pocket, and their employers reimburse them. For example, perhaps a sales account manager regularly takes potential clients out to lunch, or maybe an accountant has to enroll in a course to learn about the latest tax laws.

How these expenses are taxed depends on their categories and the nature of the reimbursement.

Are employee reimbursements taxable for employers?

Reimbursements to employees are basically part of your regular business expenses — the only difference is that your employee makes the purchase instead of you. Because you’re reimbursing them, these out-of-pocket expenses become yours, and the IRS taxes them as such. The IRS states that, as a business owner, you can “generally deduct the amount you pay or reimburse employees for business expenses incurred for your business.”

However, the Tax Cuts and Jobs Act (TCJA) of 2017 changed what types of these expenses are deductible.

For example, businesses can fully deduct food and refreshments for an employee social event. On the other hand, you can’t deduct entertainment and recreation costs (such as sports tickets you buy for a client), even if it’s related to business. But you can feel free to take clients out to lunch, as business meals are 50 percent deductible.

To avoid the risk of blurring these expense lines, business owners should carefully categorize various types of expenses. To help, the IRS offers specific guidelines for business travel and meals as well as what is and isn’t considered entertainment — all details you should communicate to your employees with a detailed expense and reimbursement policy.

The best way to navigate changing tax laws is by partnering with an experienced tax professional who is well-versed in the area. Your relationship with a tax professional will pay off in the long run as they become more familiar with the financial nuances of your business — especially because the TCJA is set to expire in 2025.

Are employee reimbursements taxable for employees?

Employees need to know whether they will be taxed on reimbursements for business expenses. The answer depends on whether their employers use an accountable plan or a nonaccountable plan.

Under an accountable plan, reimbursements aren’t taxable wages, so employees aren’t taxed for them. According to the IRS, employers are using an accountable plan if their employees’ reimbursement plan follows three rules:

- The reimbursed expenses are business-related.

- Employees must provide appropriate evidence that the purchase was for business within 60 days of the transaction.

- Employees must return reimbursements not used for business within 120 days of distribution.

If employers don’t enforce these rules in their expense policies, they default to a nonaccountable plan, which treats the extra money they give to employees for expenses as additional taxable income.

For example, an employer may give employees a lump sum to pay for business expenses that the employee doesn’t have to pay back. This allowance is taxed for Social Security and Medicare and counts as wages on an employee’s W-2 form.

Businesses can use both accountable and nonaccountable plans to manage their expenses. While nonaccountable plans are simpler, employers may find that employees see accountable plans as more fair to them. After all, lump sums make their taxes higher without the benefit of an official pay raise.

Business owners should also keep in mind that employees can’t deduct unreimbursed expenses until the TCJA expires in 2025.

Managing employee reimbursements with Jotform

The more orderly your expenses, the more likely you’ll smoothly and accurately complete your taxes. For business owners, the best way to organize expenses is to use a program that centralizes employee reimbursement claims and facilitates the expense approval process.

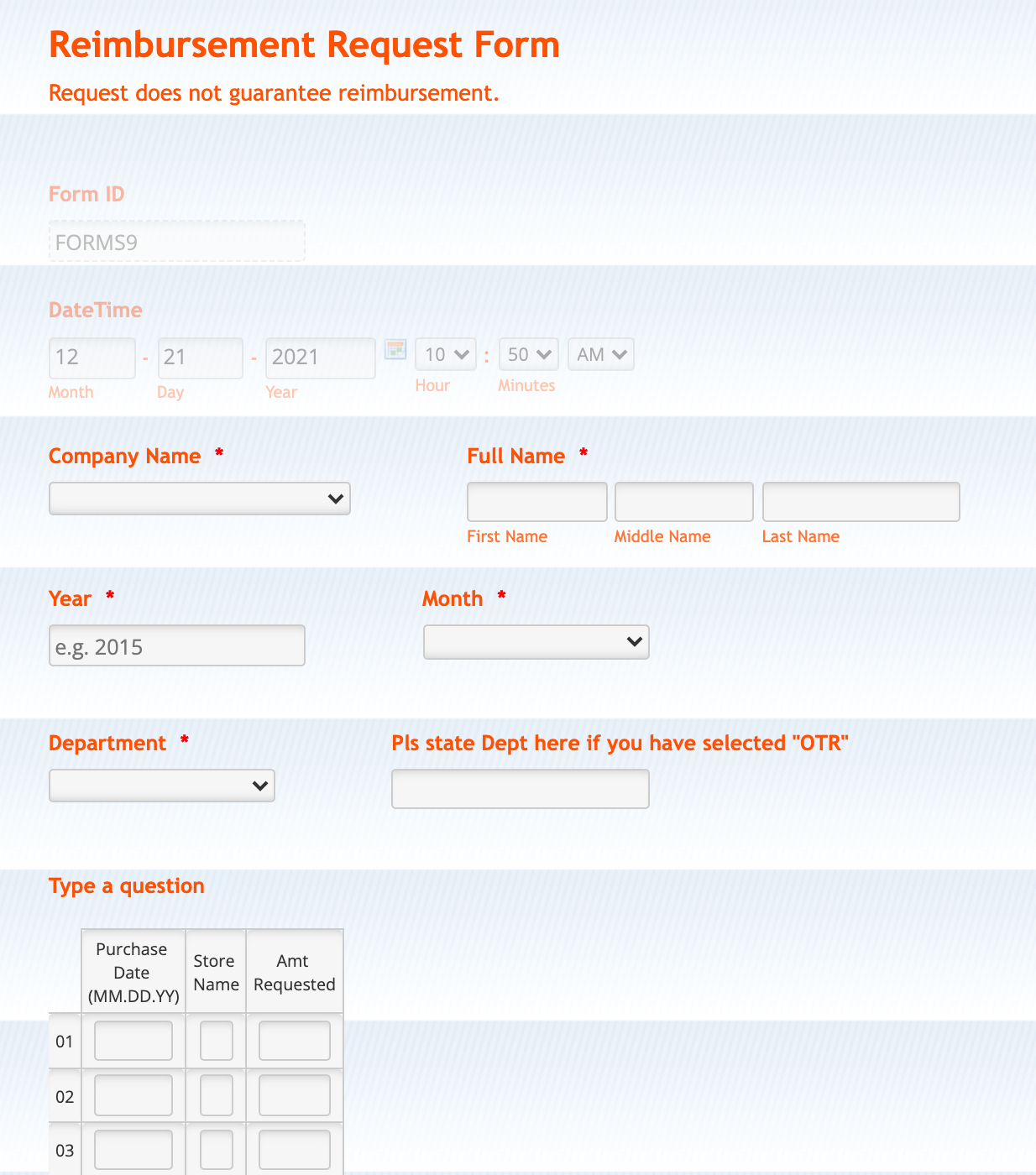

That’s where Jotform can help. You can use the Jotform Form Builder to customize a variety of reimbursement form templates. Then, you can combine employee and managerial duties in an expense approval workflow built with the Jotform Approvals drag-and-drop interface. Following the rules of an accountable plan, your workflow can enforce reimbursement policies through several online forms, conditional logic, and parallel approval paths.

Employees and managers can use any device to send or approve forms with Jotform Mobile Forms. All this information is saved in Jotform Tables, which gives you a bird’s-eye view of submissions to simplify expense analysis and quickly categorize expenses.

With Jotform, no one in your business has to wonder whether employee reimbursements are taxable. When you properly track expenses and reimbursements through Jotform, you’ll have more time to dedicate to your business and spend less time worrying about tax season.

Send Comment:

2 Comments:

308 days ago

Nice article! Was great reading about taxation on employee reimbursements

More than a year ago

Today's performance management is a new-age dynamic process that requires a powerful & effective solution. Here's the ultimate modern performance management guide.