It takes money to make money, right? That’s how the old saying goes, but it shouldn’t apply to employees earning wages.

Freelancers and business owners can write off many of the purchases and expenditures they accrue in the course of working. These write-offs count against their total taxable income and lower their liability when they file taxes.

However, traditional W2 employees can also incur expenses. That’s where employee expense reimbursements come in. A reimbursement system puts cash directly back into employees’ hands, often simplifying expenses for business owners. The way companies manage this process, however, can be surprisingly complex. Let’s dive in.

What is expense reimbursement?

Put simply, expense reimbursement is the process of paying employees back for their out-of-pocket, business-related expenses. This is a common need for employees who travel for work, as they are likely to incur expenses for driving, overnight lodging, and food or entertainment.

Just so you know…

Speed up your expense reimbusement process and get your accounts settled in minutes.

Reimbursing employees is often easier and less risky than providing them with a company credit card or giving them direct access to corporate cash.

Potential complications of expense reimbursement

Human resources and finance departments need to follow several complex policies, procedures, and laws to reimburse employees correctly. These are some of the most common challenges of the process.

Ensuring reimbursements aren’t taxed

When employees spend their own money on business-related purchases, they must get that exact amount back.

In normal circumstances, all money paid by an employer to employees counts as taxable income. But in most cases, it would be unfair to deduct payroll taxes from reimbursements. After all, employees are working to make money. They shouldn’t have to pay taxes on unpredictable expenses.

Employers can ensure reimbursements are processed tax-free by implementing an accountable plan. We’ll cover what this is and how to set one up in Chapter 5.

Clarifying expense policies

What expenses can employees be reimbursed for? What qualifies each expense for reimbursement? What’s the limit for each reimbursement?

Answering these questions creates the foundation for a fair and organized expense reimbursement process. When these points are clarified and communicated to employees, there’s never any question about whether a purchase they’re making is reimbursable. This will help them spend confidently and within parameters for business.

Expense policies also protect employers from being taken advantage of financially. With rules on what and how much will be reimbursed, finance teams can budget expense accounts more accurately.

These policies curb employees from blurring the line between business and personal purchases and manipulating their company into paying for the latter. Consistent expense reimbursement policies are foundational to respectful employer and employee relationships.

Poor expense visibility

How does an employee prove an expense is legitimate? And how do you know if their spending falls in line with the average cost of expenses like hotel rooms or meals?

Two of the biggest challenges for human resource and finance departments are outlining and enforcing policies guiding how employees document and submit expenses.

Sometimes, it’s hard for an employee to get a receipt. Other times, the receipt might not have enough information to help you understand exactly what was purchased.

Additionally, receipts never indicate how the price of the items compares to those offered by competitors. Without this information, employees may be tempted to spend lavishly, which could cost your company substantially more than necessary.

Missing expense trends

Sometimes, employee reimbursements are a one-time-only event for unforeseen circumstances. But in most companies, reimbursements are a regular occurrence. A major problem you can run into is being unable to notice when an employee’s expenses deviate from their normal pattern — a red flag for internal issues that need to be analyzed and addressed.

For example, an employee may typically request reimbursements ranging from $100 to $300 every month. But one month, they submit a claim for $700. If you’re processing a large volume of reimbursement requests and only have the data from one month in front of you, you might not notice how unusual this request is and miss the opportunity to address it.

Delayed reimbursements

Maintaining fair and short reimbursement processing cycle times is another challenge. Remember, when employees pay for business expenses, they have less money available for what they need personally. That’s why it’s important to reimburse them as soon as possible.

Many factors can slow down the reimbursement process, such as not having enough information in the claim, not receiving reimbursement requests promptly, or not having enough staff to process the requests.

However, failure to return money to your employees in a reasonable amount of time can lead to situations where they refuse to go on business trips, lose motivation or enthusiasm for their jobs, or even look elsewhere for other opportunities.

Keeping processes efficient

If you have a small organization with a few employees, it makes sense for them to submit paper receipts and for you to track all of your expense and reimbursement information in a spreadsheet.

However, imagine how difficult it would be to use the same system for hundreds of employees submitting reimbursement requests daily. You probably wouldn’t even have room in your office to store all those paper receipts, let alone keep up with the process.

Maintaining an efficient process for expense reimbursements in the face of company growth, busy seasons, and general workflow is difficult but important for every department.

Expense reimbursement platforms to the rescue

Automation isn’t limited to robots in factories or self-checkout registers. Software helps businesses manage their workflows, payroll, budgeting, e-commerce, invoicing, and more. Of course, there are several solutions for expense reimbursement.

These platforms help busy companies streamline expense reimbursement requests, collect receipts and other information, store records, analyze expense trends, spot fraud, and process payments. This can help you complete processes more quickly, with less effort, while complying with tax laws and keeping your employees happy — all without learning how to code.

Reimbursement software

When these types of high-tech systems are in place, it won’t just make work easier for your human resources and finance teams. In addition to faster reimbursement cycle times, your employees will benefit from an overall smoother process.

Many of the leading expense reimbursement management solutions on the market have mobile apps employees can download. These apps allow users to take photos of receipts for digital submissions, log mileage, and track other reimbursable expenses and activities — all from the convenience of their phone.

Because the apps are so accessible, employees can track expenses as they occur instead of taking receipts back to the office and setting aside time to complete the submission process.

Once they’ve submitted their reimbursement claims, employees can get updates in real time as they’re approved or denied, as well as check their claim review status. This way, they won’t have to bother anyone on your team for an update. The apps can also automatically send notifications when the reimbursement has been processed.

In this guide, we’ll explore the ins and outs of expense management, workflows, and tools to make it easier for your organization to manage reimbursements.

What organizations need reimbursements the most?

Now that we understand what expense reimbursements are and some of the challenges you may encounter while managing them, let’s look at what kinds of organizations need them most.

The truth is, expense reimbursement isn’t confined to specific industries or types of companies. Any job that necessitates employees spending money out of pocket will need an expense reimbursement policy and management system.

What are reimbursable employee expenses?

Reimbursable expenses can include any out-of-pocket expenses your employees incur during work. In a bid to attract more talent, many companies have adopted a more liberal definition of these expenses. But not all expenses are tax-deductible, as the IRS has specific definitions of deductible expenses.

According to the IRS, deductible business expenses “must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.”

These are the most common work-related expenses that meet the IRS definition.

Travel expenses

Business trips are often a necessity, but as everyone knows, they cost a lot of money. Thankfully, nearly all business trip expenses are reimbursable and tax-deductible. If you think about all the trouble that goes into traveling, these reimbursable expenses fall into a wide range of categories.

Reimbursable transportation expenses include obvious items like plane tickets as well as shuttle services to and from the airport and rideshare fees or taxi fares at the destination. While traveling, people don’t always have the option to shop for groceries and cook, so restaurant meals are tax-deductible as well.

Personal vehicle use

Driving to and from the office every day is a fact of life. However, when work requires employees to use their personal vehicles to travel to job sites or meetings, the IRS considers that a reimbursable and tax-deductible expense.

The reimbursement is based on miles driven between destinations, and the IRS sets a standard mileage reimbursement rate each year based on average gas prices, the costs of car maintenance, and inflation. In 2021, the federal rate was set at 56 cents per mile.

Business and office supplies

Generally, office supplies are procured by the operations department. However, if something is needed quickly, it might make more sense for an employee to run to a store and pick it up. These costs are also tax-deductible and reimbursable.

Meals and entertainment

Showing appreciation to clients and customers with free meals, events, and gifts is par for the course in a good business relationship. After all, having a business meeting over a fancy dinner is better than a stuffy conference room.

The same is true for taking clients to a live show. When employees spend out of pocket for these events, they’re deductible and reimbursable — as long as they have a clear business purpose.

Other employee reimbursements

Many companies are adding additional expense reimbursements to attract and retain high-quality talent. These aren’t necessarily deductible according to the IRS, but they are becoming an increasingly common tactic for remaining competitive in recruiting. Talk to a qualified accountant to see if or how your company can offer these benefits.

Tuition

One perk many companies offer is tuition reimbursement for higher education, additional training, or certification programs. This can include tuition for bachelor’s and master’s degrees, vocational training, or single classes. It’s up to you whether tuition for these programs is reimbursable, especially if they don’t pertain to your industry or the employee’s career track.

Regardless, tuition reimbursement comes with several potential benefits. First, if the education the employee is pursuing is related to their job or your industry, it will only make them more skilled and valuable to your company.

If not, pursuing their educational goals will bring the employee more fulfillment and happiness, which will translate to better work performance. They are likely to be more loyal to your company as well. At the very least, tuition reimbursement helps retain employees for the duration of the educational program they’re enrolled in.

Care for children and dependents

When work takes parents and caretakers away from home, someone has to watch their dependents — and this is becoming increasingly expensive. Research from the Economic Policy Institute in 2020 found that families spend $42 billion on early childhood care alone — not including older children and other dependents, such as the elderly and disabled.

Offering reimbursements for daycare, after-school care, and other dependent costs can be a way for companies to attract and retain older, more experienced talent, as it frees up their earnings to save or improve their lifestyles.

You can offer this to employees in many ways, such as flexible, pre-tax expense accounts, or direct reimbursement of bills each month. Consult with your accountant to determine the best method for your company and employees.

Fitness

Increasingly, people are becoming more conscious of their health, both physical and mental. Many companies already offer corporate rates on gym memberships. To give employees more flexibility, some are opting to reimburse for fitness costs, such as private training, personal gym memberships, pilates, yoga lessons, and even massages.

Fitness reimbursement programs are susceptible to poor planning. Make sure you create a clear policy for what is and isn’t reimbursable and determine reasonable caps on how much money your company will pay out to employees each month.

Coworking space

As more and more companies eliminate their offices, individual employees may still benefit from going to a designated workspace each day. Coworking spaces improve work-life balance, build community, and provide networking opportunities for people who don’t report to an office each day.

As a result, some remote companies are reimbursing employees for their coworking space memberships. It costs less than renting central office space while still providing a great incentive for new talent.

Other organizations that need to reimburse employees for expenses

As mentioned, expense reimbursement programs may be necessary for every type of organization regardless of their industry or even their purpose. Here are some noncommercial organizations with reimbursable expenses.

Nonprofits

Charities may run on donations, but that doesn’t mean staff and volunteers have to lose money to keep it running. Many nonprofits have reimbursement programs exactly like those of for-profit companies, so they can reimburse employees and volunteers for expenses, from traveling to buying supplies for events.

Nonprofit expense reimbursement can be tricky, however, due to the organization’s tax-exempt status. Consult carefully with your accountant or CPA for advice on how to manage this.

Boards and committees

Some small government boards, like neighborhood councils, rely on elected officials who aren’t paid a salary. Like nonprofits, these committee and board members should be reimbursed for any expenses incurred while serving their communities. This is especially true for office supplies, car mileage, or the cost of printing documents and other presentation materials.

Churches and religious organizations

Church employees can pile up significant expenses while traveling for community outreach or conducting ministry work. With well-designed reimbursement processes, employees can focus on service rather than money.

Expense reimbursement use cases

So far, we’ve covered the definition of expense reimbursement and the different categories reimbursements fall under. We’ve also reviewed the kinds of organizations in which employees are most likely to be reimbursed for expenses.

But how do you know if an expense is worth covering or when your business might have a legal obligation to cover it?

Here are some of the most common use cases in each expense reimbursement category.

Travel expenses

Travel expenses are the most frequent reimbursable expense, so travel and expense management policies are critical to streamlining operations — even in companies where there’s little or no expectation employees will travel. You never know when an employee might have to travel and pay out of pocket.

When reimbursements are necessary

Employees incur expenses when traveling to another city for a work conference or meeting. Even though these trips are often planned, it may not be possible for a company to cover all expenses up front.

Be prepared to reimburse employees for any meals they eat during their trip as well as cab and rideshare fares. If the employee has to pay for their plane ticket and hotel room, reimburse them for these expenses as soon as possible since they cost a significant amount of money.

Salespeople often go on long trips to meet with leads or reconnect with current customers. All their airfare, lodging, and meals are eligible for reimbursement, and if they are traveling for a long time, these costs will be higher than those of a week-long conference trip.

The ways different organizations handle these expenses vary greatly. Oftentimes, to control costs, the company operations team books hotels and airfare, so they can ensure they get the best deal. In some cases, corporate bookings can secure discounts.

When it comes to meals, many companies also limit how much they reimburse each day and communicate this clearly to their employees. Of course, the employee can choose to spend more, but they won’t be surprised when they’re not fully reimbursed.

Mileage expense reimbursement is also needed for trips (regardless of length) to meetings, events, and job sites that aren’t an employee’s normal place of work. For example, if an employee is required to drive their vehicle to a convention center instead of their office, the mileage to and from that destination would be eligible for reimbursement.

When they’re not

Employees may try to take advantage of the potential for free trips. For example, in a sales situation, an employee may travel to a destination they want to visit personally and later try to justify these expenses with a business reason. Avoid being taken advantage of by establishing a firm policy that all reimbursable travel must be approved ahead of time.

Unfortunately, mileage to and from an employee’s normal place of work, such as their office, is not eligible for reimbursement.

Meals and entertainment

Meals and entertainment expenses can be a gray area, so it’s important to consider your policies in this category. Here are some situations that might come up.

When reimbursements are necessary

Let’s admit it — sometimes we just get tired of being in the office. This is especially true when it comes to building relationships with clients and customers. Having meetings in a stuffy conference room is great for brass tacks discussions, but when it comes to showing appreciation for a partnership or deepening rapport, meetings over meals or at events are preferred.

It’s important to show appreciation for clients and customers periodically, and one of the best ways to do this is to hold a regularly scheduled meeting at a restaurant instead of the office. Since your company arranged the meeting, the client will expect to be treated to the meal. This expense is always reimbursable because it’s a normal business meeting that just happens to be conducted at a restaurant.

Another situation that might occur is the client holding a meeting at a restaurant to have business discussions better suited outside the office. The meeting expenses would also be reimbursable since the primary objective of the meeting is work-related.

When they’re not

Of course, your employees may become friendly with customers and clients over time. As a result, they may be more inclined to have meetings off-site at restaurants or bars. In these cases, it’s more likely that the meeting is for socialization. Don’t feel compelled to reimburse employees for all of these expenses.

You should institute a policy that all meal and entertainment expenses be approved ahead of time. This will prevent your employees from trying to get reimbursement for an unplanned social meeting after it occurs.

Office supplies

As mentioned previously, sometimes employees need to purchase office supplies. Keep these facts in mind when forming your policy.

When reimbursements are necessary

Operations and management teams typically handle procurement for all office supplies ahead of time. But unexpected projects or other emergencies may necessitate an unplanned purchase.

Often, the fastest way to handle this is to send the employee to a store to buy what they need. Examples of these kinds of supply needs are printing a report for a last-minute project or buying a certain kind of envelope to mail an unusually sized document. Regardless, any time a purchase is made with a direct business need in mind, that expense is always eligible for reimbursement.

When they’re not

Sometimes, workers can be picky about the materials and supplies they use. Perhaps management keeps a full stock of pens, but an employee prefers a particular brand. If they buy it, even if it’s for business use, it’s not necessarily a reimbursable expense.

Of course, to maintain a good relationship with the employee, management may opt to pay for the pen just to avoid bad blood. This should be the case only if the expense is reasonable. After all, an employee might prefer a high-end pen brand that’s just too expensive.

Moving expenses

Companies trying to attract new talent should consider offering moving expense reimbursements. This category also includes situations when an employee relocates for a job.

When reimbursements are necessary

Sometimes, companies hire candidates from out of town for a new role because of the skills they bring. In this case, the new hire will have to relocate to your company’s city to start the new job. Any expenses related to movers, renting trucks, and travel are eligible for reimbursement.

In other instances, an existing employee may be permanently transferred to another branch and need to relocate as well. These types of moving expenses may also be reimbursed since the relocation is required for their employment.

When they’re not

Oftentimes, existing employees already live within a commutable distance to their primary job site. To reduce time spent in traffic, they may opt to move closer to the office. These expenses cannot be reimbursed as the move isn’t required by employers.

Other reimbursements

Less popular reimbursements, such as those for tuition, aren’t standard or bound by any IRS rules. It’s up to the company whether to reimburse these expenses or not.

For tuition reimbursement, whether or not you pay could depend on how the educational program or subject matter pertains to your industry or the employee’s career. Why should your company pay for an education that will bring no direct value to the business? On the other hand, reimbursing for any sort of tuition would be a great morale booster that ensures your employees are fulfilled.

Another elective might be reimbursing employees for medical expenses. Even if you offer employees partially subsidized health insurance plans, these plans never mitigate all out-of-pocket healthcare expenses.

Some companies opt to reimburse employees for medical expenses up to a certain amount. There are no circumstances in which an employee would or would not be eligible for reimbursement — it’s entirely up to the company whether or not to offer this perk.

Expense reimbursement management

So far, we’ve talked a lot about what employee expense reimbursements are but not a lot about how to manage them. In this section, we’ll cover the basics of creating policies that can grow and scale with your company and using solutions that streamline the process and lessen the workload.

Why is expense reimbursement management so important?

If you work at a small or mid-sized company, you might be wondering why you need an expense reimbursement system. Regardless of how simple things are right now, as your company grows, keeping track of expense approvals is bound to become more complicated.

Even if there’s no growth in sight at your organization, establishing policies now can help streamline the way you process unexpected reimbursements. Here are some of the biggest benefits of having a reimbursement process.

Capitalizes on tax deductions

Many reimbursable expenses incurred by employees are also tax-deductible for employers. However, the only way to write off these expenses properly is to maintain accurate documentation. A well-designed reimbursement system will ensure this paperwork is organized correctly.

Forecasts cash flow more accurately

A system helps you track exactly who is spending your organization’s money, how much, when, and on what. This prevents you from getting hit with surprise reimbursement requests you’re legally obligated to approve.

Reimbursable expenses also wax and wane seasonally, just like revenue. Documenting all expense reimbursements allows you to spot trends so you can better estimate how much money your company will have on hand at any given time.

Minimizes reimbursement abuse and fraud

If you don’t keep track of expenses, it’s impossible to determine which reimbursements are legitimate and which are the result of employees abusing a lax system.

Good policies leave a paper trail for auditing purposes, which can also assist in catching people who are taking advantage of the system. Not only will this help you uncover fraud, but it will also deter people from committing it in the first place.

The basics of an expense reimbursement management plan

Whether you’re running a multinational conglomerate with thousands of workers or a small startup with just a few employees, these principles will help you create an efficient expense reimbursement plan that can scale to any size or improve an existing process.

Create a company expense policy

A comprehensive expense reimbursement policy controls exactly how much employees spend for business. This policy determines the conduct of all employees, including your human resources and finance teams.

The policy should outline exactly what is and what isn’t a reimbursable expense, the process employees must follow to get approval, what documents they have to submit for reimbursement, the spending limits on various types of expenses, plus other details that govern how expense reimbursements are approved.

The policy should clearly outline time frames in which employees can expect their reimbursement to be processed and how to file appeals if their reimbursement is rejected. Most important, the policy needs to be easily accessible to employees and managers in all departments to ensure compliance, transparency, and enforcement.

Finally, you should update this policy periodically to ensure it complies with the most current IRS regulations. We’ll talk more about how to create expense reimbursement policies in the next section.

Develop an efficient reporting system

The best way to ensure accurate and timely expense reports is to make it easy for employees to submit reimbursement forms and supplemental documents.

For companies to process reimbursement requests, employees need to provide proof of spending, such as receipts. In the old days, traveling salespeople had to log their expenses on a spreadsheet and keep their receipts throughout their trip until they returned to the office. This was a major hassle, and they always risked losing the receipts before they had a chance to turn them in.

Now, technology makes it easy to scan and submit documents daily for faster reimbursement. Many expense management apps allow users to take photos of their receipts on their smartphones for immediate submission.

Establish and enforce accountability

Creating the reimbursement policy involves outlining the processes employees need to follow when submitting their expenses, how managers approve or deny them, and the reimbursement time frame. An efficient and reasonable time frame is a key ingredient to motivating employees to adhere to the rules.

For example, the policy may dictate that employees have to submit their expenses by a certain date each month and that reimbursements will be distributed exactly 30 days from that deadline. If the employee is late, they will have to wait until 30 days from the next deadline to receive the reimbursement.

No one likes putting out money for things they otherwise wouldn’t buy, so employees will be eager to submit their requests quickly to avoid waiting for longer than necessary. Similarly, the finance team will be eager to distribute reimbursements in the given time frame to avoid dealing with unhappy employees or being unable to fulfill some of their other responsibilities.

Conduct regular audits

One of the benefits of an expense management system is that it deters fraud. When people understand there’s a high chance of getting caught if they do something wrong, they will be less likely to do it.

Requiring detailed records of expenses makes it easy for the finance team to audit their files and spot issues like mischaracterized or overstated expenses, fraudulent receipts, or multiple reimbursements for the same purchase.

How to create an expense reimbursement policy

Now that you understand the principles of expense management, you can create the policies that support your reimbursement process. Here’s what you need to do.

Outline reimbursable expenses

Using the information we’ve discussed so far, list the various employee expenses that will be accepted for reimbursement. Go beyond common categories like travel and meals to include detailed descriptions of expenses, such as client dinners or mileage to offsite meetings.

If applicable, include information about spending limits or budget caps. For example, you may cap client dinners at $200. If any employee spends more than this, they will be reimbursed for only $200 of the meal and liable for the remainder. Alternatively, you may require that managers give advance written approval for expenses that will go over the spending limits.

Clarify required documentation

What do your employees need to provide to prove an expense is legitimate? The most important document is the receipt. You may require that these receipts have specific information, such as an itemized list of exactly what was purchased and the price for each item.

For business meals, some companies may require both the receipt and documentation that illustrates the purpose of the meeting, such as an email that outlines the meeting agenda.

Outline submission guidelines

How should employees submit their reimbursement requests and documentation? In the past, employees may have been required to tape their receipts to standard printer paper so the finance team could easily file hard copies. For other companies, a simple scan of the receipt may have sufficed.

Now, the IRS accepts digital files, freeing companies to do the same. Determine exactly how you need information from your employees and outline the steps they need to take to provide it for you.

Set a payment schedule

Figure out a reimbursement payment schedule that works for you and your employees. Keep cash flow in mind, as well as how necessary or common certain reimbursable expenses are. Companies with a large and busy sales team need to be proactive about processing and paying reimbursements because their revenue depends on sales teams treating potential clients and customers to dinners.

For organizations where reimbursements are less common or even discouraged, it may make more sense to implement a 30-day payment policy from the date of the reimbursement request. This ensures the company has enough time to smooth out any cash flow disruptions. It also deters employees from making unnecessary purchases if they know it will take a month to get their money back.

Use expense management software to streamline your processes

If you’re currently using a manual spreadsheet system to manage a high volume of expense reimbursement requests, you’re well aware of how much time and energy it takes to manage. Fortunately, all of this wasted effort is unnecessary.

Expense reimbursement software solutions can make your life and the lives of your employees much easier. There are many options to choose from, but in general, these apps make it easier to digitally collect reimbursement requests and supporting documentation, automate approvals and repayment, analyze trends, and spot potential fraud.

Many of these solutions are offered by brands you’ve already heard of, like SAP Concur and QuickBooks. These expense reporting apps connect directly to other bookkeeping and accounting services. Plus, learning how to record a reimbursement in QuickBooks is easier than adhering to a complicated paper system.

What to look for in expense management software

All of these software platforms have several characteristics in common, but you should consider some features mandatory for expense management.

Cloud accessibility

In today’s work-from-home environment, you must be able to use your expense management software wherever you are. Make sure the solution you’re considering is a cloud-based app so you can use it from multiple devices, even when you’re traveling.

Cloud-based apps are also more likely to have features that allow employees to upload their expense requests and supporting documents directly to the platform rather than via email.

Data visualization and expense analytics

The ability to easily translate all of your expense information into graphs and charts will make it much easier to spot inefficiencies and overspending. The ideal management platform lets you compare expenses between different employees side by side to see if anyone should be reined in.

Similarly, you could group expenses by category to see if you should cut back in a particular area. It may even be possible to identify vendors, such as hotels, that you spend a lot of money with and use that information to negotiate a better rate.

Seamless approval workflows

Many platforms make it possible to approve reimbursements with a few clicks of a button. The system can analyze requests and receipts to ensure they comply with company policy and alert the user if something is missing or needs further investigation. Requests can be batched into a single dashboard so users can review expenses in rapid succession.

The tax situation for reimbursements

So far, we’ve talked a lot about what employee expense reimbursements are but not a lot about how to manage them. In this section, we’ll cover the basics of creating policies that can grow and scale with your company and using solutions that streamline the process and lessen the workload.

Why is expense reimbursement management so important?

If you work at a small or mid-sized company, you might be wondering why you need an expense reimbursement system. Regardless of how simple things are right now, as your company grows, keeping track of expense approvals is bound to become more complicated.

Even if there’s no growth in sight at your organization, establishing policies now can help streamline the way you process unexpected reimbursements. Here are some of the biggest benefits of having a reimbursement process.

Capitalizes on tax deductions

Many reimbursable expenses incurred by employees are also tax-deductible for employers. However, the only way to write off these expenses properly is to maintain accurate documentation. A well-designed reimbursement system will ensure this paperwork is organized correctly.

Forecasts cash flow more accurately

A system helps you track exactly who is spending your organization’s money, how much, when, and on what. This prevents you from getting hit with surprise reimbursement requests you’re legally obligated to approve.

Reimbursable expenses also wax and wane seasonally, just like revenue. Documenting all expense reimbursements allows you to spot trends so you can better estimate how much money your company will have on hand at any given time.

Minimizes reimbursement abuse and fraud

If you don’t keep track of expenses, it’s impossible to determine which reimbursements are legitimate and which are the result of employees abusing a lax system.

Good policies leave a paper trail for auditing purposes, which can also assist in catching people who are taking advantage of the system. Not only will this help you uncover fraud, but it will also deter people from committing it in the first place.

The basics of an expense reimbursement management plan

Whether you’re running a multinational conglomerate with thousands of workers or a small startup with just a few employees, these principles will help you create an efficient expense reimbursement plan that can scale to any size or improve an existing process.

Create a company expense policy

A comprehensive expense reimbursement policy controls exactly how much employees spend for business. This policy determines the conduct of all employees, including your human resources and finance teams.

The policy should outline exactly what is and what isn’t a reimbursable expense, the process employees must follow to get approval, what documents they have to submit for reimbursement, the spending limits on various types of expenses, plus other details that govern how expense reimbursements are approved.

The policy should clearly outline time frames in which employees can expect their reimbursement to be processed and how to file appeals if their reimbursement is rejected. Most important, the policy needs to be easily accessible to employees and managers in all departments to ensure compliance, transparency, and enforcement.

Finally, you should update this policy periodically to ensure it complies with the most current IRS regulations. We’ll talk more about how to create expense reimbursement policies in the next section.

Develop an efficient reporting system

The best way to ensure accurate and timely expense reports is to make it easy for employees to submit reimbursement forms and supplemental documents.

For companies to process reimbursement requests, employees need to provide proof of spending, such as receipts. In the old days, traveling salespeople had to log their expenses on a spreadsheet and keep their receipts throughout their trip until they returned to the office. This was a major hassle, and they always risked losing the receipts before they had a chance to turn them in.

Now, technology makes it easy to scan and submit documents daily for faster reimbursement. Many expense management apps allow users to take photos of their receipts on their smartphones for immediate submission.

Establish and enforce accountability

Creating the reimbursement policy involves outlining the processes employees need to follow when submitting their expenses, how managers approve or deny them, and the reimbursement time frame. An efficient and reasonable time frame is a key ingredient to motivating employees to adhere to the rules.

For example, the policy may dictate that employees have to submit their expenses by a certain date each month and that reimbursements will be distributed exactly 30 days from that deadline. If the employee is late, they will have to wait until 30 days from the next deadline to receive the reimbursement.

No one likes putting out money for things they otherwise wouldn’t buy, so employees will be eager to submit their requests quickly to avoid waiting for longer than necessary. Similarly, the finance team will be eager to distribute reimbursements in the given time frame to avoid dealing with unhappy employees or being unable to fulfill some of their other responsibilities.

Conduct regular audits

One of the benefits of an expense management system is that it deters fraud. When people understand there’s a high chance of getting caught if they do something wrong, they will be less likely to do it.

Requiring detailed records of expenses makes it easy for the finance team to audit their files and spot issues like mischaracterized or overstated expenses, fraudulent receipts, or multiple reimbursements for the same purchase.

How to create an expense reimbursement policy

Now that you understand the principles of expense management, you can create the policies that support your reimbursement process. Here’s what you need to do.

Outline reimbursable expenses

Using the information we’ve discussed so far, list the various employee expenses that will be accepted for reimbursement. Go beyond common categories like travel and meals to include detailed descriptions of expenses, such as client dinners or mileage to offsite meetings.

If applicable, include information about spending limits or budget caps. For example, you may cap client dinners at $200. If any employee spends more than this, they will be reimbursed for only $200 of the meal and liable for the remainder. Alternatively, you may require that managers give advance written approval for expenses that will go over the spending limits.

Clarify required documentation

What do your employees need to provide to prove an expense is legitimate? The most important document is the receipt. You may require that these receipts have specific information, such as an itemized list of exactly what was purchased and the price for each item.

For business meals, some companies may require both the receipt and documentation that illustrates the purpose of the meeting, such as an email that outlines the meeting agenda.

Outline submission guidelines

How should employees submit their reimbursement requests and documentation? In the past, employees may have been required to tape their receipts to standard printer paper so the finance team could easily file hard copies. For other companies, a simple scan of the receipt may have sufficed.

Now, the IRS accepts digital files, freeing companies to do the same. Determine exactly how you need information from your employees and outline the steps they need to take to provide it for you.

Set a payment schedule

Figure out a reimbursement payment schedule that works for you and your employees. Keep cash flow in mind, as well as how necessary or common certain reimbursable expenses are. Companies with a large and busy sales team need to be proactive about processing and paying reimbursements because their revenue depends on sales teams treating potential clients and customers to dinners.

For organizations where reimbursements are less common or even discouraged, it may make more sense to implement a 30-day payment policy from the date of the reimbursement request. This ensures the company has enough time to smooth out any cash flow disruptions. It also deters employees from making unnecessary purchases if they know it will take a month to get their money back.

Use expense management software to streamline your processes

If you’re currently using a manual spreadsheet system to manage a high volume of expense reimbursement requests, you’re well aware of how much time and energy it takes to manage. Fortunately, all of this wasted effort is unnecessary.

Expense reimbursement software solutions can make your life and the lives of your employees much easier. There are many options to choose from, but in general, these apps make it easier to digitally collect reimbursement requests and supporting documentation, automate approvals and repayment, analyze trends, and spot potential fraud.

Many of these solutions are offered by brands you’ve already heard of, like SAP Concur and QuickBooks. These expense reporting apps connect directly to other bookkeeping and accounting services. Plus, learning how to record a reimbursement in QuickBooks is easier than adhering to a complicated paper system.

What to look for in expense management software

All of these software platforms have several characteristics in common, but you should consider some features mandatory for expense management.

Cloud accessibility

In today’s work-from-home environment, you must be able to use your expense management software wherever you are. Make sure the solution you’re considering is a cloud-based app so you can use it from multiple devices, even when you’re traveling.

Cloud-based apps are also more likely to have features that allow employees to upload their expense requests and supporting documents directly to the platform rather than via email.

Data visualization and expense analytics

The ability to easily translate all of your expense information into graphs and charts will make it much easier to spot inefficiencies and overspending. The ideal management platform lets you compare expenses between different employees side by side to see if anyone should be reined in.

Similarly, you could group expenses by category to see if you should cut back in a particular area. It may even be possible to identify vendors, such as hotels, that you spend a lot of money with and use that information to negotiate a better rate.

Seamless approval workflows

Many platforms make it possible to approve reimbursements with a few clicks of a button. The system can analyze requests and receipts to ensure they comply with company policy and alert the user if something is missing or needs further investigation. Requests can be batched into a single dashboard so users can review expenses in rapid succession.

A typical expense reimbursement workflow

By now, you understand the ways employees incur expenses and which of these are reimbursable. We’ve covered how employees need to substantiate their expenses and how employers manage these expenses in compliance with IRS rules.

A company’s expense reimbursement policy governs these processes. The reimbursement workflow is how they actually play out.

Let’s look at the basics of an expense reimbursement approval workflow, as well as some of the issues that may crop up.

How to set up a reimbursement workflow

Each organization follows different processes for reviewing and approving employee expense reimbursement requests. Regardless of these differences, all reimbursement workflows have certain elements in common. Here are four steps to creating a reimbursement workflow.

- Identify your approvers

Even in relatively small organizations, approving reimbursement requests rarely falls on the shoulders of one person. Often, the journey to approval begins with a department manager, goes through human resources, and ends with the director of finance.

Decide who should be involved in the decision-making process based on their familiarity with employee expenses, their knowledge of your organization’s budget, and their authority to approve funding.

- Establish approval conditions

One of three things can happen during the review of any reimbursement request — approval, denial, or delegation to other decision-makers for further evaluation. To streamline this review process, write a clear list of the elements every request must have to be approved.

These conditions should also be in your reimbursement policy. For example, your policy may state that reimbursement for meals cannot exceed $200. If an employee submits a reimbursement request for $240, a manager may approve reimbursement of $200 or reject the request for failing to adhere to the policy. It’s up to you how strict you want to be.

- Define approval hierarchies

Business owners can apply other conditions to determine who has final approval authority.

For example, your company may have a standard approval workflow for everyday expenses below a threshold amount of $500. When an employee incurs an expense of more than $500, only the director of finance has the authority to approve the request.

This ensures that a knowledgeable stakeholder properly scrutinizes the request and that no one approves large reimbursements without reviewing available cash flow.

- Decide how to collect requests

Companies have different options for requesting expense reimbursements.

Small organizations may accept requests verbally. Others may have employees turn in paper forms with attached receipts to the accounting department. Other organizations set up a dedicated email address to accept employee requests with supporting documentation attached as PDFs. An increasing number of companies are accepting reimbursement forms through online platforms like Jotform.

Common challenges in reimbursement approval workflows

Organizations of every size experience similar issues with their expense management systems. Here are some of the biggest ones.

Missing receipts

As proof of transactions, receipts are the most important component of any expense approval workflow. When substantiating an expense, employees have to show what was purchased, when, and where, and be able to provide reasons the expense was business-related.

If the receipt is for a stapler at Office Depot, the business nature of the purchase is self-evident. Meals and travel, however, require a bit more support, such as calendar invitations that corroborate business dinners or airline ticket dates that coincide with a business meeting. Even in these situations, receipts are the most vital documents, because they prove employees spent money.

If employees lose a receipt, they should request another copy. If they are unable to do this, they won’t be able to request a reimbursement.

Damaged receipts

Another downside of physical receipts is that they fade or easily become illegible. As you’ve probably noticed, the sun bleaches ink off exposed receipts in your car in just a few days. In addition, crumples, creases, and tears can make receipts impossible to read. Again, if there is no proof of an expense, there’s no basis for reimbursement. Employees can avoid damaged and lost receipts by digitizing them, making submissions easier and more convenient.

Unclear expense policies

Long before beginning an expense approval workflow, you should draft a reimbursement policy and share it with employees and stakeholders. A reimbursement policy outlines exactly what’s reimbursable, spending limits or budget caps, and the time frame in which an employee can expect approval after submitting their request.

Don’t start accepting requests until you put these policies in writing. Of course, unforeseen circumstances can reveal the need for addendums or updates to the reimbursement policy. In this case, make the necessary changes to your policy and its documents, and notify all employees of the changes.

You can overcome many of these challenges by automating your workflow. We’ve already covered some of the different software solutions that manage expenses. In this final section, let’s look at how they speed the approval process and make life easier for employees as well.

Using a form and workflow hybrid

Once you understand how to organize a typical expense approval workflow, you should figure out how to optimize your company’s processes.

Earlier, we mentioned that reimbursement software can help you manage your company’s expenses. In this section, we’ll cover the different ways these platforms build better approval workflows.

How expense reimbursement software streamlines processes

The main advantage of using expense management software is that it automates many processes, reducing or eliminating the time-draining activities from every workflow. Here are some of the benefits of using these platforms.

Simplifies receipt collection

Paper receipts are the bane of every expense management system’s existence. It’s so easy for employees to lose them and miss out on the reimbursement for a purchase they can’t prove they made. Finance teams also have to store copies in case of an IRS audit. Scanners create copies of receipts, but scanning numerous receipts is cumbersome.

Many expense management apps allow users to take a picture of receipts with their smartphones and upload the files directly to the platform. This enables the finance department to see them immediately. Some programs can even read the information from the photos to automate data entry.

Automates multilevel approvals

In the past, employees submitted a paper reimbursement request form to their managers, who would then have to stamp or sign to approve it before taking it to the finance team for payment. Unless they followed up with their boss or the finance team, the employee didn’t know right away whether or not their manager had approved the request.

With expense management software, approvers review reimbursement claims in just a few clicks. The system also automatically notifies each employee about the status of the reimbursement, so no one ever has to wonder what’s happening or start any awkward conversations.

Enforces the policy

Expense reimbursement policies can be quite complicated and a burden for time-strapped employees to learn when they’re just trying to get their jobs done. That’s why many expense management platforms implement your policies in the form of rules and conditions you can modify.

For example, to adhere to the written policy, you can set the program to prevent employees from requesting reimbursements for expenses over a certain amount. Similarly, decision-makers may see an alert on a reimbursement request indicating it’s over the allowed limit so that they don’t approve a payment that violates the expense policy.

Sets up direct deposits

Direct deposits aren’t just for payroll processing. Finance teams can transfer funds directly to an employee’s bank account. Many expense management platforms connect to banks or integrate with popular payment processors so one-time reimbursements can be deposited with the click of a button.

Manage reimbursements with Jotform Approvals

Jotform’s multiple products differ from other expense management platforms in that you can tailor them to multiple approval functions and streamline many of your everyday business operations.

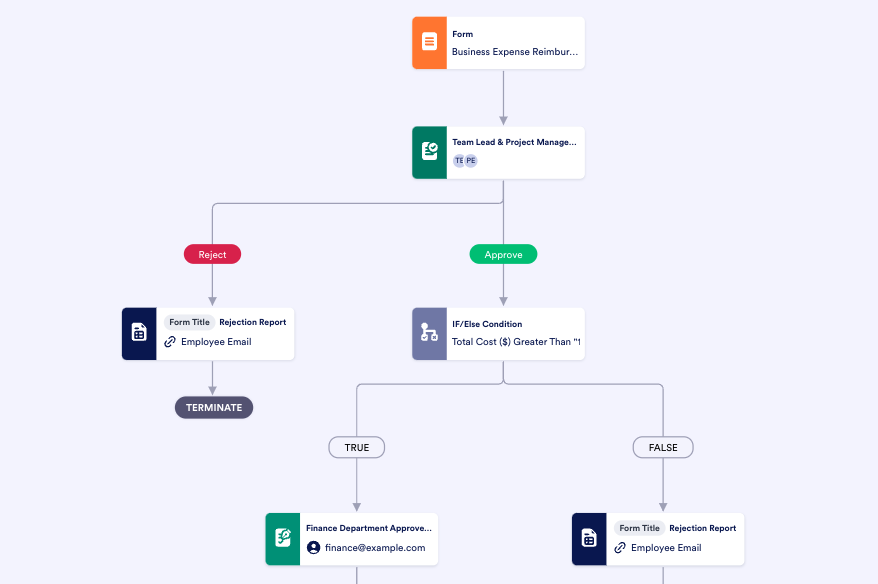

Jotform offers more than 10,000 customizable form templates that can become the foundation of an automated workflow in Jotform Approvals. Jotform Approvals provides templates for approval workflows, allowing users to build an expense reimbursement workflow by plugging in the forms, conditions, employees, and decision-makers that are part of the process.

With a drag-and-drop interface, Jotform Approvals makes routing approvals and automating notifications incredibly intuitive. Just like the individual forms, the workflow templates are fully customizable and can scale up approval processes to the size and complexity of any organization.

Conclusion

Employee expenses are necessary to ensure work proceeds as efficiently as possible, without the interruptions of asking managers for money. It’s never fair for employees to spend their own money just to do their jobs, so it’s important to have a streamlined reimbursement approval process so they can recoup their funds and not feel put out by their employers.

With this guide, you can draft a comprehensive and fair expense reimbursement policy, and avoid many of the challenges that are bound to crop up in the approval process. You’ll also know what to look for in expense management software, such as Jotform Approvals, which makes streamlining your processes even easier — for free.

Send Comment:

1 Comments:

More than a year ago

This really helped me implement a reimbursement policy. My employees don’t have a lot of expenses, but we do get busy during the summer when they’re more likely to go on road trips and stay overnight for meetings. Some employees were staying in really cheap places, not realizing that I could cover better lodgings for them. This made me realize that I have to formalize expense caps so they have a better idea of what’s allowed and what’s not. And now I get their reimbursements handled so much easier as well.