Best expense trackers for small business

If you’re running a small business, everything has to be precise. A misplaced comma or decimal point can drastically affect the decisions you make in all aspects of your workflow. It’s important to keep regular and meticulous notes on your operations — how much money you’re taking in, what you’re spending, how much you’re producing.

Tracking your expenses gives you a clear picture of the current state of the business and what you need to do to stay on course and continue to grow. Investing in tools that allow you to centralize these records is a necessary step to stay organized. Thankfully, there are plenty of platforms tailored to do just that.

Here’s everything you need to know about small business expense tracking — and the best tools available to do help you do it right.

1. Jotform

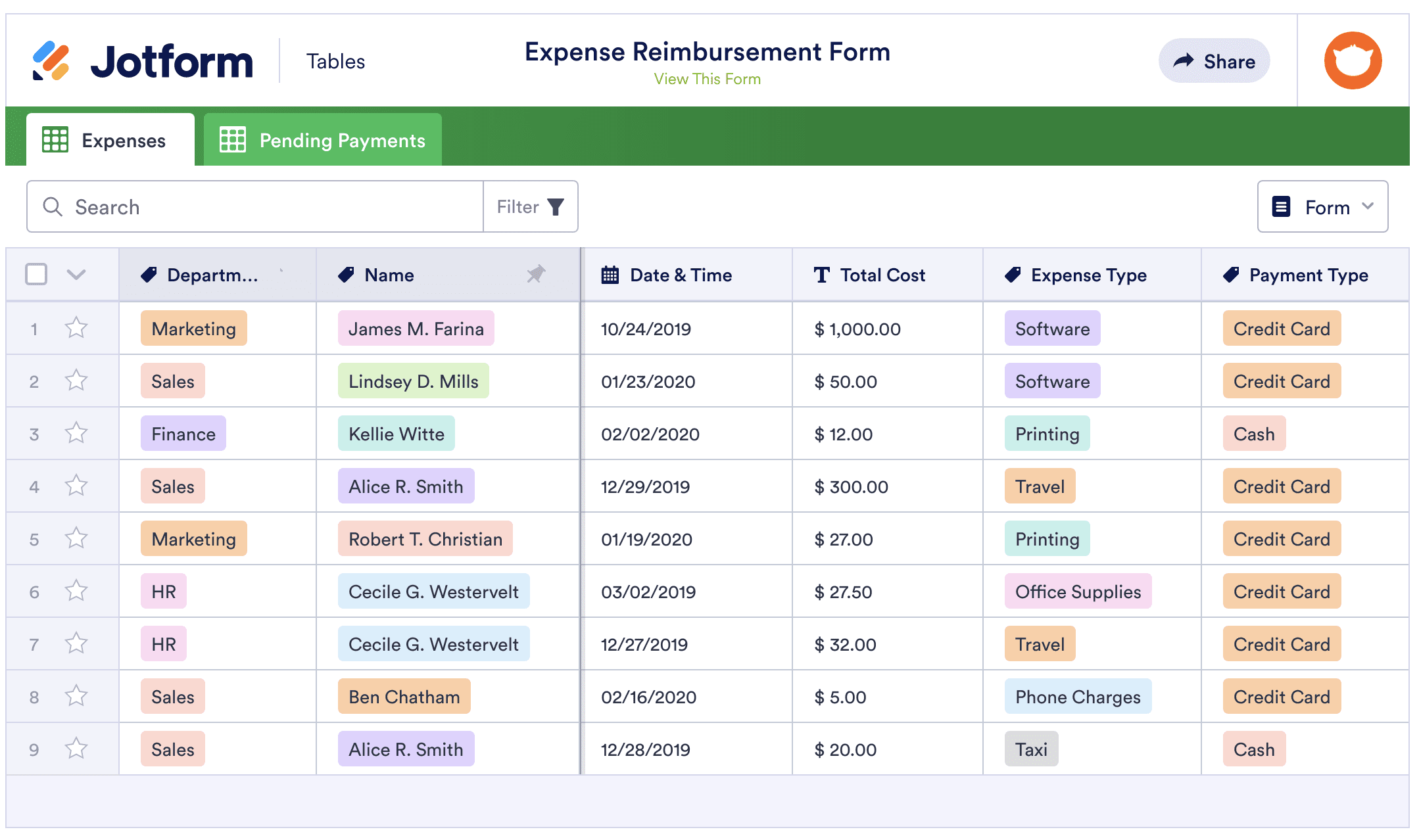

Jotform works as an all-in-one service for your small business expense tracking needs. You can choose from a wide range of form templates to match specific business functions. An expense reimbursement form can help you track what you owe and who owes you. What’s more, you can track expenses and ensure that you monitor any bugs or errors.

The best part? All of these forms automatically send responses to Jotform Tables. Just use one of Jotform’s table templates and connect the template with the appropriate form. You can arrange expenses by color, pinpoint the when and where of your expenses, and monitor the minutiae of your business operations.

Jotform offers a free plan as well as tiered plans — priced at $29, $39, or $99 per month — that give you greater flexibility, so if there’s one area of your business you want to focus on, you can choose the plan best suited to your goal.

2. Dext (formerly Receipt Bank)

Dext, which offers pricing plans starting at $24 per month, is great for consolidation. If you’re a one- or two-person operation or a midsized business, Dext has a plan for you.

Dext’s calling card is its ability to categorize, store, and maintain records of your bills, business receipts, and bank statements. Users can upload their financial materials from a smartphone, laptop, or email account.

Dext’s formula is based on machine learning; its software extracts all necessary data from the documents you provide, assisting with bookkeeping and connecting with cloud accounting platforms like QuickBooks or Sage. Plus, with Dext’s Advanced Expense Reports package, you’re in the captain’s chair — you can create and approve rapid-fire expense reports and assign anyone on your team ownership and control.

3. Fyle

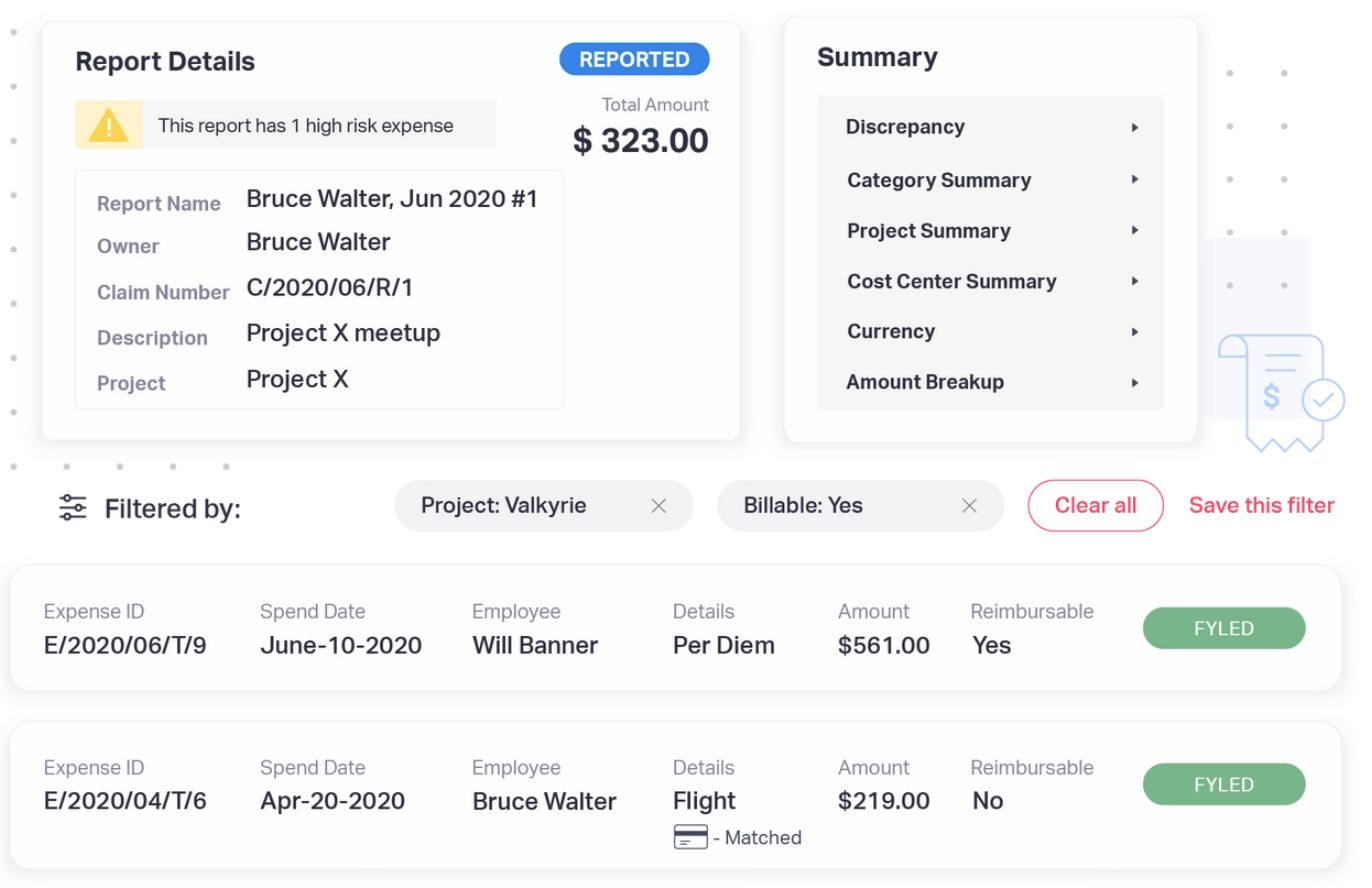

You shouldn’t have to be a detective to run a business, especially when Fyle can do that work for you. Powered by artificial intelligence, Fyle automatically scans your receipts to detect fraud and potential duplicates to ensure nothing nefarious is going on.

In addition to its extension connections with Gmail, Slack, and Office 365, Fyle centralizes all information related to your approvals, payments, operations, and employees so you have it all in one place. This way, you can make big-picture decisions about your business with everything you need just a click away. Fyle’s plans start at $6.99 per user, per month.

4. Mint

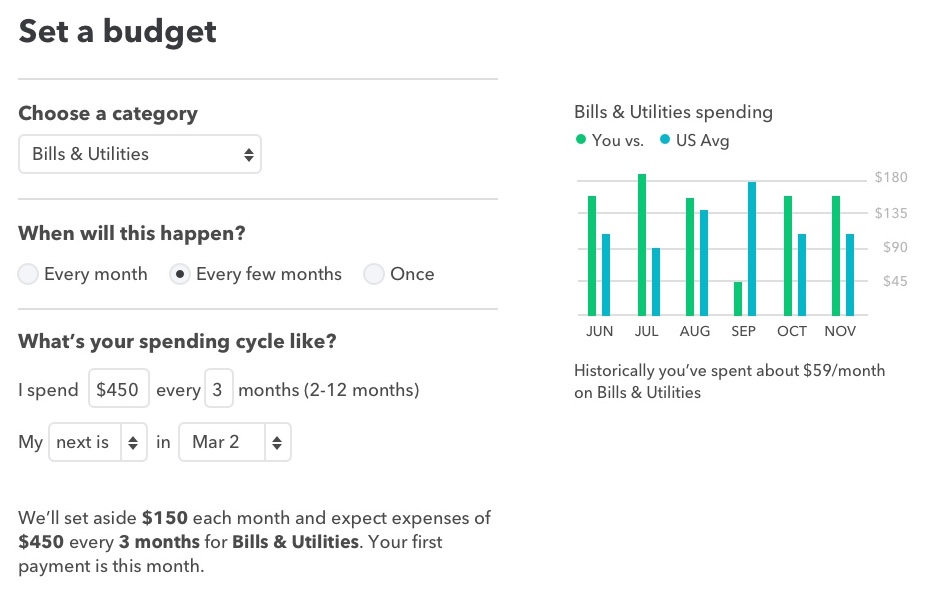

You may know Mint as a personal finance tool, but did you know that it can help with your small business needs too? In addition to financial information automation, this Intuit software helps you manage and save money by analyzing thousands of savings, checking, brokerage, credit card, CD, and IRA offers, then giving you advice on the most cost-effective options. You can also add manual actions like pending checks or cash that a financial institution doesn’t manage.

Mint provides comprehensive breakdowns of your expenses and how your spending affects your year-end budget. Taking this legwork out of the process can free you up to be aggressive in your action plans, because you’ll know what impact your decisions will have. The cherry on top? Mint is free!

5. Expensify

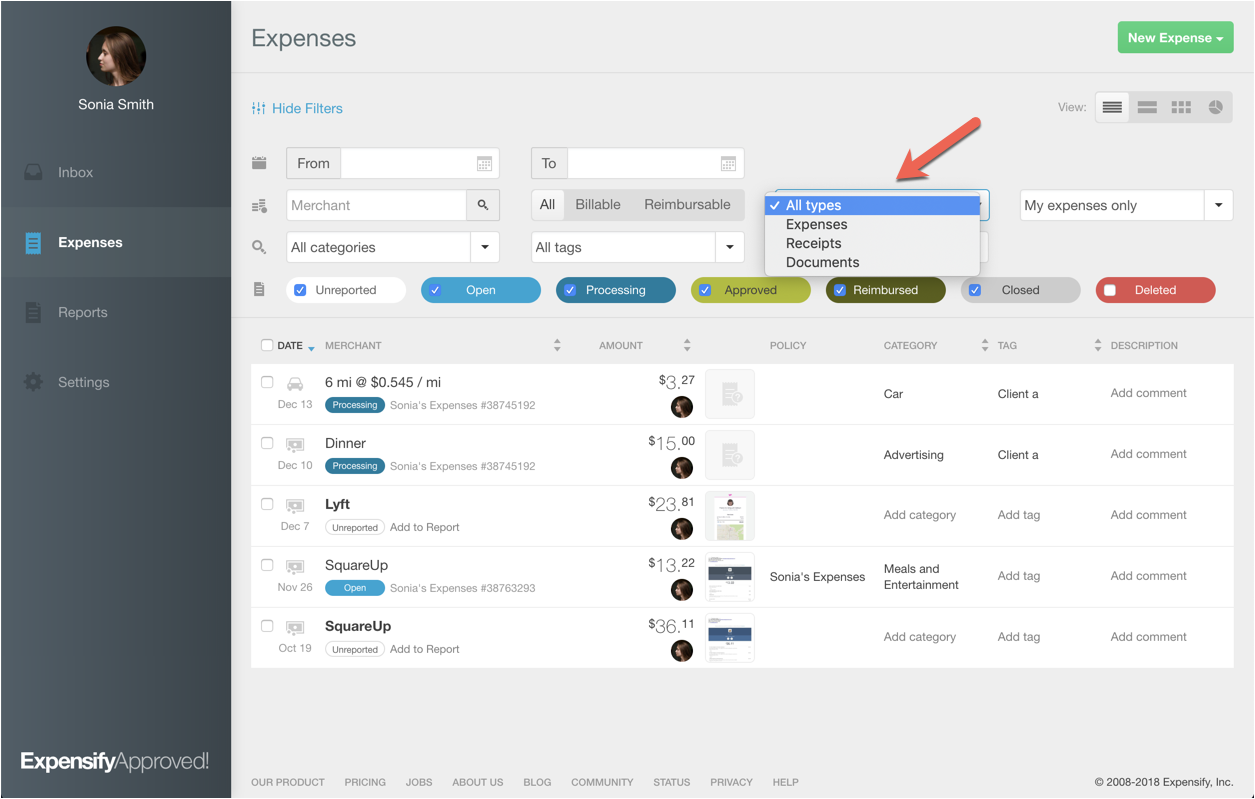

Expensify is a jack of all trades. Its SmartScan technology provides unlimited receipt scanning starting at $5 per month. Expensify’s expense management tools code and submit your spending for approval, reimbursement, and automatic uploading to your accounting software.

You can also manage travel, create and collect invoices, and import your company credit card information to Expensify, so that you have it all in one place. Even the more petty charges of your day-to-day life are covered, connecting with apps like Uber and Lyft for real-time expenditure tracking.

Expensify also gives you the controls — you can delegate administrative tasks to your employees through secure one-click logins.

Staying on top of things

When you run your own business or work at a small business, you’ll be involved in multiple, if not all, areas of the business. There’s a lot you have to consider and manage on a day-to-day basis.

Having tools at your disposal to streamline this process is vital. Business expense tools can be like a trusty companion — there to catch you when you fall and be a guidepost for your business future.

Send Comment: