Top 5 invoicing software

Everyone hates waiting, but we all have to do it.

Whether you’re waiting in traffic or waiting for your food to arrive in a restaurant, it’s a fact of life that makes you groan, sigh, complain, and stress out all at once.

But one thing you shouldn’t have to wait on is payment for your services.

If you’re using paper invoices to bill your customers or clients, you’ll likely need to print each invoice, mail it out, wait for a response, and process the payments when they arrive. Even if you create an invoice on your computer and send it as an email attachment, you’ll still need to wait for payment information to come in for processing.

Online invoicing software can help you save money and time by eliminating the need to print invoices, cut snail mail out of the equation, and, above all, get you paid faster so you’re not playing the waiting game.

Why use online invoicing software?

Although there’s no shortage of online invoicing software out there, paper invoices are still a popular choice for many businesses.

In fact, a 2018 Levvel Research survey of more than 400 back-office employees across several industries in North America revealed how common paper invoices still are:

- About 36 percent of all the invoices they received were on paper, while another 34 percent were sent and received by email.

- Electronic invoices or those uploaded through a web portal made up only 30 percent of all invoices received.

- Employees from small- and medium-sized businesses reported receiving higher rates of paper invoices, which made up about 44 percent and 30 percent, respectively, of all the invoices they received.

- Employees from large organizations estimated that only 28 percent of all the invoices they received were on paper.

- Fifty-four percent said data from incoming invoices are manually entered into their company’s billing or accounting software systems.

- Fifty-two percent said invoice automation workflow tools are used to send invoices throughout the approval process within their company or organization.

- Manual data entry and inefficient processes were significant pain points for 48 percent of all surveyed employees.

- More than 30 percent said they were worried about losing or misplacing invoices, dealing with paper invoices, and having to manually route invoices for approval.

There is, perhaps, a logical explanation for some of these findings: Large companies can afford automated systems that generate, accept, and process invoices electronically.

Since small- and medium-sized businesses generally have smaller budgets, they may be hard-pressed to invest in online invoicing software and pay the associated processing fees.

Many online invoicing platforms require you to buy a subscription and pay for the processing fees charged on each transaction, but there are some benefits that may make one of these platforms a worthwhile investment.

Online invoicing software allows you to generate customized invoices, send them out electronically, and track the status of each one. This is particularly important since paper invoices can easily be lost or misplaced at any stage in the billing process. Once an invoice leaves your hands, you have no control over what happens to it until a payment arrives.

Some platforms can even track your expenses, manage details on who you bill, accept multiple currencies, and generate reports that show you where everything stands.

Online invoices also eliminate the need for time-consuming manual data entry after you receive a payment and after clients, customers, or buyers receive your invoice.

Since clients and customers can make payments through online invoices, you can count on getting paid quickly, rather than waiting for a check or someone’s credit card information to arrive in the mail. This seamless payment process is especially helpful when you need the money to pay for your own business expenses.

There’s no shortage of online invoicing services out there, and each one offers a unique range of features that are designed to streamline your workflow.

The top services that offer standout features, especially for small- or medium-sized businesses in search of cost-effective solutions are listed below.

Did you know?

You can use Jotform to gather information from clients or customers, and then use the collected data to create professional and polished invoices in Jotform PDF Editor. You can even get a jump start on the process by using one of Jotform’s invoice templates.

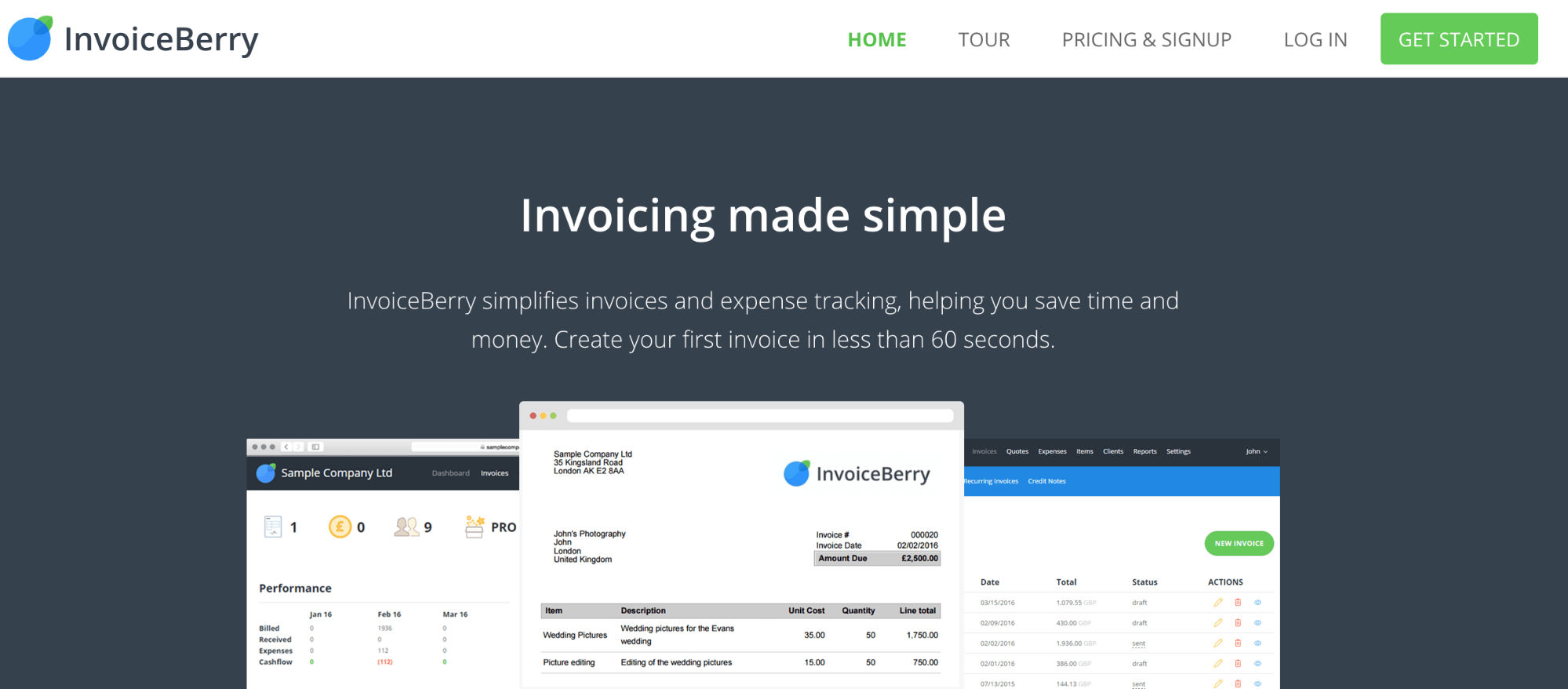

1. InvoiceBerry

Cost: Paid subscription required after a 14-day free trial

InvoiceBerry is an online invoicing platform that tailors a range of bookkeeping services to the needs of small businesses, sole traders, and freelancers.

As a starting point, InvoiceBerry offers a wide range of ready-made templates so you can save time and create invoices that follow a consistent format. From there, you can customize your invoice by adding a company logo, line items for purchases or services, and billing details for customers or clients.

The entire invoice creation process takes a matter of minutes (maybe even as little as one minute, according to InvoiceBerry’s website). This is because InvoiceBerry allows you to automate some manual tasks that can be time-consuming. You can, for instance, create billable items, along with terms and conditions, that can be automatically added as you’re creating a new invoice. InvoiceBerry even allows you to include notes to customers, add the account number for sales tax, and apply discounts or credits.

When you’re ready to send out your invoices, all you have to do is provide a recipient’s email address, and InvoiceBerry will take care of the rest. InvoiceBerry also allows users to share customized messages with clients and customers before an invoice is sent or after someone makes an online payment through an invoice.

Businesses and organizations can enable payments through their online invoices by connecting with Stripe, PayPal, Square, or WeChat to process transactions. The best part is that invoices can be sent in seven languages and more than 200 different currencies.

InvoiceBerry also offers a helpful feature that automatically displays unpaid invoices on your dashboard as soon as you sign into your account. This enables you to actively monitor outstanding invoices and follow up by sending a payment reminder with the click of a mouse.

After a payment is made, InvoiceBerry will automatically record it and update the status of an invoice in your account. The platform’s recurring invoice feature also makes it easy to schedule and automatically send bills to regular or repeat customers.

When you need to take stock of how your business is doing, InvoiceBerry has a handy dashboard that allows you to find invoices, quotes, or payments and generate itemized reports. This seamless process allows you to stay on top of your finances and share only the data you need to while keeping everyone — from clients to accountants — in the loop.

You can even control how this data is shared by printing it out, exporting it to a spreadsheet, or saving it as a PDF file.

InvoiceBerry requires businesses and organizations to sign up for a paid plan after trying out their services for free 14-day trial.

Paid plans start at $15 per month, which accommodates up to two users, unlimited invoices and 35 clients. If you want to collect payments through an InvoiceBerry invoice, you must also account for credit card processing fees charged by individual payment processors, such as PayPal, Square, and Stripe.

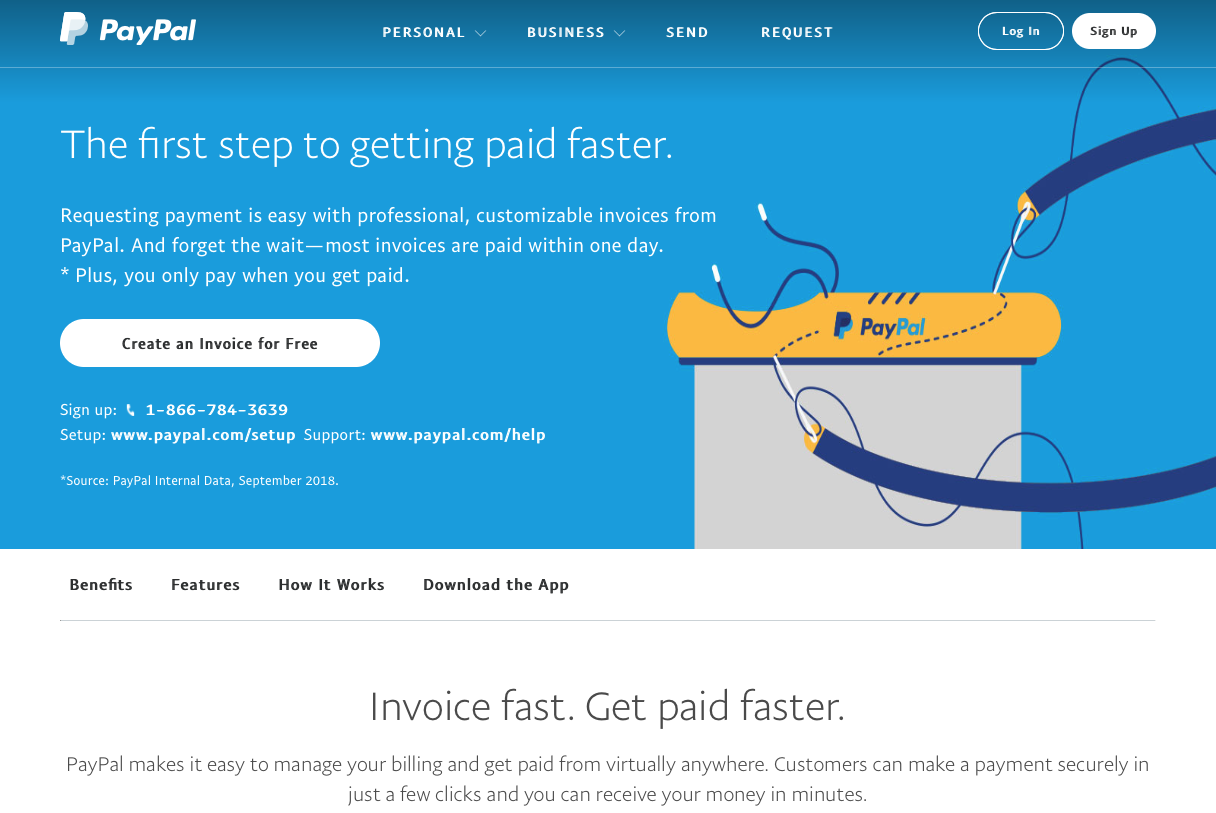

2. PayPal Invoicing

Cost: Free, with fees assessed on each completed transaction

Anyone who has sold anything or conducted business online has heard of PayPal, but the tech giant’s scope of services isn’t limited to processing payments.

The company also offers an online invoicing service that’s built into its payment platform for businesses and organizations. This is a particularly attractive and affordable option if you’re using PayPal as your preferred payment processor.

PayPal has taken steps to comply with PSD2 and its strong customer authentication requirements — both of which are important to understand, especially if your business is in the European Union, or if you have customers or clients there.

Once you create a PayPal account and locate the invoicing feature, all you need to do is fill in your contact information along with the billing details for your customers or clients, such as their name, email address, and shipping address.

In addition to details for individual items, including a brief description, the purchase quantity, and the total price, your invoice can account for special charges, such as taxes, shipping costs, or discounts.

You can even give your invoice a personal touch by adding a business logo. You can also create a template so you don’t have to repeat the entire process. Since PayPal automatically places the data you enter into a standard template, this may be an issue if you’d like to have more control over the format of your invoices.

When everything’s good to go, you can send a PayPal invoice as an email or shared link. PayPal also allows you to schedule an invoice to go out on a future date so you don’t have to send it manually.

Customers, in turn, can make payments directly through an invoice with their credit card, debit card, PayPal account, or PayPal Credit. By leveraging the payment processor’s broad reach, you can collect payments in 25 currencies from more than 200 countries and offer nonprofit discounts for PayPal transactions.

To ensure you’re on top of everything, you can view your billing history, track payments, and send reminders from your PayPal account dashboard. PayPal even sends you notifications when a payment arrives in your account.

If you’re on the go and can’t log into your account on a desktop or laptop, the PayPal Business app lets you create invoices, send them out, keep track of those that haven’t been paid, send reminders, and manage payments from your mobile device.

Unlike their competitors, PayPal doesn’t require people to buy a subscription for their invoicing services. Although it’s free to create invoices and send them out, PayPal tacks a flat fee onto each successful payment that’s collected through an invoice. PayPal’s fee for each completed invoice payment is 2.99 percent of the total amount collected, along with an additional $0.49 charge, as of March 2024.

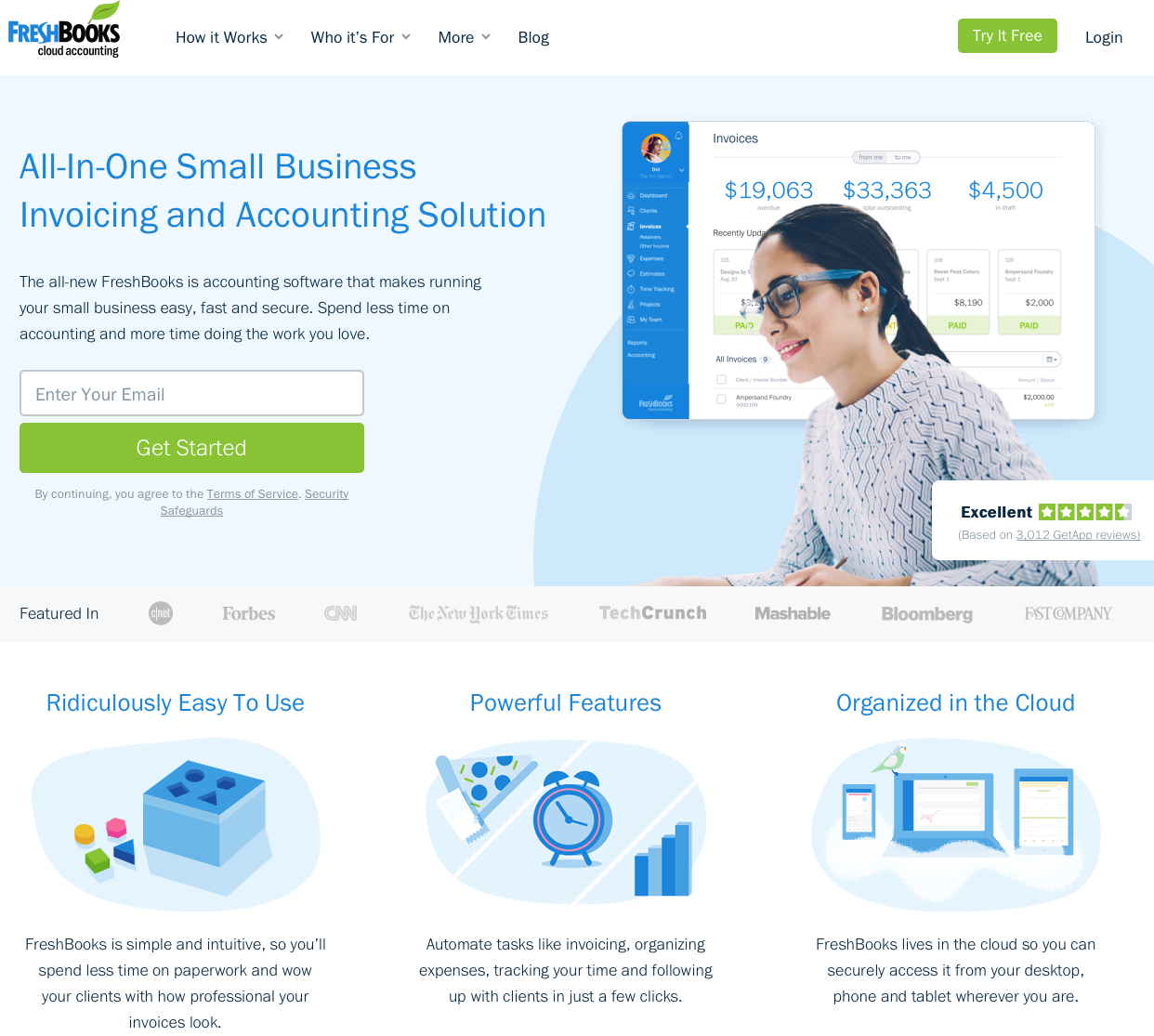

3. FreshBooks

Cost: Paid subscription required after free, 30-day trial

FreshBooks may be more well known for bookkeeping, but the popular accounting platform for small- and medium-sized businesses also allows users to send electronic invoices to customers or clients.

Apart from online invoicing, FreshBooks enables business owners to keep track of expenses, create estimates or proposals, monitor the time employees work, stay on top of all their active projects, and communicate with coworkers and customers.

If you need their full range of accounting services, FreshBooks may be a good investment, since you can manage some key business functions under a single platform.

FreshBooks makes it easy to find the invoice feature from their account dashboard. There, you can select from the templates you’ve already made. The invoice dashboard also allows you to see how much money clients or customers still owe and if there are any overdue invoices.

Even if you need to create invoices from scratch, FreshBooks cuts some manual data entry out of the process by automatically importing an account holder’s contact information into an invoice.

Although FreshBooks offers only three preformatted templates in the invoice builder, you can customize how they look by adding a company logo and changing the theme colors or font. Since invoices in progress are always shown in preview mode, you can see how changes will affect the final product.

As you’re building an invoice, you can specify when it’s due, add billable line items, offer customized discounts, send reminders at customizable intervals, request a deposit, and account for taxes that will automatically be calculated by Freshbooks. You can even schedule late fees for invoices, send invoices in 14 different languages, accept payments made in dozens of currencies, and add notes or terms and conditions.

In addition, Freshbooks allows customers or clients to make payments directly through an invoice using either Stripe or FreshBooks Payments, which accept Apple Pay, Mastercard, Visa, and American Express.

Payments made with Visa, Discover and MasterCard charge a 2.9-percent processing fee plus $0.30 on each transaction and the payments made with American Express charges a transaction fee of 3.5 percent processing fee plus $0.30.

You can schedule recurring invoices and create automated thank-you emails. You can also use the Freshbooks mobile app to create and send invoices as well as chat with clients or customers and receive instant updates when an invoice has been viewed or paid.

As an added bonus, Freshbooks allows businesses that collect retainer fees to create the terms and billing schedule for a recurring invoice. These businesses can leverage Freshbooks’s time tracking feature to set aside a specific number of hours for a client’s project and send an invoice for any additional hours worked or expenses accrued during a set time period. Businesses can even generate and share retainer summary reports with clients at any point during a retainer period to ensure everyone’s on the same page.

Freshbooks’ paid plans start at $5.70 per month — or $152.00 for an annual subscription — as of March 2024.

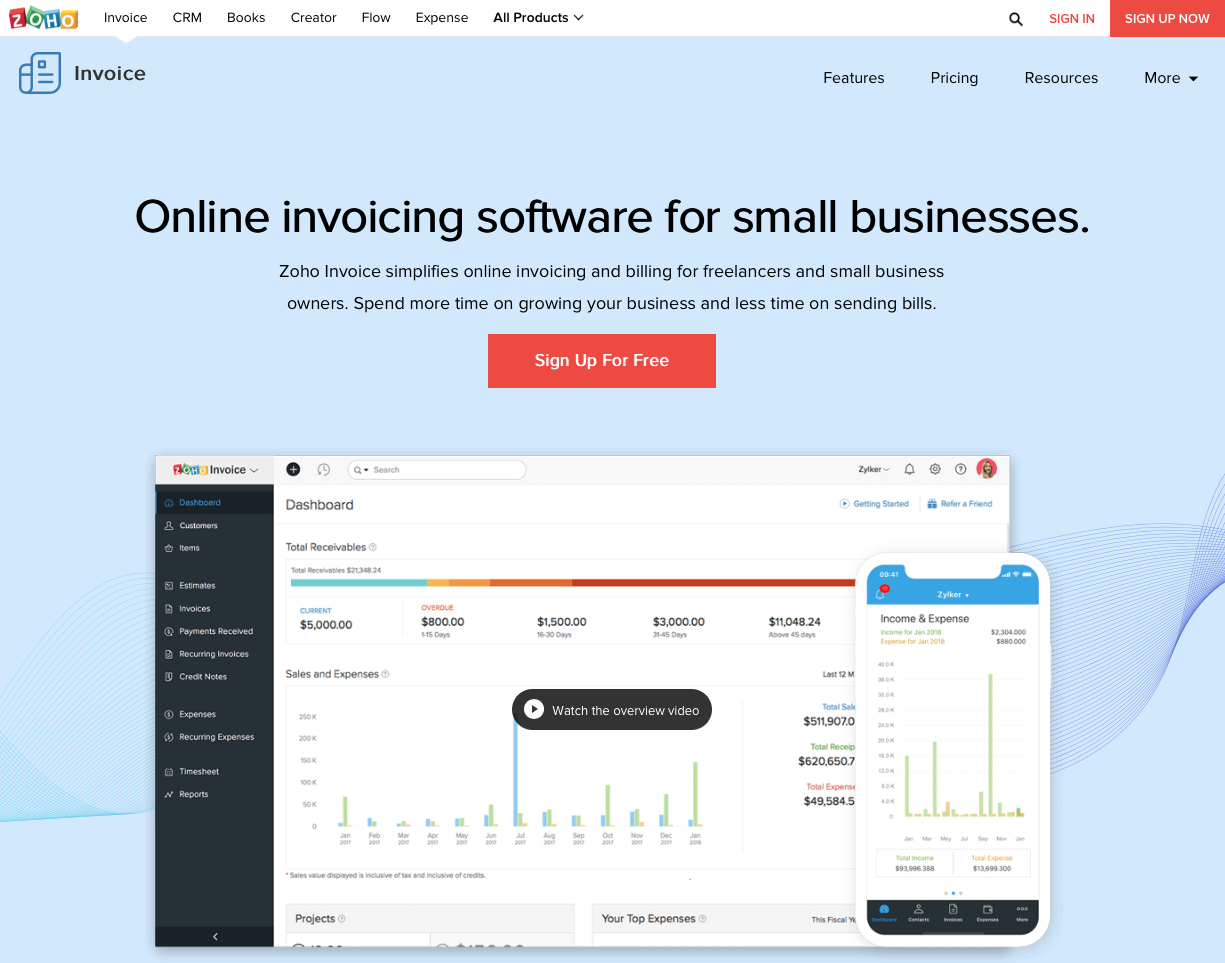

4. Zoho Invoice

Cost: Free

Zoho may be more well known as a customer relationship management platform for sales teams, but the company has set themselves apart from competitors by offering a broad range of services that can be used by businesses and organizations of all sizes across industries.

Zoho Invoice is primarily geared toward small- and medium-sized businesses.

Although Zoho Invoice offers a number of preformatted templates, users can personalize them by uploading a company logo or changing the page orientation, background appearance, labels, font color, and font type in any section of the document. That means you can effectively create a branded invoice that’s just as unique as your business.

As you’re creating an invoice, you can add details about billable line items, employees, and customers or clients. This handy feature also allows you to easily pull up this information for future invoices, which saves you time and reduces the need for repetitive manual data entry.

Zoho Invoice also allows you to set due dates, apply discounts, add shipping charges, factor in any billing adjustments, include sales tax, type in customized notes for customers, attach files, and spell out any terms and conditions.

If you do business with clients or customers in other countries, you can send invoices to them in 10 different languages, show prices in dozens of different currencies, account for changes in foreign exchange rates, and analyze any adjusted balances.

You can even collect payments from customers or clients by connecting your invoices to Stripe, Square, PayPal, Authorize.Net, PayPal Payflow Pro, PayPal Payments Pro, 2Checkout, Braintree, Worldpay, and Forte.

Zoho Invoice makes it easy for you to set up and schedule recurring payments for automatic billing. You can also send personalized thank-you notes when you receive payments.

Zoho Invoice has a unique feature that allows you to create credit notes for refunds and price adjustments, which can be applied to another invoice or recorded as a refund in your account.

One feature that really makes Zoho Invoice stand out is the client portal, where businesses can forge deals, negotiate prices, and hammer out terms and conditions in real time without the need to exchange lengthy back-and-forth emails.

In addition to managing your billing workflow, Zoho Invoice can help you create estimates, which you can easily convert into invoices once your clients or customers give you the green light. This saves you time by eliminating the need to manually transfer data from one online document to another.

Much like FreshBooks, you can use Zoho Invoice to send retainer invoices to collect money from clients up front.

With the Zoho Invoice dashboard, or mobile app, you can track and record the hours that you’ve worked on a project, which will be captured and displayed in a calendar layout. You can even give your coworkers restricted access to your Zoho Invoice account so they can record the amount of time they spend working on a project.

The platform’s time-tracking features can also help you create a budget based on the total cost of a project or amount of hours set aside for it. Once a project is underway, you can use Zoho Invoice to track how much of your budget has been used and how much remains.

Zoho Invoice allows you to set up recurring expenses so you don’t have to re-enter them into your account. There’s also a convenient option that allows you to take pictures of paper receipts and upload them to your expenses.

When you’re ready to bill clients, Zoho Invoice will not only include the retainer payment in the invoice automatically but also add any unbilled hours and expenses.

You can create a Zoho Invoice account and take advantage of all Zoho’s services without upgrading to a paid Zoho account, but you can send invoices to no more than five customers. Free plans also limit you to five automated workflows and restrict account access to only one person.

5. Xero

Cost: Paid subscription required after free, 30-day trial

Xero has not only carved out a space for themselves among accounting platforms, but they also offer an invoicing service. Some standout features make it easy to collect payments and share information with customers and clients.

More specifically, Xero allows you to send bulk invoices or statements to customers in a single action and set expected payment dates so you can manage your cash flow. Xero also enables businesses and organizations to schedule bill payments and invoice groups of customers. Since payments, returns, and credits are all tracked automatically, it’s easy to stay on top of everything.

Along with their invoicing service, Xero helps small businesses manage their payroll tasks, leave requests, and bookkeeping operations.

Like many of their competitors, Xero offers a wide range of invoice templates to give you a jump start on the process. You can then personalize your invoice by adding a branded theme, outlining your payment terms, attaching files, and uploading a company logo.

When it comes down to the nitty-gritty details, you can indicate whether a billable line item is a taxable expense, account for any sales taxes that must be collected, and set an issue date for your invoice. Xero makes it easy to accept credit and debit card payments through an invoice and allows your customers or clients to pay from their PayPal or Stripe account.

If you send invoices to customers or clients regularly, you’re in luck because Xero allows you to schedule recurring invoices. You can also create a template that can be updated and used for the same customer on future purchases.

With Xero, you can set a due date for an invoice and schedule automated reminders for customers or clients who haven’t responded by the due date. All you have to do is decide when and how often the reminders should be sent out.

From your Xero account dashboard, you can see how much money your customers or clients owe you, as well as whether they have viewed and paid their invoices. Since Xero records each time someone views outstanding bills online, you can use that information to follow up with customers and justify further actions, such as late fees.

As an added benefit, the platform’s Xero Accounting mobile app allows you to expense receipts and add files, such as photos, to the invoices you want to send.

Conclusion

Getting paid for your services isn’t just rewarding; it’s necessary for any business to survive.

If you’re using paper invoices to bill your customers or clients, you’re making your life a little harder.

Waiting for payments to arrive can be a drag, especially when you’re relying on snail mail and the process takes days or weeks. Even when do hear back from your customers or clients, you still need to manually process their payments and enter them into your books.

Online invoicing software can cut manual data entry out of your workflow and speed up the payment process so you can dedicate your time to more meaningful tasks. By automating tedious tasks — such as applying sales tax, shipping costs, credits, or discounts to invoices — and eliminating the need to re-enter data, including your contact information, individual line items, and your terms and conditions, online invoicing software makes your life easier.

Online invoicing platforms also help you stay organized by letting you see who has viewed their bills and keep track of when payments are made. Some of these software solutions can even tell you who hasn’t paid, follow up with them, or send recurring bills to regular clients or customers.

As an added benefit, some online invoicing platforms offer accounting and bookkeeping features so you can charge retainer fees, keep track of billable hours, and account for expenses.

Waiting is a game that you don’t have to play.

Give online invoicing a try so you can get paid faster and dedicate more of your time, money, and resources to important work.

Send Comment:

2 Comments:

More than a year ago

Hey, Thanks for sharing the best invoicing software. As it will help in selecting the top most invoicing software for the business. very informative blog. Keep sharing.

More than a year ago

If more people that write articles really concerned themselves with writing great content like you, more readers would be interested in their writings. Thank you for caring about your content.