Imagine a child running their first lemonade stand in their front yard. They purchase the lemons and sugar needed to satisfy their customers and (hopefully) collect a tidy profit by the time supplies run out.

But say a tech billionaire sees the lemonade stand and decides to order enough lemonade to treat their entire office to a mid-day drink. With the promise of a hefty bonus for a completed order, it’s in the child’s best interest to take on the contract. But they can’t expect their current customer base to provide the revenue needed to purchase more supplies.

A child may look at this conundrum and say, “No thanks. I’d rather go inside and play video games.” In the business world, however, you can’t afford to turn down such a lucrative offer. Instead, you’ll look to purchase order financing for the quick cash you need.

How purchase order financing helps vendors

The child with the lemonade stand might just ask their parents for a quick loan with a promise to pay it back. Vendors can do the same, thanks to purchase order financing from qualified banks and lenders.

There are downsides to purchase order financing, such as being left holding the bill when a buyer drops out of an agreement or declares bankruptcy. Legal measures mitigate these costs, but the seller takes on most of the risk. Additionally, fees and surcharges may limit the amount of revenue a business can earn from a large purchase order.

Still, business owners often prefer financing to turning down an offer due to a lack of resources or cash flow.

Pros and cons of financing

If you need financing to fulfill a purchase order, consider the benefits and drawbacks.

Pros

- It allows your business to complete projects and orders that would otherwise be impossible.

- It encourages tight financial planning, as the project goals are specified by the purchase order and financing agreement.

- It improves your industry reputation as a vendor/supplier that can get the job done under duress and with limited time.

- It helps with cash flow problems and prevents revenue loss.

- You can pay when you complete the project, meaning your business won’t have to make hefty monthly payments while fulfilling the order.

- There are easier financing options for vendors with mediocre credit, as purchase order financiers typically only care about the details of a purchase order.

Cons

- Lenders may take a percentage of the revenue for the project as the cost for financing.

- Customers often pay the financier directly instead of your company, making them aware of your cash flow issues.

- Fees range from 1.6–6 percent.

- Purchase order financing only works for companies that produce products, not service-based businesses.

- Lenders provide financing only for large orders worth more than $50,000.

- Employees are burdened with more paperwork, which can lead to errors and mistakes.

How vendors use purchase order financing

Distributors, resellers, and wholesalers all regularly use purchase order financing. Through financing, these businesses can keep pace with retail customers that place large orders at irregular intervals.

Vendors that produce seasonal products may also find value in financing to get started for the busy part of the year. After hibernating during the down months, they can get the ball rolling again with a lump sum of cash. Any business with tight cash flow will quickly see the benefits of financing, especially if they’re stuck in a cycle in which they need to purchase materials before beginning production.

How to acquire purchase order financing

To receive financing, you have to provide a number of documents to a prospective financier, including the purchase order, invoices, financial statements, and tax filings. Keeping track of these documents can be a task in itself. Creating and maintaining these records and requesting more from stakeholders is best done with a unified platform like Jotform, which allows you to assign forms to team members.

With Jotform’s Form Builder, you can create personalized forms for managers and company stakeholders, giving you easy access to first-hand data that may help your business decide if financing is right for you. You can start with Jotform’s customizable form templates — such as financing requests, invoices, and purchase orders — that give stakeholders a one-stop shop to create and view additional paperwork.

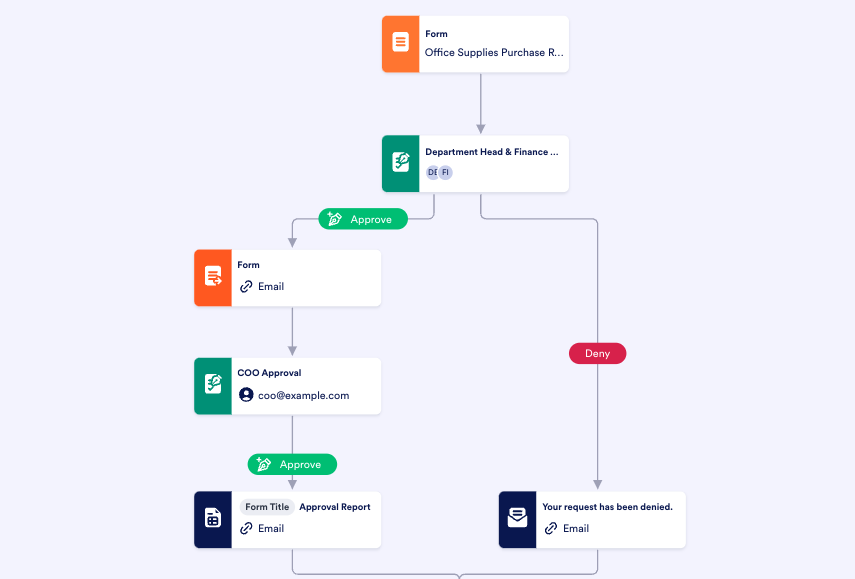

You want to put your best foot forward when applying for financing, so it’s a good idea to use tools like Jotform Approvals to automate your internal workflows. With Jotform Approvals, you can build a workflow to quickly process purchase orders from customers. As your team puts together a purchase order financing request, Jotform Approvals can automate internal approvals to produce and send the necessary paperwork, making this time-intensive procedure that much easier.

With an effortless approval process, you can quickly get the financing you need to fulfill your customer orders.

Send Comment: