-

AA_CAsked on December 3, 2016 at 11:36 AM

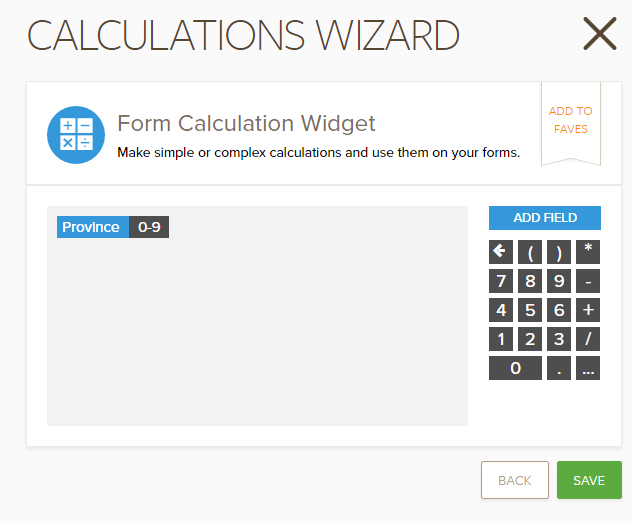

Is it possible to do multiple calculations with one cal-widget and insert different results into different fields?

For example my form 63315093011948 uses cal-widget to place a value into shipping/handling costs based on province selected, I would like the same cal-widget to place TAX rate into another field or do I have to create another cal-widget for that?

I have created an image of what I'm thinking about. The bottom section is what I'm asking about.

Thanks,

Regards

Robert

AAC -

jonathanReplied on December 3, 2016 at 4:05 PM

Hi Robert,

Currently you cannot for the Update/Calculate conditions as there is no "add" another DO action available in the calculation part. You can see that its only the IF rule that have the + option to add another IF rule.

But for the other conditional statement type, it is possible as both the IF rule and DO action have option to have multiple rules on them.

Example:

--

Take note though that with the Calculation action, you can still put multiple calculation by using formulas.

If you do create another conditional statement and if you targeted the same field (SUMMARY) it will overwrite the value.

Please tell us the multiple calculation you wanted to do on the same conditional statement. Perhaps we will be able to come up with a workaround for it.

Thanks.

-

AA_CReplied on December 3, 2016 at 10:04 PM

OK,

Thanks.. I understand.

What I'would like to do is have the Province drop-down field calculate the S&H plus the TAX rate for that province. Right now it is calculating a 13% TAX rate for all Provinces which is incorrect.

So here are the two tables:

S&H Table

BC, AB, SK, MB = $18.50

ON = $16.00

QC = $17.75

NB, NS = $19.75

PI, NL = $21.25The TAX table

BC, AB, SK, MB, QC = GST 5%

ON = HST 13%

NB, NS, PI, NL = HST 15%A workaround would be helpful, Thanks,

Regards

Robert

AAC -

Elton Support Team LeadReplied on December 4, 2016 at 4:06 AM

Hello Robert,

On S&H table, you can use form calculation field so you can fetch the value easily without creating conditions. This is possible since you have already assigned calculation values on the provinces.

Example:

Demo:

--

For the taxes, you have to create a calculation/update conditions like the following.

If province is equal to BC, insert 0.05 into Tax

Then on Tax Added field (HST), use the Tax field multiplied by the Sub Total.

E.g. SubTotal * Tax

Here's a cloned version with this changes https://form.jotform.com/63381858116966.

Feel free to clone this form if you want.

-

AA_CReplied on December 4, 2016 at 8:09 PM

Hi Elton,

Thanks for pointing this out and the clone ... I will definitely make a copy... I did notice however that the clone has no total if NS or NB are selected... An easy fix for sure... OH!and the ON S&H only shows up as 16 not 16.00

...I don't have any time right now but I will look at it tomorrow.

Many Thanks,

Regards

Robert

AAC -

Chriistian Jotform SupportReplied on December 4, 2016 at 9:58 PM

On behalf of my colleagues, you are most welcome. I have updated the conditions so that the Total appears if NS or NB are selected. I've also set it so that empty decimal places will be visible for S&H. You can check out and clone the updated form using this link: https://form.jotform.com/63387988459986.

Cheers. -

AA_CReplied on December 5, 2016 at 2:55 PM

Thank you one and all for the help... Very!! much appreciated.

Regards

Robert

AAC

- Mobile Forms

- My Forms

- Templates

- Integrations

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

PayPal

Slack

Google Sheets

Mailchimp

Zoom

Dropbox

Google Calendar

Hubspot

Salesforce

- See more Integrations

- Products

- PRODUCTS

Form Builder

Jotform Enterprise

Jotform Apps

Store Builder

Jotform Tables

Jotform Inbox

Jotform Mobile App

Jotform Approvals

Report Builder

Smart PDF Forms

PDF Editor

Jotform Sign

Jotform for Salesforce Discover Now

- Support

- GET HELP

- Contact Support

- Help Center

- FAQ

- Dedicated Support

Get a dedicated support team with Jotform Enterprise.

Contact SalesDedicated Enterprise supportApply to Jotform Enterprise for a dedicated support team.

Apply Now - Professional ServicesExplore

- Enterprise

- Pricing