-

TheLifestyleBrokerAsked on August 19, 2014 at 8:57 AM

The accommodations tax of 11% is NOT calculating properly on my forms.

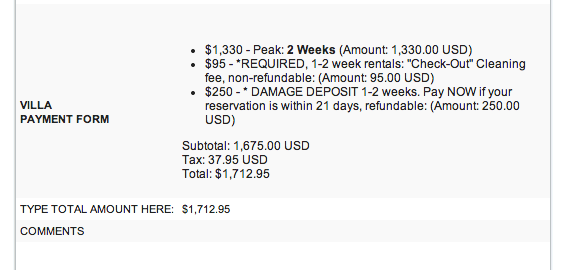

Example on a recent submission:

Rent amount $1,330

Tax 11%

Should be $146.30

Tax was calculated at $37.95

THIS IS A HUGE PROBLEM. And I have suspected it on my other forms also. Here are the forms that need to be inspected.

https://secure.jotformpro.com/TheLifestyleBroker/Villa2014wkends

https://secure.jotformpro.com/TheLifestyleBroker/Monty2014wkends

https://secure.jotformpro.com/TheLifestyleBroker/Avanti2014wkends

-

Welvin Support Team LeadReplied on August 19, 2014 at 11:25 AM

Hi,

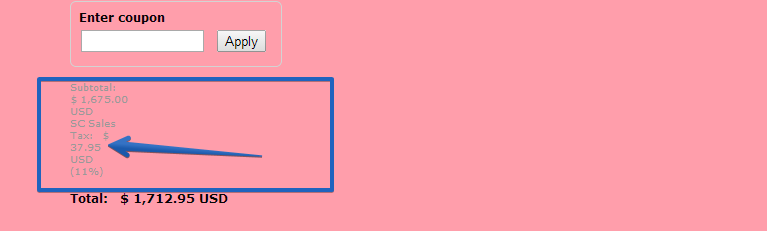

The tax calculation was correct. Here's the proof based on your form settings:

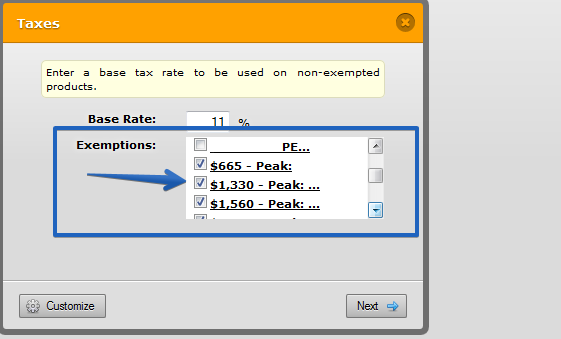

Since "$1,330 - Peak: 2 Weeks" from the "________ PEAK - RENT 1-3 WEEKS – PEAK ________ " category is exempted from the tax calculation. Only both $250 USD and $95 USD are calculated. So, 250 + 95 = 345 x 0.11 = 37.95.

So far, tax calculation to all the forms are correct. Just one thing to note, you have some exceptions:

If you don't want to exempt every item from the tax calculation, uncheck the items.

Thank you!

- Mobile Forms

- My Forms

- Templates

- Integrations

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

PayPal

Slack

Google Sheets

Mailchimp

Zoom

Dropbox

Google Calendar

Hubspot

Salesforce

- See more Integrations

- Products

- PRODUCTS

Form Builder

Jotform Enterprise

Jotform Apps

Store Builder

Jotform Tables

Jotform Inbox

Jotform Mobile App

Jotform Approvals

Report Builder

Smart PDF Forms

PDF Editor

Jotform Sign

Jotform for Salesforce Discover Now

- Support

- GET HELP

- Contact Support

- Help Center

- FAQ

- Dedicated Support

Get a dedicated support team with Jotform Enterprise.

Contact SalesDedicated Enterprise supportApply to Jotform Enterprise for a dedicated support team.

Apply Now - Professional ServicesExplore

- Enterprise

- Pricing