-

PetraTestAsked on August 26, 2016 at 6:42 AM

Hi

We have customers complaining that they pay to much in VAT when they use a coupon code to get a discount. PayPal seems to calculate the VAT based on the ordinary price and not the lower, discouted price.

Can you check this, please?

Page URL: https://form.jotform.com/60483091643960 -

RoseReplied on August 26, 2016 at 7:43 AM

Let me some time to investigate another possible way for it. I will get back to you soon.

-

RoseReplied on August 26, 2016 at 8:44 AM

Thank you for your understanding and patience for waiting.

The VAT value is calculated based on non-discounted price on payment tool. If your customer would like to pay vat value according to discounted prices, you need to configure it with condition logic and pass the value to a payment tool.

Here is the results of my work to meet your requirement.

1. You need to use a DropDown/Radio/CheckBox field to specify your product(s). I declared only one product with a price of $100 on my work and I chose Radio Button field.

2. You need to use three calculation widgets to calculate vat and total. To drop calculation widget to your form, you just need to search it on "More Field" and then just drag and drop it to the form.

3. To calculate Vat value, you need to configure it as you see below. Please note that, the rate value for vat that I specified is %10. You need to change 0.1 part on the calculation to your vat rate. For example, If your vat rate is %20, you need to change to 0.2, etc.

4. You need to indicate shipping value in calculation widget as below. In other words,You just need to enter its value.

5. Now the time is to calculate total value. You need to Add up prices of vat, shipping and product.

Until here, we make calculations based on no- discount situation.

Now, you need to built conditions for discounted calculations.

1. First Add a TextBox Field to allow your user to enter a coupon code.

2. Click Coupon field >> Arrow >> Conditional Logic

>> Conditional Logic

3. Choose Update/Calculate Condition

4. Set your condition based on the idea of if a user enter a coupon code, vat and total values are calculated according to price after discount.

For example, I declared two coupon codes having same discount amount which is $50 in my example. Because of the same amount, I just set coupon code condition in the same logic but if your coupon code values are different than each other, you may need to duplicate conditions for all coupon values. I indicated coupon codes in my example as " abc " and "def" but you can of course choose whatever you want.

Conditions For Vat Field :

Conditions For Total Field :

Now, the problem is how to pass this calculation to a payment field. Following user guidances comes to your rescue.

https://www.jotform.com/help/275-How-to-pass-a-calculation-to-a-payment-field

After following above steps, you will see a similar screen as below regarding the result of them.

Hope, these would help you.

If you need any further assistance by our side, please do not hesitate to contact us. -

PetraTestReplied on August 26, 2016 at 9:29 AM

I do not want to calculate VAT myself, or in Jotform, but leave that to PayPal. But they dont seem to get the right amount from you, that is what the customer actually is paying, with the discout deducted, in order to calculate the correct VAT.

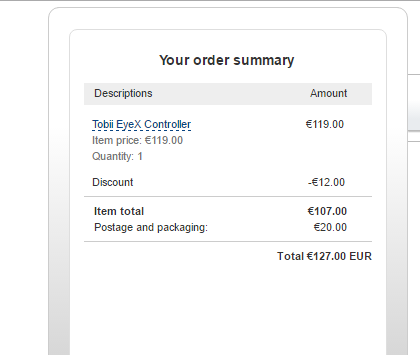

PayPal calculates based on 139 instead of 127.

-

Welvin Support Team LeadReplied on August 26, 2016 at 10:31 AM

Would you mind letting us know your tax rate(s)? I have tested your form and selected the UK as my country, here's the calculation in Paypal:

Is this not correct?

-

PetraTestReplied on August 29, 2016 at 4:06 AM

Yes, so far it is correct. It is in the next step where PayPal calculates the VAT that it is wrong. The tax rate is 25% (Swedish tax) to all purchases within EU. 25% of 127 is 31,75, but PayPal adds 34,75 which is based on the original price without the discount (139). This meas that the customer pays 3€ too much, in this case - the difference is bigger whe the discounted amount is larger.

-

RoseReplied on August 29, 2016 at 7:50 AM

It seems that it is a PayPal issue more than a Jotform issue.

I do not want to mislead you. Since; I don't know how you set up your tax rate on your PayPal account. Moreover, I do not know if there is any option to calculate Vat value according to discounted price rather than original one.

However, The solution I provide you above will works for your situation. You can make tax rate on your Paypal account as " 0" base and calculate tax rate on the form and then pass the amount to Paypal Payment Tool.

If you need any further assistance by our side, please let us know.

- Mobile Forms

- My Forms

- Templates

- Integrations

- INTEGRATIONS

- See 100+ integrations

- FEATURED INTEGRATIONS

PayPal

Slack

Google Sheets

Mailchimp

Zoom

Dropbox

Google Calendar

Hubspot

Salesforce

- See more Integrations

- Products

- PRODUCTS

Form Builder

Jotform Enterprise

Jotform Apps

Store Builder

Jotform Tables

Jotform Inbox

Jotform Mobile App

Jotform Approvals

Report Builder

Smart PDF Forms

PDF Editor

Jotform Sign

Jotform for Salesforce Discover Now

- Support

- GET HELP

- Contact Support

- Help Center

- FAQ

- Dedicated Support

Get a dedicated support team with Jotform Enterprise.

Contact SalesDedicated Enterprise supportApply to Jotform Enterprise for a dedicated support team.

Apply Now - Professional ServicesExplore

- Enterprise

- Pricing