It’s almost April, and that means the U.S. tax season is approaching. 😱

Everyone is getting a bit of breathing room this year, because the deadline for filing has been extended to May 17, but that’s just one extra month.

Though tax filing has a bad rap among businesses and entrepreneurs for being stressful and time-consuming, Jotform’s here to make it a little easier.

The tax templates we’ll discuss today are part of our Smart PDF Forms product, which allows users to turn PDF documents into online forms and back again. So you’ll still be able to submit the good ole government tax forms, but you’ll have a much easier way to collect and manage the information.

Let’s dive into five Jotform tax templates to help small businesses and entrepreneurs get through tax season.

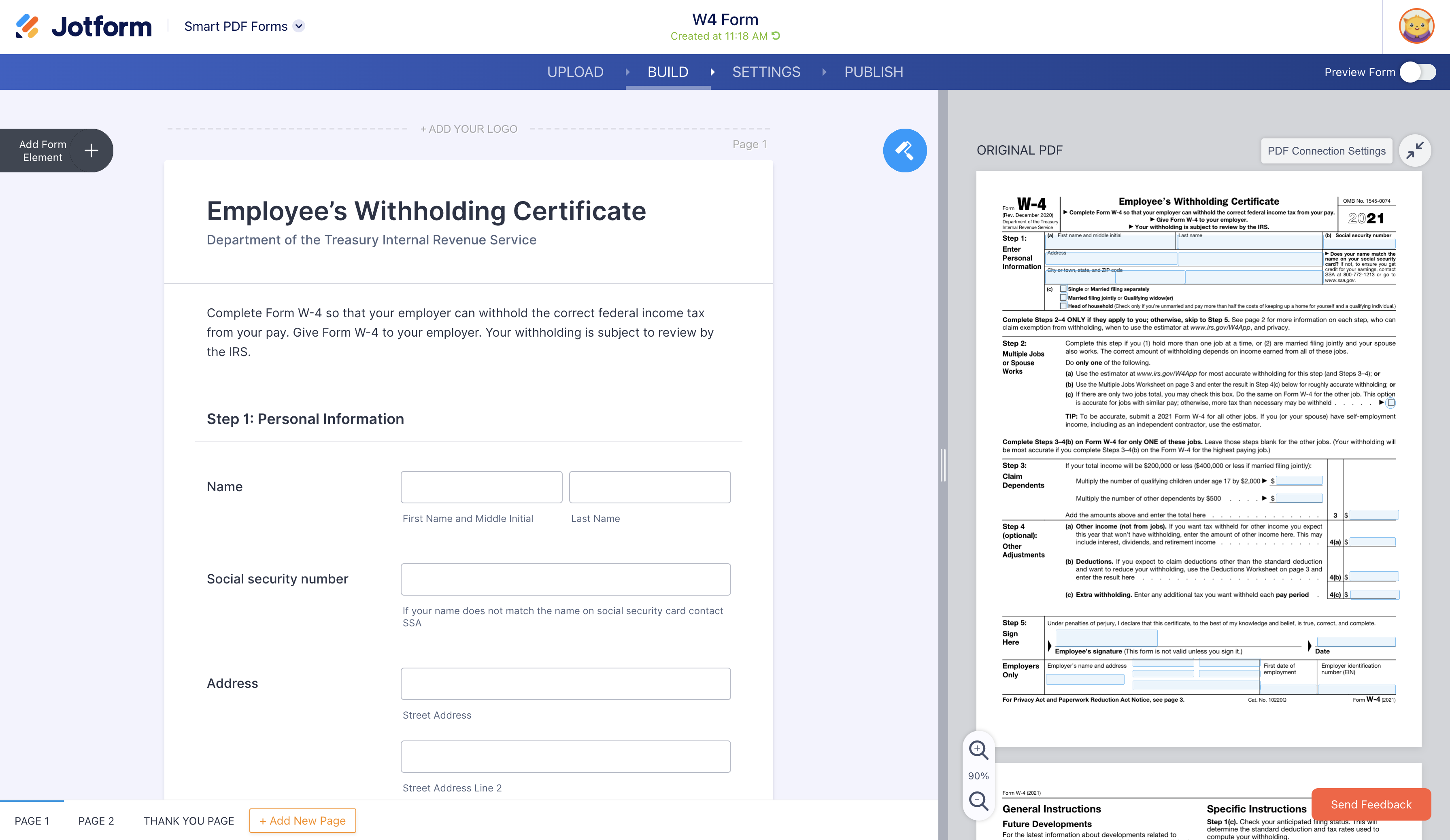

1. Form W-4

Form W-4, Employee’s Withholding Certificate, is a standard IRS (Internal Revenue Service) form that new employees fill out after starting a position. It essentially tells an employer how much money to withhold from a paycheck for federal taxes.

According to H&R Block, “Accurately completing your W-4 will help you avoid overpaying your taxes throughout the year or owing a large balance at tax time.” Cheers to that. 🙌

Now that we have the gist of a W-4 Form squared away, let’s talk about how an employer can use Jotform to get this critical employee information.

Traditional W-4 Forms are tedious to fill out and not very user-friendly. But with our W-4 Smart PDF Form template, it’s simple to convert a W-4 PDF into a web form. Once this happens, you’ll be able to send the W-4 as an electronic form to each of your new employees.

Better yet, once each employee fills out the W-4 form, submissions are instantly sent back to you and stored in Jotform Tables. You also have the option to save the responses in the original PDF format. It’s a much cleaner way to manage new employee W-4 tax forms.

2. Form W-9

Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, is another IRS form that companies use. This one is sent to self-employed individuals, such as freelancers and independent contractors, to collect personal information and a TIN.

In a nutshell, once filled out, the W-9 Form communicates that self-employed individuals are responsible for withholding their own taxes, and the employer isn’t.

If you’re self-employed and work with many different businesses, you’ll have to fill out this form with each new client. Just make sure you keep a record of what you earn and owe to avoid a big shock when taxes are due. 🤑💸

And for the companies sending this form along to their freelancers and independent contractors, here’s how to use Jotform to streamline the process.

The process is the same as with the W-4 Form. Your company can use our W-9 Smart PDF Form template to turn a W-9 PDF into an online form, then back into a PDF again. Using Jotform to manage your W-9 Forms will save you time, which is optimal if you work with many freelancers and contractors. Or you can directly use Jotform’s W9 generator to immediately create and download online W-9 forms filled with relevant information.

You’ll be able to keep all of the information safe and secure in Jotform’s back end, as well as turn the completed online forms back into PDFs to download and save for your records.

3. Form 1040

You might be familiar with Form 1040, U.S. Individual Income Tax Return, since most Americans, whether employed by a company or self-employed, have to fill one out.

According to NerdWallet, “Form 1040 is the standard federal income tax form people use to report income to the IRS, claim tax deductions and credits, and calculate their tax refund or tax bill for the year.”

Form 1040 asks individuals for information, such as personal and spouse social security numbers, number of dependents, taxable income, and more.

Since the majority of Americans have to fill out this form, why not make things a little easier and use Jotform? 🤷♀️

Jotform’s Form 1040 template provides form fields that are nicely spaced and easy to read, and you won’t have to worry about accidentally missing an entry.

Once you complete the 1040 Form via Jotform, you’ll be able to sync responses with the original IRS 1040 Form and can download and submit it. The data is also housed in Jotform, so you’ll have a couple of records on hand if need be.

4. Schedule SE (Form 1040)

Next in line, we have the Schedule SE (Form 1040), Self-Employment Tax. The Schedule SE is one of the many schedules that help make calculations for your 1040. FYI, this one’s for you, self-employed folks. 🤓

According to the IRS, “Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.”

The Schedule SE (Form 1040) is pretty simple in that it helps self-employed individuals, like freelancers and independent contractors, know how much they owe in taxes, depending on their net earnings for the year.

“You must pay self-employment tax and file Schedule SE if your earnings from self-employment were $400 or more for the year,” notes The Balance Small Business.

Long story short, if you’re self-employed and make $400 or more per year, you’ll need to complete the Schedule SE (Form 1040). And doing it through Jotform is the way to go.

With our Schedule SE (Form 1040) template, you’ll have a clean user experience, and you can save your responses in the original PDF form layout to download and send along to the IRS easily.

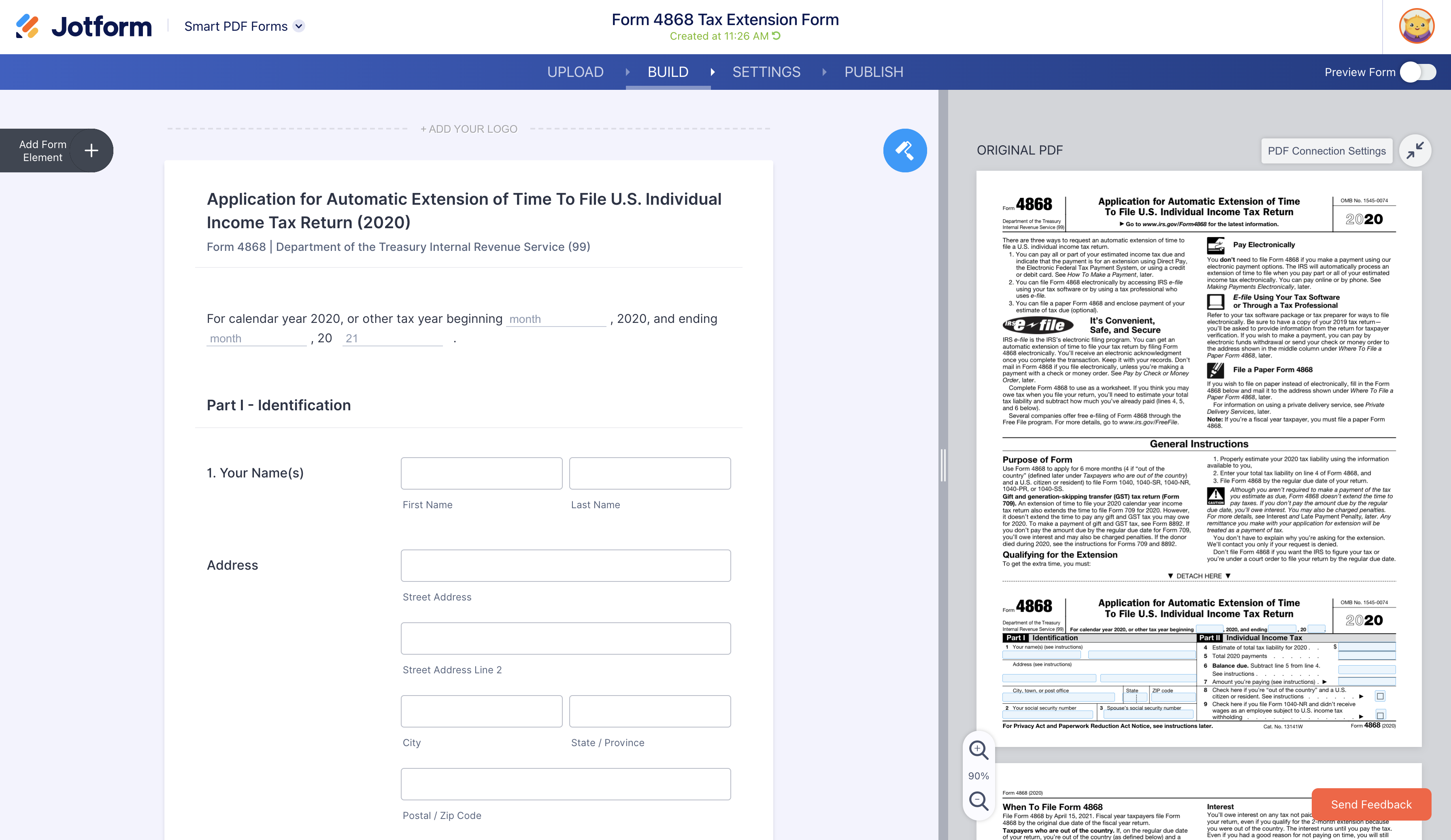

5. Form 4868

Last but not least, we have Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It’s the longest name out of the bunch and a safety net for Americans who need a tax extension. 😬

Investopedia notes, “A U.S. citizen or resident who wants an automatic extension to file a U.S. individual income tax return should file this form. Taxpayers in the country receive a maximum six-month extension.”

So even though we hope you file your taxes on time, it’s good to have this form in your back pocket, just in case.

Form 4868 is available as a Smart PDF Form template on Jotform, so it’s simple to complete online, convert back into a PDF with submission info included, and send to the IRS.

It might be good to add this one to your Jotform account if something goes awry and you need to use it this year.

Final thoughts

There you have it, five Jotform tax templates to simplify tax season! If you’re looking for more templates, be sure to browse our library of tax form templates.

Please note that while we think using Jotform will make the tax form filling process easier, we don’t recommend using our product to make changes to the IRS forms.

Thanks for reading! Let us know your thoughts and feedback in the comments. 👋

Send Comment: