Apple Pay has been available in the U.S. since 2014, but it wasn’t always as popular as it is today. A lot has changed since then, including people’s perceptions of digital payment options, especially those powered by trusted brands like Apple.

Also at play was the pandemic, which saw tons of Square sellers go cashless virtually overnight. A modest 8 percent of these sellers were cashless as of March 1, 2020, but that number rose to a staggering 31 percent by April 23 — just 54 days later.

This isn’t surprising, given that safety was one of the biggest concerns during the pandemic. Before we knew that the coronavirus spreads primarily through airborne transmission, no one wanted to touch anything in public, so contactless payments quickly became the norm.

But safety isn’t the only benefit here — contactless systems also make the checkout process much quicker for customers, reducing cart abandonment rates.

The public is now much more comfortable with these types of payments, chief among them Apple Pay. Many common places accept Apple Pay, including

- Brick-and-mortar retailers

- E-commerce stores

- Grocery stores

- Nonprofit organizations

In this guide, we walk through the ins and outs of Apple Pay for business. There tends to be less readily available information on this payment system for merchants compared to the information available for consumers, and this guide will help fill in the gaps.

You’ll learn about the benefits of Apple Pay, how to use it, and more. You’ll also get valuable input from actual business owners who use the technology.

Check out the chapter synopsis below to get a sneak peek, then keep scrolling to get great insights that will inform the implementation of Apple Pay at your business.

Chapter synopsis

- Introduction.

- Why accept Apple Pay? Beyond popularity, we explore why accepting Apple Pay is a good idea for your business. We also provide a few cons to consider, so you can make an informed decision.

- How does Apple Pay work? It seems so simple — the customer just swipes their phone or watch near your register, and magic happens. Get a closer look at the technology and the parties powering the process.

- How to set up Apple Pay for business. Discover the steps you must take to accept Apple Pay as a for-profit or nonprofit business.

- Apple Pay costs. What are the costs involved in accepting Apple Pay? Where is this technology accepted? Get more details from both the merchant and customer perspectives.

- Tell your customers. Accepting Apple Pay doesn’t do your business any good if customers aren’t aware that they can use this new payment method. Learn about several ways to share the good news with your shoppers or donors.

- Integrate Apple Pay with your website using Jotform. See how easy accepting Apple Pay on your website is when you use this powerful form builder.

Remember to bookmark this guide for later reference.

Why accept Apple Pay?

Apple Pay is accepted at more than 85 percent of retailers in the U.S. If you’re among the 15 percent of retailers that don’t accept Apple Pay, it’s time to board the train before you get left at the station.

While the widespread merchant acceptance rate is certainly compelling, it isn’t the only reason to implement this payment method. Below is a complete list of the pros and cons of Apple Pay that you, as a retailer, should know.

Pros and cons of Apple Pay

Benefits of Apple Pay for merchants

Attract more customers

Over 500 million people use Apple Pay worldwide. While some users may be OK with using a different option at your store, some will be put off if their favorite payment method isn’t available. Offering Apple Pay gives customers one less reason to walk out of the store or abandon their online shopping cart.

No extra fees

Many people don’t like paying in cash. In fact, lots of people don’t carry cash at all. This is why businesses like yours accept credit cards. Apple Pay offers yet another way to attract customers without incurring additional fees beyond the ones you already pay for regular credit card usage.

Benefits of Apple Pay for consumers

Security

Worldwide e-commerce losses to online payment fraud rose 14 percent year over year to $20 billion in 2021. It’s no wonder customers are more wary than ever about payment security.

Apple Pay users already have a leg up because they aren’t using physical cards that can be easily lost or stolen. And while no payment system can escape some degree of fraud, Apple Pay offers additional layers of protection that can help reduce risk, including

- Authentication. Customers must use either their password or biometric data — Face ID or Touch ID — to access Apple Pay when making a purchase. So even if someone steals their phone, the thief won’t be able to buy anything using Apple Pay.

- Encryption. The credit card details customers enter into Apple Pay are encrypted, and the original data is never shared with Apple or any merchants. Instead, the technology sends a transaction-specific dynamic security code that the payment network verifies to approve the payment. This process occurs each time you complete a transaction, whether it’s done in-store or online.

Speed

In the same amount of time it takes to check and respond to a text, customers can complete a purchase with Apple Pay and walk out of the store (or navigate to another web page). Since customers don’t have to enter their credit card and other personal information manually, they can breeze through the checkout process with just one or two clicks or taps.

Convenience

With Apple Pay, consumers don’t have to carry their wallets while out shopping — nor do they have to run downstairs to grab their credit card to check out online. Everything they need is in their smartphone, which everyone knows is always within arm’s reach.

Drawbacks of Apple Pay for merchants

Confusion

While many users have Apple Pay on their iPhones, not all have used it frequently — or at all in some cases. Don’t expect a seamless transaction if you get a first-time user in your store. And if they’re shopping online, don’t be surprised if you receive a request via chat, email, or phone for help getting their payment to work.

Card clash

If you’ve never heard the term, card clash is the interference that occurs when someone brings more than one card or contactless payment system close to a card reader. For example, if a customer has a case that stores their physical cards and they try to use Apple Pay, they may experience card clash, causing confusion and delays.

Drawbacks of Apple Pay for consumers

Potential security holes

Despite the multiple security protocols Apple Pay has in place, users who have jailbroken iPhones may negate some of these protocols, as this overrides certain restrictions, including security measures. The result is a less secure purchasing experience, leaving the door cracked for hackers.

Public Wi-Fi issues

While Apple Pay doesn’t require an internet connection to work (it uses NFC, the technology that enables contactless payments), users face the same security threats as anyone else when using public Wi-Fi, such as network snooping and rogue networks.

Now that you’re aware of the pros and cons of Apple Pay and how it will impact your business, let’s explore how the technology works.

How does Apple Pay work?

From a consumer perspective, using Apple Pay is simple, which is a large part of its appeal. When it’s time to check out, all a customer has to do is

- Hold their iPhone up to the merchant’s card reader

- Unlock their phone when prompted

- Complete the payment

But the underlying mechanics and technology are a bit more complicated. Apple Pay uses near field communication (NFC) technology to communicate with contactless payment terminals (readers).

What is NFC?

Near field communication, or NFC, is a short-range wireless communication technology used for exchanging data between two devices that are physically located within a few inches of one another.

“It may help to think of NFC as a cousin to Wi-Fi as they’re similar technologies — but NFC only works when two data-exchanging devices are very close together, while Wi-Fi works at greater distances,” says Fiona Lewis, cofounder of Notta.

Lewis says one of the main uses of NFC is smartphone payments — e.g., Apple Pay — but the technology can also be used to share contacts, photos, and other files between devices or to discover information about something by tapping your phone against it. There are numerous use cases for NFC technology.

What other technical concepts are important to understand?

NFC is one part of the Apple Pay equation. It’s also important to understand the concept of digital wallets — apps that allow you to store, track, and transfer money using a mobile device.

“Digital wallets are more secure than carrying cash and can be used for a variety of different financial tasks,” Lewis explains. “Digital wallets allow you to make purchases with your smartphone. You can use them to shop online, pay bills, or transfer money to friends and family. In this way, Apple Pay is considered a digital wallet service.”

How far we’ve come: Consumers’ perception of mobile payments

Mobile payments are pretty standard today, but they were once steeped in skepticism — even just a few years ago. A Pew Research study from 2019 indicated that “across generations, consumers remain skeptical of this financial technology, have persistent concerns about security, and are more likely to trust traditional methods, such as debit and credit cards.”

The reasoning consumers cited included

1- Concerns about loss of funds

2- Lack of trust in protections afforded by mobile payments compared to debit and credit cards

3- Difficulty in resolving mobile payment issues vs issues with traditional cards

Clearly, these concerns have dwindled as mobile payments have risen in prominence and companies like Apple have put more significant security measures in place.

What happens when customers use Apple Pay?

When customers use Apple Pay, their device sends a unique token — a transaction-specific dynamic security code — to the payment terminal. “This token is used to process the payment and does not contain any of your personal information,” Lewis explains.

Is Apple Pay safe?

“Apple Pay is as safe as any other form of digital payment,” says Lewis. “The data for each transaction is encrypted, whether making a payment in-store or online, which prevents hackers from accessing your information.”

Additionally, Lewis explains that Apple Pay security uses tokenization, which generates a single-use code for each transaction instead of pulling the encrypted credit card details stored on consumers’ devices. “If your phone is stolen or lost, you can disable it with Find My iPhone. So yes, Apple Pay is as safe as they come.”

Authentication is another plus for Apple Pay security. Since consumers must first unlock their phones via password, Face ID, or Touch ID, this helps ensure the customer authorizes any transaction made with Apple Pay.

In the next chapter, we’ll walk through some instructions on how to set up Apple Pay at your business.

How to set up Apple Pay for business

So you’re ready to implement Apple Pay in your business. What does it take to get started with this online payment method? Check out the steps below, paying close attention to the distinctions between in-store and online transactions.

How to set up Apple Pay for business: 5 steps

1. Choose a payment processor

To use Apple Pay, you must first implement a payment processing platform such as Authorize.net, Square, or Stripe on your website. Alternatively, if you currently use an e-commerce platform that supports Apple Pay, you can use an Apple Pay SDK or JavaScript API from one of these providers.

Kyle Graycar, creator of the Decarbon app, started accepting Apple Pay about a year ago. He chose Stripe as his payment processor because it seemed to be “an industry leader with mobile apps and was the easiest out-of-the-box option” for his situation. He also notes that it’s easy to keep payments through Stripe in sync with his app database.

If you’re already working with a payment processor, verify whether it accommodates Apple Pay.

2. Set up Apple Pay in-store or online

For in-store transactions, you’ll need physical hardware to accept Apple Pay. For example, if you partner with Square, any of its NFC-enabled payment terminals will work:

- Square Reader

- Square Stand

- Square Terminal

- Square Register

Once you set up one or more of these products in your store and enable payments via Apple Pay, you’re all set. Customers using Apple Pay can simply hold their device near the reader during a transaction to complete the purchase.

For online transactions, you’ll likely be accepting payments through a custom-built website or app or an e-commerce platform such as Shopify. Each use case requires a unique approach, but whatever platform you use probably has some sort of documentation to help you set up Apple Pay for your business.

“You should always refer to documentation provided by your e-commerce platform or payment processor, as they’re typically the best option to help you get set up quickly,” says Graycar. “Apple’s documentation can be a useful reference too, but it’s too general for most use cases. And if you get stuck, you can always check out online forums — chances are high that another business has already faced and conquered your setup challenge.”

If you want an easy way to implement Apple Pay while creating a streamlined checkout experience, use a powerful form builder like Jotform. In addition to numerous order form and payment form templates, Jotform has integrations with Apple Pay and Google Pay, which Square and Stripe Checkout support.

3. Test your setup

Whatever path you go down, Graycar says it’s critical that you test your setup thoroughly — both in-store and online. Just because it seems to work after a few tries doesn’t mean it’s ready to roll out to customers.

“Test as much as possible before going live with your new payment setup,” he says. In fact, he recommends trying to break the system before rolling it out to avoid any hiccups with customers.

For an in-store setup, this may mean using different iPhone iOS versions and hovering the phone from different distances. For an online setup, you may try checking out on different devices — iPhone, iPad, Apple Watch, and through Apple’s Safari browser — as well as using mobile data and Wi-Fi.

Graycar recommends being diligent about testing the online checkout process with Apple Pay, as many scenarios may hinder the transaction.

“In my case,” he says, “I had a situation where if a customer tapped the Apple Pay button multiple times while the page was still loading, a checkout popup would appear for each tap. This was confusing to users, so I had to recode on the back end to ensure the window only displayed once.”

Apple Pay for nonprofits

nearly identical. The main exception is that you must be approved to accept donations by Benevity, a company that performs nonprofit vetting and eligibility for Apple.

Using Apple Pay at your nonprofit can reduce friction for donors, increase security, and boost trust in your giving process — all of which will help increase your conversions. Check out this article on Apple Pay for nonprofits for more setup information.

4. Train your staff

Training may not be as relevant online, as checkout typically occurs without any assistance, but your in-store staff needs to know how to work and troubleshoot any devices that accept Apple Pay. This may include the fixed front-of-store POS system, handheld POS tablets, or other devices.

5. Inform your customers

Once you have Apple Pay set up, inform your customers so they know it’s an option when they shop with your business. “Apple Pay is a trusted brand that can help your conversion rates, especially online — so make the option visible as much as possible in your store or on your website,” says Graycar.

Now that you know how to set up Apple Pay for business purposes, let’s move on to Apple Pay costs.

Apple Pay costs

One of the first concerns merchants have when they hear about Apple Pay is whether there are any costs involved in using the payment system. This chapter will discuss Apple Pay costs for consumers, merchants, and foreign transactions.

Does Apple Pay have fees for consumers?

There are currently no Apple Pay costs for consumers when paying in-store, through apps, or online — and it stands to reason that won’t change.

When consumers have multiple payment options available, they will most likely use free options unless it’s inconvenient to do so. Of course, there are always outliers, so some customers might still prefer a speedier checkout process (e.g., Apple Pay) even if it costs them a bit more.

Does Apple Pay have fees for merchants?

Like consumers, merchants don’t have to pay any fees to use Apple Pay — including processing or interchange fees. However, remember what’s behind every Apple Pay purchase: a debit or credit card.

Customers enter their debit card or credit card information into Apple Pay and then use it to make purchases. Your payment processor treats these purchases as card transactions, just as it would an actual card. The medium may be different, but the way it’s processed is essentially the same. Therefore, you’re still on the hook for whatever standard fees you would typically pay for a debit or credit card purchase.

In most cases, these fees range from 1.5 to 3.5 percent of each transaction’s total. If you run a small business, you’re keenly aware that even this seemingly small fee can quickly eat into your profits. However, the appeal of this frictionless checkout service can increase conversions — as discussed in Chapter 2 — which could help minimize the impact of these fees.

Does Apple Pay charge fees in other countries?

There are no additional Apple Pay-related costs for international purchases. Of course, your bank may charge foreign transaction fees for credit cards, but this cost would apply with or without Apple Pay. So feel free to sell to customers in the geographic regions that support Apple Pay:

- 49 countries in Europe (including Austria, Belgium, Germany, Italy, Poland, Spain, Sweden, and the United Kingdom)

- Eight countries in the Asia-Pacific region (including Australia, Hong Kong, and Japan)

- Six countries in the Middle East (including Qatar, Israel, and Saudi Arabia)

- Six countries in Latin America and the Caribbean (including Argentina, Brazil, and Mexico)

- Two countries in North America (the United States and Canada)

- One country in Africa (South Africa)

For a complete list of the countries where Apple Pay is accepted, refer to this Apple support article.

In the next chapter, we’ll explain how you can inform customers about your new payment option.

Tell your customers

Once you begin accepting Apple Pay in your physical or virtual store, it’s important to get the word out to your customers. Below are a few of the best ways to let them know.

8 ways to let customers know you accept Apple Pay

1. Store window signage

If you run a brick-and-mortar shop, chances are you already have a “We Accept” decal in your window that displays the payment options you accept, such as Mastercard and Visa. You can either place an Apple Pay decal near your current one or order a new decal that includes all your payment options. That way, customers know the payment options available before entering your store.

2. In-store signage

In addition to a window decal, you can put up signage around the store indicating that you accept Apple Pay. Even a small sign at the register, where customers will complete their purchases, is helpful to give people a last-minute heads-up before they pull out their credit cards.

You can keep it simple with black lettering and a white background or have fun with it, making it match your brand colors and adding imagery. You can purchase signage online or create your own.

3. Checkout reminders

As part of your employee training on Apple Pay, direct your cashiers to remind customers that the payment system is now an option. The reminder can be simple — for example, as a customer is checking out, a staff member can simply say, “Did you know that we accept Apple Pay?”

4. Receipt message

In case a customer misses the preceding queues or doesn’t have Apple Pay set up at the time of purchase, send them home with a reminder. Make a note on their receipt so they can get prepared for their next visit to your store.

5. Phone call inquiries

“You’d probably be surprised how many phone calls I receive from customers with questions about products and delivery times,” says Lou Haverty, owner of Enhanced Leisure. “Being able to reach a real person at my store by phone is a big differentiator that helps me stand out from some of my larger competitors who can only be reached by email or social media.”

Haverty frequently mentions to customers the option to use Apple Pay when he talks to them. He says it works exceptionally well for security-conscious customers who prefer Apple Pay because of its security protocols.

“I still have customers who use traditional credit card payments, of course, but probably more so out of habit,” Haverty explains. “However, when a customer calls and they ask questions relating to payment security, I always let them know we accept Apple Pay. I mention that it’s a great option because of the additional security measures. Those customers frequently end up using Apple Pay.”

6. Online checkout badge

You can let your online customers know about your new payment option in much the same way you would for in-store customers. Add the Apple Pay logo to the checkout screen so customers see it before entering their credit card information.

Not only does this tactic build trust in your store, but it also tells customers they’ll be able to speed through the checkout process. Both of these factors positively impact conversions and help avoid card abandonment.

7. Website footer

Beyond the checkout page, you can also place the Apple Pay logo in your website footer so it appears on every page a customer visits. Trust is an important factor here; if a customer is unfamiliar with your brand, the Apple Pay logo may give them the confidence to proceed to the checkout page.

8. Email

Emailing customers is another valuable way to inform them that you accept Apple Pay. Include the news in your regular newsletters, send an email blast announcing it, add an alert to a customer’s order confirmation, or do all of the above.

Up next is the last chapter in our guide on Apple Pay for business — in it, we’ll discuss how to integrate Apple Pay into your website.

Integrate Apple Pay with your website using Jotform

If your website has a checkout page, that checkout page needs a form to collect payment information. One of the simplest ways to start accepting Apple Pay as a payment option on your website is to create those forms using Jotform, an online form builder that integrates with Apple Pay.

Not only can you easily create order and payment forms through Jotform, but you can also embed them directly on your website and enable customers to make purchases.

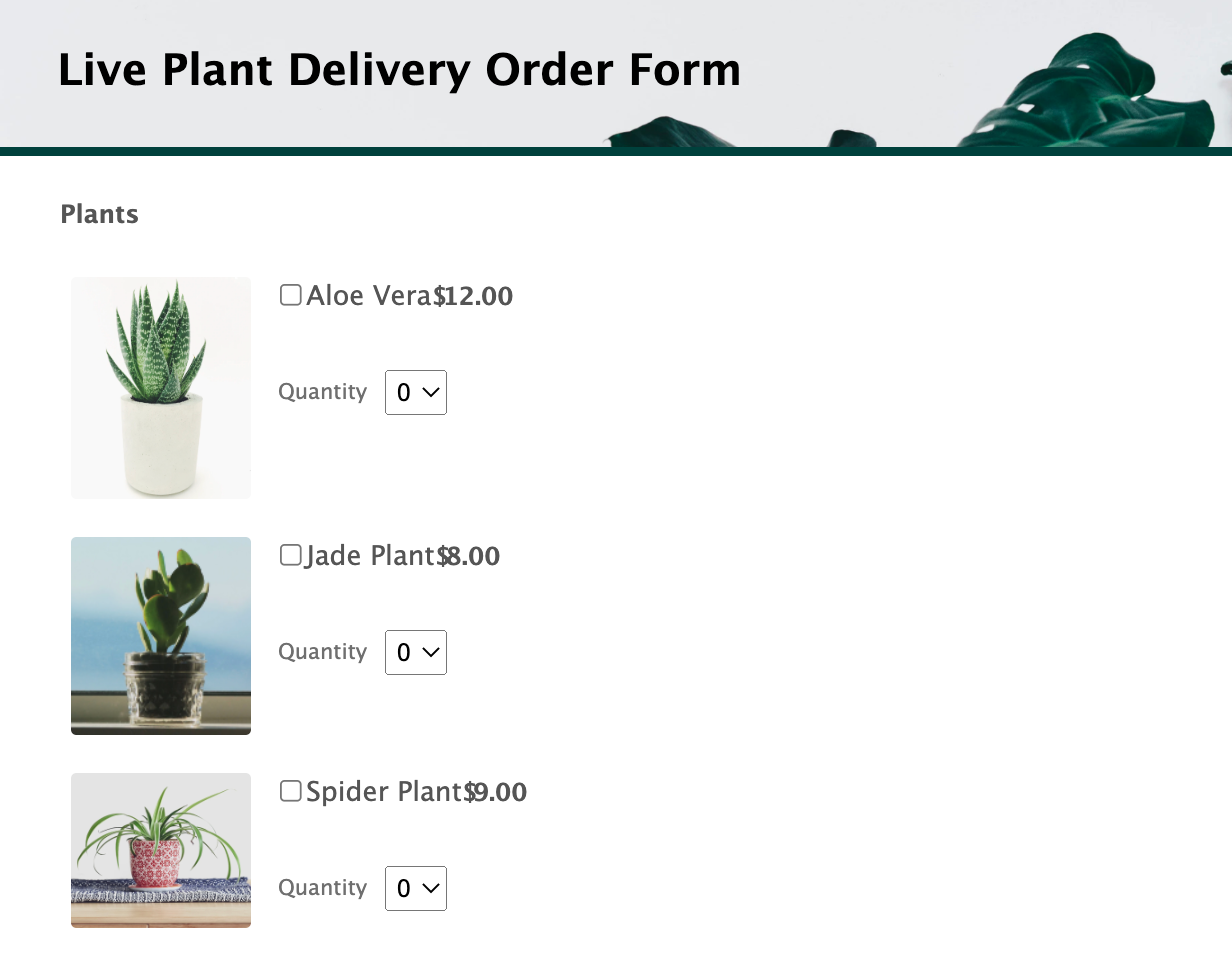

1. Create your checkout form

If you sell physical products like T-shirts and jewelry, you can start with one of these product order forms and customize it to your liking — add images, names, prices, quantities, color, sizes, and so on. These templates already include standard customer information fields like name and address, but you can change virtually every part of a template to suit your needs.

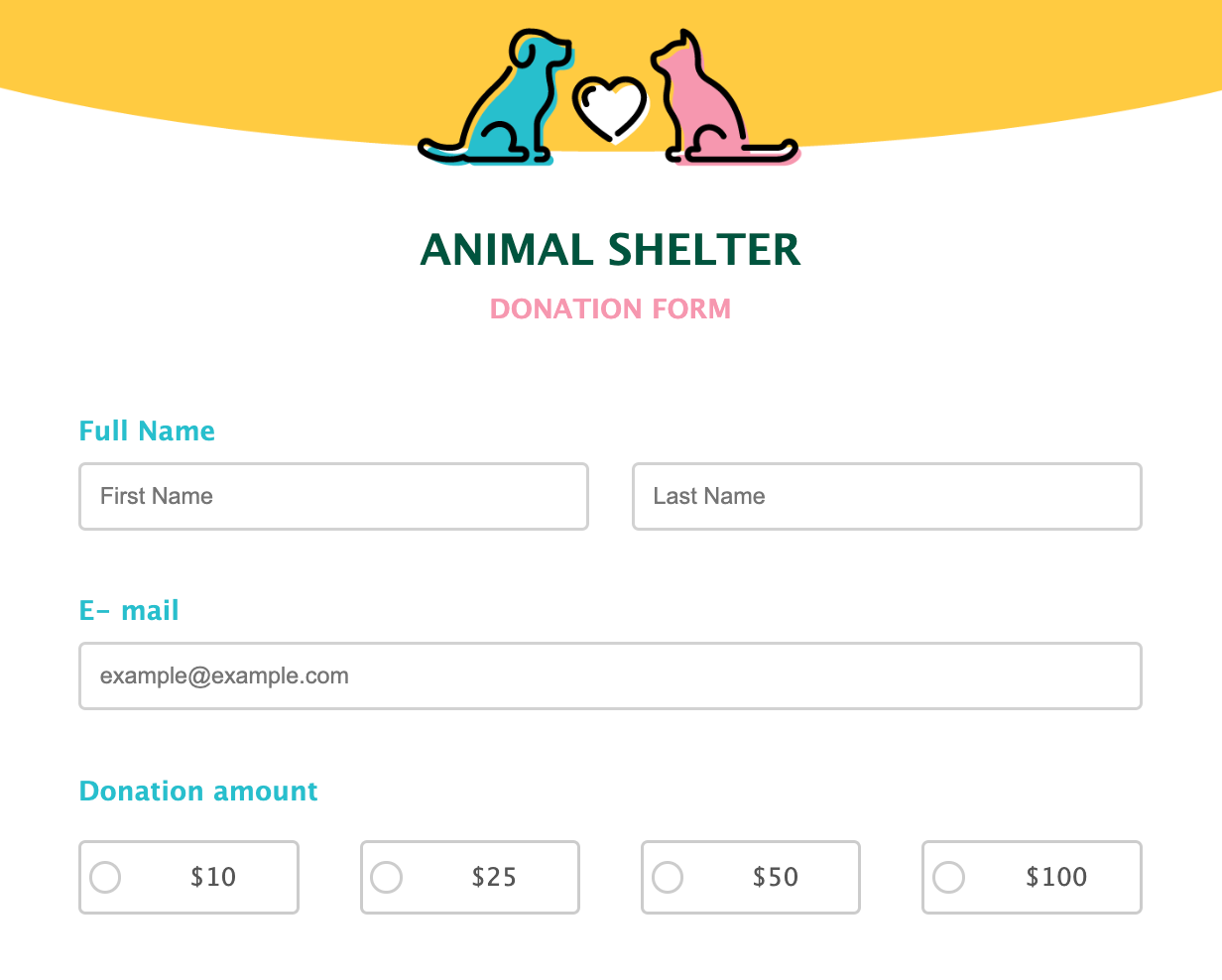

Choose from more than 100 donation form templates if you’re a nonprofit. You can either keep it simple, requesting only contact information and a donation amount, or use a template with multiple donation options.

Once you modify a form to your liking, you can add one of the checkout options below to enable customers to pay with Apple Pay.

2. Set up Apple Pay payments

As noted several times throughout this guide, you need a payment processor to accept Apple Pay. Stripe and Square are two popular processors that easily integrate with Jotform. Learn more about these two options below.

Stripe + Apple Pay integration

Powered by Stripe, Jotform’s Stripe Checkout integration is a customizable checkout page that includes Apple Pay. You can add this checkout option to your order, donation, or other forms. The checkout page is fully optimized, providing customers with a quick and easy payment experience. It also supports recurring payments, subscriptions, and donation collections.

The Stripe Checkout experience works on mobile phones, tablets, and desktops. You can use it to accept and process card payments in more than 135 currencies, 25 languages, and over 35 countries, though Apple Pay will be limited based on its availability.

Jotform makes integrating Stripe and Apple Pay quick and easy. Just drag and drop the Stripe Checkout icon onto your desired form, then share or embed the form on your website. We also charge no additional transaction fees.

Square + Apple Pay integration

Much like its Stripe counterpart, Jotform’s Square integration can be added to any form to help you collect payment for whatever product or service you offer. (Again, Jotform charges no additional transaction fees.)

Square can also handle in-person transactions; if you use Square for both types of transactions, all payments will be stored in the same Square dashboard to help you stay organized.

Does Square take Apple Pay? Yes! Like Stripe Checkout, you can use our Square integration to accept Apple Pay and standard credit card transactions.

Ready to start your journey with Apple Pay for business? Get started with a Jotform template today.

Meet your Apple Pay for business guides

Fiona Lewis

Fiona is the cofounder of Notta, an AI-powered voice-to-text transcription service. With a computer engineering background, she focuses on the business’s machine learning side.

Kyle Graycar

Kyle Graycar built Decarbon, a free and open-source carbon budgeting app, out of his desire to understand his impact on climate change and what he could do about it. He firmly believes that awareness and education are essential to making progress on the climate crisis. Decarbon provides users with a straightforward way to track, reduce, and offset their carbon footprint. You can download it from the Apple App Store or the Google Play store.

Lou Haverty

Lou Haverty is the owner of Enhanced Leisure, a family-owned small business focused on providing home leisure products from the highest quality brands in the industry at fair and transparent prices.

Send Comment: