It’s easier to break a business than it is to build one. That’s why Know Your Customer (KYC) protocols are so important. They help organizations verify who they’re doing business with and assess whether they pose unnecessary risk. And in some industries, KYC isn’t optional — it’s a legal requirement designed to prevent fraud, money laundering, and other financial crimes. So what exactly is KYC?

At its simplest, KYC is the process of confirming a customer’s identity and understanding their risk profile before granting them access to your products or services. It’s a core part of anti–money laundering (AML) laws and a safeguard that protects both businesses and the people who rely on them.

But KYC isn’t just about compliance. It’s also about building trust. When you take the time to verify a person’s identity and handle their information responsibly, customers feel more confident that their money and data are protected. That level of transparency can directly improve loyalty, especially in digital environments where security is top of mind.

KYC also plays an increasingly important role in data protection. With rising expectations around privacy and security, organizations need reliable ways to collect, store, and review sensitive information. Using secure forms and workflows that follow strong data security standards makes it easier to meet today’s evolving regulatory requirements.

In this article, we’ll break down why it’s important to know your customer, who needs to comply, and how automation tools like Jotform can streamline verification, reduce risk, and support long-term customer trust.

Why is it important to know your customer?

When you onboard a new customer, you also take on their potential risk. Without clear visibility into who they are, how they operate, or whether they meet compliance standards, organizations expose themselves to penalties. KYC provides the structure needed to prevent any issues. Here are six reasons that demonstrate the importance of knowing your customers before approving accounts or transactions.

1. Enhance regulatory compliance

KYC is critical to regulatory compliance because it ensures organizations meet legal requirements for anti–money laundering, counterterrorist financing, and fraud prevention. When businesses fail to verify customer identities or don’t maintain proper documentation, they risk violating federal and international compliance standards. Strong KYC practices help organizations avoid investigations, fines, and costly remediation efforts by ensuring that every customer meets required regulatory criteria before the onboarding process begins.

2. Reduce fraud and financial risk

Knowing your customer reduces fraud and financial risk by making it easier to spot suspicious behavior and false identities early. With clearer visibility into customer activity, teams can intervene before funds are moved, accounts are compromised, or fraudulent transactions slip through. The result is lower financial exposure and fewer operational disruptions.

3. Build customer trust

KYC plays a critical role in building customer trust by demonstrating an organization’s commitment to security and responsible data handling. A clear, well-structured verification process reinforces that commitment without creating unnecessary friction. When people feel confident their information is protected, they’re more likely to build long-term relationships with your business.

A well-managed KYC process also aligns with broader customer experience automation efforts, helping organizations create smoother onboarding journeys.

4. Increase onboarding efficiency

Strong KYC processes speed up onboarding by clearly separating low-risk customers from higher-risk cases, allowing legitimate users to proceed quickly without compromising compliance. When performed efficiently, these processes reduce friction while still filtering out profiles that require additional scrutiny. The result is faster approvals and less unnecessary exposure for the business.

5. Protect business reputation

Weak KYC processes create reputational risk by increasing the likelihood of fraud, compliance failures, and public loss of trust. When identity checks fail or violations become public, brand credibility can erode quickly and be difficult to rebuild. A strong KYC program helps organizations demonstrate accountability and maintain confidence with regulators, partners, and customers.

6. Improve decision-making

Understanding your customers leads to better decisions by providing organizations with clearer visibility into risk levels, behavioral patterns, and compliance needs across the customer life cycle. With well-defined customer profiles, teams can more easily identify emerging risks before they escalate.

Beyond compliance, a deeper understanding of customers also supports strategic initiatives to reduce friction, improve experiences, and personalize engagement — especially when paired with tools that help you get to know your customers in meaningful, compliant ways.

Who must comply with KYC regulations?

KYC requirements apply to a wider range of businesses than many people expect. While banks and financial institutions have long been the primary focus, today’s regulatory landscape also reaches into fintech, digital services, and even certain high-value retail sectors.

For many of these organizations, maintaining compliance also means protecting sensitive information with strong security practices. To learn more about that, read our article about what an organization can do to keep its data safe.

Here are the types of organizations most commonly covered by KYC regulations.

Financial institutions

These are the businesses most closely associated with KYC. They’re expected to verify customer identities, assess risk, and keep accurate records as part of standard operations.

- Banks and credit unions

- Payment processors

- Mortgage and lending companies

- Investment firms and broker-dealers

Non-financial businesses handling high-value transactions

Large purchases and asset transfers can attract bad actors, which is why certain non-financial businesses also fall under KYC and AML expectations.

- Real estate agencies

- Precious metals and jewelry dealers

- Art brokers and auction houses

- Automotive dealerships

Cryptocurrency and digital-asset platforms

Because crypto transactions can move quickly and anonymously, digital-asset companies often have strict KYC requirements to prevent misuse.

- Crypto exchanges

- Wallet providers

- Blockchain-based financial services

Online businesses offering financial services

Many digital platforms handle payments or account creation at scale. Even if they aren’t traditional financial institutions, they may still need KYC controls.

- Fintech apps

- Digital wallets

- Peer-to-peer payment platforms

- Marketplaces with built-in transaction features

Businesses serving higher-risk customers or industries

Some organizations work with customers who require additional verification due to their location, industry, transactional behavior, or other factor. In these cases, KYC helps companies understand and manage their elevated risk without slowing down legitimate activity.

Examples of such businesses might include

- A global software-as-a-service (SaaS) platform that onboards customers in regions with stricter AML controls

- A financial advisor that works with politically exposed persons (PEPs)

- A lending platform that evaluates applicants with unusual income sources or transaction patterns

Any organization required to prevent fraud or money laundering

At a high level, KYC applies to any business that handles financial activity and requires identity verification. This can include both traditional and digital-first companies. The exact requirements vary, but the goal is always the same: Ensure your customers are who they say they are and that their activity aligns with regulatory expectations.

Examples of this in practice include

- A marketplace that offers escrow or stored-value features

- A fundraising platform that needs to validate donors for compliance reasons

- A fintech startup that wants to add payments or withdrawals to its product

- A digital-wallet provider that reviews users during account recovery or suspicious activity checks

KYC obligations are broad, and the volume of required data only continues to rise. For many organizations, manual processes simply can’t keep up with regulatory expectations. Automation helps close that gap by creating faster, more consistent verification workflows that reduce risk and support ongoing compliance.

How can you automate the KYC process?

Instead of relying on manual reviews and scattered documents, you can use automation to turn KYC into a predictable workflow. Automation not only centralizes the information you collect, it also standardizes the checks you run and ensures that the right steps happen in the proper order.

Here’s how KYC automation typically works and why it’s becoming an essential part of modern compliance operations.

1. Digitize data collection

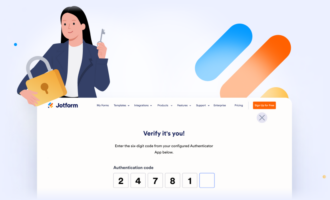

The first step in KYC automation is moving away from paper forms and email attachments to start collecting customer information through secure digital channels instead. This includes IDs, signatures, proof of address, and any supporting documents needed for verification.

Using secure forms — such as those offered by Jotform — helps organizations maintain strong data-protection practices and align with data security standards while gathering sensitive information.

Automating KYC also protects the information you collect with strict internal safeguards, such as the security protocols Jotform follows.

2. Integrate verification tools

Automating verification reduces manual review time and lowers the risk of human error. Many organizations connect their intake forms to third-party tools or APIs that handle

- ID authentication

- Sanctions and watch-list screening

- PEP checks

- Proof-of-address validation

Integrations like these help teams catch discrepancies early on and ensure that customer data is checked against the appropriate compliance databases.

3. Apply smart routing and review logic

Once the data is collected and verified, automation can route submissions to the appropriate reviewer or escalation path. This ensures that higher-risk profiles receive additional scrutiny while low-risk customers move through the funnel quickly.

Common routing rules include

- Flagging mismatched identity details

- Escalating customers from high-risk regions

- Assigning enhanced due diligence (EDD) reviews automatically

Smart routing keeps onboarding fast, consistent, and aligned with compliance requirements.

4. Monitor, remind, and update automatically

KYC compliance isn’t a one-time event. Regulations often require periodic reviews, record updates, and ongoing monitoring to detect changes in customer risk. Automation helps by

- Sending reminders when documents expire

- Triggering refresh cycles for long-term customers

- Maintaining accessible audit trails for regulators

These ongoing workflows help teams stay proactive instead of reactive.

Why automation matters

Automation simplifies the KYC compliance process by replacing repetitive manual tasks with consistent, dependable workflows. It allows teams to spend less time chasing paperwork and more time reviewing what actually matters. Along the way, it also improves accuracy, speeds up onboarding, and makes overall risk easier to manage.

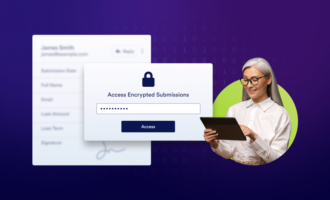

Automate KYC end-to-end with Jotform

Jotform makes it easy to build secure KYC workflows that collect documents, trigger reviews, and maintain a complete audit trail from a single dashboard. You can quickly get started with ready-to-go Jotform templates like the KYC Approval Process Workflow and KYC Form.

Using automation not only speeds up onboarding but also reduces compliance risk by ensuring the right steps happen every time.

What does the next chapter of KYC look like?

Know Your Customer has always been about protecting businesses from fraud and meeting regulatory expectations, but its role continues to evolve. As digital onboarding becomes the norm and compliance standards grow more complex, knowing your customer is no longer just a legal requirement — it’s a strategic advantage. The organizations that invest in robust verification processes today are best positioned to earn trust and maintain long-term regulatory alignment.

Looking ahead, KYC will continue shifting toward automation and continuous monitoring. Instead of one-time identity checks, businesses will rely on dynamic, data-driven workflows that adapt to customer behavior and emerging threats. This approach will support both security and the customer experience, especially as more companies explore broader customer-experience automation strategies.

Digital tools can help make this transformation possible. Platforms like Jotform give businesses a centralized, secure foundation for collecting information, routing approvals, and maintaining the audit trails regulators expect. As compliance requirements evolve, these automated workflows will help organizations stay prepared without slowing down operations.

Ultimately, the future of KYC is about trust: building it, maintaining it, and proving it. By adopting modern verification processes and using tools that support secure data handling, businesses can protect themselves and their customers while staying compliant in an increasingly regulated world.

Frequently asked questions

A common example of KYC in action is a financial institution verifying a new customer’s identity before opening an account. This typically involves collecting government-issued ID, proof of address, and any additional documents as needed, then reviewing the information to verify legitimacy and assess risk. Other industries follow similar steps when onboarding customers for high-value transactions or financial services.

While frameworks vary, most KYC programs include four core elements:

- Customer identification — Collecting and verifying essential identity information

- Customer due diligence (CDD) — Assessing the customer’s risk level based on their background, behavior, or business activity

- Enhanced due diligence (EDD) — Applying additional checks for higher-risk customers

- Ongoing monitoring — Periodically reviewing accounts for unusual or suspicious activity

Together, these four steps help organizations maintain compliance and reduce fraud risk throughout the customer life cycle.

This article is for compliance officers, fintech professionals, digital business leaders, and anyone who wants to understand why knowing your customer is critical for legal compliance, fraud prevention, and building lasting customer trust in an increasingly regulated digital environment.

Send Comment: