Top 15 payment methods for e-commerce

Launching an e-commerce store can be exciting and financially rewarding. An e-commerce store can help you connect with customers beyond your local area, expanding your audience for your products and helping drive sales.

But as you prepare to launch your e-commerce store, it’s important to choose a payment processing solution that will work well for both you and your customers. A payment processor plays a key role in the customer’s checkout experience, and when you have a payment processor that customers trust, it can build their trust in your business, too.

Choose the best payment processing solution to power your e-commerce store.

The types of payments you’re able to receive can help reduce shopping cart abandonment and allow you to sell to the largest audience possible. Plus, it’s important to choose a payment processor that’s reliable and has minimal fees so it doesn’t eat into your profits.

The best online payment processing solutions for e-commerce

The good news is that you’ll have plenty of payment processing solutions to choose from for your e-commerce business. We’ve highlighted some of the best options, including the key information you need to know to make a well-informed decision about which option is right for your business.

1. PayPal

Overall Capterra user rating: 4.7 out of 5

Overall G2 user rating: 4.4 out of 5

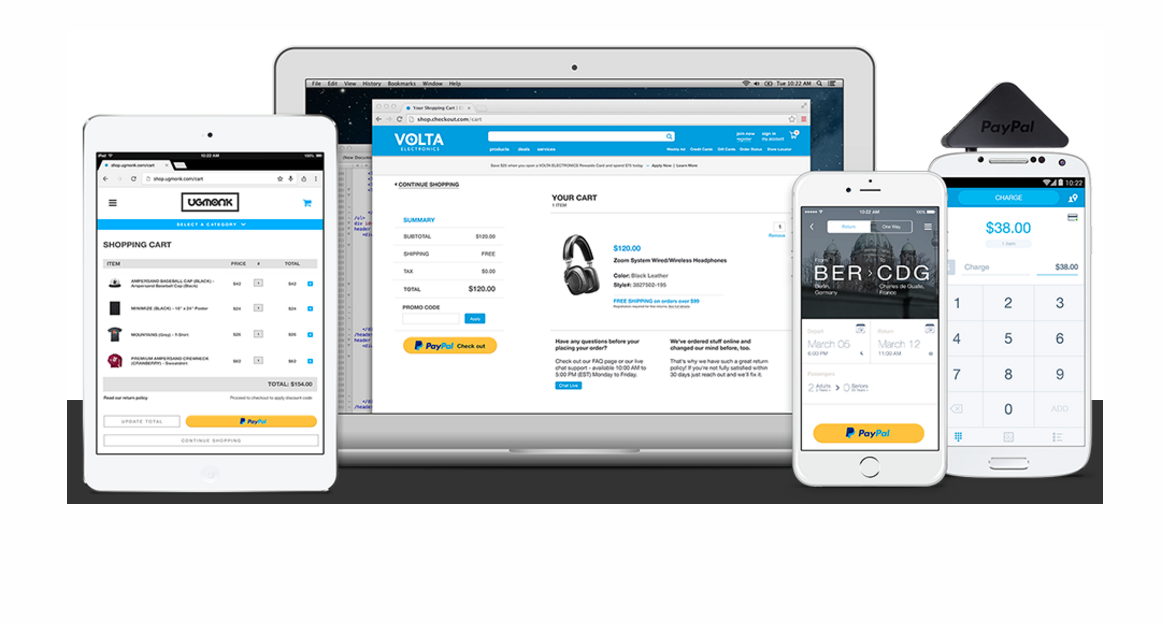

PayPal is one of the most widely used and widely recognized payment processors. Functioning as a digital wallet, PayPal allows users to store their credit card and debit card details in their accounts. When shoppers make a purchase from an e-commerce store that accepts PayPal, they just have to log into their account and approve the transaction, rather than having to enter credit card information for each purchase.

With PayPal, you can accept payments 25 currencies, and PayPal accepts most major credit cards. The platform lets you create invoices and estimates, and you can also create recurring payments and sell subscriptions.

According to PayPal’s site, 27 million merchants use PayPal Business, which is designed for small to medium-sized businesses. PayPal Business offers extra features, including chargeback, fraud, and seller protection options. PayPal Business integrates with tools like Jotform, Shopify, Wix, and Squarespace, making it easy to add the payment processor to websites, online forms, or other e-commerce tools.

Pricing: PayPal rates for merchants vary depending on the payment method. Invoicing, PayPal checkout, and PayPal guest checkout are subject to a 3.49 percent fee, plus an additional fixed fee. QR code transactions start at 1.90 percent plus a fixed fee, and standard credit and debit card payments cost 2.99 percent and a fixed fee.

There are fixed fees for international commercial transactions, too. With the variations in pricing, it can be tricky to determine just how much you will pay when using PayPal.

User review:

“PayPal is great, allows me to pay for my personal purchases and business. I like the way it is easy to navigate around, I love how quick transactions are.” (Source: Capterra)

2. Stripe

Overall Capterra user rating: 4.7 out of 5

Overall G2 user rating: 4.3 out of 5

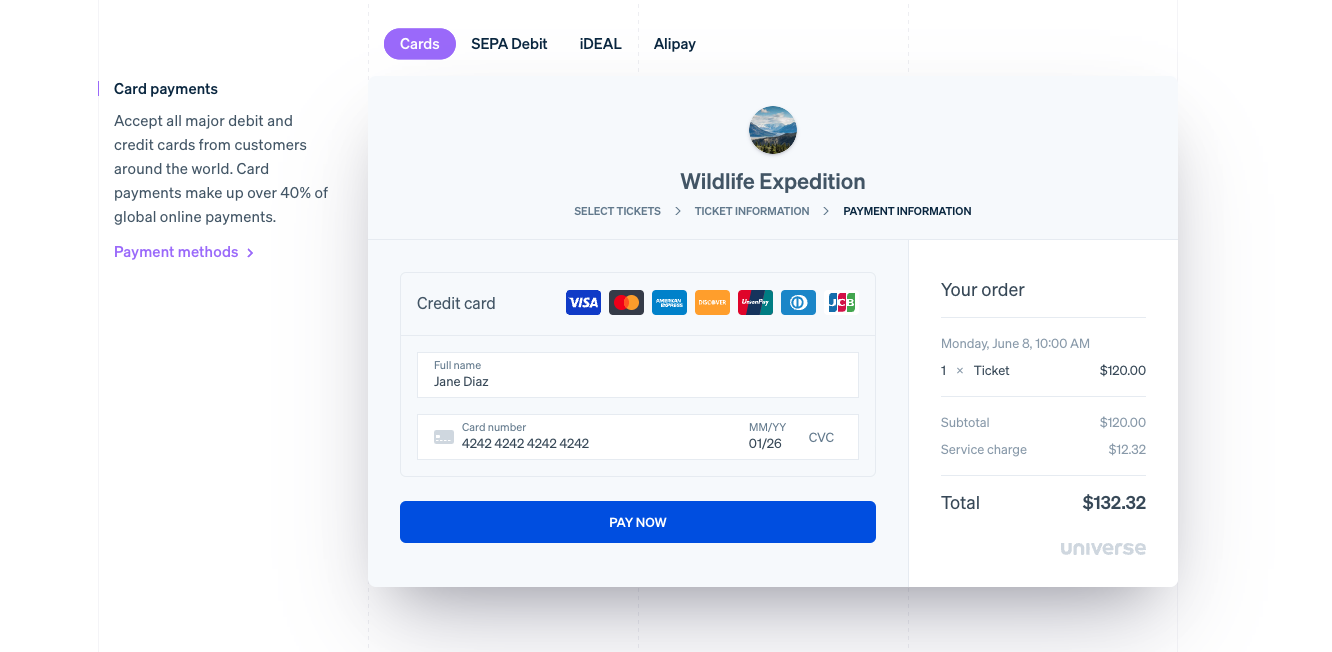

Stripe is a popular choice for startups, small businesses, and even Fortune 500 companies. Stripe accepts more than 135 currencies, making it a popular choice for accepting international payments.

The Stripe checkout automatically adapts to your customer’s location and device, which can help reduce cart abandonment. It’s full of features, including the ability to accept coupons and calculate tax rates.

With Stripe, AES-256 encryption protects your customers’ financial information, and you can opt to use Stripe Radar for additional fraud prevention that uses machine learning to detect risks. With Stripe, you can accept credit cards, debit cards, and other popular payment methods worldwide. Stripe is easy to add to your e-commerce store.

Pricing: Rates start at 2.9 percent plus $0.30 per successful card charge.

User review:

“Our experience has been excellent, we integrate in all our online stores and have not had any problems, we love that the section to enter the card data fits perfectly to the checkout.” (Source: Capterra)

3. Venmo

Overall Capterra user rating: 4.8 out of 5

Overall G2 user rating: 4.5 out of 5

While many people use Venmo to send and receive money from friends and family,it’s also a quality e-commerce payment processor. You can use it in apps and online stores as well as with point-of-sale systems.

More than 83 million people use Venmo, and with a Venmo business profile, you can easily accept payments from Venmo users. When you use Venmo for your business, you can accept payments through the Venmo app or use a unique business QR code to collect in-person payments.

While Venmo lacks some of the functionality and features other payment processors offer, it can be a great way to give your customers a familiar payment platform to use.

Pricing: Venmo has some of the lowest payment processor fees. There’s no setup fee, and the transaction fees are just 1.9 percent plus $0.10. There are also no monthly fees, so it’s easy to determine how much you’ll pay when using the payment processor.

User review:

“Makes sending money feel safe and secure. Its great reputation and popularity allows me to feel confident and responsible when using.” (Source: Capterra)

4. Square

Overall Capterra user rating: 4.7 out of 5

Overall G2 user rating: 4.6 out of 5

With Square, you can easily accept card payments in person and online. You can use Square to set up an online store, or you can add Square to your existing e-commerce store. It takes just minutes to create and verify a Square account, and you can start using the account immediately. With Square Checking, you can access your money instantly or transfer it to an external bank account.

Square’s active fraud protection and end-to-end encryption help keep your business’s and your customer’s data protected, and live phone support is available, too. Square also offers transaction dispute management.

Pricing: Square also offers transparent pricing that’s easy to understand. When customers make an e-commerce store purchase, the processing fee is 2.9 percent plus $0.30 per transaction. The fees for in-person purchases are slightly less.

User review:

“The best part is the analytics. Love how easy it is to customize the menu and make it easy to check people out.” (Source: Capterra)

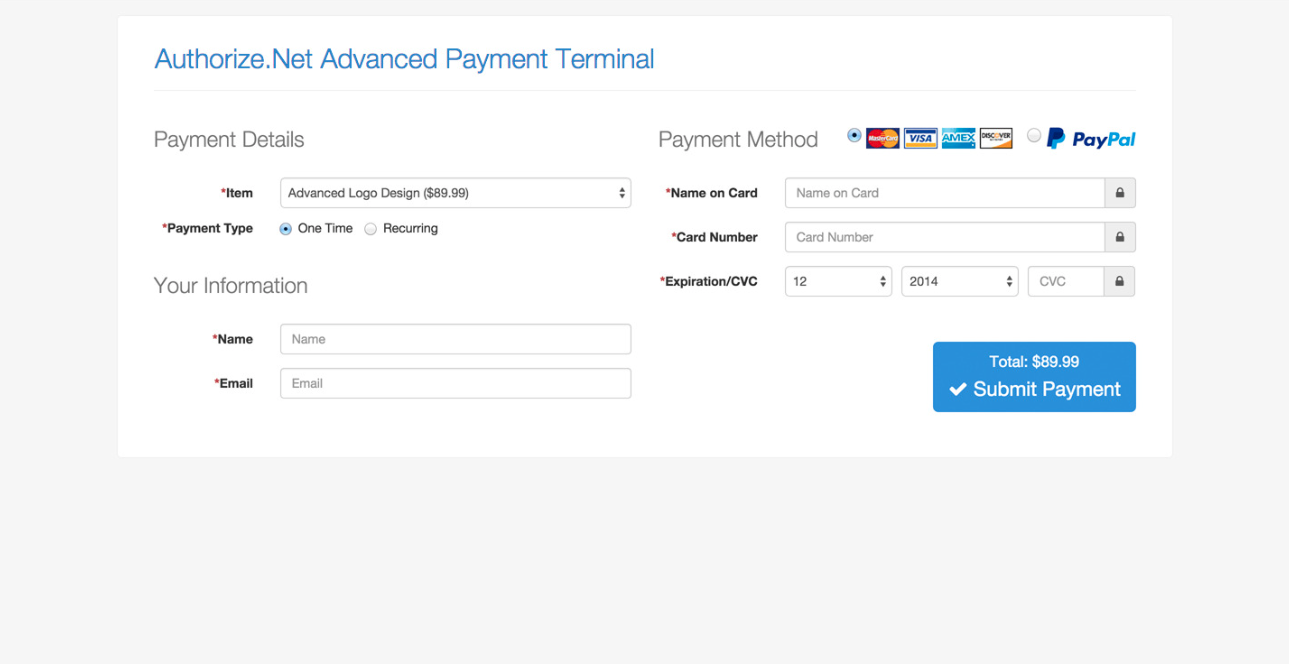

5. Authorize.net

Overall Capterra user rating: 4.5 out of 5

Overall G2 user rating: 4.2 out of 5

Authorize.net allows you to accept a wide array of payment methods, including debit and credit cards, e-checks, Apple Pay, and PayPal. You can process transactions through a website or mobile app, and you can also process manual transactions. Authorize.net gives you the ability to add a “buy now” button to your website for one-time payments, and its simple checkout process is easy to navigate.

Businesses located in the United States, Canada, U.K., Europe, or Australia can accept international transactions.

Pricing: Authorize.net offers two main subscription plans. The payment-gateway-only plan features a monthly gateway fee of $25 as well as a per-transaction fee of $0.10 and a daily batch fee of $0.10. The all-in-one option includes a merchant account and a payment gateway. The monthly gateway costs $25, and the plan charges a 2.9 percent plus $0.30 fee per transaction.

User review:

“I like that Authorize.net is easy to integrate into our website and other things that we use to accept money. It makes it seamless when needing to do event registration.” (Source: Capterra)

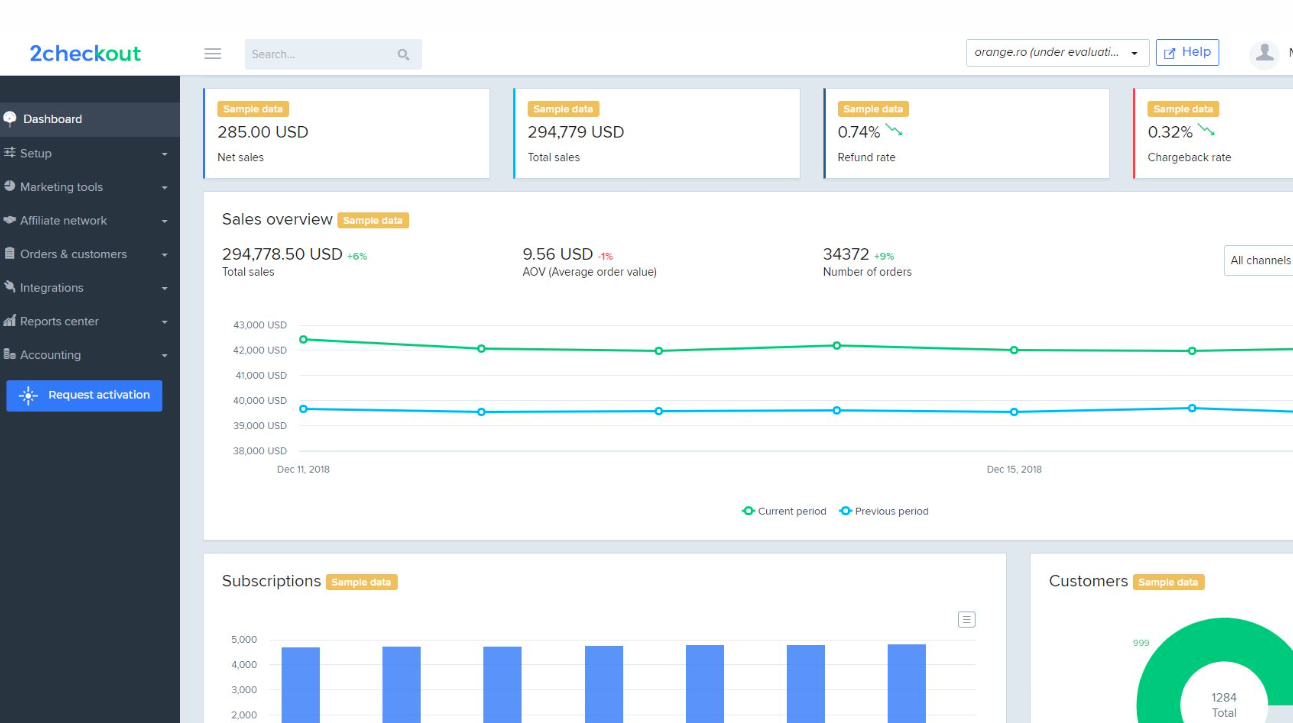

6. 2Checkout

Overall Capterra user rating: 4.2 out of 5

Overall G2 user rating: 3.9 out of 5

With 2Checkout (now Verifone), you can sell your products to customers in more than 180 countries. The platform accepts major credit and debit cards as well as digital wallets, so your customers can use their preferred payment method.

The platform’s smart ordering interface can optimize the checkout process by tailoring it to the customer’s location for a better buying experience. It also features advanced billing capabilities that are ideal for recurring customers, such as those who’ve purchased subscriptions.

Pricing: Three plans are available, but the most basic plan, 2SELL, is ideal for many e-commerce businesses. You can sign up for free and only pay when you start selling and processing payments. Fees are 3.5 percent plus $0.35 per sale.

User review:

“Overall, its a great tool for managing your financial systems and for integrating it according to your different requirements with customer support always helping you for getting the job done.” (Source: Capterra)

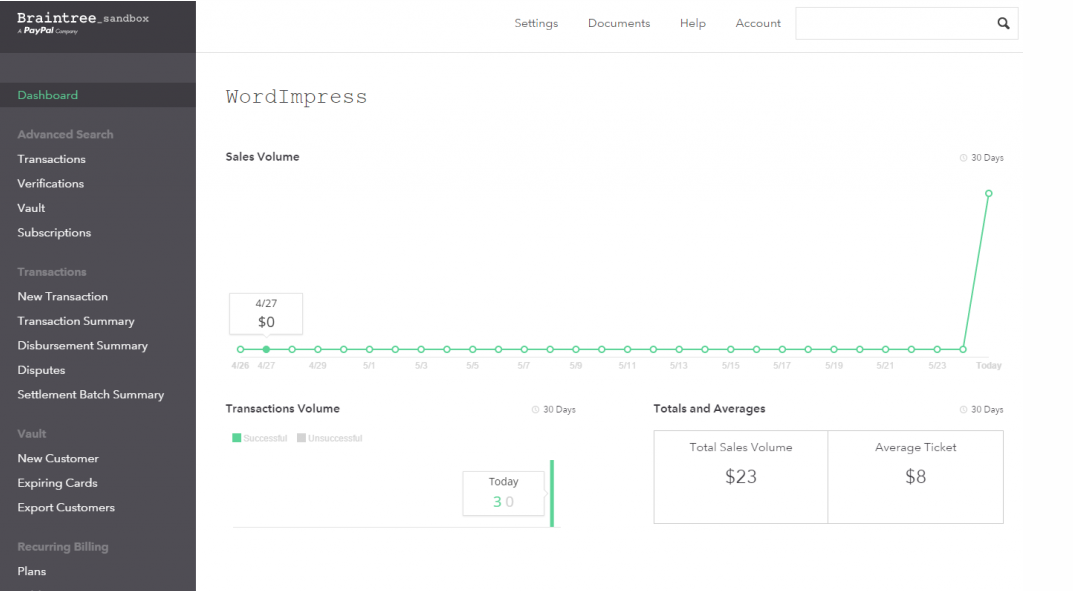

7. Braintree

Overall Capterra user rating: 3.9 out of 5

Overall G2 user rating: 3.4 out of 5

With Braintree, you can accept many of the most popular payment options available today. Not only can you process credit and debit cards, but you can also accept payments made through PayPal, Venmo, Apple Pay, and Google Pay. This capability can streamline the checkout process for your customers, allowing them to use their most trusted payment methods. Plus, when accepting payments through these methods, you can save your customers from having to enter their credit card information, increasing the chances they’ll complete the transaction.

Braintree offers basic and advanced fraud tools to help you protect your business. The platform is also Level 1 PCI DSS-compliant to protect your customers’ information. You can also access robust reporting features to ensure that your business’s finances are accurate.

Pricing: The pricing plan depends on the payment method. Cards and digital wallets carry a 2.59 percent plus $0.49 fee per transaction. Venmo payments carry a 3.49 percent plus $0.49 fee per transaction, while ACH direct debit transactions have a 0.75 percent fee per transaction.

User review:

“In addition, it is also an advantage that it supports most billing methods and integrates flawlessly with websites.” (Source: Capterra)

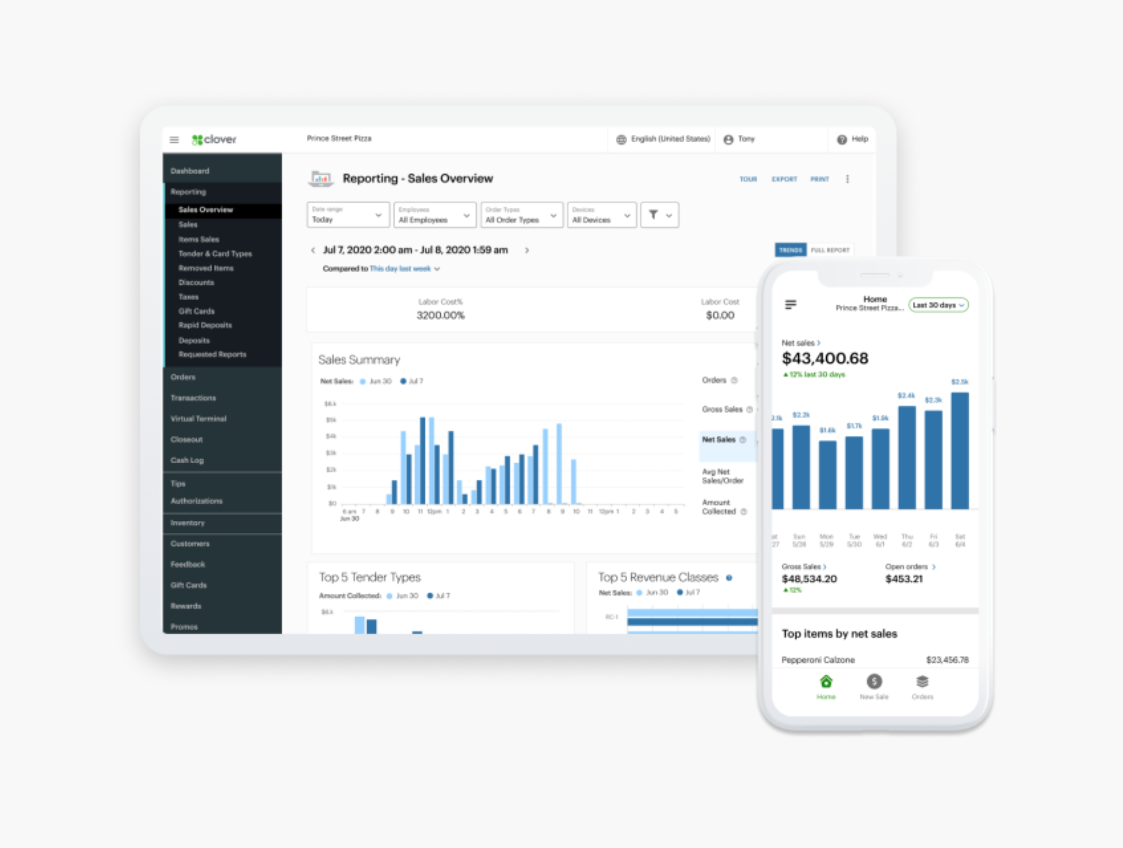

8. Clover

Overall Capterra user rating: 3.9 out of 5

Overall G2 user rating: 3.8 out of 5

Ideal for brick-and-mortar businesses that are also selling online, Clover offers point of sale (POS)-based solutions. Clover can integrate with an existing website, or you can build a new site using the Clover platform.

With Clover, you can easily keep your orders, inventory, and customer data synced up across all your channels for increased accuracy and easier order processing. Clover’s online dashboard is accessible online or through a mobile app, so you’re never far away from the information you need.

With Clover, you can accept credit and debit cards, gift cards, and contactless payments. You can automatically apply the tax rates that you’ve set up, and Clover offers fraud protection up to $100,000. Setting up Clover is easy, thanks to the help available 24-7 from the phone-based support team.

Unlike some of the other payment processors, Clover charges a monthly software fee in addition to the per-transaction processing rates. That software fee covers expenses like the POS system, but they waive the fee for your first 30 days.

Pricing: Clover offers three plans for retail businesses. The Starter plan costs $799 plus a $14.95 monthly fee if you pay in full up front (you can also opt for monthly payments of $60). The Standard plan costs $1,799 plus $49.95 per month, while the Advanced plan costs $2,398 plus a $64.90 fee per month.

User review:

“Really easy to run transactions, reports or refunds. The customer service has been knowledgeable and super friendly when we have had any issues.” (Source: Capterra)

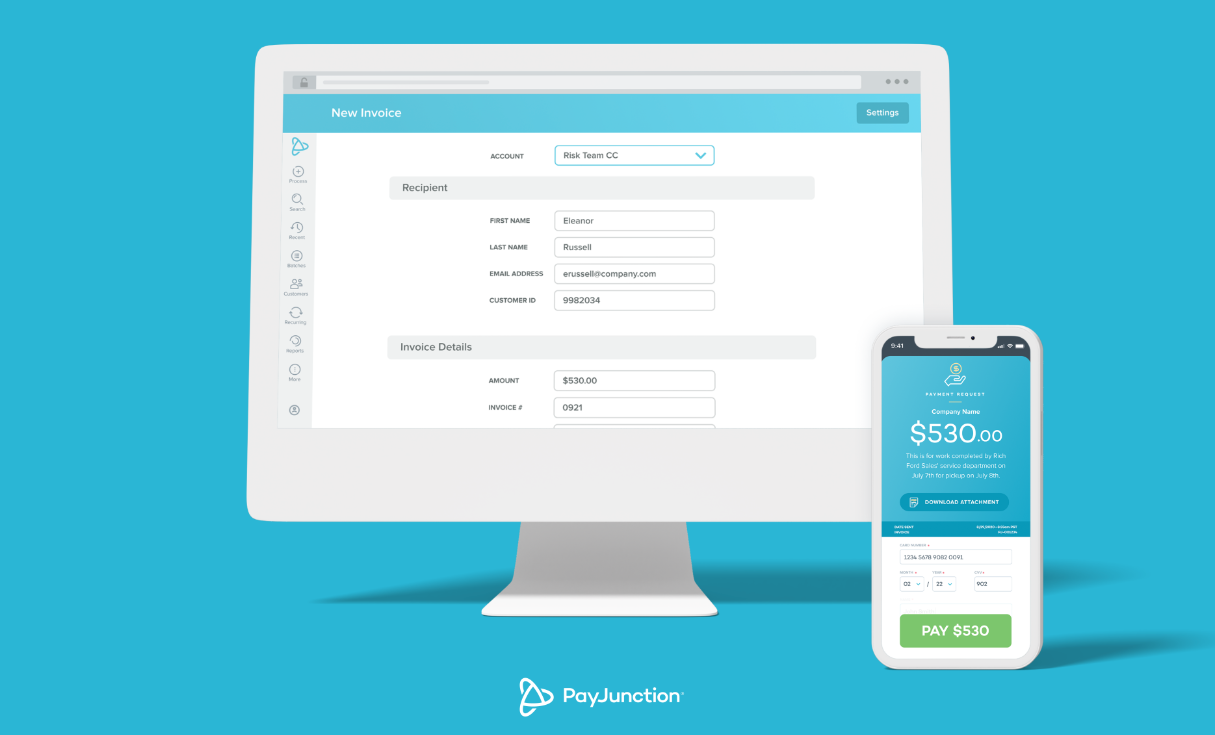

9. PayJunction

Overall Capterra user rating: 4.8 out of 5

Overall G2 user rating: 4.7 out of 5

PayJunction is a payment-processing solution known for providing excellent customer service. The platform‘s hosted checkout option means that PayJunction manages your site’s credit card processing, simplifying the process of getting the processor up and running. You can easily customize the checkout screen with the colors and information of your choice, and checkout is also optimized for desktops, smartphones, and tablets.

PayJunction features more than 80 integrated shopping carts, including Jotform, Magento, OpenCart, WooCommerce, and 3dcart (now Shift4Shop), making for seamless payment processing.

The platform also offers some valuable features. You can receive notifications of every transaction processed, so you can stay on top of fulfillment. You can also email customers digital receipts for them to sign, helping to prevent chargebacks. Address verification system (AVS) and card verification value (CVV) checks offer additional security to help identify fraud, too.

Pricing: PayJunction has no monthly or annual fees. Processing fees vary depending on the transaction and payment type. Keyed and swiped debit cards incur a 0.80 percent fee, while keyed credit cards incur a 2.55 percent fee. There’s also a transaction fee of $0.07, but these fees are some of the lowest you’ll find. You’ll also see money deposited into your account in just one day.

User review:

“The ability to do payment plans with our clients and either debit a checking account or charge a credit card really helps us manage our accounts better. I also love not having slips with signatures.” (Source: Capterra)

10. Elavon

Overall Capterra user rating: 3.4 out of 5

Overall G2 user rating: 4.2 out of 5

With Elavon, it’s easy to accept online payments with your online store. This platform is compatible with many top e-commerce platforms like WooCommerce, BigCommerce, Ultra Cart, and Cube Cart. Elavon allows you to process payments in nearly 100 countries, so you can grow and scale your e-commerce business.

Elavon also has an impressive 99.99 percent uptime and uses encryption and tokenization to maximize security. Customer service is available by phone 24-7, so help is available when you need it.

Elavon takes a personalized approach to helping you identify and implement the solution that’s right for your business. The platform’s e-commerce professionals review your business and determine the virtual terminal options that are best for your needs. Elavon supports billing and invoicing needs, and you can also add a buy button to your website for a simplified checkout process.

Pricing: While Elavon doesn’t publish its pricing online, you can request a callback if you’re interested in setting up a merchant account.

User review:

“It seemed fairly simple to use and could get good details.” (Source: Capterra)

11. KIS Payments

Overall Capterra user rating: 5 out of 5

Overall G2 user rating: N/A

With KIS Payments, you can explore multiple online payment solutions for your e-commerce store. If you’re looking for a hands-off option, then you can let the KIS Payments team set up an online store for you, including all of the layout and listing of up to 100 items or unlimited items. The store of up to 100 items starts at $50 per month, or you can use the simple site builder to create your own online store.

KIS Payments also offers a virtual payment terminal portal. When you log into the terminal on a computer, phone, or tablet, you can run credit card transactions wherever you are.

Alternatively, you might consider the KIS Payments hosted e-commerce payment pages. Customers access those pages, process payments away from your site, and then are directed back to your site once the order is complete. This option is secure and effective, and it minimizes the amount of setup needed.

Pricing: KIS Payments doesn’t publish information on their pricing online. You can call the platform’s advisors to determine the solution that’s right for your business and get the pricing for it.

User review:

“Interface, flexibility, support team and so easy to use”

12. Adyen

Overall Capterra user rating: 4.8 out of 5

Overall G2 user rating: 3.3 out of 5

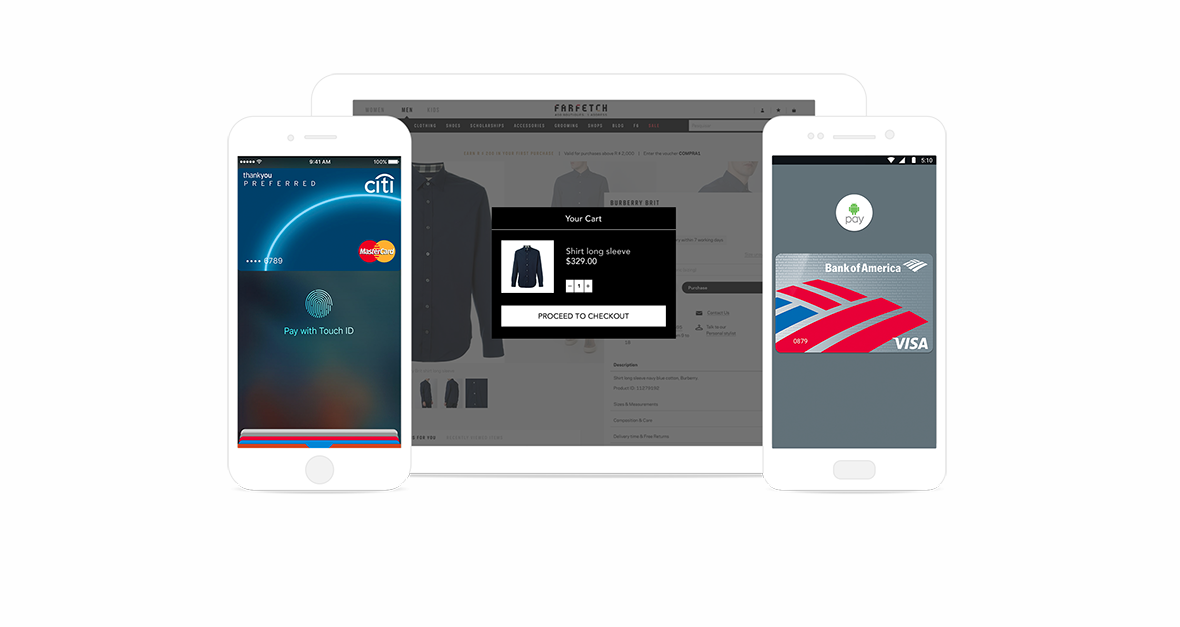

Adyen is an online payment processor with a wide array of tools. It offers global payment coverage that allows you to accept popular payment methods like major credit cards and debit cards, Apple Pay, Alipay, PayPal, and more. Artificial intelligence and rule-based technology help identify fraud, and dashboards give you access to valuable performance, testing, and reporting data.

The platform is very easy to use, and you can drag and drop new payment methods into your online checkout. You can also build your own user interface for payments, which gives you complete control over the checkout and payment process.

Pricing: Adyen posts up-front pricing (in euros), but prices vary depending on the payment method. For example, Apple Pay transactions cost €0.11 plus a processing fee that’s defined by the card used.

User review:

“Chargeback resolution is very easy with Adyen: you receive a notification via email and you can upload all the required documentation directly from the platform, very easy.” (Source: Capterra)

13. Payline

Overall Capterra user rating: 5 out of 5

Overall G2 user rating: 4.6 out of 5

Payline integrates with many common gateways like CardPointe and Authorize.net. This platform allows you to easily accept payments through your website for a streamlined customer experience. The platform offers both fraud and chargeback prevention to minimize the risk to your business.

While Payline integrates with common shopping carts like Shopify and WooCommerce, the user-friendly API also lets you build your own integration into your website, putting you in charge of the customer experience.

Pricing: Payline pricing is transparent and easy to understand. The subscription costs $20 per month, and online transactions incur a 0.75 percent fee plus a $0.20 fee per transaction. You can also use Payline’s online calculator to estimate your monthly costs.

User review:

“We never had any issues with Payline, everything worked as it should. We were very satisfied with its service and customer service. Highly recommended.” (Source: Capterra)

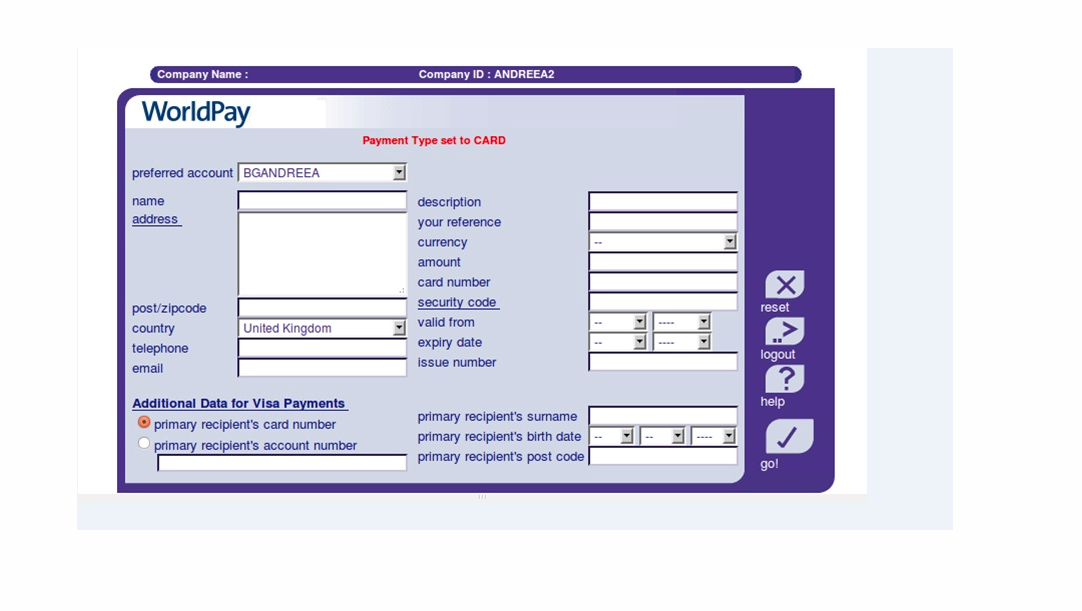

14. Worldpay from FIS Global

Overall Capterra user rating: 4.2 out of 5

Overall G2 user rating: 3.2 out of 5

Worldpay from FIS Global streamlines the online payment process to reduce cart abandonment. With the platform, you can take secure payments by phone or email, or you can process them online.

The platform lets you accept PayPal, debit, and credit card payments, and you can even email customers a link so they can check out. FIS Global can even assist with the process of building your e-commerce shop.

Pricing: FIS Global doesn’t post its pricing information online, so you’ll need to contact the company for a quote.

User review:

“I like the newly integrated CHIP system. I like that I can assure them of a secure connection for the transaction.” (Source: Capterra)

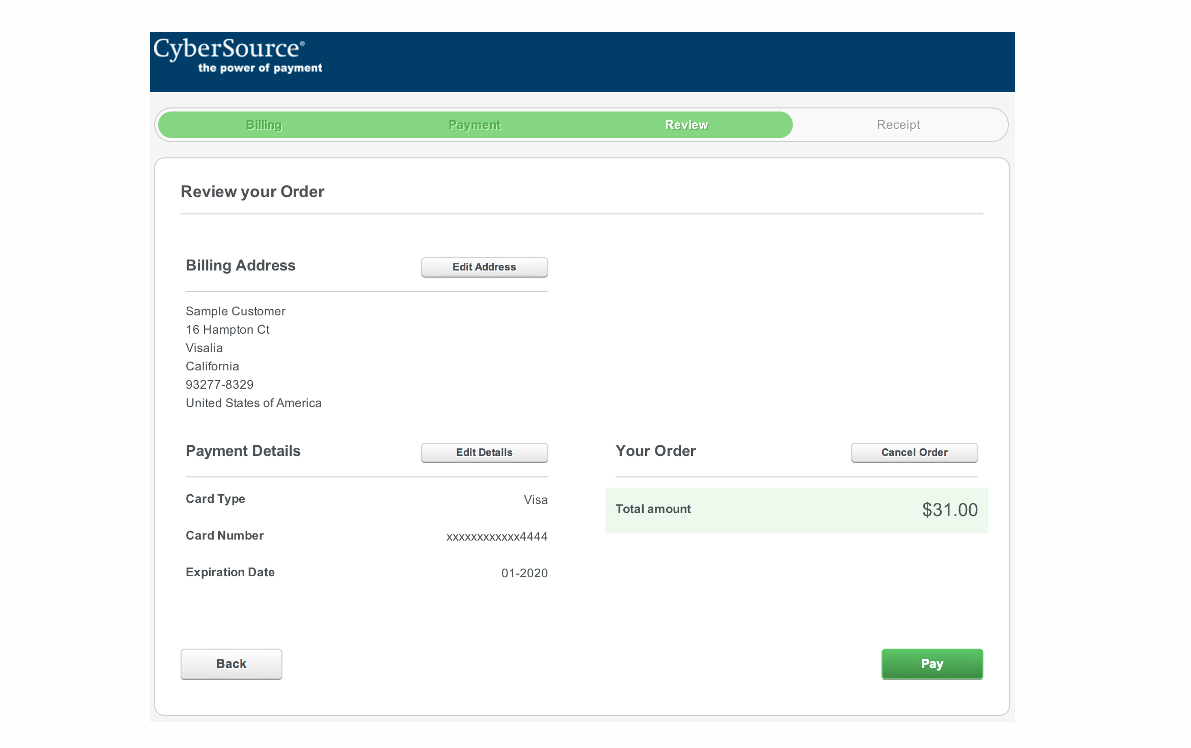

15. Cybersource

Overall Capterra user rating: 3.5 out of 5

Overall G2 user rating: 4.1 out of 5

Cybersource lets you accept payments worldwide, which is ideal for e-commerce businesses with a global audience. The platform allows you to accept a wide variety of payment methods, including credit and debit cards, bank transfers, digital wallets, and even installment payments.

You can choose from checkout templates for more than 40 counties and more than 42 languages. Many payouts are available in just 30 minutes.

Pricing: Cybersource doesn’t publish pricing information, so contact the company to learn more.

User review:

“It’s easy to use, easy to search historical transactions.”

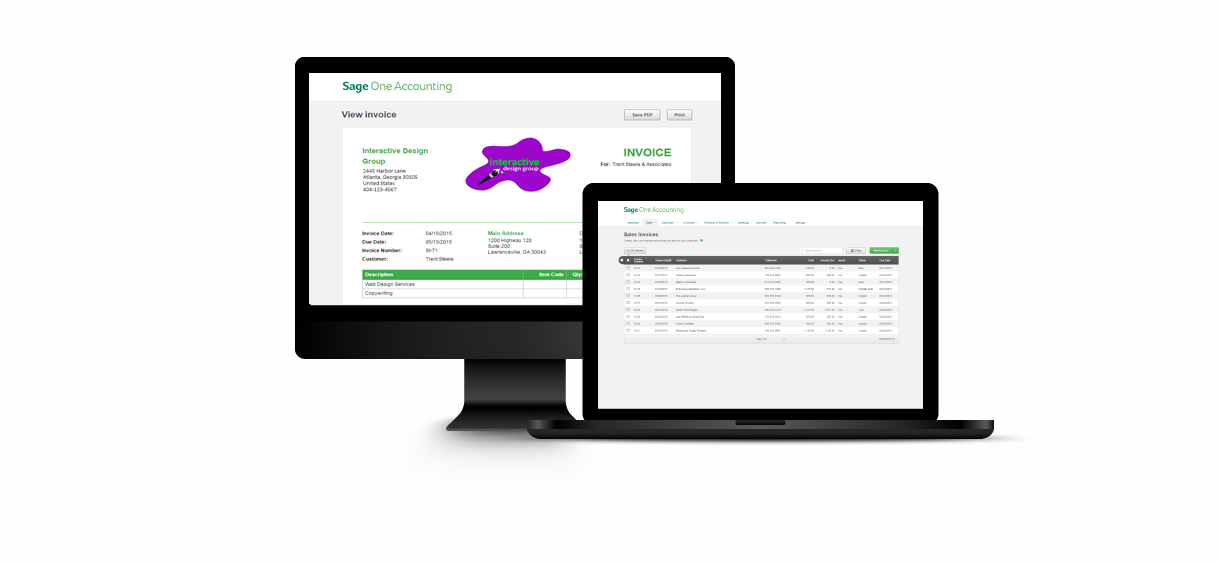

The way to design your e-commerce site for success

Operating a successful e-commerce store starts with a quality payment processing solution, but the platform that you build your store on can also affect your success. Jotform makes it easy to create order forms or payment forms and then to embed that processor right in your form.

Thanks to Jotform’s payment processor integrations, your customers will enjoy a seamless checkout process with processors like PayPal Business and Personal, Stripe, Venmo, Square, and more. With the payment processor embedded within the form, customers don’t have to open up a separate website to make their payment before returning to complete their order. Such an easy, streamlined checkout process can increase your completed orders, leading to bigger profits and a better overall customer experience.

Send Comment: