How to automate the loan origination process

The concept of the loan — borrowing capital or other resources and paying it back over time — has been around for thousands of years.

The formalized loan origination process, though, isn’t nearly as archaic — even though it sometimes feels like it is in today’s digital age. That’s because for many lenders, loan origination still consists of paper-based tasks, disconnected handoffs, and other inefficiencies. The result is a loan origination process that’s unnecessarily lengthy and prone to human error.

If you’re a lender looking to modernize parts of your loan origination process, keep reading. We’ll provide a refresher here on the most common steps of the process — every lender is different, after all — and follow that with several automation opportunities you can explore.

Adding his insights here is John Reed, former aerospace engineer turned life insurance expert. Reed is a senior consultant at Balanced Strategies, a finance consulting firm aiding high-net-worth clients with life insurance strategies and financing analysis.

Check it out…

Collect loan applications and send them through automated approval flows with Jotform Approvals. It’s free!

5 steps of the loan origination process

The loan origination process can vary, depending on the lender — some require different documents, prequalify borrowers quicker, or won’t negotiate on terms. But nearly all lenders follow the general steps below.

1. Prequalification

“It’s important to first understand the financial needs of the borrower and whether they have what’s required to address those needs,” says Reed. For example, the borrower may be looking to borrow $1 million, but if they can’t prove their ability to pay that amount back within the necessary time frame, they won’t qualify for a loan.

At the prequalification stage, lenders look for any red flags, which typically involve issues with the borrower’s income, assets, debts, or credit record. The level of due diligence at this juncture differs among lenders, as some are more risk-averse than others. But no lender wants to invest too much time or too many resources only to realize that the borrower won’t be able to shoulder the loan.

2. Loan packet preparation

Assuming the borrower is prequalified, the lender then does a more comprehensive review of the borrower’s financial statements — property, investment accounts, cash, and business ownership and cash flows, if applicable.

Some lenders will take the extra step of confirming the values via a third party. For example, the lender may refer to a real estate website to verify the value of a home or review state-filed business documents to verify ownership percentage.

Lenders then prepare the loan packet, which includes all the documents the lender will use to underwrite the transaction. These documents detail what’s being financed and why, whether the borrower can pay the loan principal back, and whether they can generate cash flows that cover the interest until they’ve repaid the loan in full.

3. Term sheet disclosure

Next up is the term sheet, which includes the lender’s loan offer to the borrower — the amount they can loan, the time period they’re willing to loan for, the interest rate, setup fees, prepayment penalties, and any other provisions. Exact numbers vary based on the loan and the lender.

4. Negotiation

At this stage, the borrower has the opportunity to ask for changes, such as longer loan terms, better interest rates, and different rate structures. For example, the borrower may prefer the consistency of a fixed rate over a floating rate that adjusts based on market conditions.

5. Loan commitment and closing

After negotiation is complete and the borrower accepts the loan terms, it’s time to put everything in writing. Here the lender provides binding legal agreements, including titling documents and the promissory note. The borrower and lender sign the documents, and the lender funds the loan to be used in the manner agreed upon.

Renewal and refinancing

“It’s important to note the post-loan options borrowers often have,” says Reed. For example, renewals are applicable to certain loans (e.g., life insurance). With renewals, borrowers can take out an additional loan, but they’re subject to a reassessment of their ability to pay back their loan.

Renewals are almost identical to the original loan with regard to terms and conditions, though some aspects — such as the loan amount and maturity date — may change.

As a simple example, say a borrower wants a $5 million life insurance loan but can’t get approved. Instead, they get approved for $1 million to be paid back over one year. At the end of the year, the borrower asks to renew for another $1 million.

The lender reassesses the borrower’s financial position, though most lenders do this with less rigor than their initial origination efforts (unless the borrower is asking for more money).

In most cases, the borrower just has to show there have been no material changes since their approval — e.g., no bankruptcy, divorce, business dissolution, or other loan defaults. The borrower can repeat this every year until they’ve reached their desired amount.

For refinancing, borrowers may be looking to change lenders or adjust terms, such as seeking a lower interest rate. Most lenders allow borrowers to refinance at any time, though it may not always be in the borrower’s best interest to do that. They may need to consider the market or a prepayment penalty.

With refinancing, the original loan is canceled and any remaining debt rolls into the new loan.

4 areas for automation in the loan origination process

There are a few areas within the loan origination process described above that you can automate using a solution such as Jotform, an easy-to-use form builder. With Jotform, you can build not only forms but also tables and approval workflows to make loan origination more efficient. See below for tips and automation opportunities Jotform can help with.

1. Collect borrower data online for prequalification

“Not every borrower will be prequalified, so you don’t want your team spending unnecessary time or effort if they can avoid it,” says Reed. That’s why he recommends using a digital approach to gather initial borrower data instead of a paper application.

Collecting borrower data is easy with Jotform, which has over 40 prebuilt loan application form templates. The forms include many of the standard data points you need during the loan origination process — name, birth date, email, phone number, address, employment, income, credit inquiry authorization, etc.

You can change any of the loan application forms to suit your needs — remove or add data points, create new sections, add your logo, modify the colors, and so on. Make a loan application form that reflects your company’s look and feel so borrowers have a consistent experience between touch points.

Once borrowers have submitted their applications, you can view all the submissions from your secure Jotform account.

2. Digitize loan packets

“No matter how organized your team is, stacks of paper are never as efficient as their digital counterparts,” says Reed. Instead of dealing with couriers running documents back and forth across town, make all loan documents electronic.

Of course, if you’re asking borrowers to provide documents in digital form, you need a way to collect them. Jotform enables easy document collection through forms. Simply add a file upload field to a loan application form — or create a new form specifically for this purpose — to accept key documents, such as pay stubs, proof of address, and bank statements.

3. Streamline borrower communication

Naturally, there’s a lot of information exchange between the lender and the client. While you can’t eliminate all of that, you can decrease some of it. “One of the most significant aspects of borrower communication — and one that can cause delays — is requesting documentation,” Reed explains.

Making paperwork digital doesn’t mean it’s automatically taken care of — borrowers often need multiple reminders to submit outstanding documents. This can take a lot of your team’s time.

Requesting documentation through Jotform is easy once you’ve built a form. Just send the form to your client and set up reminder emails to eliminate that task for your team.

4. Make signatures electronic

Even as electronic signatures (or e-signatures) have become more prominent across industries, many lenders have lagged in adopting them. “They still require wet signatures, which means borrowers have to go in person to provide their written consent to the loan agreement. Borrowers may not be available for several days, further lengthening the loan process,” Reed explains.

E-signatures are legally binding in most cases and eliminate these potential delays. They also make the borrower experience more convenient and limit disruption in the lender’s workflow. You can easily capture e-signatures with Jotform.

Bonus: Create automatic notifications for renewals

“It’s valuable to implement a system that enables you to automatically push notifications to borrowers (and members of your team) to prepare for renewals,” says Reed.

For example, you can give borrowers a 30-day heads-up about their upcoming renewal, complete with what documentation they’ll need. This way, borrowers can start preparing and prevent delays in the renewal process.

Automate loan origination with Jotform

In addition to the 40-plus loan application form templates, Jotform also offers two key capabilities for lenders looking to be more efficient: tables and approvals.

Tables

With Jotform Tables, you can easily keep borrower loan information organized. Forms automatically connect to tables, so you can track loan applications, uploaded documents, and so on. Tables provide the foundation for building reports as well — meaning managers can get a high-level view of what’s going on in the loan origination process.

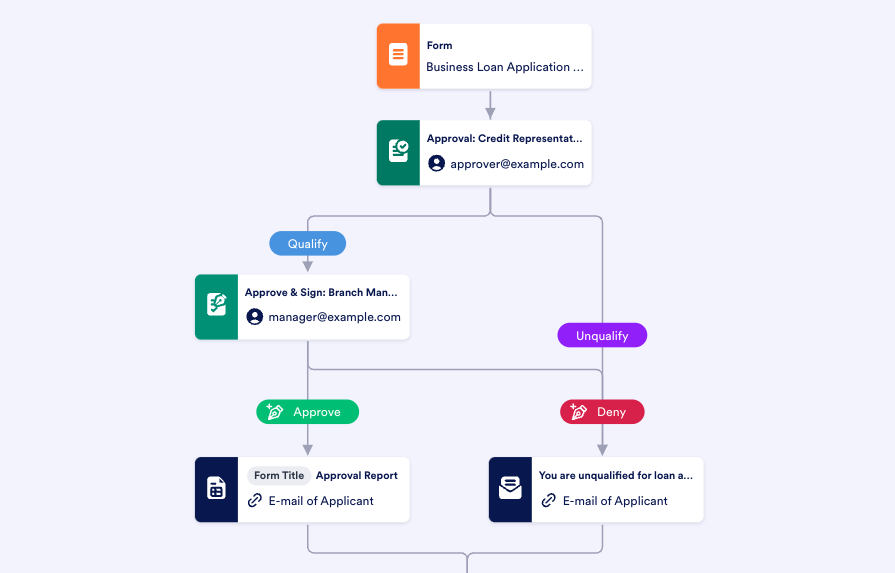

Approvals

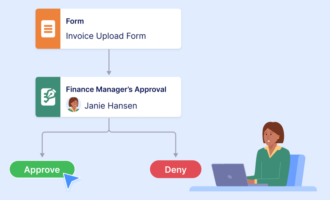

Instead of tracking down where a borrower is in the loan origination process and figuring out next steps, use Jotform Approvals to automate the process. You can build these approval workflows in whatever manner suits the way you do loan origination. Make them as simple or complex as you need, and add different members of your team to the workflow.

You can even loop in borrowers so they are automatically notified of their prequalification or approved status.

The drag-and-drop builder makes customizing an approval workflow simple. And you can add personalized autoresponder emails, set up notifications and time limits, and more.

Boost the efficiency of your loan origination process with Jotform. Get started today.

Send Comment: