Whether or not you’re good at math, numbers will always factor into your business goals.

When you’re first starting out, you may be able to use your high school algebra skills to stay on top of your business expenses. But if you want to keep it running long term, you’ll have to upgrade not just your math skills but also your tracking — especially if you want to hit ambitious growth targets. In fact, most businesses fail because they don’t manage cash well.

The sooner you learn how to track business expenses, the faster your business can grow. Good expense tracking isn’t just about being successful — it gives you the invaluable peace of mind that your business finances are running smoothly.

Examples of business expenses

Simply put, if you spend money on something that relates to your business, it’s a business expense. Expenses can vary greatly between different industries and company sizes, but they always fall into operating or capital expenses. They can also be fixed (think mortgages), occasional, or periodic (like building repairs). Even people who work from home have specialized expenses.

These are just a few examples of business expenses:

- Utility bills

- Rent and mortgage payments

- Industry education

- Gifts for clients or employees

- Office supplies

- Insurance

- Taxes and fees, such as permits

- Interest payments

- Travel

- Salaries

- Subscriptions

- Payroll costs, such as benefits and wages

- Marketing and advertising efforts

The importance of expense tracking

Money makes the world go ’round — your business is no exception. When you know how to track business expenses, you gain in-depth knowledge of how your practices and processes are working for or against your goals. With this knowledge, you can be more flexible in your decision-making and build the resilience needed to face industrial upheavals and economic downturns.

Tracking expenses is probably most critical for paying your taxes correctly. Differentiating between deductible and nondeductible expenses saves you money and keeps you legally in the clear.

In addition, your expenses directly impact the health of your business budget. You can’t just set your budget once and let it run — you need to adjust it as your circumstances change.

On the other hand, there’s no way to know if your budget is actually feasible unless you know your expenses. When you track your expenses, you consistently target your revenue goals, allowing you to adjust your budget accordingly.

Finally, expense tracking keeps you accountable not only to your employees but also to yourself. Whether you tend to overspend or underspend, your expense records reveal problems before they become unsolvable, empowering you to make proactive changes.

Tracking methods

It’s not enough to know how to track business expenses — without the right tools, inefficiency will stifle your finances. Here are a few tracking options.

Pen and paper

Writing is thinking on paper, so many people find it worthwhile to examine their finances by doing the math by hand, maybe with a calculator.

Though it makes sense to use pen and paper for quick calculations or ballpark estimates, it doesn’t work in the long run. We end up losing paper, discover our rushed handwriting is indecipherable, and may find it tricky to keep receipts and bills organized. This mess leads to costly mistakes that hurt your bottom line.

Spreadsheets

Programs like Google Sheets or Microsoft Excel are a step up from pen and paper. They display information in a format most users are familiar with. The more tips and tricks you know, the better these programs work for you, because they perform complex calculations and create charts.

These programs may be a good launching point for business owners learning how to track business expenses, but the more your business grows, the more your spreadsheets can get out of hand.

Software

Robust and agile expense and accounting software is the best option for businesses with multiple expenses. But even smaller organizations will find these platforms’ features and functions useful, especially when set up to encompass multiple departments.

Mobile apps

Depending on your needs, mobile apps can stand on their own or complement software. For example, your employees may use an app that digitizes receipts and integrates with your expense software, or traveling workers might submit accurate reports with mileage tracking apps.

Tracking expenses step by step

Start where you are

Inspect the current state of your expenses. What are you spending money on now? Is there anything you can cut? Would you like to spend more in one area, but hold back because you don’t know where your finances stand? Knowing these answers is vital.

Streamline accounts

Even if your business is small, put up financial boundaries by opening business checking and savings accounts as well as a credit card. Just like with your personal finances, savings accounts give you a safety net, while credit cards establish credit. These accounts unite your spending under one roof, making analysis easier. And business credit cards give business owners special perks.

Categorize

When you label each expense, you can organize them quickly — whether it’s flowers for an employee’s birthday or an annual software subscription. These categories will also make expense reports easier to file for employees, even those who don’t know how to track business expenses themselves. Need ideas? Take a look at the business categories the IRS recognizes.

Institute policies

Employees often question what they should report when they spend money on work-related items. They may make mistakes or request approvals at the last minute because they don’t know how and when to report expenses. Detailed expense policies allay confusion.

For example, you can institute weekly expense deadlines that employees have to meet when turning in receipts or invoices. You can also limit the number of employees who can access company credit cards and set up approval processes so the right managers approve or reject expense requests. Plus, rock-solid policies prevent expense fraud.

Track everything

This step may go without saying, but it’s the crux of your accounts. Record all purchases immediately or as soon as possible. Log receipts, bank statements, and credit card bills — whether you spent $50 on a client lunch or thousands on office furniture. To cut down on paper, take advantage of apps that scan and digitize receipts, such as Shoeboxed.

Invest in software

If you’re not using software, you might as well not be tracking. While QuickBooks is the ubiquitous choice, plenty of other software programs have great features that save time on expense logging, such as WellyBox, FreshBooks, Bench, and Sunrise. Whichever you choose, make sure it integrates with your other software as well as your bank accounts.

Also, look for the capability to automate expense processes and create reports. Programs with a mobile app are especially useful, as they allow you and your employees to track expenses on the go, lowering the chances of forgetting to report a purchase.

Review

Every business process needs tweaking. Part of understanding how to track business expenses involves reviewing them regularly to see what you can improve. Maybe you’re spending too much money on office parties or you need to find better invoicing software. Routinely aligning your goals to your expenses is vital to a thriving business.

Making expenses easy with Jotform

The simpler your expense tracking, the more likely you — and your employees — will stick to it.

Jotform provides a wide variety of form templates, such as business expense request forms, that you can customize to your needs. All form responses from employees and other stakeholders are saved in one place, centralizing your financial records. You can view all submissions from any device with the Jotform Mobile Forms app.

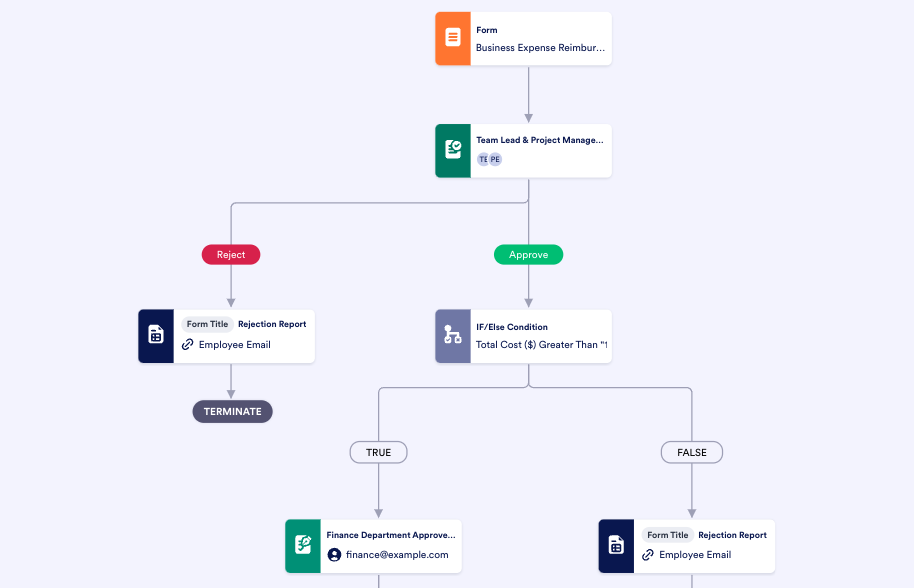

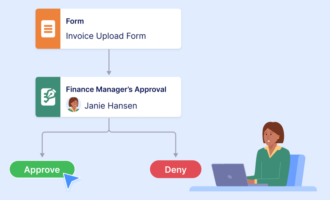

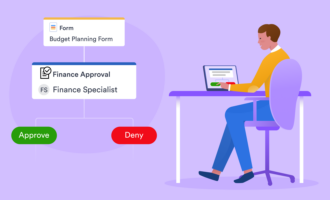

The new Jotform Approvals supercharges your expense approvals process. Any forms you create become steps in your approval process, which you build in a drag-and-drop interface. Using if-then conditions allows you to automatically implement your expense policies, saving your team time.

Even if you’re just beginning to understand how to track business expenses, you can take control with tools like Jotform Approvals. The better your tracking, the more confidently you can run your business.

Send Comment:

1 Comments:

More than a year ago

VAT stands for Value Added tax, and the companies that have registered for VAT with HMRC are liable to pay VAT. The condition to register for VAT is based on threshold set by the HMRC.

If your taxable income exceeds £85,000 in thirty days period, then it is compulsory for you to register for VAT. You can also register voluntarily if you are sure that your income in the next 30 days period will exceed £85,000.

The VAT return can be based on monthly, quarterly, or annual schedule. VAT includes the input which is the sales and output which is expenditure. The comparison of input and output value is the VAT that is payable.

Calculating VAT is also a complex process which should be left to the VAT return accountants to avoid any sort of mistake. It is not only compulsory to register for VAT return depending on your income, but it also depends on certain services and goods that you provide and depends on where you are sending these goods and services.