Best credit card processing solutions for nonprofits

When was the last time you had cash on you? If you’re like most people who get this question, your answer is probably that you don’t carry it. For most people, cash now takes a backseat to its plastic counterpart. That’s why accepting credit cards isn’t an option for any organization — including nonprofits.

The need for credit card processing for nonprofits

Online credit card processing is about more than convenience — it’s about customer experience. Consider a few of the benefits accepting credit cards delivers to supporters and organizations:

- Supporters can contribute anytime, anywhere, and often with just a few clicks.

- Organizations can set up recurring donations, allowing supporters to make automatic contributions at regular intervals.

- Nonprofits can rely on a steadier, more predictable flow of funds.

By offering credit card processing, nonprofits reduce friction in the donation process and better meet consumer expectations. This functionality also helps nonprofits attract more donations while building stronger relationships with their supporters. Everybody wins!

5 frequently asked questions about nonprofit credit card processing

Let’s take a look at some common questions about how nonprofits can process donations through credit cards.

Q: How does nonprofit credit card processing work?

A: Donors enter their card information into the payment processing platform. Then, the payment processor verifies the details, checks for sufficient funds, and transfers the donation amount to the nonprofit’s bank account.

Q: Are there fees associated with credit card processing for nonprofits?

A: Yes. These typically include a transaction fee (a percentage of the donation amount) plus a fixed fee per transaction.

Q: Is credit card processing for nonprofits secure?

A: Yes. Reputable payment processors use advanced encryption and security measures to protect the donor’s credit card information and the nonprofit’s financial data.

Q: Can nonprofits set up recurring donations with credit card processing?

A: Absolutely! Many payment processors allow nonprofits to set up recurring donations, enabling supporters to automatically contribute a specified amount at regular intervals (e.g., monthly or annually).

Q: Can nonprofits accept international donations through credit card processing?

A: Yes, most payment processors allow nonprofits to accept international donations. However, it’s important to check the processor’s policies regarding currency conversion and associated fees.

Top credit card processing solutions for nonprofits

Let’s take a look at the features and fees of some of the most popular credit card processing tools.

1. PayPal

PayPal is probably the most well-known digital payment processing platform on the planet. Its size and scope mean that consumers instantly trust it, which makes them more comfortable donating. PayPal Credit Card Processing for Nonprofits is specifically tailored for nonprofit organizations, enabling them to easily accept credit card payments for donations, membership fees, event registrations, and more. PayPal is easy to set up and great for organizations of all sizes.

Features

- Familiar, user-friendly interface

- Simple setup and integration options

- Recurring donations and donor data management

- Competitive transaction fees

Fees: For verified 501(c)(3) nonprofits, PayPal charges a fee of 1.99 percent plus a fixed fee per transaction that varies by country.

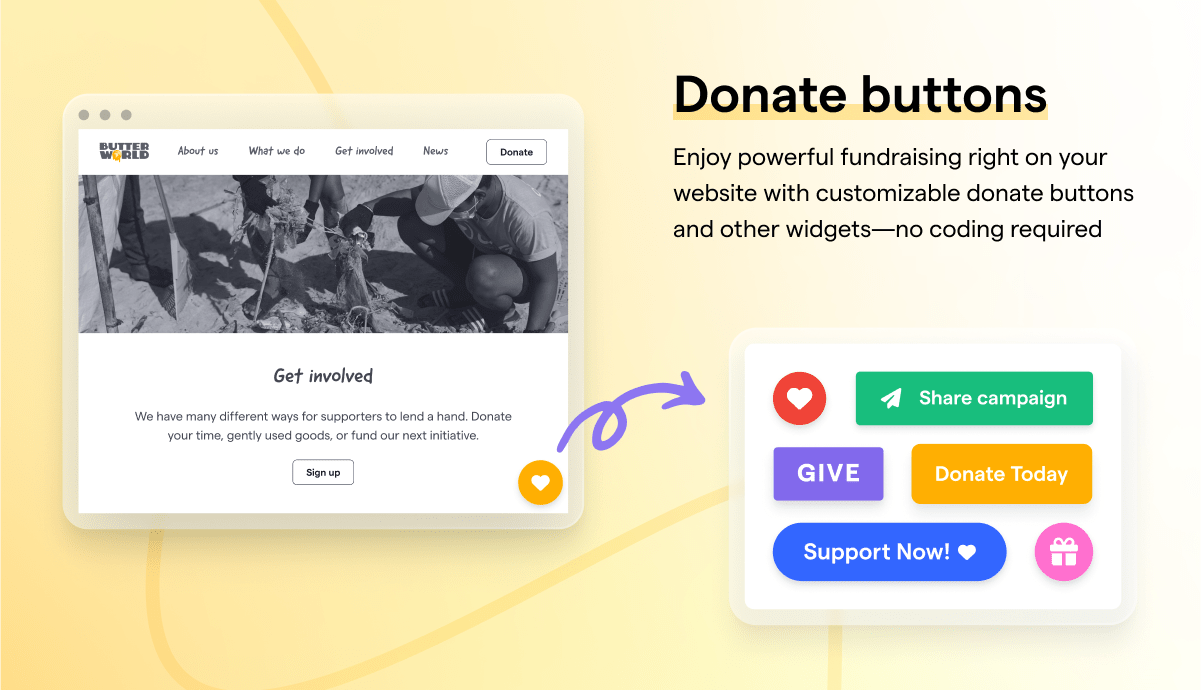

2. Givebutter

Givebutter is a fundraising platform that offers credit card processing services specifically designed for nonprofit organizations. It allows nonprofits to set up online donation pages, sell event tickets, and run fundraising campaigns. Givebutter offers transparent pricing with no up-front fees, making it an affordable choice for nonprofits. In addition to credit card processing, Givebutter provides fundraising tools to help nonprofits engage with their supporters and manage their fundraising efforts effectively.

Features

- Customizable donation pages

- Social sharing options

- Donor tracking

Fees: The fee is 2.9 percent plus $0.30 per transaction. However, Givebutter allows supporters to cover credit card fees; its website claims 95 percent of donors opt to do so.

3. Zeffy

Zeffy is a fundraising payment processing platform that doesn’t charge fees for nonprofit organizations. It’s customizable, allowing organizations to tailor their donation page to fit their audience. To keep the platform free, Zeffy is wholly supported by supporter donations. To increase convenience for supporters, it accepts many types of payments, including Google Pay and Apple Pay.

Features

- Customizable donor questionnaires

- Automatically sent tax receipts

- In-person payments

- A dashboard to manage all donor communications

Fees: Free (supported by supporter donations)

4. Stripe

Stripe is a popular payment gateway known for its ease of use, secure transactions, and transparent fee structure. One of its main features is a flexible API that allows teams to integrate it with the platforms they’re currently using.

With Stripe, nonprofits can also set up recurring donations, allowing supporters to give regularly without manually inputting their payment details each time. It’s an excellent tool for nonprofits looking to enhance the payment processing part of their donation process.

Features

- Powerful and flexible API that simplifies integration

- Security and compliance practices that meet the highest standards

- Built-in global payment processing

Fees: Stripe offers a discount for verified 501(c)(3) nonprofits. Contact Stripe for more information.

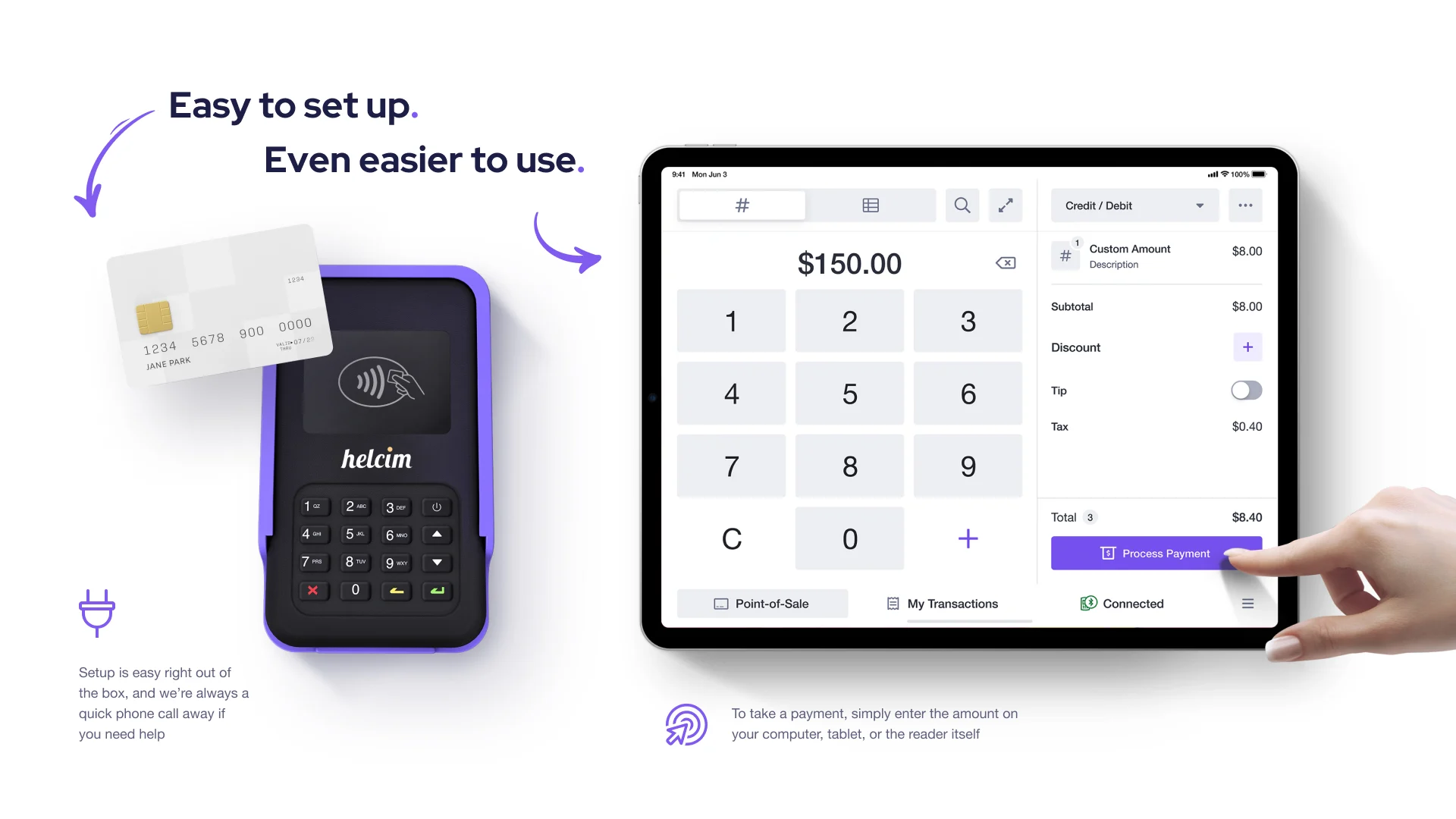

5. Helcim

Helcim helps nonprofit organizations accept credit and debit card donations, both online and in person. It’s a merchant services provider known for its transparent pricing, user-friendly platform, and excellent customer service. Helcim offers nonprofits discounted rates to process credit card payments, ensuring that more of the donation goes toward the organization’s mission rather than fees.

Features

- Flexible payment options that include phone, in-person, and online payments

- Customer service that prioritizes the human touch

- Transparent pricing

Fees: Pricing for nonprofits varies based on region and card type:

- Visa Canada: 0.98–2 percent per transaction

- MasterCard Canada: 0.92–1.80 percent per transaction

- Visa U.S.: 0.65 percent plus $0.15 to 1.35 percent plus $0.05 per transaction

- MasterCard U.S.: 1.45 percent plus $0.15 to 2 percent plus $0.10 per transaction

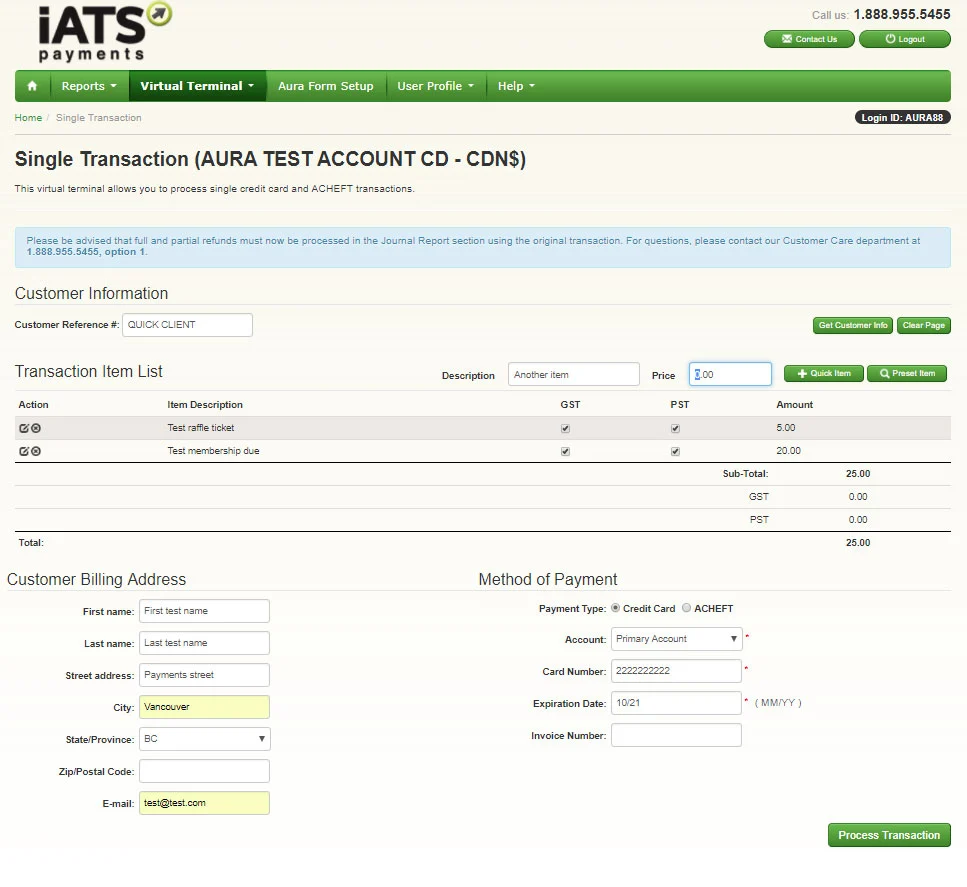

6. iATS Payments

iATS is a leading payment gateway that focuses solely on the nonprofit sector, providing tools and features geared toward the unique needs of charitable organizations. With iATS, organizations can integrate seamlessly with popular nonprofit software platforms, making managing donor data, tracking fundraising efforts, and automating processes easy. Additionally, iATS doesn’t charge any setup or hidden fees, so nonprofits know what to expect regarding costs.

Features

- Multi-currency support to reach international donors

- Recurring donations that foster predictable funding

- Dedicated customer support

Fees: Contact iATS for the flat monthly rate.

A streamlined payment collection process with Jotform

Jotform is an online form builder that allows nonprofits to create customized forms for various purposes, including collecting credit card payments. The best part is that Jotform offers nonprofits a 50 percent discount. With Jotform, users can enable payments instantly without paying any extra transaction fees to Jotform.

Follow these steps to collect credit card donations for your nonprofit:

- Log in to or create a Jotform account.

- Create a new form. Click the Create Form button and choose whether to start from scratch, use a template, or import an existing document.

- Customize your form. You’ll be taken to the Jotform Form Builder, where you can drag and drop to add fields to your form, such as name, email address, and any other information you’d like to collect from donors. This step is also where you can add branding elements to customize your form.

- Add a payment processor. Jotform integrates with 30-plus payment processors, including PayPal, Stripe, and Square. To add a payment processor, go to the Form Elements panel, click Payments, and select your preferred payment processor. Follow the instructions to connect your payment account.

- Configure your payment settings. Once your payment processor is connected, configure your payment settings. You can set up one-time donations, recurring donations, or specific donation levels. Be sure to specify your currency and any other relevant settings.

- Share your form. Once your form is complete, click the Publish button at the top of the page. You’ll have several options for sharing your form, including through a direct link, by embedding it on your website, or through social media.

By using Jotform to collect credit card payments, nonprofits can create a seamless donation experience for their supporters, making it easier for them to contribute to their cause. Check out our payment gateway comparison chart for a complete list of payment processors you can integrate with Jotform. With thousands of templates available, Jotform lets you create a donation form that perfectly fits your needs. Try Jotform for free today.

Photo by Mikhail Nilov

Send Comment: