How to fill out a W-9 form as a nonprofit

- Name

- Business name

- Federal tax classification

- Exemptions

- Address

- Taxpayer identification number

- Certification

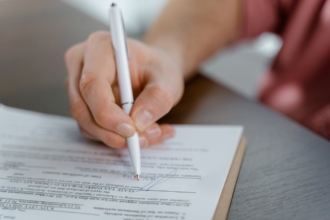

When you’re running a nonprofit, you need to complete many different types of forms. One of those forms may be the Form W-9, or the Request for Taxpayer Identification Number and Certification.

What is a W-9 form for nonprofits?

A W-9 form is a form used to collect a taxpayer identification number (TIN) to confirm the identity of a person or organization for the purpose of filing information with the Internal Revenue Service (IRS).

This information is then used to fill out a Form 1099, which reports miscellaneous income. The W-9 form itself does not go to the IRS.

For example, your nonprofit may need to request a W-9 from an independent contractor you’ve paid to perform work.

What is a taxpayer identification number?

A taxpayer identification number is a unique nine-digit number that identifies people and organizations for tax purposes.

There are different types of TINs, but for nonprofits, the most important ones to know of are Social Security numbers (SSNs) for individuals and employer Identification numbers (EINs) for businesses and organizations.

When does your nonprofit need to fill out a W-9 form?

Your nonprofit will need a W-9 form if you pay someone over $600 for their work during a tax year, or if someone pays you over $600.

For example, if your nonprofit works with a freelancer and pays them over $600 for their services, the freelancer will need to complete a W-9 so your nonprofit can report the money you paid to them.

If you have performed paid work for another nonprofit or business, like acting as a consultant on a project, you’ll need to complete a W-9 for the other nonprofit.

Why do nonprofits need a W-9 form?

W-9 forms are helpful when your nonprofit needs to fill out a 1099 form to send to any contractors you’ve paid in a given year. Since a W-9 form provides your nonprofit with the payee’s name, address, and TIN, you’ll get the necessary information you need to report to the IRS.

How to fill out a W-9 form as a nonprofit

Form W-9 is relatively straightforward, but it’s important to ensure that you fill it out accurately and completely. The explanation below will guide you through the various fields:

- Name: Provide your nonprofit’s name as it appears on your articles of incorporation and tax form.

- Business name: Identify any trade name or DBA (doing business as) that’s different from the nonprofit name listed on your articles of incorporation.

- Federal tax classification: Check the “other” box under the federal tax classification section. Then write, “Nonprofit corporation exempt under IRS Code Section ___,” and identify the appropriate code section for your nonprofit’s tax exemption.

- Exemptions: Leave the exemptions box blank if you’re a 501(c)(3) nonprofit. Your accountant can provide you with additional information on the exemptions section of the form.

- Address: List your nonprofit’s mailing address.

- Taxpayer identification number: Provide your nonprofit’s employer identification number, or EIN. If your nonprofit doesn’t yet have an EIN, you can apply for one online.

- Certification: Sign and date the form.

Once you’ve completed the W-9, you can give it directly to the business or organization that has requested it.

FAQs about W-9 forms and nonprofits

My nonprofit is tax-exempt. Why do I have to complete a W-9 form?

The W-9 form allows a business to file the payments that they’ve made to your nonprofit with the IRS. Even if your nonprofit is tax-exempt, the business that paid your nonprofit still has to report that those payments were made. The W-9 form gives the business the information it needs to report that payment and stay compliant with IRS laws.

When should my nonprofit collect a W-9 form from others?

When you pay another nonprofit, an independent contractor, or any third party, your nonprofit should have that third party complete a W-9 form. Collect the W-9 forms and use them to submit your informational report to the IRS each year.

Does my nonprofit have to give our completed W-9 form to the IRS?

No, you can give the completed W-9 form to the business or organization that requested it. You don’t have to file the form with the IRS.

Jotform: An easier way to fill out a W-9

You can find Form W-9 as a PDF on the IRS website, and Jotform can streamline and simplify the process of completing it.

With Jotform Smart PDF Forms powered W9 Generator, you can easily fill out and download your W-9 Form in PDF format.

If you need to collect completed W-9 forms from freelancers or other third parties who you’ve hired, that’s easy with Jotform, too. Jotform is already equipped with a W-9 form template. You can clone this and share your form with your freelancers or third parties through an email link or text or even by embedding it on your website. When a third party fills out the form field, their responses populate into a PDF of the W-9 form, so you can collect and store that data for submission to the IRS when you prepare your taxes.

Jotform can benefit your nonprofit in other ways, too. Whether you’re starting a nonprofit or running a well-established organization, Jotform can streamline the process of completing forms, collecting data, and storing data. Jotform features plenty of nonprofit forms and templates, including volunteer registration forms, donation apps, and more. You can customize these templates to your needs, publish your forms, and easily collect and store data.

When you run a nonprofit, every dollar matters. That’s why Jotform offers a 50 percent nonprofit discount on paid plans, giving you access to this powerful tool that can help you organize and streamline your nonprofit processes.

Photo by Corinne Kutz on Unsplash

Send Comment: