How nonprofits can accept stock donations

- Put someone in charge

- Get your policies in order

- Open the brokerage account

- Prepare your website

- Have a plan for the stock

Nonprofits often have many different revenue streams. Funds may come from cash donations, bequests, and fundraising events, to name a few. Nonprofits can also receive donations in another way that often doesn’t get as much attention — through the gift of stocks.

How donating stock benefits the donor

Donating stocks has obvious benefits for the donor. Individuals donating stock can avoid paying capital gains tax when donating the security to a qualified charitable organization if the stock has increased in value from the time they purchased it. If the donor has held that appreciated stock for at least a year, they can itemize it as a tax deduction on their tax return for its fair market value.

How stock donations enhance a nonprofit’s funding

For the nonprofit receiving stocks as a donation, there are benefits as well. When stocks are part of a nonprofit’s revenue stream alongside fundraisers, cash donations, and other sources, it can help the organization achieve financial goals more quickly and fund specific initiatives like construction projects and other improvements.

Nonprofit stock donations can also provide a path to long-term operational viability by helping nonprofits budget more effectively. Accepting stock donations also offers a donor another way to make a donation. A Texas Tech University study found that nonprofits that accepted non-cash donations of securities saw 66 percent revenue growth over five years, while those that accepted only cash saw 11 percent growth.

Prospective donors are sometimes more willing to give from their gains on investments rather than from their disposable income. Allowing gifts of stock can encourage generosity from individuals who might otherwise put off giving a cash donation of equal value. Carefully managing relationships with donors can lead to recurring stock donations of significant value.

How nonprofits can accept stock donations

Receiving donated stocks involves adhering to the rules for both securities and nonprofits. Follow these steps to set up an organized, structured, and compliant framework for accepting stocks as donations.

- Put someone in charge. Organizations typically pick a person from their accounting or finance team to handle the receipt of gifts from brokerages. They might also designate other team members to cultivate relationships with donors by thanking them for their donation when appropriate.

- Get your policies in order. One of the most important steps in getting ready to receive donated stocks is to develop an investment policy statement (IPS). This statement outlines the people involved in the handling of securities for the nonprofit, the liquidity needs for the organization, risk tolerance and return goals, allowable asset classes, and other circumstances unique to the organization.

- Open the brokerage account. To receive stocks, you’ll need a brokerage account. Having this account will help you make sure the stocks you receive are appropriately valued for accounting purposes. Publicly traded stocks are clearly valued by the exchange they’re traded on, but an appraiser will need to value privately owned stocks before the donation.

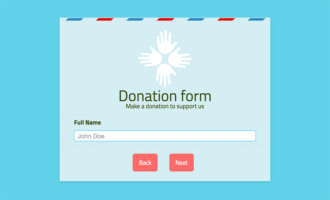

- Prepare your website to receive donor information. Your website should clearly state your ability to receive stock donations, describe benefits of doing so, and explain how their donation will further the cause you both care about.

Before receiving the stock directly, you’ll want to collect information from your prospective donor. This information will include

- Their contact information (name, address, phone number, etc.)

- The specific type of shares they wish to donate

- The date the donation will take place

- Whether the value of the stock has appreciated

- How long the donor has held the stock

Once the donor submits their information, you can send the donor the requisite information to facilitate the stock transfer, such as depository trust company (DTC) information, brokerage information, etc.

- Have a plan for what to do with the stock. Selling the stock immediately after receiving it is considered a best practice. The reason for this is that it avoids any discrepancy between the value of the stock when your organization receives it and the value when you sell it. If you hold the stock, the value may go up or down over time.

How Jotform can help with fundraising

Jotform has a number of tools available to nonprofits that make the process of collecting donation information easier. Your nonprofit can combine any of Jotform’s extensive library of donation forms and Jotform Donation Apps to ensure that donors can support you whether they use a desktop, laptop, or mobile device.

With Jotform Donation Apps, you can create a custom app for donations without any coding skills — and for no additional fee. The Donation Box element within Jotform Apps integrates with more than 30 payment gateways to collect donations. You can also add forms to your app to collect information for stock donations. Simplify the donation process by sharing a QR code for the app, so donors just need to scan the code and make their donation.

Jotform Inbox lets you track, search and manage your form submissions, so all of your donor information is easily accessible. It also updates you in real time by notifying you via email when someone makes a donation. Jotform also offers a 50 percent discount to nonprofits on its already affordable pricing.

Photo by Alexander Grey on Unsplash

Send Comment: