Tax Deduction Letter

About this template

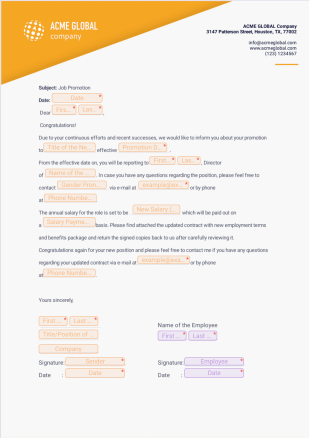

A tax deduction letter is used by charities and foundations to acknowledge donations, thank donors, and give each donor the information required to use the donation as a tax deduction. If your charity or nonprofit needs a more efficient way to write tax deduction letters, do it with this automated Tax Deduction Letter from Jotform Sign.

Start by customizing the letter design as you like. You can update the text, include your logo, and make other design changes with ease. Then fill out each donor’s information into your templated letter and watch as it’s converted to a PDF document — ready to be downloaded and sent to donors.

Details

1,479 Clone

Created by

Download PDF File

Related templates

The e-sign templates here are for informational purposes only. Jotform is not providing legal, financial, or other advice, or implying that the forms are legally valid in all or any jurisdictions. Before using any such template, consult an attorney and/or other applicable professionals to make sure that the form meets your needs, legally and otherwise.