Top 9 payment gateways for online transactions

The high level of security required to handle financial information online makes in-house payment processing cost-prohibitive for most internet sellers. Luckily, there’s a better way for sellers to manage financial transactions, and it’s called a payment gateway.

A payment gateway is a technology solution that enables online merchants to accept debit cards, credit cards, e-checks, and other forms of payment from customers or buyers when making a purchase. Brick-and-mortar store merchants, who typically accept physical cards in addition to phone-based payments, also use payment gateways.

Payment gateways essentially receive financial account information and hold it until a payment processor authorizes the charge with the appropriate financial institution. Payment gateways enable merchants to complete purchase transactions with their customers in a safe way, minimizing risk on both ends.

A list of popular payment gateways for merchants

A wide range of businesses and organizations now use payment gateways, which is why there are so many options to choose from. This list of payment gateways can help you get started, whether you’re building a site for a nonprofit, a new online storefront, or a payment portal for services. While the following is by no means exhaustive, it’s a good start, and it includes some of the leading payment gateways in the world.

1. Authorize.Net

It pays to go with a gateway that’s easy to implement, and merchants value Authorize.net for its easy setup.

Authorize.net offers a comprehensive suite of developer resources, including a detailed API reference collection. Its API sandbox environment lets developers test integrations and run experiments without real-world risks.

Since it went live in 1996, Authorize.net has grown into one of the most recognized names in payment gateways with more than 445,000 sellers.

Best for: Easy implementation

Pros

- Automated Account Updater features keep customer card information up to date.

- Businesses love the comprehensive fraud protection.

- The streamlined transaction process is easy for customers and merchants.

Cons

- The tools may be too complex for small businesses.

- Some advanced features have high fees.

- Customization options are limited.

Pricing

Authorize.net has a monthly gateway fee of $25, plus a processing rate of $0.10 per transaction and a $0.10 daily batch fee.

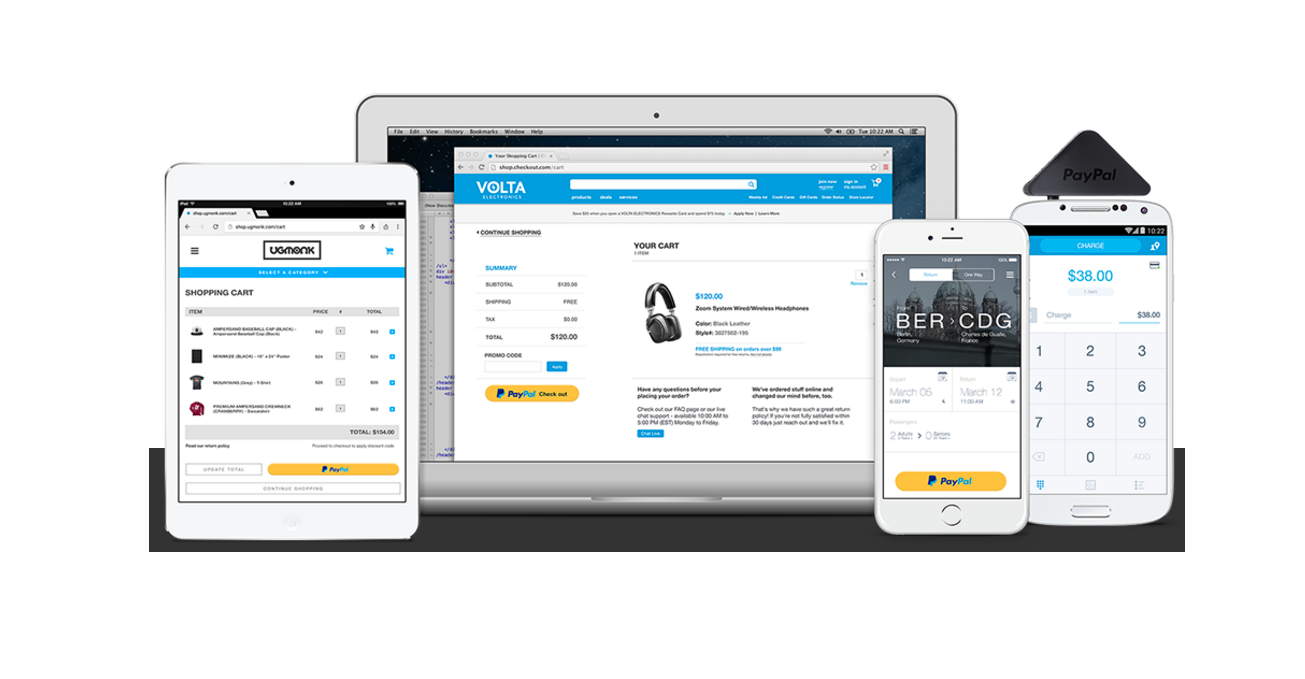

2. PayPal

PayPal is a household name because it’s the only payment gateway that offers both consumer and merchant payment services.

When your checkout process redirects customers to the PayPal website, the familiarity promotes confidence in your checkout experience, boosting conversions. In fact, PayPal claims that online checkout conversions are 44 percent higher with its products compared to competing options with less name recognition.

PayPal is easy to use, and you can set it up in just minutes. Plus, it offers a wide range of easy-to-use business tools to help smaller-volume sellers get off the ground.

Best for: Instilling customer confidence through name recognition

Pros

- It offers a range of e-commerce features like inventory management and abandoned cart savers.

- The Seller’s Protection Program benefits merchants.

- Customers are more likely to trust it as a household name.

Cons

- There’s an extra cost for POS hardware.

- The fee structure is complex and can be difficult to understand.

- Transaction fees are high compared to other options.

Pricing

PayPal provides comprehensive fee structure tables on its website, and fees are based on the type of transaction taking place. For example, the standard rate for processing a domestic (U.S.) commercial transaction is 3.49 percent + a fixed fee.

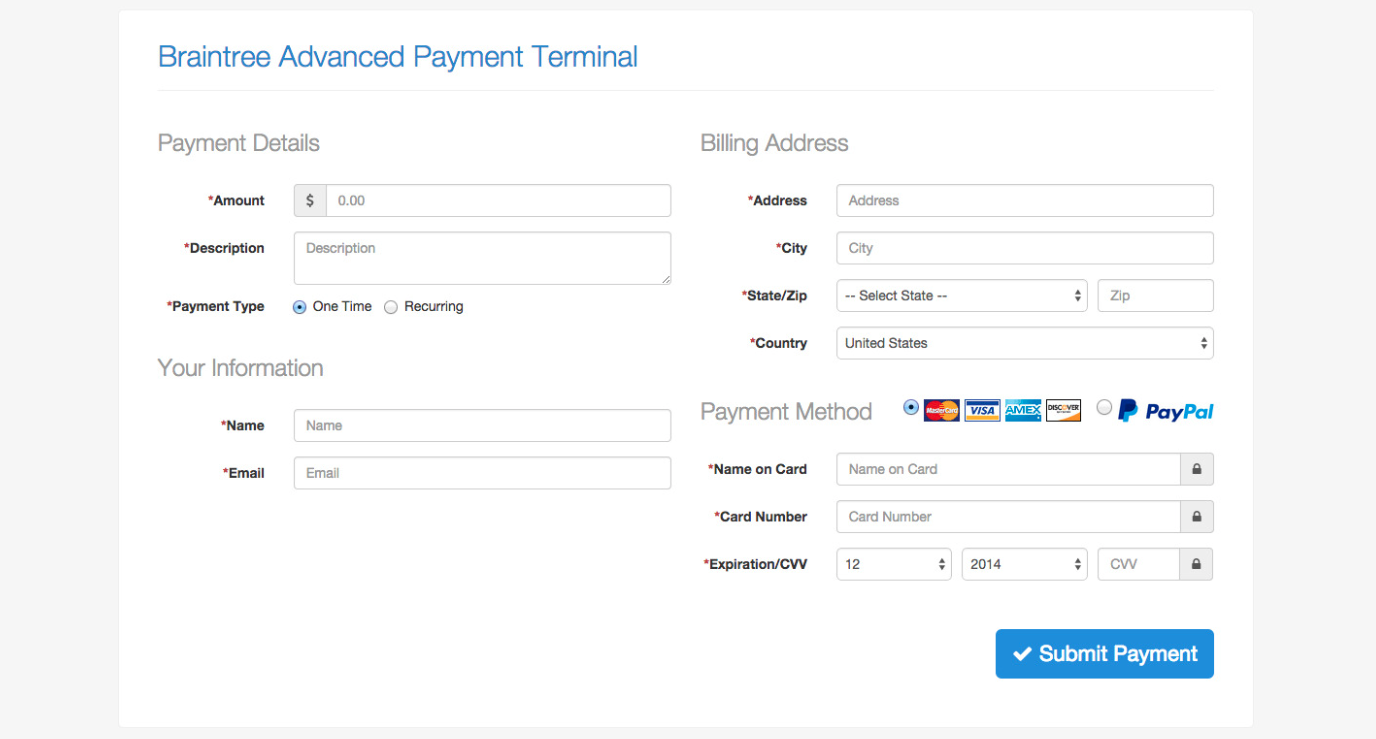

3. Braintree

Braintree is the only payment gateway in the United States that accepts payments through Venmo, along with more common payment methods like PayPal, Google Pay, Apple Pay, and credit/debit cards. This wide-ranging integration is possible due to PayPal’s 2013 acquisition of Braintree and Venmo, which paved the way for greater reach among buyers.

Site visitors follow the same simple process whether they use PayPal, Venmo, or credit/debit cards. According to Braintree, this seamless payment path boosts conversions by removing obstacles on the way to the payment button.

Best for: Accepting a wide range of payment methods

Pros

- It provides access to PayPal’s infrastructure via a seamless integration.

- Advanced features like fraud checks and chargeback management are great for merchants.

- Automated workflows and processes create efficiency.

Cons

- There are limited customer support options.

- Invoicing is only available via a third-party integration.

- It doesn’t offer many business tools.

Pricing

Braintree has a standard pricing structure of 2.59 percent + $0.49 per transaction for cards and digital wallets, and it offers separate pricing for PayPal, Venmo, and ACH direct debit.

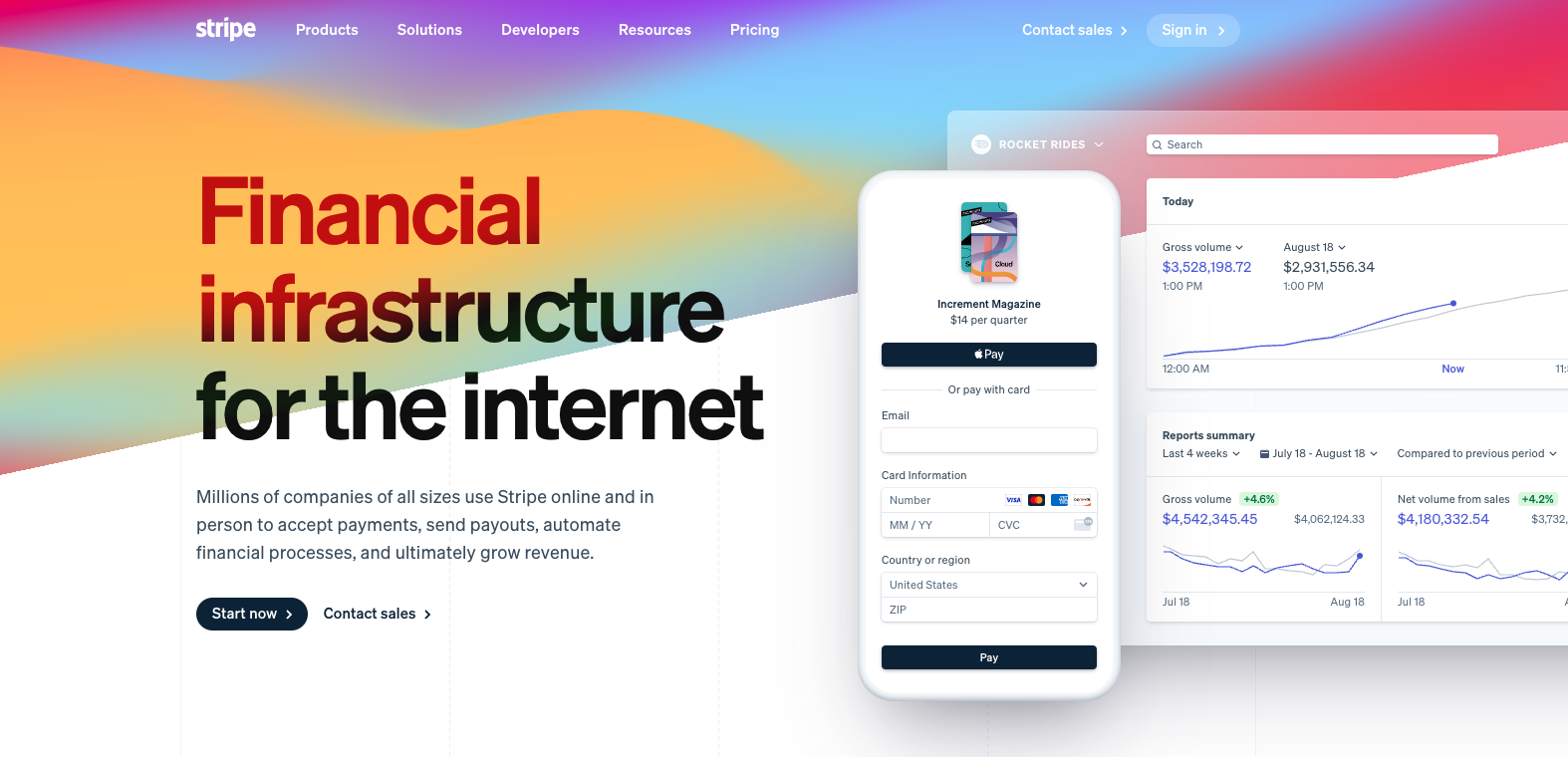

4. Stripe

Stripe is a popular choice among first-time e-commerce sellers because it’s so easy to set up. All users need in order to sign up for a free account is a valid email address. Activating the account requires detailed business information, but even that data is fairly limited:

- Identification details like your business address and EIN

- Business owner’s name and contact information

- Text that identifies you as a seller on your customers’ credit card statements

- Your bank account numbers

- Two-step authentication preferences (Stripe requires some form of multifactor authentication for sellers.)

When your account is activated, you can either sign up for one of Stripe’s partner platforms or follow the prompts to integrate the Stripe API into an existing site, which requires a bit of coding.

Best for: Instant payout

Pros

- Stripe offers an extensive ecosystem of plug-ins and integrations.

- It has advanced reporting tools.

- It offers instant payout options for merchants.

Cons

- It requires some technical expertise to set up.

- Some users find customer support lacking.

- It doesn’t offer many options for in-person transactions.

Pricing

Stripe has a standard fee of 2.9 percent + $0.30. It also offers a custom plan based on volume and business model.

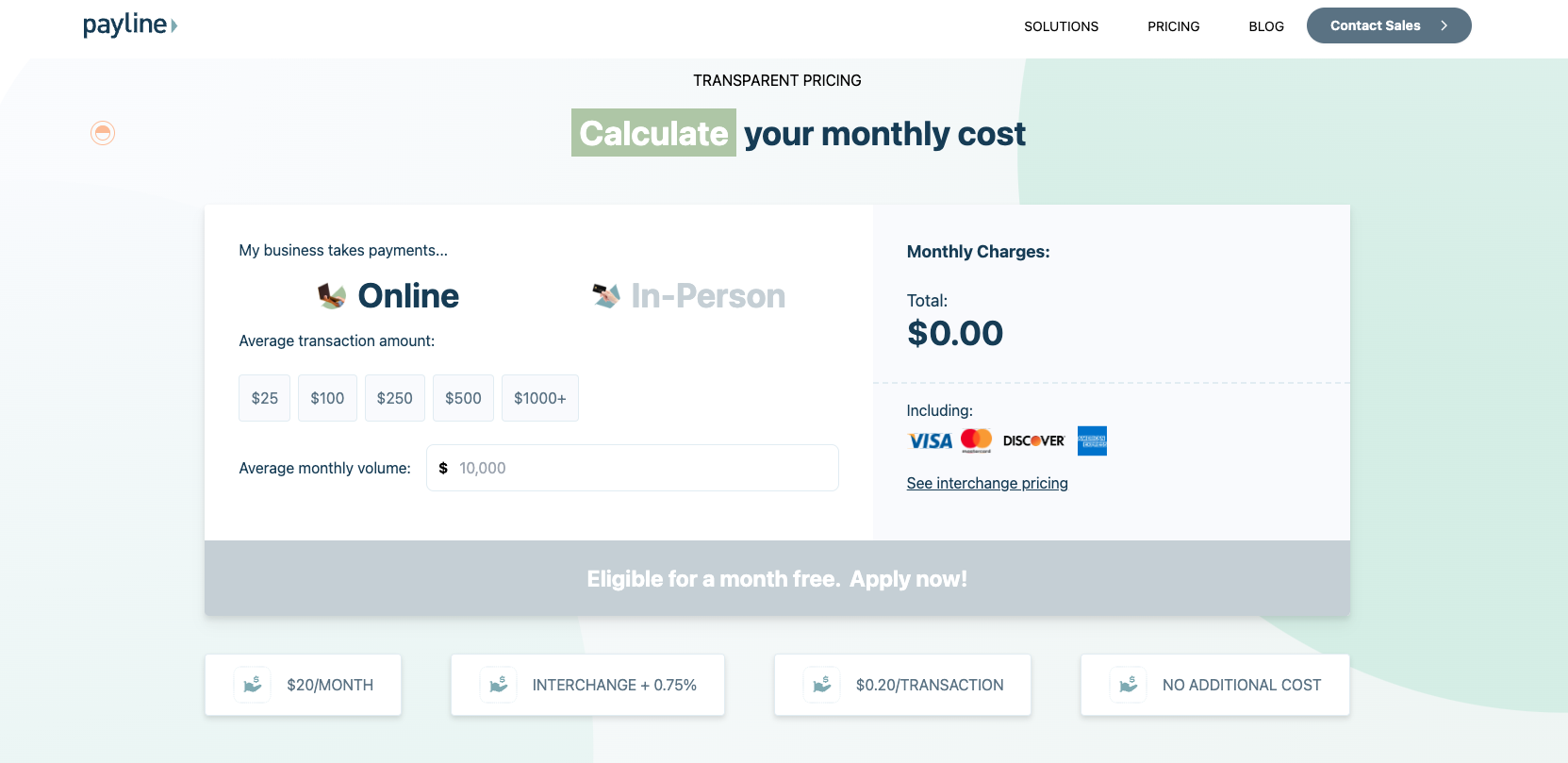

5. Payline

Check out Payline if you’ve been frustrated by a payment gateway passing on hidden card-processing fees. Payline’s main strength is its transparent pricing structure.

Its prices are in line with market standards, but Payline makes it a point not to surprise users with undisclosed fees. The company even provides a free monthly cost calculator so you can estimate what you’ll really pay before signing up.

Best for: Transparent pricing structure

Pros

- It has direct integrations with popular shopping carts and POS systems.

- Next-day funding is available to optimize cash flow.

- The custom reporting functionality provides an in-depth look at the business.

Cons

- It charges monthly fees on top of transaction charges.

- The initial setup can be complicated for new users.

- Large organizations may find some features too simplistic.

Pricing

For in-person sales, Payline charges 0.4 percent plus $0.10 per transaction and $10 per month. For online sales, you’ll pay 0.75 percent plus $0.20 per transaction, and $20 per month.

6. Venmo

Venmo is known as a peer-to-peer money transfer mobile app that allows friends to transfer money to each other. But did you know that businesses can also use it as a payment gateway? It offers a business account that works well for small organizations looking make purchasing easier for their customers.

Venmo has a number of great features for businesses, such as a tipping option you can turn on to increase income for your business and your staff. Plus, the name recognition is great for customers who already use the app with their friends and family.

Best for: Mobile payment processing for small businesses

Pros

- There are no setup fees and no monthly fees.

- It has low transaction fees compared to other options.

- It can accept payments through a custom QR code.

Cons

- It’s only available in the United States.

- It doesn’t offer an option for instant payments.

- It doesn’t come with advanced features for businesses.

Pricing

Venmo has a low seller transaction fee of 1.9 percent + $0.09 and 2.29 percent + $0.09 per tap for Tap to Pay.

7. Skrill

Skrill is a digital wallet that lets customers make money transfers and online payments without sharing their bank details with the seller. It’s also a payment solution for businesses, allowing them to accept a variety of different payment methods for online purchases — including the ability for customers to pay directly from their bank account. It also has a loyalty program, so customers can earn points for each transaction they complete and exchange those points for cash rewards.

Skrill offers high-level chargeback protection and fraud protection, which help reduce payment fraud.

Best for: Fraud protection

Pros

- It has highly competitive processing rates and fees.

- Multilingual customer support benefits businesses around the globe.

- Advanced security measures keep data safe.

Cons

- The exchange rates on large transactions can be high.

- Some of its transaction limitations are too stringent for some businesses and customers.

- It has a limited network of integrations.

Pricing

Contact Skrill for more details on the costs associated with accepting payments as a merchant. Its sales team can provide custom quotes based on your business needs.

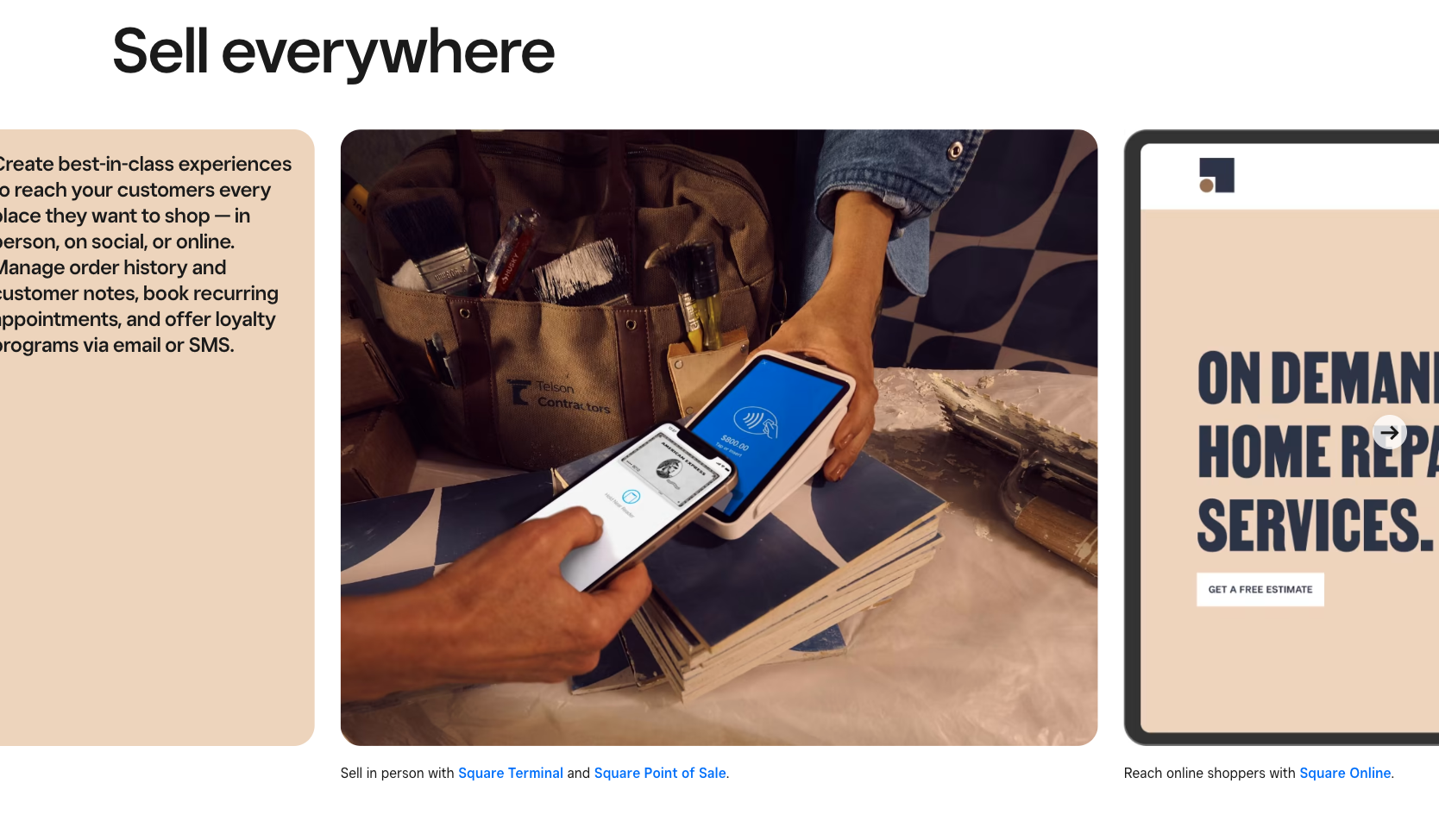

8. Square

Square is a leading payment gateway that supports brick-and-mortar businesses that also conduct online sales. It has a user-friendly point-of-sale system and an intuitive online interface, making purchasing from your business seamless for your customers, no matter how they buy.

Square also addresses other business needs such as booking appointments, building websites, sending invoices, accepting online gift cards, managing loyalty programs for customers, collecting customer feedback, managing teams, and much more.

Best for: Businesses that conduct sales both online and offline

Pros

- It offers a comprehensive feature set that goes well beyond payments.

- The detailed dashboard provides a financial snapshot of your business.

- It has many customization options.

Cons

- Fees are high for businesses with a high volume of transactions.

- It has a long list of prohibited goods and services.

- Additional features like scheduling and loyalty programs come at a cost.

Pricing

Square charges 2.6 percent + $0.10 for every credit card swipe or tap transaction, 3.5 percent + $0.15 per keyed-in transaction, and 2.9 percent + $0.30 per online transaction.

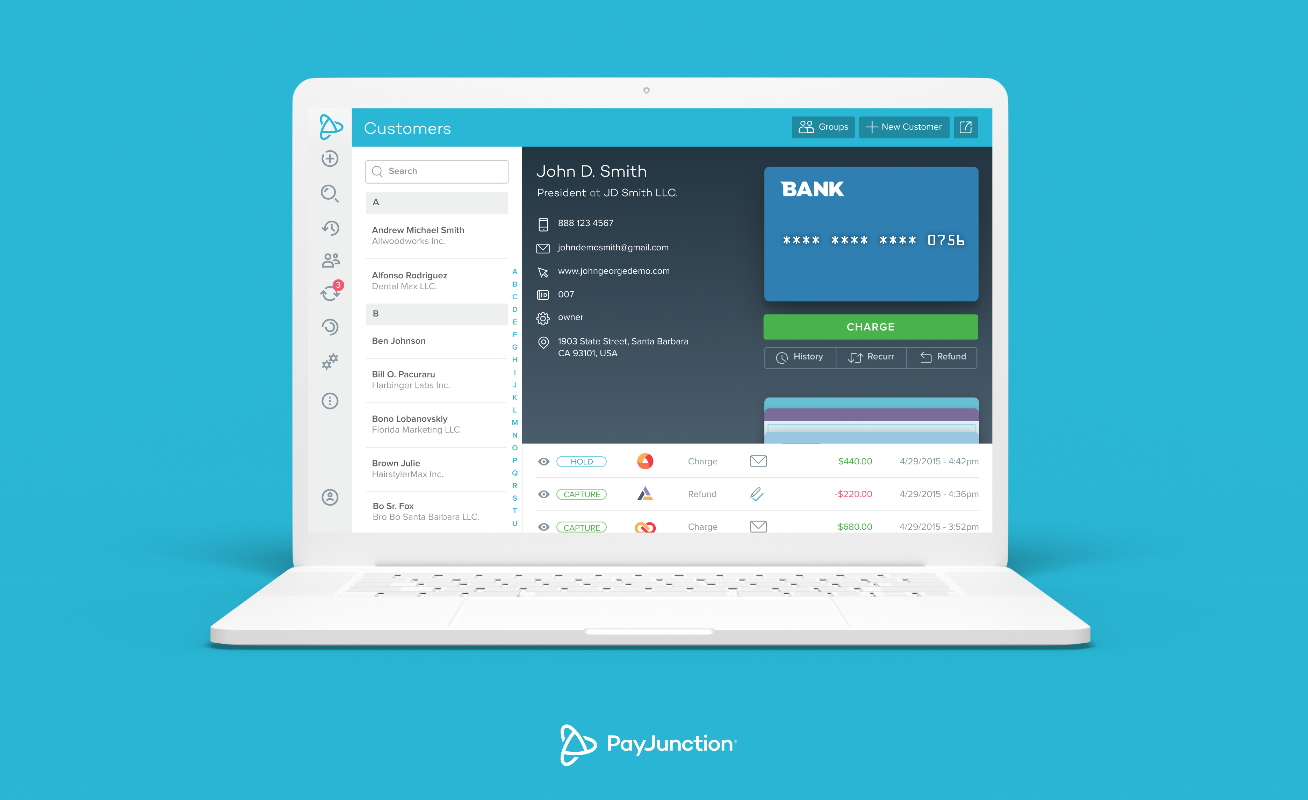

9. PayJunction

PayJunction is a no-code payment processor that’s easy to install into any SaaS application. You can get up and running in minutes with a customer-facing POS terminal and a hosted checkout button on your online store. PayJunction also enables businesses to set up recurring billing for customers who are paying in installments or have purchased an ongoing subscription.

Other standout features include invoicing, quick refunds, mobile app compatibility, and a portable POS terminal.

Best for: Businesses that want to integrate payments into a SaaS application

Pros

- It has a user-friendly interface with great tech support.

- You can email receipts for completed transactions.

- Setup is quick and easy.

Cons

- Some users note that payment processing can be slow.

- Some users report that the system can glitch when syncing.

Pricing

PayJunction’s standard plan charges 1.49 percent + $0.15 for card transactions. There’s also a custom enterprise plan available as well as a Surcharge plan that allows businesses to pass on some credit card fees to their customers.

30-plus payment gateway options with Jotform payment forms

Before you can sell anything online, you’ll need a payment form to collect customer information.

If you’re considering using Jotform to create a robust online store or just simple forms for selling event tickets or collecting donations, there’s good news: Jotform integrates with more than 30 trusted payment gateways, including PayPal, Stripe, Venmo, Braintree, Square, Skrill, and Moneris.

Jotform makes it easy to create payment forms and accept payments, whether it’s for your e-commerce site or an event registration. It offers enterprise-grade security, customizable form templates for forms and tables, electronic signature tools, and more. Plus, Jotform never charges you to receive payments through its online forms, so you only pay the standard fee of your chosen payment processor.

With Jotform, you have everything you need to accept payments online securely and seamlessly.

You can find a full list of payment gateway integrations available through Jotform here.

Send Comment: