Figuring out the best way to collect payments is critical to your business. Your customers should be able to pay quickly and without glitches. Choosing the right payment service for your business is key to ensuring a smooth customer experience.

Stripe and Square are two of the most popular payment gateways that provide payment services for a variety of business types and sizes. If you’re in the market for a payment solution, understanding what each service provider offers and how it can benefit your business is important.

In this article, we’ll compare Stripe and Square based on their products, features, and services, and determine the best use cases for each platform. Let’s start with an overview of both.

Stripe vs Square overview

Stripe and Square are third-party processing services, also called third-party aggregators. They make it easy to receive payments without creating a traditional merchant account, which requires extensive documentation and vetting. Simply sign up for Stripe or Square. If you meet all the requirements, your business could be approved almost instantly.

Founded in 2010 by two Irish brothers, Patrick and John Collison, Stripe has become one of the most popular payment gateways. Stripe handles payments for companies of all sizes, from small startups to large enterprises like Google and Lyft.

Jack Dorsey, CEO of Twitter, and Jim McKelvy launched Square in 2009 as a mobile payment platform. Square focuses on providing small businesses with the hardware and online platform needed to collect payments, both online and in person. Square’s hardware is highly tailored to the industries it serves — retail, restaurants, and service businesses.

Major similarities between Stripe and Square

As payment gateways, Stripe and Square are similar in a lot of ways. They both

- Offer payment services and cover a wide range of industries

- Serve similar businesses, from brick-and-mortar stores to online stores and e-commerce websites

- Offer similar pricing

- Make signing up easy and straightforward

Major differences between Stripe and Square

Although they share a lot of similarities, they are also remarkably different in certain ways. Francisco Hernandez, director of risk and underwriting at Redde Payments, says the main difference lies in the original focus of these payment gateways.

“Square has always been a brick-and-mortar service provider,” Hernandez says. “It was originally known as the mobile swiper. Back in its early stages, it offered a square device connected to a smartphone via the audio jack.”

Hernandez explains that over time, Square has developed more sophisticated hardware for storefronts, including point-of-sale systems that meet specific needs for restaurants and retail locations. The hardware is configured to these business types.

Stripe, on the other hand, describes itself as “the backbone for internet businesses” and “payments infrastructure for the internet.” But according to Hernandez, “while Stripe offers a point-of-sale service, it is not as robust as Square’s line of terminals.” Stripe’s services are tailored to internet-native businesses looking to expand internationally.

Stripe’s focus on internet businesses also explains its developer-friendly capabilities. Stripe allows developers to customize the checkout experience in ways that may not be possible with Square.

Square vs Stripe comparison table

| Feature | Stripe | Square |

|---|---|---|

| Online transaction fees | 2.9% + 30¢ | 2.9% + 30¢ |

| In-person transaction fees | 2.7% + 5¢ | 2.6% + 10¢ |

| Point-of-sale hardware price | $0 to $1700 (depending on hardware) | Free – $799 depending on item |

| Countries supported | 46 | 6 |

| Multi-currency support | Yes, 135+ currencies | Works with most credit cards |

| Security | PCI-compliant | PCI-compliant |

| Integrations | 600+ (including Jotform) | 600+ (including Jotform) |

| Customer support | 24-7 phone, live chat, and email | Phone, live chat, and email |

Stripe vs Square: Major features

Now that we have a background on both payment gateways, let’s compare their features and services in more detail.

Stripe vs Square

1. Products and services

Stripe

Stripe offers more than 10 distinct products, grouped into payments, financial services, and business operations. Below are some of the important ones.

- Stripe Payments, easily Stripe’s most popular product, allows businesses to receive online payments. Stripe Payments supports e-commerce stores, subscription businesses, platforms, and marketplaces. The payment options available include credit cards, mobile wallets, bank debits, and card-based vouchers. Stripe supports multiple currencies and allows extended customization of the checkout process.

- Stripe Terminal is tailored for in-person payments. With Stripe Terminal, your business can build a customized in-person checkout that’s supported by Stripe’s pre-certified card readers.

- Stripe Atlas helps businesses outside of Stripe’s supported markets incorporate their startups in the U.S. The service lets businesses skip the lengthy paperwork and complex setup process for a one-time setup fee of $500.

- Stripe Billing focuses on subscriptions and invoicing, and is used by companies like Slack, Udacity, and Notion. It supports several billing models and payment types, including ACH.

Square

Square’s products can best be described as omnichannel. In addition to payments and point-of-sale hardware, Square also offers customer-focused products, such as Square Marketing, Messages, Loyalty, and Gift Cards.

These products are integrated into Square payment and hardware services, meaning your business can offer loyalty programs, and send marketing messages and gift cards to customers without leaving the Square ecosystem. Square’s product lineup also includes payroll services, time cards, and employee services, all of which can be managed from Square’s point-of-sale system.

Another standout feature of Square is its website design functionality. Square acquired the website builder Weebly in 2018 and integrated it into the Square platform. This means you can set up your e-commerce store and enable payments in a few clicks.

Overall, Square categorizes its solutions under the categories of payments, point-of-sale, hardware, and other business tools.

Square Point of Sale may be regarded as its flagship product, but Square has completely customized the solution to fit specific business niches, including

- Square for Restaurants

- Square for Retail

- Square Appointments

Each product is tailored to meet specific industry needs and includes Square’s entire product lineup. Square for Restaurants, for example, is described as an all-in-one restaurant POS system and includes online ordering, order management, a kitchen display system, and payments. Restaurant owners can also manage payroll and run loyalty programs within the Square for Restaurants system.

2. Transaction fees

Stripe

When it comes to its primary product (Payments), Stripe’s pricing is clear and straightforward. Stripe charges 2.9 percent + 30¢ per successful transaction. For in-person payments through Terminal, the fee is lower (2.7% + 5¢).

Stripe charges an additional 1.5 percent for international cards. If currency conversion is required, another 1 percent is charged.

Stripe’s hardware includes Stripe Reader M2 and Stripe Reader S700 pre-certified card readers, priced at $59 and $349, respectively. Other Stripe products have their own pricing models:

- Billing: 0.5 percent

- Atlas: one-time payment of $500 + the ongoing costs of running a company

Square

Square’s transaction fees are more variable. They differ based on whether you’re accepting in-person payments or card-not-present payments. However, Square charges the same as Stripe for online payment processing: 2.9 percent + 30¢ per swipe, dip, or tap.

When credit card information is entered manually in the Square point-of-sale app, (i.e., card-not-present transactions) Square charges are higher, at 3.5 percent + 15¢. For in-person payments, Square is slightly cheaper at 2.6 percent + 10¢.

Square offers five types of hardware, each with different pricing:

- Reader for magstripe (free)

- Reader for contactless and chip (2nd generation) ($59)

- Stand ($149 or $14/month for 12 months)

- Terminal ($299 or $27/month for 12 months)

- Register ($799 or $39/month for 24 months)

Square also offers three payment plans with its Square Online solution, which allows businesses to create an online store that’s powered by Square’s website builder. The payment plans are

- Free (no monthly fees and 2.9 percent + 30¢)

- Plus ($29/month billed annually and 2.9 percent + 30¢)

- Premium ($79/month billed annually and 2.6 percent + 30¢)

Each succeeding tier unlocks additional features, such as a custom domain and removal of Square branding (professional plan) or customer reviews and abandoned cart emails (performance plan).

3. Supported countries

Stripe

At the time of writing, Stripe is available in 46 countries, some in beta. See the full list here.

Businesses in countries that aren’t covered by Stripe can still activate Stripe payments when they incorporate a U.S. company using Stripe Atlas.

Stripe offers multi-currency support and processes payments in 135+ currencies. You can charge customers in their local currency and receive the funds in your currency.

Square

Square’s card payment service is currently available in only eight countries: the United States, Canada, Japan, Australia, the United Kingdom, Republic of Ireland, France and Spain. Certain payment methods may also not be available in some countries. See the full options here.

Square doesn’t support multi-currency payments. If you intend to receive payments from customers in multiple currencies, this is an important limitation to consider.

4. Account setup

Requirements for creating a Stripe account

The information Stripe requests depends on your type of business. For example, if you run a partnership, you’ll provide information about beneficial owners. In general, however, you need to provide the following details to set up Stripe in any of the countries it supports:

- Tax ID

- Physical location at which you can receive mail (cannot be a P.O. box)

- Phone number

- Government-issued ID, such as a passport or driver’s license

- Website URL (must be working/active) that shows what your business sells or what services you provide

- Physical bank account (cannot be a virtual bank account)

Requirements for creating a Square account

The account requirements are similar for Square but a bit more restrictive. You’ll need to provide the following details before you can create a Square account:

- Full legal name

- Social Security number (SSN)

- U.S.-based bank account

- Date of birth

- U.S. home mailing address

Both Stripe and Square investigate accounts on an ongoing basis; your account could be terminated if your business is found wanting.

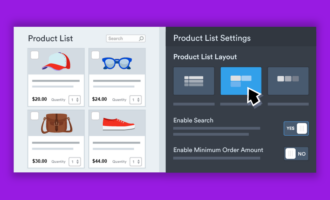

5. Ease of use

On Capterra, both Stripe and Square Payments have an overall rating of 4.7 out of 5 stars. However, Square is rated easier to use at 4.7, while Stripe is rated 4.5.

Stripe

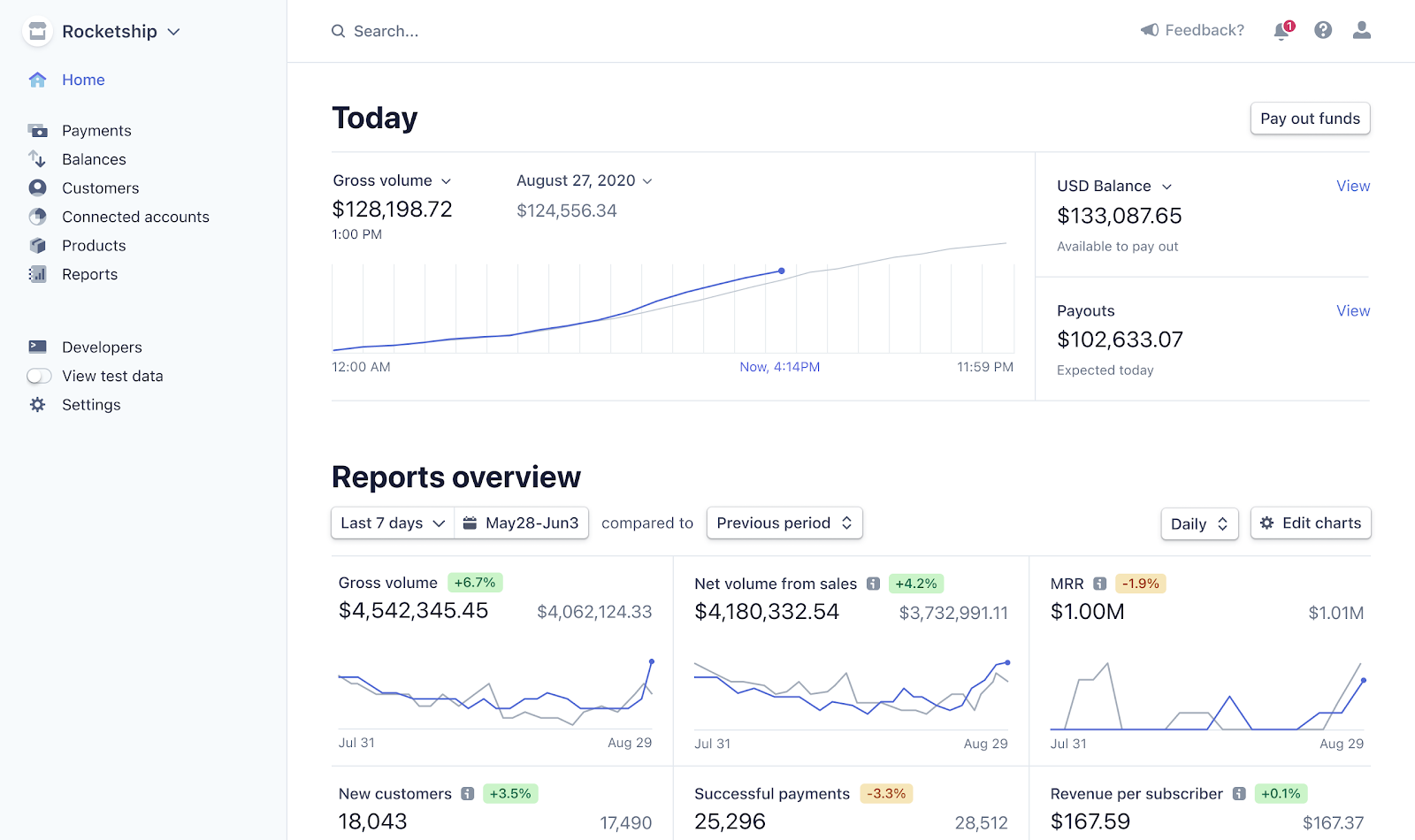

Stripe offers a clean dashboard that’s easy to use and master. At a glance, you can view payments, balances, customers, products, and reports.

However, integrating Stripe with your website and other business software can be a bit tricky. While there are Stripe plug-ins for the most popular e-commerce platforms, such as WooCommerce, it’s best to use the services of a developer if you need to customize your checkout process.

Square

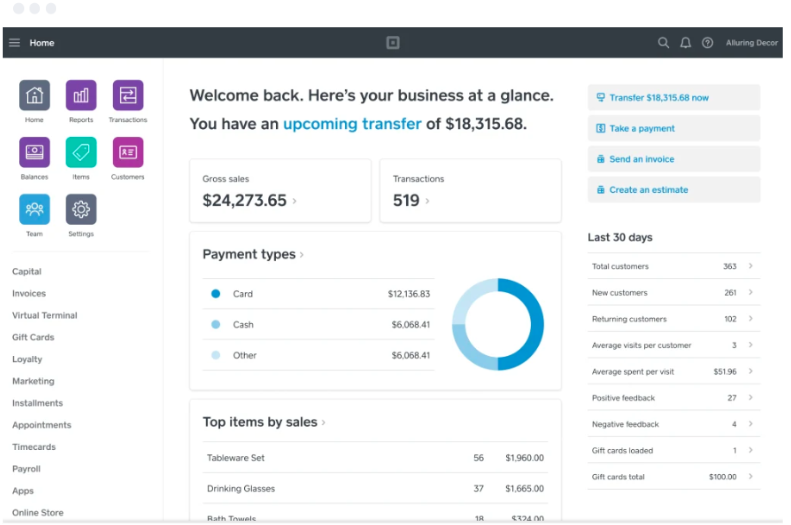

Square’s dashboard is also extremely easy to master. You can customize it to your preference. Major Square tools, such as reports, balances, and transactions, are accessible via app icons in the top left corner of the dashboard.

Integrating Square with websites and apps is straightforward because Square provides several official plug-ins to make it faster. Overall, you don’t need a developer to enable Square payments on your website or online store.

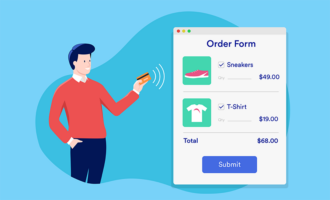

6. Checkout experience

The checkout process is an important consideration when choosing a payment gateway. A study by Baymard Institute found that 18 percent of U.S. online shoppers have abandoned an order in the past solely because the checkout process was too long or complicated. Therefore, ensuring that your payment gateway provides a seamless checkout for customers is important.

Stripe

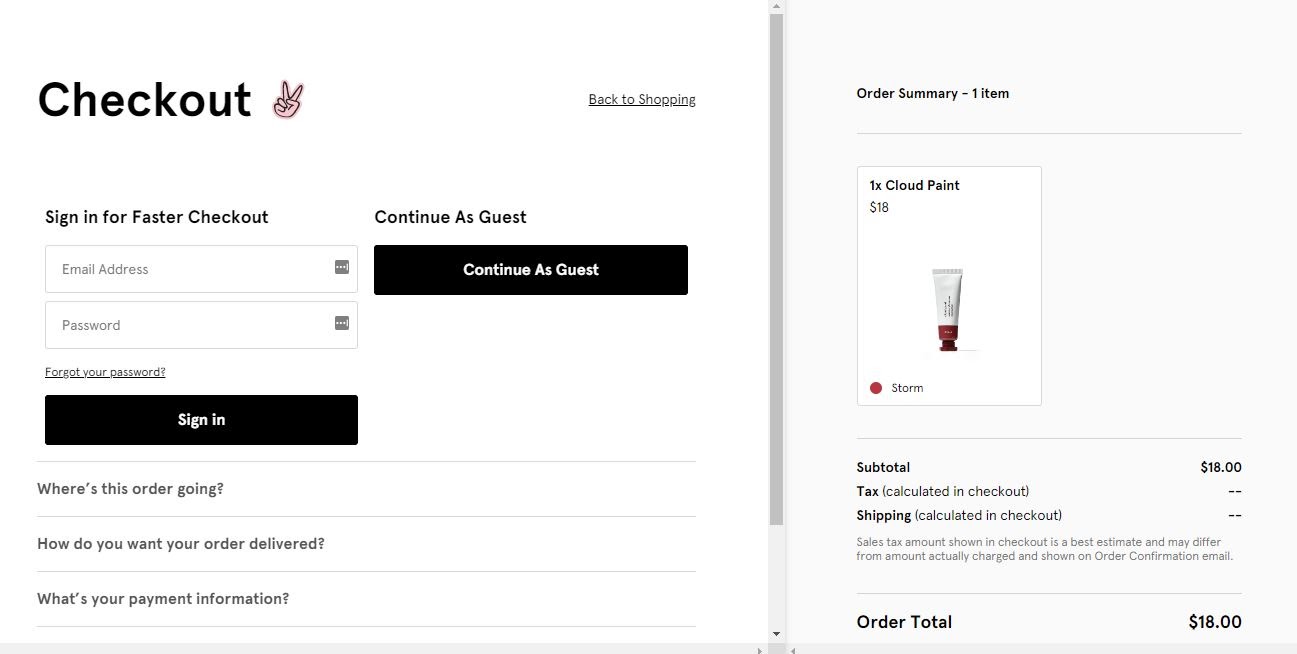

Stripe takes a minimalistic approach to checkout and allows for full customization of the process with its developer-friendly features. As seen in the screenshot below, Glossier, a Stripe customer, has tailored the checkout process to suit its brand, including options for guest checkout and replacing traditional fields with more engaging questions.

Square

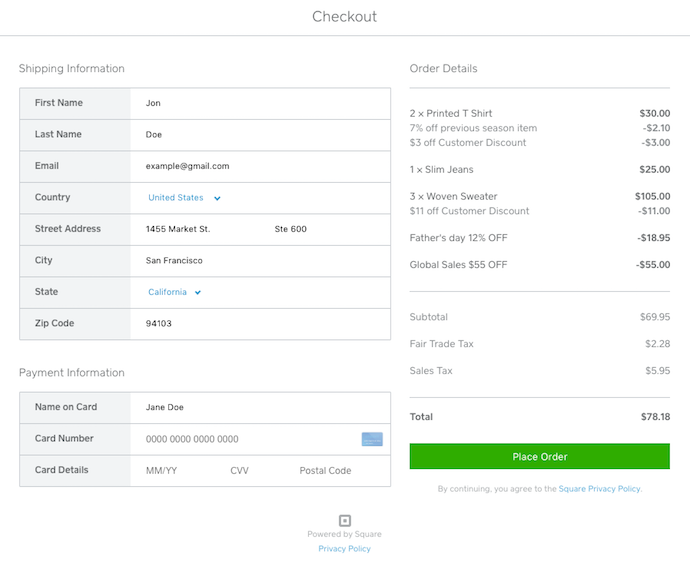

Square also has a minimalist checkout but offers fewer customization options compared to Stripe.

7. Receiving payouts

The whole point of using a payment gateway is to get the money into your bank account easily. The process should be as stress-free as possible.

Stripe

Stripe has no limitations on withdrawals, but only offers payouts within a minimum of two business days for customers in the U.S. and Australia, and up to 30 business days for businesses in Brazil.

So if your business is located in the U.S., and a customer makes payment on Monday, the funds will be available to you on Wednesday. For Brazilian businesses, the funds become available 30 days later.

Square

Similar to Stripe, Square has no payout or transfer limits. Square offers standard next-business-day transfers. Payments generally become available within 36 hours or one to two business days.

According to its official docs, Square “won’t hold funds based on the amount, frequency, or type of transaction.” However, in June 2020, Square withheld up to 30 percent of payments made to some merchants, according to the New York Times.

While this might be an isolated case, it could be taken as a precedent for how Square could handle payouts during a crisis such as a pandemic.

8. Prohibited businesses

Payment gateways take extreme care with the type of businesses they accept, to limit chargebacks and reduce risks as much as possible. Both Stripe and Square have a list of prohibited and high-risk businesses.

Businesses prohibited on both platforms include those in the following categories:

- Credit services

- Multilevel marketing

- Betting and gambling

- Firearms

- Adult-oriented services

Neither Stripe nor Square will work with any of these businesses. If you’re considering either platform, be sure to read their policy pages.

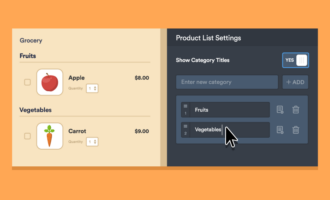

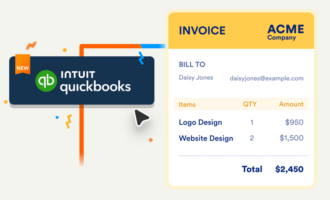

9. Integrations

The ability to connect your payment platform to existing business software is an important consideration. Both Stripe and Square integrate with several third-party services, including JotForm.

Stripe

Stripe integrates with more than 600 third-party apps and services, such as WooCommerce, Freshbooks (accounting), HubSpot, Google Drive, and Slack.

Stripe also integrates with Jotform, so you can easily create visually appealing payment forms at no additional cost. Here’s a step-by-step guide to help you integrate Stripe with Jotform.

Square

Although Square has fewer integrations than Stripe, it still integrates with more than 600 applications. The most popular integrations include Wix, WooCommerce, Xero, Zoho Books, and Mailchimp.

Like Stripe, you can integrate Square with Jotform at no extra cost using this step-by-step guide. Also, you can receive 100 payments for free every month.

10. Security and fraud detection

Security is a critical part of online payment processing. Customers should feel safe while shopping on your website and providing their payment information. Both Stripe and Square take security and fraud detection very seriously.

Stripe security measures

Stripe is PCI-compliant, processes all payments through secure connections, and encrypts all card data. Also, new businesses signing up with Stripe are thoroughly vetted to ensure they adhere to business practices.

Square security measures

Similar to Stripe, Square is also PCI-compliant and takes industry-standard security measures to protect merchants and their customers.

11. Customer support

Will you get help when you need it with Stripe or Square? Customer support can be a deal-breaker for many businesses, and it’s important to consider the available support options on either platform.

Stripe

Stripe expressly states that all customers get 24-7 phone, chat, and email support as part of their plan. The company also has a comprehensive knowledge base, and Stripe’s popularity means you would be hard-pressed to encounter a problem whose solution isn’t already documented online.

Customers who need more dedicated help can purchase premium support, you can contact with sales to find about pricing.

Square

Square’s support channels are harder to find on its website. However, Square also has a comprehensive knowledge base and vibrant seller community. You can get support via phone, email, live chat, and social media. Phone support is available Monday through Friday, 6 a.m. to 6 p.m. (PT).

Summing it up: Major considerations before choosing Stripe or Square

Below is a summary of the main factors to consider before deciding between Stripe and Square.

- Type of business. If you mostly receive payments in person, like in a restaurant, Square is a better option because its payment system is built to serve physical businesses that need customer-facing screens. Stripe, on the other hand, is better suited for businesses that process mostly online payments.

- Size of business. Stripe is built for businesses that handle a large volume of online transactions across the globe. Square is more tailored to small brick-and-mortar businesses that need an online payment solution.

- Business location. Stripe is supported in 46 countries, give or take, and Square in only eight countries. If your business is outside of these locations, then you might need to consider other payment gateways. For example, PayPal is a great Stripe alternative and supports more countries. You can see this comparison between PayPal and Stripe for more details.

- Currency support. If you need to receive payments in multiple currencies, Stripe is the gateway for you. Square doesn’t currently offer multi-currency support and has more limitations on credit cards.

- Customization needs. Stripe offers more flexibility than Square when it comes to customizing the checkout and payment experience. If you need more control over these processes, Stripe is a better choice.

Both businesses, however, won’t support certain high-risk businesses, so be sure to check out the list of prohibited businesses before creating an account.

Meaghan Brophy, retail expert at Fit Small Business says it’s also important to consider business growth goals before making a decision. “Businesses could grow out of Square, but Stripe is used by some of the biggest online sellers, so it’s built for scale,” Brophy explains.

Keep in mind that you may need to hire a developer to make those customizations possible with Stripe. Square, on the other hand, is more plug and play and is best suited for small-scale businesses that want an out-of-the-box solution.

Stripe vs Square: Which payment gateway should you use?

In the end, the choice of payment solution boils down to your business needs. If you’re a small business owner who wants to receive payments seamlessly both in your physical store and online, Square is right up your alley.

Stripe is the developer’s favorite and is suitable for larger or rapidly growing businesses that need to process payments mostly online, are interested in international markets, and have more complex needs. Of course, that’s not to say that Stripe can’t be used by a solopreneur or very small business, but it may be overkill if you just need a simple payment solution.

Whichever payment platform you prefer, be sure to check availability in your location and make sure your business type is supported. And whatever your preferred payment platform, remember that Jotform’s tight integration makes it even easier to build a successful business and collect payments.

Send Comment: