The terms “ACH” and “e-check” are often used interchangeably. This can confuse e-commerce beginners, causing uncertainty about crucial site-building decisions like which payment gateway to use.

Is there a difference between the two terms? If so, and the choice boils down to e-checks vs ACH payments, which option gives merchants access to the broadest possible customer base?

E-checks and ACH aren’t synonymous, but they are related. Here’s a quick primer on e-checks, ACH, and how the two interact to move funds safely from one bank account to another.

Pro Tip

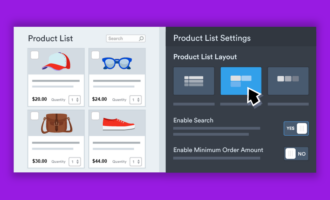

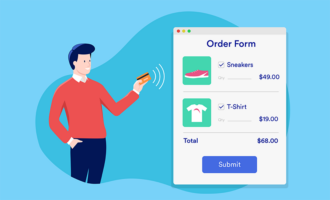

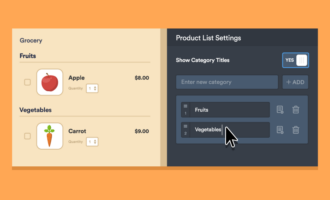

Jotform offers 30+ payment processors, giving you more ways to get paid online — including by e-check or ACH. Sign up for a free account to start collecting payments instantly.

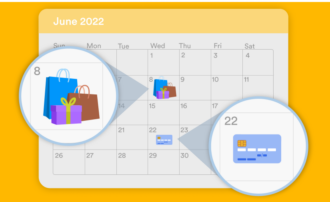

The difference between ACH and e-checks

Geometry teachers will point out that while all squares are rectangles, not all rectangles are squares. E-checks and ACH payments have a similar relationship.

An e-check is a type of ACH payment — but not the only type. So while all e-checks are ACH payments, not all ACH payments are e-checks. At this point, a few definitions are in order.

- ACH stands for the Automated Clearing House, an electronic payment network that dates back to the early 1970s. The ACH Network transfers funds from one bank account to another through a centralized system. Read our blog post to learn more about how payments move through the ACH Network.

- E-checks are the digital equivalents of traditional paper checks (the “e-” is short for “electronic”). Like their paper counterparts, e-checks enable the transfer of funds directly from a payer’s checking account to the receiver’s bank account. The key financial identifiers supplied by checks, both online and off, are the amount of the payment, the bank routing number, and the account holder’s bank account number. You can find out more about e-checks and how they work on our blog.

- EFT stands for “electronic funds transfer.” We include this definition here because an e-check is one type of EFT. The term “EFT” includes any request to credit or debit a consumer’s bank account originating from a telecommunications platform, whether that’s the internet, an ATM machine, or even a phone call. Using the same square/rectangle relationship, all online payments are EFTs, but not all EFTs are online payments.

Now that we have our definitions in place, the relationship between e-checks and the ACH Network is a bit clearer: An e-check is a type of EFT that is processed through the ACH Network.

The ACH Network processes many other types of EFTs in addition to e-checks. More than 90 percent of American workers receive their pay through direct deposit, a program that runs on the ACH Network. Recurring bill payment systems, like those used by utility companies and subscription services, run on a program called Direct Payment via ACH. Even U.S. Social Security benefits are paid through ACH.

How e-checks and ACH payments benefit online businesses and nonprofits

Both e-checks and ACH payments have a few advantages over other online payment methods. The ACH Network generally charges lower fees than credit card networks, leading to savings for merchants.

Businesses that rely on recurring payments can benefit from ACH payments. Checking accounts tend to be more stable than credit card numbers, reducing payment breakage for subscription services.

In the business-to-business world, payments often exceed credit card limits. With an ACH payment, charge limits aren’t an obstacle.

Because ACH transactions (including e-checks) are processed in large batches, they are much more affordable than wire transfers, which are processed one at a time.

By now, the answers to our opening questions should be clear. Is there a difference between e-checks and ACH? In short, yes, although given that e-checks use the ACH Network for processing, the terms are bound to get tangled up.

And if you face the decision about whether to accept e-checks vs ACH payments, take both. Any payment gateway that allows you to accept e-checks provides the key ACH benefits of lower processing fees and more choices for customers and patrons.

Send Comment:

2 Comments:

More than a year ago

How would an eCheck and an ACH redeem Cash to me in the island ?, and are they at high risk of being bounce ?.

More than a year ago

Know more about the difference between ach and echecks