If you’re looking to grow your business and build your customer base, you might be tempted to reach out to an international audience. Selling overseas means you can reach even more potential customers, and when done well, it can be a real boost to your business.

But selling overseas isn’t without its complications and challenges. In addition to the logistics of shipping and communication, you need to figure out how to accept international payments. From understanding exchange rates to providing secure payment options, you’ll need to make sure you can address all of the essential details before expanding your business to an international market.

What to consider before selling overseas

Expanding your business and selling products or services overseas may seem overwhelming at first, but it’s a hurdle that many businesses have successfully cleared.

Still, before you take on this task, it’s important to understand everything involved and to decide if it’s the right move for your business. You’ll be investing significant time and some financial resources into this decision, so consider the benefits that it will offer your company.

Below are a few of the most significant considerations that should factor into your decision and planning.

Determine your market and the demand

You may know exactly who your target customers are here in the United States, but when you take your business international, that target market may change. Cultures, values, and shopping habits that vary from country to country demand some market research on your part.

Your competition will also change when you take your business overseas. As you identify your target market, focus on whether there’s demand for your products or services. If there is demand, look for your competitors.

If you sell physical goods, you’ll probably be competing against local sellers. You’ll need to have a product that offers enough value for buyers to bypass similar products available from local sellers and purchase it from you. That can be challenging.

Think about your product’s unique sales proposition as well. This may be different for an international audience, and it may need to be stronger. If you’re marketing to an audience with different values and pain points, how you market your product may need to change to remain effective.

Learn about shipping and tax requirements

Shipping options vary depending on the country you’re shipping to. Carefully research available shipping options, rates, and restrictions. As you conduct this research, don’t forget to account for exchange rates — they’ll help you get an accurate idea of what your actual shipping costs would be.

Customers don’t like to pay high shipping costs, so consider wrapping some of those expenses into your product costs, if possible. Duties and taxes vary from country to country, and it’s essential to understand these requirements and build them into your costs.

If customers order products and are then surprised by additional taxes that they have to pay to receive them, they may not buy from you again. In fact, underestimating duties and taxes can eat into profits and make it impractical to sell your products at certain rates.

Customs are another concern when shipping products internationally. Familiarize yourself with customs forms and ensure that they’re accurate and affixed to any package you ship internationally.

To understand these elements, you’ll need to research the requirements specific to any country you’re looking at expanding into.

Consider making a spreadsheet of these requirements, including tax rates and any other additional fees you’ll need to account for. Being able to compare all of this information at a glance can help you decide which countries are best to focus on first — and which, if any, you should avoid for now.

Consider your return policy

Accepting international returns is much more complicated than handling domestic returns. Think carefully about your return policy, and remember that your policy will need to comply with local laws.

As you develop your return policy, outline key information, like restocking fees and what condition items need to be in for you to accept them. You may want to highlight the fact that international shipping takes longer than domestic shipping, so customers will need to wait longer for their returns to be processed.

Invest in translation

If you’ll be selling to countries where the majority of the population speaks a language other than English, you may want to make your site available in multiple languages. While automated translation programs are a start, they rarely read naturally and can confuse some key information that might make it difficult for buyers to purchase confidently from your store.

It’s often worth the cost to pay for a professional translation. Your site content and product descriptions will read better and be more accurate, and that can build trust with your potential customers. When you invest into a quality site translation, it could convert to increased sales and buyer satisfaction.

Make your website compliant

You may need to make sure your site complies with certain regulations as well. For example, the U.K. has strict General Data Protection Regulation (GDPR) requirements that protect people’s personal data, including names, usernames, IP addresses, and cookie identifiers.

Businesses that don’t comply with the GDPR requirements can incur fines. Even if you’re a United States-based business, if you’re targeting customers in the U.K., your site will need to be GDPR compliant.

Prepare your business analytics

When you make a big change to your business, like taking it international, you need to be prepared to measure the effects of that change. If you haven’t done so already, now’s the time to implement quality website analytics.

Establish your website analytics well before you expand into a new market so you’ll have base numbers that reflect your current traffic and sales. You can then compare that information to the new data from your expansion.

Be sure that the analytics you’re capturing don’t cover only your sales and return rates, but also where your site traffic comes from and how effective your social media marketing is. The more details you have about who’s visiting your site and where they come from, the better you’ll be able to track the effects of your expansion.

If you haven’t yet done anything with your site analytics, consider hiring a professional to help you better gather and understand them, and then implement what you learn from them.

This can be particularly helpful as you start to market to new audiences. You may find that your target audience in foreign countries isn’t on the same social media platforms as your domestic audience. Be prepared to try new things with your marketing.

Consider fulfillment centers

Depending on your business and your products, it might make more financial sense to partner with a fulfillment center than it would be to continuously ship products overseas.

Fulfillment centers have the advantage of being local to your international audience, which allows them to ship quickly and reduce shipping times. This is particularly valuable for audiences who want or need their products quickly, and it may make your business the preferred brand over other competitors with longer shipping times.

Using a fulfillment center also takes some of the workload off of your shoulders if you’ve been handling all of the shipping yourself. The fulfillment center’s responsiveness and performance will reflect directly on your business, though, so do your research and look for a fulfillment center that you can trust.

It’s a good idea to read plenty of reviews and ask lots of questions so you know just what to expect when working with the center. And, as always, read any contracts carefully.

Decide how to accept international payments

Accepting payments from a foreign country requires additional processes. While some payment gateways, like PayPal, can also accept international payments, it’s important to choose the payment option that works best for you. Factors like conversion fees, processing fees, and even processing times are all important considerations as you explore how to best accept international payments.

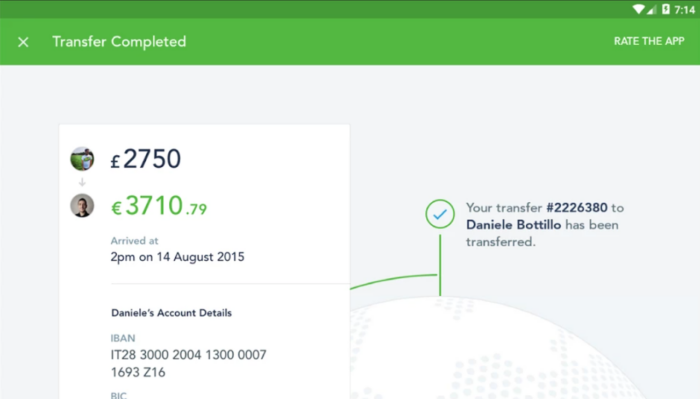

Wise

Wise, formerly TransferWise, is a multicurrency account that functions like an online bank account. Wise lets you receive international payments without having to set up a bank account in each country, which saves you time and headaches.

Wise doesn’t have any setup fees or monthly charges, and it processes payments quickly. Wise offers competitive foreign currency exchange rates, and you can receive payments in different currencies, making it easy for customers or clients to pay you, no matter where they are. Wise also offers a debit card in certain countries, including the U.K. and Australia.

With a Wise business account, you can make payments in more than 70 countries. You’ll receive all of the international banking necessities, including a short code, routing number, and IBAN.

Wise supports more than 55 currencies, and, if you have an international supplier, you can make international payments without foreign transaction fees. It’s a simplified way to make secure international transactions.

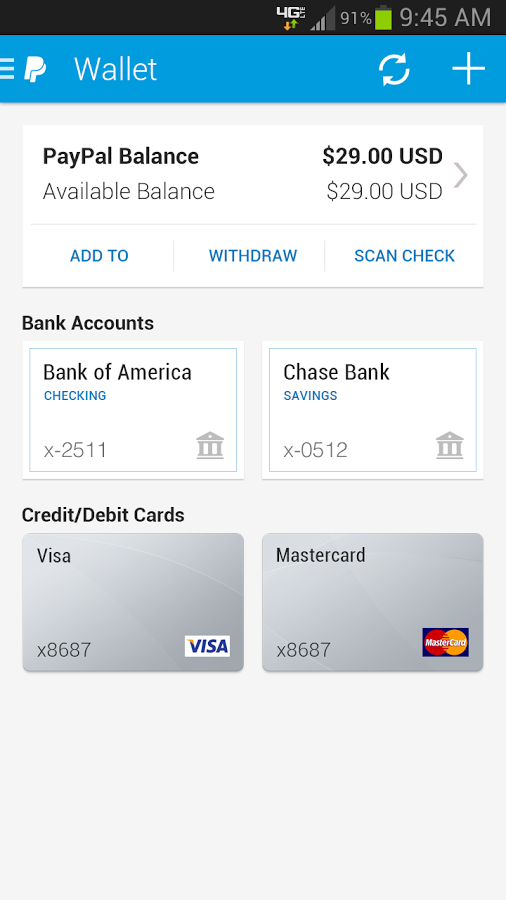

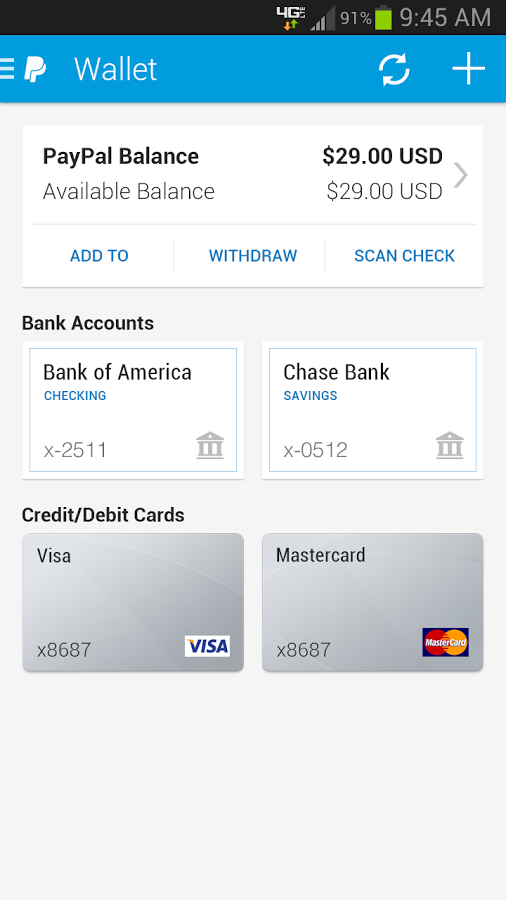

PayPal

PayPal is one of the most popular payment methods, and it can make accepting international payments easy. PayPal is a trusted payment method, and your customers can use bank accounts or make credit card payments through the portal. You don’t have to worry about storing credit card data, and PayPal supports transfers between more than 200 countries.

There are downsides to PayPal, though. The fees for international transfers vary from country to country. This platform is known for having higher exchange rates than others, meaning you’ll end up with less money in your PayPal account at the end of the day.

Customer service can be questionable, especially for businesses, and PayPal has frozen accounts, which could restrict your business until the issue is solved.

Wire transfers

Wire transfers are one payment possibility when working with international clients. This is a better option for service-based small businesses; it’s not practical for an e-commerce store.

With an international wire transfer, clients can send money to you from just about anywhere in the world. International transfers tend to be fast and largely safe, but there are some downsides. Every wire transfer will have a transaction fee, and international transfers are more expensive than domestic ones.

Clients can initiate transfers through their banks or through a global payment service provider like Western Union. Some countries limit the maximum amount of money you can transfer at one time.

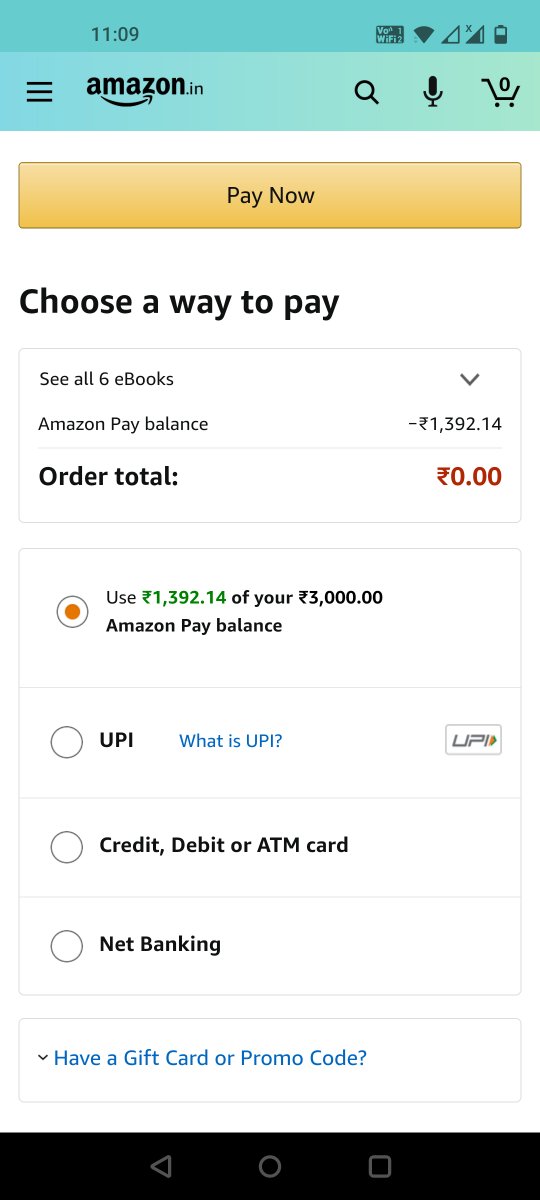

Amazon Pay

With Amazon Pay, it’s easy to set up multicurrency options on your site. You can charge your customer the exact price they should pay based on their location, and customers don’t have to deal with currency conversions. Amazon Pay then converts the currency and credits your account with the appropriate amount.

This feature is available in 12 currencies. It’s an ideal choice for e-commerce businesses, since customers can view upfront, accurate pricing. Amazon Pay charges flat fees and authorization fees, so you’ll need to budget these into your pricing.

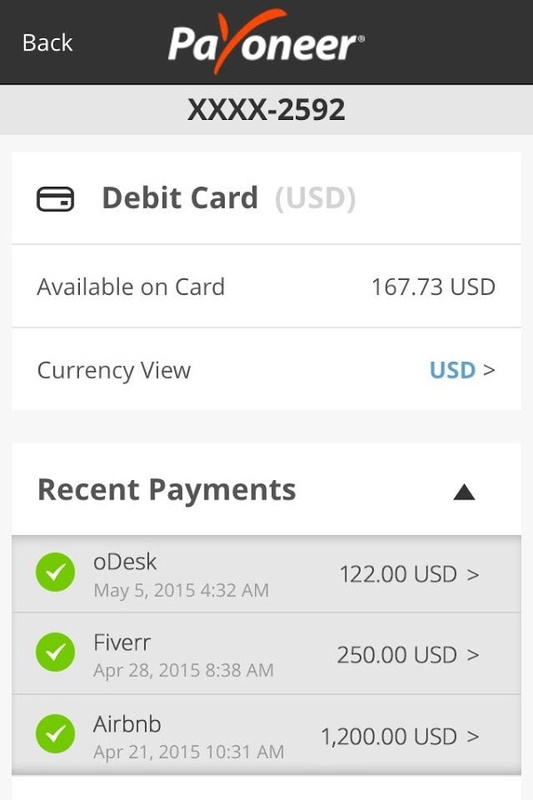

Payoneer

Payoneer is a payment platform that makes it easy to grow your business globally. International clients and customers can pay with a local bank transfer, but Payoneer acts like a local bank account, eliminating those costly transfer fees. Payoneer supports more than 150 countries, and you can withdraw funds in your local currency.

Payoneer also makes it easy to send payments to contractors or suppliers internationally. Fund conversion is simple, and Payoneer has low costs. Payments received via local bank transfer within the U.S. have a 0–1 percent fee, but payments received in other currencies are free.

This platform is ideal for service-based businesses that work with clients overseas.

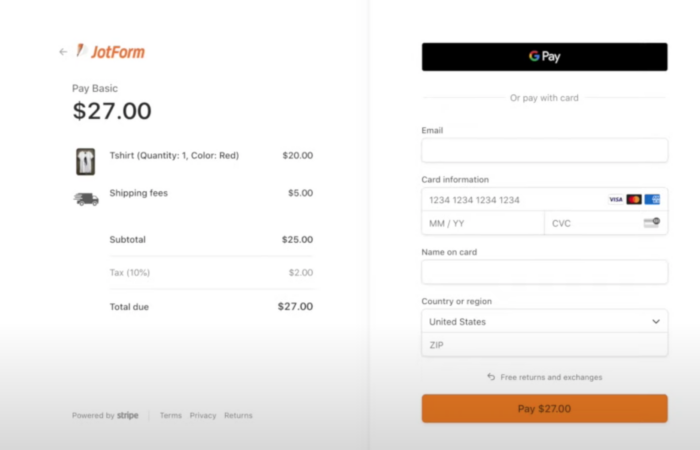

Jotform

Jotform’s integration with Stripe Checkout lets you collect payments using payment forms. With Jotform’s free, customizable templates, you can tailor the payment form to match your needs and your branding.

Using a customized payment form offers many advantages. Because you can fully customize the form, you can eliminate unnecessary fields that contribute to cart abandonment. With a streamlined checkout process, your customers will have an easier time completing their orders.

Stripe Checkout is part of your Stripe account, so there are no extra fees beyond the standard Stripe processing fees. Stripe Checkout is capable of collecting more than 135 currencies, so no matter where your customers are in the world, this is a practical option that can help you collect payments easily and securely.

Choosing the right payment option for your business

When weighing different payment options, you’ll need to consider who will be paying you. Some of these options, like wire transfers, work better for clients who make occasional, large payments. If you’re working with e-commerce buyers, then convenience and a platform that you can integrate within your existing website are essential.

It’s also important to consider all of the fees you might incur, whether those are transfer fees, conversion fees, processing fees, or others. These fees can quickly add up, and you’ll need to budget for them in addition to your product costs and shipping expenses.

Other important elements to consider are a platform’s customer service and overall speed.

Pay attention to how quickly a service processes payments and makes the money available for withdrawal in your account. You don’t want to get into a position where you’re waiting for weeks to be able to withdraw your money.

Quality customer service is also important, particularly as you get started.

Making the decision to take your business international

Deciding to pursue an international audience is an exciting step for any business, and it may be the next phase in the growth of your business. However, keep in mind that taking your business international isn’t without risks or challenges. You’ll need to weigh these factors when deciding if this is the right move for your business.

If you decide to accept international payments, carefully research all of the details of the payment option you’re considering. Be sure to read the frequently asked questions section of the provider’s site, and ask for details about any elements you don’t fully understand. It can also be helpful to talk with other business owners who have used the platform to see what they like and don’t like about it.

When you put plenty of effort into thoroughly researching your market, the payment method you’ll use, and any other challenges you’ll face, you increase the chances of your international expansion being a success. It just might be the best decision you make in growing your business.

Send Comment:

2 Comments:

More than a year ago

Nice Article

More than a year ago

We are a small business that attends and sells at various conferences as and exhibitor. While at US meetings will process sales via a mobile app on our phones (SwipeSimple) in USD. We will be attending a conference in Australia this fall and do not want to request only cash sales. Is there a mobile app for phones that utilizes various currencies?