Contactless payment methods have been steadily growing over the past few years due to their convenience, speed, and security. But since the onset of the COVID-19 pandemic, concerns about safety and cleanliness have caused adoption to skyrocket. According to a study by Mastercard, 79 percent of global consumers now use contactless payment methods, with nearly all of them planning to continue usage even after the pandemic.

Businesses of all types can benefit from adding (or switching to) contactless payments to meet consumer demand for safe, fast, and easy transactions. In this post, learn more about contactless payment and how to implement these payment methods in your business.

Pro Tip

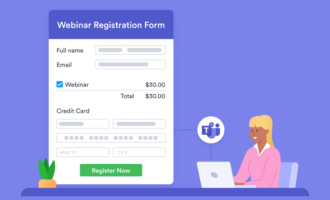

Create contactless online payment forms with 30+ payment integrations — including Square, Stripe, and PayPal — to get paid instantly from any device.

What are contactless payments?

Contactless payment methods are exactly what they sound like — payment methods that don’t require any contact between a customer and a vendor (compared to traditional payment types such as cash, checks, or magstripe credit and debit cards, that require some type of physical contact).

There are four main types of contactless payments:

- NFC-enabled contactless cards. NFC, or near-field communication technology, allows consumers to transmit payment information to a point-of-sale (POS) terminal simply by waving a contactless credit and debit card at a reader.

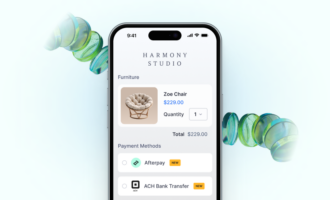

- Mobile wallets. Mobile wallets such as Apple Pay, Google Pay, Samsung Pay, and certain bank apps allow consumers to pay from their smartphone, and transmit the payment information to the POS terminal using NFC technology.

- In-app purchases. Any purchase facilitated by an app, such as food delivery apps like Grubhub or DoorDash, is contactless, as all payment happens in the app and no physical transaction occurs.

- Digital payments. Payments made through a website or digital platform are also by nature contactless and can replace physical payment flows.

How your B2C business can switch to contactless payments

Contactless payments at physical locations

To begin accepting contactless payment methods such as contactless cards and mobile wallets, merchants need two things:

- An NFC-enabled payment terminal

- A payment processing platform that accepts payments from mobile wallets

Most newer terminals can process NFC transactions — 88 percent of all POS terminals that were shipped in the U.S. by the end of 2017 had NFC capabilities. If you have an older terminal, prices range from $49 for a basic NFC reader to $149 or more for a terminal that can also read traditional credit and debit cards.

Whether a consumer uses a contactless credit card or a smartphone, the terminal processes the transactions the same way. NFC payments are much faster than magstripe or chip card transactions and cash transactions.

These payments are also more secure than traditional cards or cash, as the payment data exchanged is securely encrypted, and cannot be replicated or forged in the same way as a magstripe card or cash. Mobile wallets add an extra step that requires the customer to verify transactions on their mobile device using a PIN, password, or biometric marker such as a fingerprint.

When it comes to larger purchases, your payment processor may not accept contactless cards, or they may be subject to the same signature requirements as traditional payments. “If you need to grab a pen and sign, then it’s not entirely contactless,” says Estelle Mense, SVP of marketing at BlueSnap, an all-in-one payment platform for B2C and B2B companies.

While major processors such as Visa and Mastercard have raised contactless transaction limits during the COVID-19 pandemic, it’s still a good idea to check with your processor. Since there are some rules about which transactions don’t need signatures, Mense recommends talking to your provider to see if you can remove the signature requirements.

Contactless payments using websites and apps

To do business online, your B2C company must either add your business to any relevant discovery and ordering apps (such as Grubhub or Postmates) or create (or update) your own website to allow for online and mobile orders. Or you can do both.

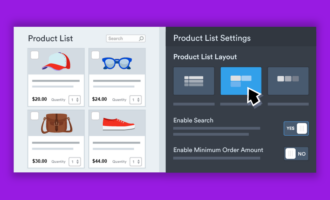

Setting up a website for online orders requires choosing an e-commerce platform for digital shopping cart functionality and a payment processor that can process digital payments.

“Typically if you set up an e-commerce shop, you’re going to use an e-commerce platform such as Magento, BigCommerce, or WooCommerce for WordPress sites,” Mense says. “There are different platforms for specific market segments, such as Shopify for entry-level or Salesforce Shopping Cloud for enterprise, so choose the one that’s best for your market. From there, you can pick payment solutions that are already integrated into the platform you’ve decided to go with.”

If your business is already using management software designed for your specific niche (such as Mindbody for gyms and salons), it likely has a built-in payment module that will allow you to process digital payments.

How your B2B business can switch to contactless payments

While contactless payments are most often associated with in-person retail purchases, they can also be helpful for B2B businesses.

According to Mense, “[Payments] have been a big issue for B2B businesses, which tend to be a bit forgotten. A lot of small to mid-market companies still rely on physical invoices and checks sent through the mail. As people have gone out of office with the pandemic, that’s created a problem.”

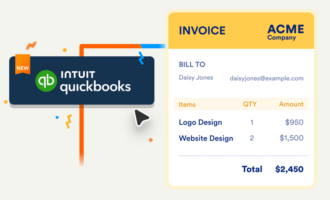

In order for B2B businesses to go contactless, they need to use platforms that facilitate digital invoicing and payments. Digital invoices contain links that allow buyers to pay online using ACH, a payment card, or an online payment provider like PayPal. Switching to online invoicing and payment allows you to collect payments faster, saves time, makes operations more efficient, and is more convenient for your customers.

No matter what kind of business you run, adopting contactless payment methods can help make transactions safer, faster, and more convenient for both you and your customers.

Send Comment:

1 Comments:

More than a year ago

Merci infinement que dois-je faire après