For financial services firms that specialize in preparing investors for lenders, onboarding is more than an administrative step — it sets the tone of the client experience.

That reality was front and center for one firm known for delivering a white-glove investor experience, including preparing personal financial statements (PFS) for lenders. While the firm prided itself on speed, accuracy, and professionalism, the systems behind the scenes were a different story.

The firm was collecting investor data and financial documents through emails, PDFs, spreadsheets, and ad hoc processes. Information arrived fragmented and inconsistent, forcing highly skilled team members to spend hours chasing missing details, validating documents, and manually restructuring data before a PFS could even be prepared.

As deal volume increased, the cost of this approach became impossible to ignore. Slower onboarding meant it took longer to get investors’ materials ready for lenders, which reduced investor confidence in the firm and added even more strain on operations. For a growing business that relies on trust and momentum, sticking with the existing process was no longer an option.

Seeing intake differently

When the firm engaged Amine Ayadi, chief automation officer at the tech consultancy ZapWizards and a Jotform Enterprise reseller partner, the conversation quickly moved beyond software tools and features.

“The real issue wasn’t workflow complexity,” Ayadi explains. “It was data quality at the point of entry. If the intake isn’t clean, everything downstream becomes expensive.”

Rather than recommending a rigid workflow platform or a heavily engineered system, Ayadi reframed the challenge: the intake process needed infrastructure that was intelligent, secure, and adaptable.

That perspective led ZapWizards to recommend Jotform Enterprise as the foundation of the solution.

Why Jotform Enterprise

Ayadi and his team evaluated multiple intake and form-building solutions. While many platforms appeared capable on the surface, most fell short in practice. Some lacked meaningful AI support. Others required extensive custom development to intelligently automate the onboarding experience. Many weren’t flexible enough to support a dynamic, investor-centric process.

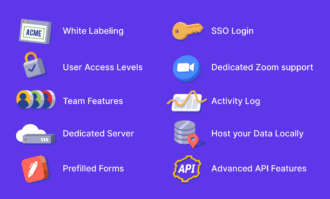

Jotform Enterprise stood out because it offered enterprise-grade security and governance alongside the flexibility to iterate quickly — without forcing the client into a rigid architecture.

“What mattered most,” Ayadi says, “was AI readiness, fast iteration, and the ability to scale without increasing operational overhead. Jotform Enterprise checked all of those boxes.”

As a reseller partner, ZapWizards positioned itself not as a software vendor, but as a trusted technical advisor. The team designed the full solution architecture and demonstrated how Jotform Enterprise could integrate seamlessly into a broader AI and automation ecosystem.

Building an intelligent intake process

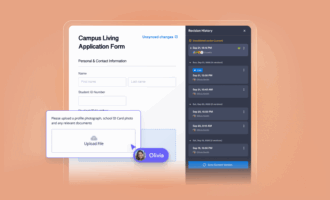

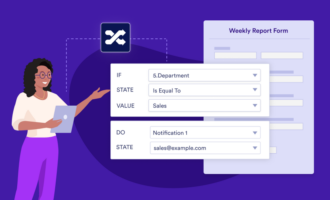

The final implementation focused on creating an intelligent intake layer, not an end-to-end workflow engine. Investors submit structured financial data through secure forms, upload supporting documents, and receive real-time guidance from Jotform AI Agents during the submission process.

“These AI agents don’t just collect information,” Ayadi notes. “They actively help investors complete the process correctly the first time.”

Rather than uploading existing PFS documents, the firm uses structured data collected through Jotform Enterprise to generate lender-ready PFS materials. This approach preserves flexibility while dramatically improving data quality at the source.

Internally, the firm uses Jotform Enterprise features for multiple purposes. The Admin Console provides centralized governance and access control, while Tables and the Report Builder support internal visibility and quality checks.

The platform’s enterprise-grade security, single sign-on (SSO), and auditability were also critical to scaling securely.

Productivity gains without adding headcount

The impact of the new intake experience was immediate.

Investor onboarding became smoother and more predictable. Completion rates increased, the need for internal follow-ups dropped, and confidence in the quality of collected data improved significantly. Teams were able to prepare lender-ready documentation faster, improving financing timelines and overall deal velocity.

From an operational perspective, the gains were substantial. Internal estimates showed a 60–80 percent reduction in manual data handling, saving several hours per investor. Most importantly, the firm increased productivity without adding operational headcount.

“That’s the real win,” Ayadi says. “You’re not just moving faster — you’re scaling sustainably.”

A strategic win for client and partner

For the financial services firm, Jotform Enterprise enabled a guided, AI-assisted onboarding experience that feels effortless for investors while delivering cleaner, more reliable data to lenders.

For ZapWizards, the engagement reinforced its positioning as a strategic automation and AI partner. Selling Jotform Enterprise strengthened credibility in sales conversations and enabled larger, higher-value engagements. The Jotform Reseller Program provided the flexibility to bundle Jotform into broader solutions while maintaining strong alignment with the platform.

Amine offers simple advice to other partners considering Jotform Enterprise:

“Sell it as infrastructure, not just forms. Focus on outcomes — better data, better experience, and scalable operations. That’s where the real value is.”

Looking ahead

Ayadi sees Jotform Enterprise as a critical building block in modern, intelligent systems, particularly as AI becomes more deeply embedded into operational workflows.

“When intake is treated as strategic infrastructure,” he says, “everything downstream gets easier, faster, and more reliable.”

Explore the Jotform Partner program that aligns with you and your business.

Send Comment: