9 alternatives to Venmo

Whether you need to shop for food, schedule a teeth cleaning, practice yoga, or learn a new language, there’s an app to make it easier, more convenient, and a lot more enjoyable. Mobile payment apps like Venmo even make it easy to split tabs with friends and family — like when you’re out at a restaurant or at home paying the utility bills.

Venmo is a mobile payment service that allows people to easily send and receive money digitally. In doing so, Venmo has revolutionized how we spend money socially — making the awkward “I forgot my wallet at home” excuse a thing of the past. It’s easy to set up, free to use, and allows users to register for both personal and business accounts without any complicated setup or monthly fees.

There are a lot of advantages to using Venmo. The platform is quick and simple, and you can send money using a bank account, debit card, or credit card. It’s reminiscent of a social media platform, allowing you to send payments to friends with fun messages and emoji.

But Venmo has some downsides, too. Once you’ve sent a payment, you can’t cancel it, and payments are public by default, meaning others on the app can see how much you’ve sent and received and what you’ve sent money for. Plus, Venmo doesn’t support international transactions.

Using Venmo presents additional privacy-related concerns. Venmo’s privacy policy highlights the fact that some of your information, including your profile photo, first and last name, and public transactions may be visible to anyone, even if they aren’t a member of the Venmo platform. Venmo stores information — like your geolocation data and social network information — and may store that information for up to 10 years. Venmo doesn’t sell your personal information to other companies for marketing purposes though.

When using Venmo, you’ll need to adhere to its transfer limits. Until you verify your identity, Venmo limits transfers to your bank account to $999.99 per week.perso

Once you’ve confirmed your identity, you can transfer up to $19,999.99 to your bank each week. There’s a $5,000 per-transfer limit, so if you have lots of money to move, you’ll need to perform several transfers. While it’s free to open a Venmo account and there aren’t any monthly fees, senders who use a credit card pay a three percent fee.

Venmo is one of the most well-known digital wallet apps, but there are other mobile payment platforms to consider. Comparable in price, ease of use, security, and overall functionality, here are nine Venmo alternatives worth looking into.

1. Jotform’s Venmo integration

Jotform’s Venmo integration allows you to easily collect mobile payments through your online forms. When customers or clients choose Venmo as their payment option on your mobile form, they’ll be directed to the Venmo app. From the app, they can use their bank account or debit card to complete the payment.

This integration lets your customers enjoy the convenience of Venmo, and you’ll enjoy an easy payment processing experience. Customers can pay using their mobile devices, which is ideal if you’re collecting donations or selling in a setting where you don’t have access to your POS system.

You can create a payment form and start collecting Venmo payments in minutes. You can also use a QR code to help your customers access the Venmo payment app. This Venmo integration is one more way to give your customers an easy payment option through a payment processor they already use. It’s a great way to enhance the customer experience and ensure a smooth checkout process.

Jotform charges no additional fees, so you’ll only have to pay Venmo’s fees.

2. Zelle

When it comes to sending and receiving money quickly and safely, few mobile payment services are as convenient as Zelle. It’s free to use, included in more than 1,000 banking apps (like Chase Bank, Bank of America, and Citi), and enables same-day transfers. What’s more, it works between U.S.-based banks, which means you can still use Zelle with friends and family who use a different bank than you (as long as both sender and recipient have Zelle).

If your bank offers Zelle, then your Zelle daily spending limit will depend on the limits that your bank institutes. If your bank doesn’t offer Zelle, you can use the Zelle app, which has a $500-per-week spending limit. While Zelle doesn’t charge any fees to send or receive money, it’s a good idea to confirm with your bank that it doesn’t charge any fees for these transactions, either.

Zelle helps to maintain a safe transaction platform by allowing you to send or receive money without sharing sensitive financial information. Zelle also has authentication and monitoring features to help ensure your transactions are secure.

Zelle’s privacy policy, which applies to the Zelle app, explains that Zelle collects personal information including your name, email address, IP address, and postal address. Zelle stores this information for four years after you’ve closed your app profile. Another bonus is that it doesn’t sell your personal information to third parties.

3. PayPal

Digital wallet service PayPal — which actually owns Venmo — is also free to use. It’s accessible in 200 countries, includes a high transfer limit, and is available on iOS, Android, and the web. Transferring money from a PayPal account to your debit card or bank account of choice without an additional fee usually takes one to three business days, which is comparable to Venmo.

Users with verified PayPal accounts can send up to $60,000 in a single transaction. There’s no limit to the total amount of money that you can send with a verified account. While there’s no fee to transfer a PayPal balance to a bank account, payments made with credit cards are subject to a 2.59 percent fee plus a fixed fee. Amex Send accounts also have no fees.

PayPal doesn’t share your financial information with the seller or buyer. The company monitors every transaction to prevent fraud and identity theft. All transactions are encrypted, and PayPal doesn’t sell your personal information to third parties.

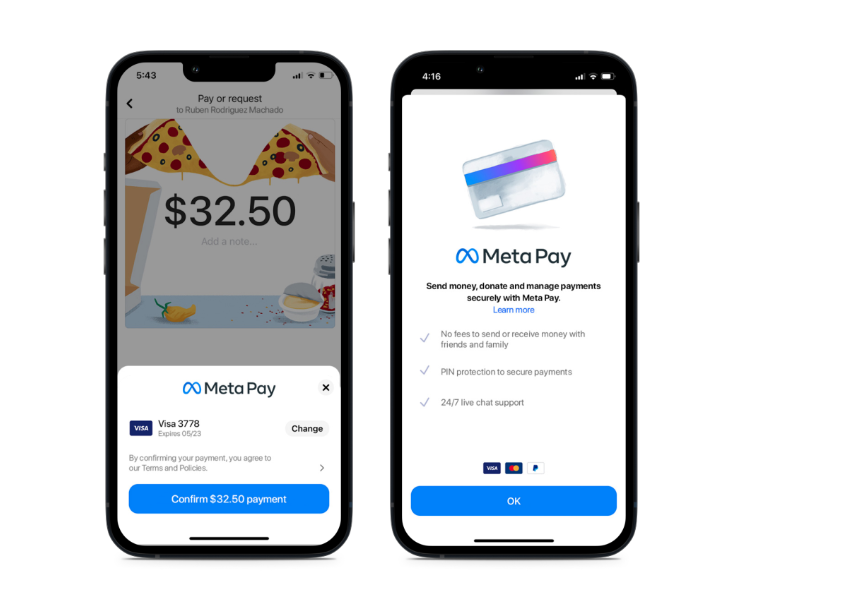

4. Meta Pay with Messenger

Next on this list of Venmo alternatives is Meta Pay with Messenger from Meta, which allows Facebook users to send money to each other. Transfers with Messenger are private, easy to use, and, like Venmo, socially engaging, since they live on the most widely used social media platform.

To use Meta Pay with Messenger, all you need to do is link your debit card or PayPal account to your Facebook account and create a PIN. Once you’ve connected an account, payments received will be automatically accepted and will show up in your account within three business days.

Meta Pay limits Visa debit card payments to $10,000, MasterCard debit cards to $5,000, and PayPal accounts to $3,000 per transaction. There are no fees for using Meta Pay.

Meta Pay uses anti-fraud technology to monitor purchases and detect any unauthorized activity. Your card number is encrypted and stored separately from your profile data for enhanced security. Meta Pay does not share or sell any of your personal information.

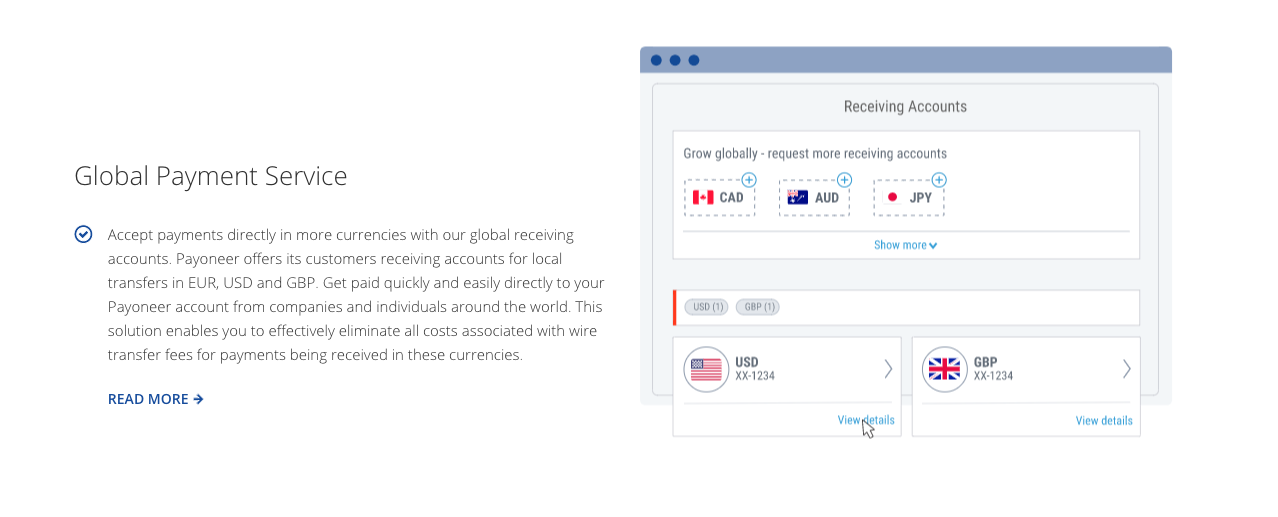

5. Payoneer

Though Venmo does offer business profiles that enable users to accept payments from customers, it’s pretty limiting — especially since Venmo is only available in the United States. But with payment platform Payoneer, you can receive payments from clients all over the world (since the platform is accessible in more than 200 countries) to grow your business quickly and securely. It’s powerful, scalable, and affordable — whether you’re a freelancer, digital marketer, or e-commerce seller.

With Payoneer, you can withdraw up to $5,000 total per day and make up to 30 withdrawals per day. Payoneer limits point-of-sale transactions to 30 per day with a total $2,500 daily limit.

It’s free to receive payments from other Payoneer customers. Payments from a client who isn’t a Payoneer customer carry a 1–3 percent fee, depending on whether they use a debit card or a credit card.

Payoneer payments are made through a secure financial platform that undergoes regular audits. Payoneer’s Risk Committee carefully reviews risk rates, so if any banks have risk factors, Payoneer moves your money to a safer bank. Payoneer collects your personal information, including your name, date of birth, IP address, and email address.

6. Braintree

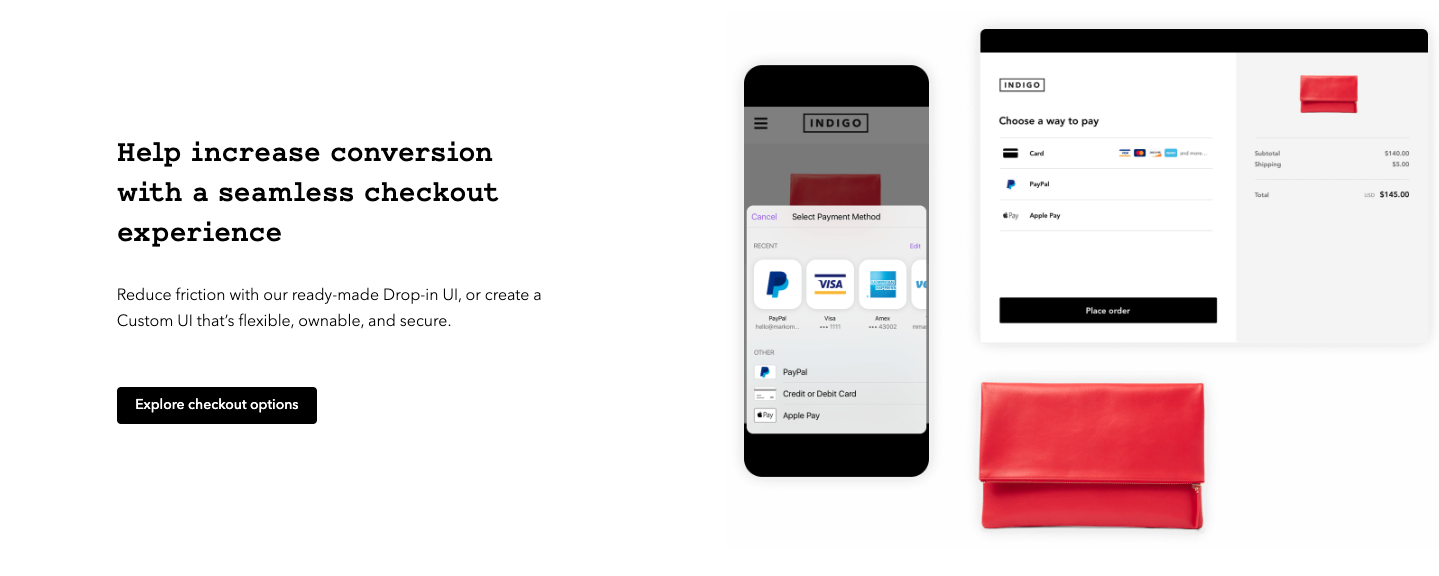

Another popular Venmo alternative owned by PayPal, Braintree is a powerful web-based payment system that primarily benefits business users — especially in terms of security and reporting capabilities. With the optimized payment experience from Braintree, users can increase sales, expand into new markets, and streamline everyday operations. Plus, the platform integrates with Venmo, PayPal, Apple Pay, and Google Pay for even more customer convenience.

Braintree doesn’t currently advertise a maximum transaction amount. There are no monthly fees with Braintree. Instead, you’ll pay 2.59 percent plus $0.49 per transaction for credit cards and digital wallets. Braintree also assesses a $15 fee for each chargeback.

Braintree offers Fraud Protection and Fraud Protection Advanced to help protect your transactions and minimize chargebacks. If you choose to leave Braintree, you can take all of your data with you.

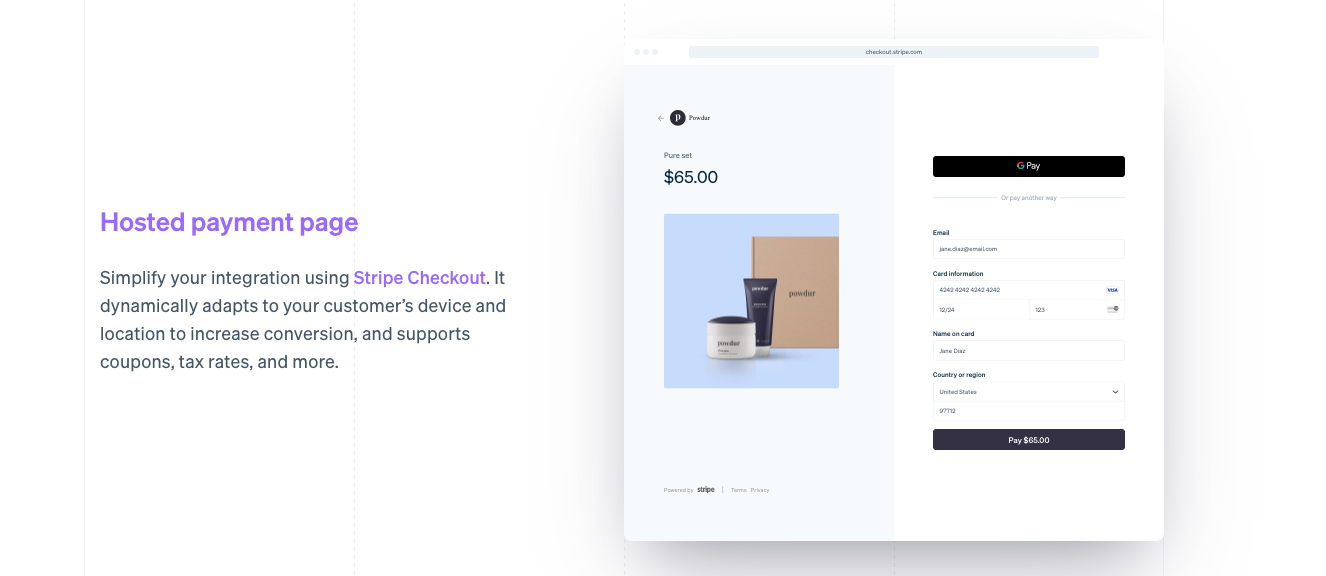

7. Stripe

Built solely for business transactions, mobile payment app Stripe is intuitive, easy to use, and affordable — there are no monthly fees or fees for card storage, validation, or refunds. With Stripe, users can accept payments, send invoices, manage business expenses, and combat fraud from one powerful, fully integrated suite. The platform does not, however, offer any person-to-person transaction capabilities.

Stripe has a limit of $999,999.99 for single transactions. Fees are 2.9 percent plus $0.30 per credit card charge. Stripe also offers customized packages for businesses that include volume and multi-product discounts.

Stripe is a certified PCI Level 1 Service Provider and uses top security tools, including HTTPS and TLS to ensure secure connections. The platform uses AES-256 encryption. While Stripe collects your personal data, it doesn’t sell that data.

8. XE Money Transfer

Best for users who often travel internationally for business or pleasure, online money transfer company XE Money Transfer lets users send money to more than 130 countries — including France, New Zealand, and Japan — at lower rates than banks offer. And thanks to its Mass Payments feature, your business can cut manual processes, use fewer resources, and consolidate multiple currencies in a single file — all from one trusted, highly secure platform.

When you use the XE Money Transfer phone app, there are no maximum transfer limits. If you use a personal account, transactions are limited to $535,000 each. XE Money Transfer adds small send fees to some transfers, and you’ll see that fee when you start the transfer process. You may also be charged a fee when using a credit or debit card to pay for your transfer, depending on where you’re located.

XE Money Transfer uses enterprise-grade security measures and standards to ensure that money transfers are safe. The platform collects personal data, including your name, address, email, telephone number, date of birth, and images. The company doesn’t specify how long it stores data.

9. Cash App

Last on the list of Venmo alternatives is mobile payment solution Cash App, which lets users send and receive money more privately with a unique screen name, or “$cashtag,” instead of with bank account numbers, phone numbers, or email addresses. For extra security, Cash App also requires a one-time login code only accessible by the account holder.

With Cash App, you can send and receive up to $1,000 a month before extra identity verification is required, while you can send $299.99 a week with unverified personal accounts with Venmo. Verified Venmo personal accounts have a higher spending limit of $19,999 per week — vs $7,500 per week with verified Cash App accounts. Fees vary depending on the type of transaction. Instant deposits carry a 0.5–1.75 percent fee, with a minimum fee of $0.25.

Cash App keeps your money secure by using encryption and fraud detection technology. The app is compliant with PCI Data Security Standard Level 1. While Cash App collects personal information like your name, email address, signature, and authentication credentials, the platform doesn’t sell or rent your personal information to third parties.

Clearly, there’s no shortage of mobile payment apps for personal and business use. They’re affordable, accessible, and user-friendly tools — making sending and receiving payments easy and convenient on any device.

So, whether you choose Venmo — or any platform from this list of Venmo alternatives — you’ll be sure to have an online payment solution that can meet your needs.

Send Comment: