Have you ever stumbled across the perfect item online, but you didn’t buy it because it just cost too much up front? It’s more than likely this has happened to your customers. Of online customers, an average of 70 percent abandon their carts because they don’t want to spend so much money at once.

“Buy now, pay later” shopping solutions may be the answer to reducing this high abandonment rate. As much as 50 percent of millennial shoppers want to have financing options for their purchases.

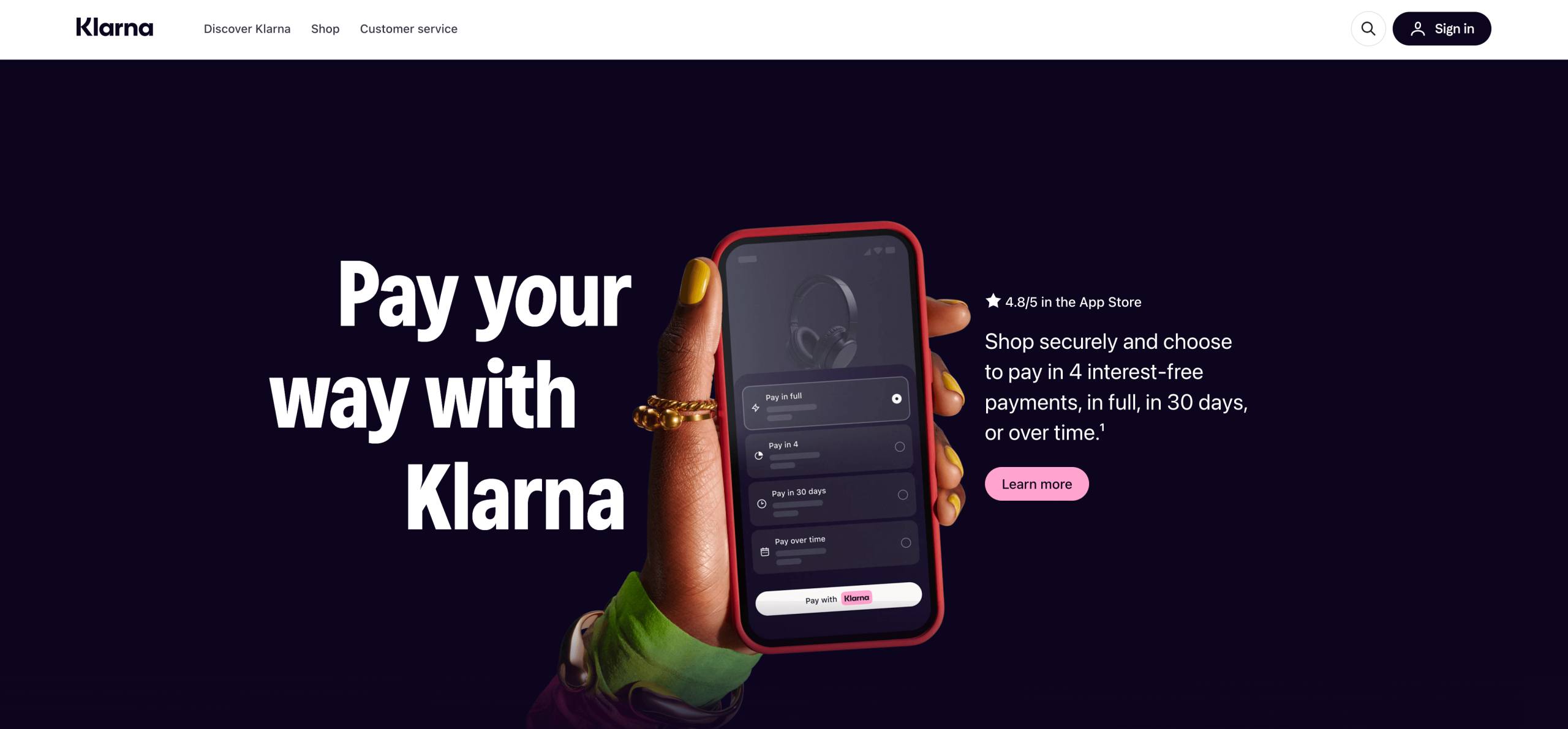

What if there was an easy way to offer these options to your customers without added interest for them? That’s where Klarna comes in.

What is Klarna?

Klarna, a payment services provider (PSP), facilitates payments for retailers, especially in e-commerce. The company has partnered with more than 200,000 brands (including ASOS, Etsy, Calvin Klein, and H&M), so their customers can get the products they want and pay at a less demanding pace. As the pioneer of the “buy now, pay later” business model, Klarna is incredibly popular. Since its founding in 2005, the company has raised $3.1 billion and is currently valued at $31 billion, making it one of Europe’s highest-valued fintech startups.

Founded in Stockholm, Klarna was created by two Swedish business students who wanted to make it easier for people to shop online. After figuring out the mechanics to make “buy now, pay later” a workable concept, Klarna took Europe by storm. The company expanded into more than 11 countries before entering the US and Australian markets. More than 1.8 million people have downloaded the Klarna app.

We’ll tell you how Klarna works and what it costs for businesses.

How Klarna helps consumers

Since its launch, the app has helped over 80 million shoppers worldwide increase their purchasing power by dividing payments, giving them more spending flexibility.

Klarna gives consumers three options:

1. Interest-free payments

The most popular solution is to split a purchase into a maximum of four payments. Unlike a credit card or a loan, there aren’t any hidden fees or and there’s no interest. Customers just receive their order and pay for it over time.

2. A 30-day payment plan

Great for product tryouts, this option allows customers to buy a product and pay for it later, with no interest. Even better, if a purchase doesn’t work out, customers pay only for what they keep.

3. Long-term financing

Klarna even works with major purchases that can take multiple years to pay off. The service completes these purchases without a credit check and with significantly lower interest rates than credit cards. Financing options range from six to 36 months.

How Klarna helps businesses

The biggest benefit of partnering with Klarna is that it boosts sales. Remember that 70 percent cart abandonment rate? Klarna cuts it down drastically.

According to Shopify, retailers see their order values increase by an average of 68 percent when customers are able to pay in installments with Klarna. When long-term financing is an option, the average order value increase is 58 percent. Even the option to pay in 30 days leads to significant sales increases. On average, this option increases customer purchase frequency by 20 percent.

All of these benefits come without any risk to your company. Klarna pays merchants up front for whatever a customer purchases and then takes on the burden to collect payments.

Klarna also advertises partner merchants and their products through an e-commerce directory, which is a great way to reach consumers who aren’t familiar with your brand.

In addition, the service offers merchants two proprietary tools:

The Klarna business insights dashboard

Through this analytics tool, businesses can monitor site traffic, weekly sales volume, conversion rates, and other e-commerce KPIs.

Onsite messaging

This chat tool communicates the different Klarna payment and financing options available throughout the shopping process, long before customers ever get to checkout. Doing so ensures that customers don’t abandon their carts before knowing they have the option to buy now and pay later.

What is the cost of Klarna for businesses?

This service is amazing for customers, but what is the cost of Klarna for businesses? Klarna never charges fees from consumers unless they are late on a payment. Indirectly, they charge interest on loans for long-term financing. Most of Klarna’s revenue actually comes from merchants.

These fees vary based on the country and the payment method. Here are the payment methods and costs in the United States:

Pay in 4

With this option, customers pay in up to four interest-free installments. Klarna assumes all the risk of customer nonpayment, but the merchant pays fees for the convenience. The standard fee is $0.30 and 5.99 percent for each transaction.

Klarna financing

Through Klarna financing, consumers pay for purchases with a long-term loan of up to 36 months. Klarna typically charges interest, which may make this option less enticing for consumers. However, this option lowers merchant fees, which are $0.30 and 3.29 percent per transaction.

Pay in 30 days

This popular option lets customers try a product before they buy it. Klarna doesn’t charge interest for the purchase, which encourages sales and drives new business. However, payment must be made within 30 days. Klarna charges merchants $0.30 and 5.99 percent per transaction.

Connect to Klarna through Mollie and generate more sales

“Buy now, pay later” is still an emerging model in the United States, but in Europe, it’s a mainstream shopping model that consumers expect. How can American brands that are expanding to Europe accept payments from Klarna? Accept Mollie payments through Jotform.

Mollie is the most popular PSP in Europe, accepting more than 30 EU and national payment methods in the region, including Klarna. Mollie is a must-have tool for any business trying to sell in Europe, because it accepts payments from more consumers than any other PSP.

With Jotform’s Mollie integration, you can supercharge your online payment forms and easily build an international e-commerce site. Klarna’s innovation helped it become a global juggernaut in record time. Imagine what it can do for your brand.

This article is for online retailers, e-commerce teams, and small businesses exploring buy now, pay later options, who want to understand how Klarna works, how it affects customers and merchants, and what it costs before adding it to checkout.

Send Comment: