As commerce moves online, digital transactions are becoming more and more common. But the term “digital transaction” isn’t limited to only financial exchanges. Digital transactions can also be exchanges of documents or data between people and organizations that occur automatically without the use of paper (like online payments, form submissions, etc.).

These types of transactions have already transformed the way we work — but the digital transaction revolution is just getting started.

Going paperless and using digital transaction technology can benefit organizations in any industry. Wondering how it can help improve your workflows? Let’s take a tour of everything you need to know about digital transactions.

How do digital transactions work?

The term “digital transaction” can encompass many types of exchanges, including accepting cashless payments online, signing contracts virtually, or updating an order status. The behind-the-scenes mechanics of each of these transactions vary widely depending on the type of transaction and the industry it pertains to. Online payments, for example, need to adhere to many regulations and security requirements because of the sensitive nature of the information that’s being exchanged.

How do digital transactions help?

Digital transactions provide several universal benefits for any industry. Aside from saving time and money, digital transactions streamline exchanges for greater convenience — the ultimate marker of a good customer experience. Here are some examples of digital transactions in various industries.

Financial services

Banks and other organizations in the financial services sector have been some of the biggest adopters of digital transaction technology. In fact, financial technology (or fintech) companies like PayPal, Venmo, and Stripe emerged specifically to meet consumer demand for fast, easy online payment options. Many banks and legacy institutions have followed suit and created their own payment platforms to compete with these fintech startups.

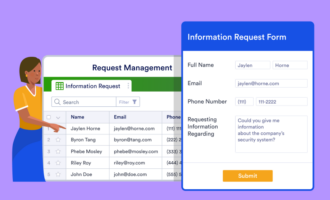

Aside from online payments for customers, financial service companies benefit from digital transaction technology by using it to streamline their own internal workflows. With online form builders like Jotform, for example, finance form templates can help organizations collect, manage, and store information from their customers and partners.

Jotform’s robust library of form templates include applications for new accounts or credit cards, loan requests, and membership signups, to name a few. With Jotform Approvals, users can easily route all submissions through customizable approval workflows to process requests in record time. Jotform integrates with online payment platforms to facilitate financial transactions as well.

Retail

E-commerce has emerged as one of the biggest industries in the world, thanks to the rise of online payment capabilities. But both digital and brick-and-mortar retailers alike can benefit from digitizing transactions throughout their operations.

Jotform’s form template library features a number of customizable forms perfect for retailers, including customer loyalty membership applications, surveys, and feedback forms. Users can customize each form with their store’s logo and aesthetics to align with their brand identity. Plus, all form submissions from customers automatically collect in customizable tables that retailers can use to build comprehensive profiles for their shoppers.

Insurance

Like the fintech revolution in banking, “insurtech” companies have started creating major disruptions in the insurance sector. New technology allows insurers like Lemonade to process claims in minutes. As a result, insurance companies are under pressure to streamline their processes. Digital transaction technology is the key to making this happen.

Insurance companies can use platforms like Jotform Approvals to collect claims forms from customers and quickly move each submission through a custom-built approval workflow. Jotform Approvals works by letting users link forms and responses to a set of automated actions, so claims always get to the correct adjuster for faster review. Once they’ve completed their review, adjusters can simply click the “approved” button to notify accounting to process a payment.

Contract management is a notorious source of bottlenecks in the insurance industry, and it requires a lot of hands-on labor. But platforms like Jotform Sign can even streamline contract management for insurers. Once an application is approved, insurance agents can use Jotform Sign to submit a policy agreement to the applicant and collect their legally binding e-signature.

This type of contract automation dramatically accelerates the approval timeline for insurance applications.

How your business can stay competitive with Jotform

Thanks to digital transactions, business processes are becoming more and more efficient. Tools like Jotform can help you reap the benefits of digital transformation and keep up with customer expectations. Jotform’s extensive library of templates for forms, tables, and approval workflows — along with legally binding e-sign capabilities — can give your organization the technology it needs to stay competitive now and in the future.

Send Comment: