Business owners know how important it is to manage the financial health of their business. A balance sheet gives small business owners an excellent way to stay on top of their financial statements, review their total assets, adjust their budgets, and better understand their overall financial position.

If you haven’t yet created a balance sheet, make this a priority so you can stay well informed and make better decisions to grow your business.

What is a balance sheet?

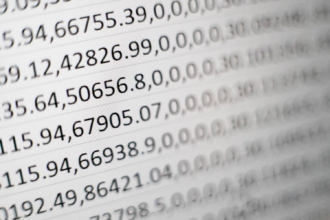

A balance sheet helps you keep your small business finances organized. You can update your balance sheet at any time, but it’s best to do it at least quarterly. An updated balance sheet provides detailed insights on how well your business is doing from one moment to the next.

A business balance sheet includes assets, liabilities, and your shareholders’ equity. Your assets need to correspond with your business liabilities and the shareholders’ equity. As you create your sheet, you’ll need to make it balance by adjusting the liabilities (mainly, the owner’s equity) until they equal the assets.

What to include on a balance sheet

Balance sheets contain comprehensive and detailed financial information. It’s easiest to make sense of them by reviewing a sample balance sheet or template. Once you’re familiar with how to read a sheet, you’ll feel a lot more prepared to create one for your business.

Divide your balance sheet into three main sections — one each for assets, liabilities, and shareholder equity. As you build each section, include the following details.

Assets

Account for your current assets by dividing them into two categories: short-term assets and long-term assets.

Short-term business assets include inventory, cash, employee accounts receivable, trade accounts receivable, and any other assets that you can convert into cash within a year.

Long-term assets include items like fixed assets (buildings, machinery, and land), investments, and intangible assets (like patents and trademarks). These should be the assets you plan on retaining for longer than one year.

Liabilities

Divide your total liabilities — or what your business owes — into short-term and long-term categories.

Short-term liabilities include items like your trade accounts payable, accrued expenses, taxes payable, dividends payable, short-term debt, and any other expenses you’ll pay within one year.

Long-term liabilities include capital leases, pension liabilities, long-term business loans, deferred income taxes, and any other current liabilities you won’t pay off within one year.

Shareholders’ equity

In addition to your shareholders’ equity, this section of your balance sheet includes items like retained earnings and the per-share value of your stock (if your business issues stock).

How to make creating a balance sheet easier

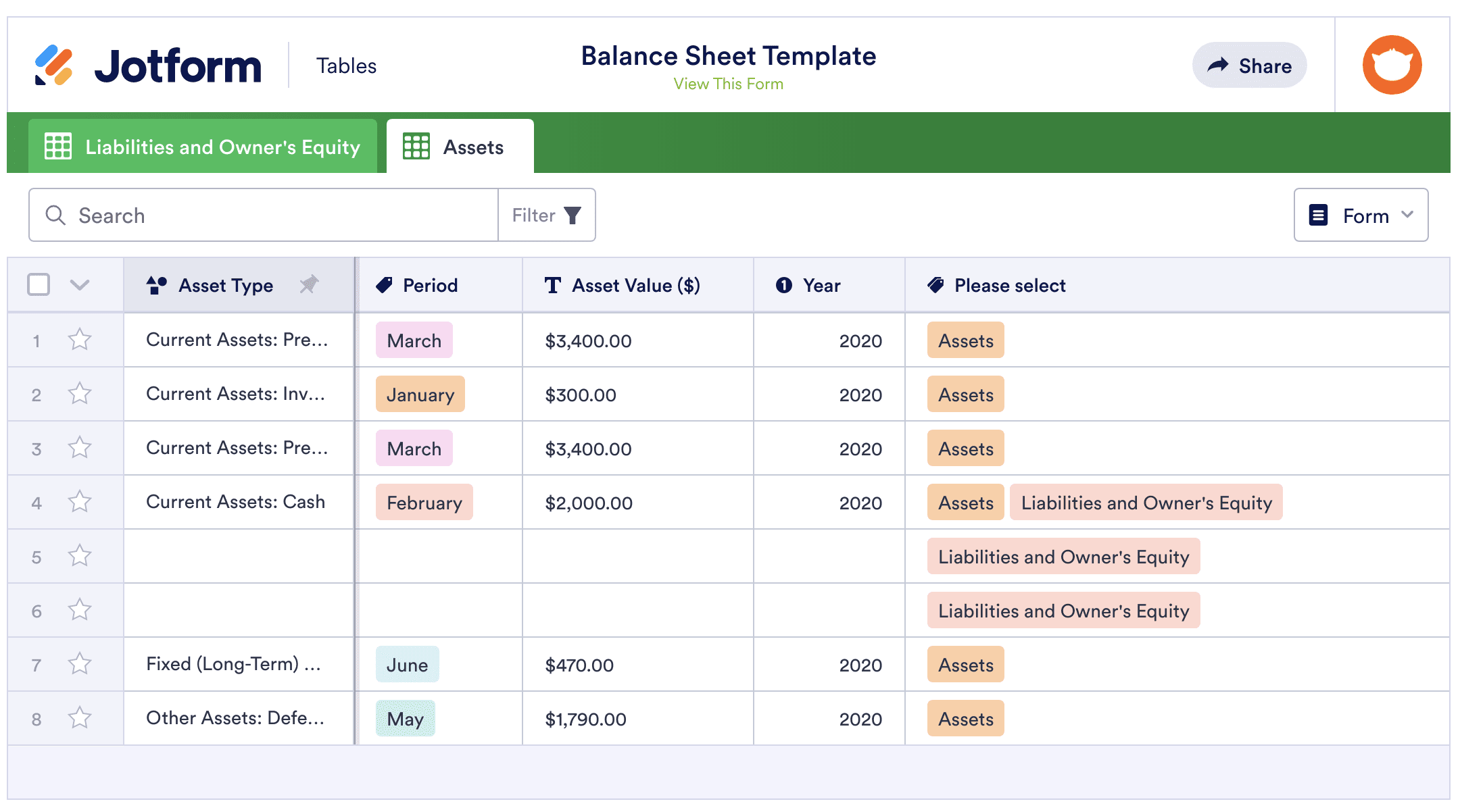

When it comes to creating a balance sheet, using a program like Jotform can help. You can use Jotform’s finance sheets to gather and organize financial information.

Jotform’s balance sheet template and classified balance sheet template are fully customizable, so you can tailor them to your specific needs. These templates are ideal if you’re creating a balance sheet for the first time — they take a lot of work out of the process, and the sections will guide you through the process and help you find the information you need.

Once you’re done editing the sheet, you can download it as a CSV, PDF, or Excel file. You can also print it or share it with your partners and stakeholders. And if you update them regularly, these balance sheets can provide a detailed financial health history for your business.

What your balance sheet tells you

A small business balance sheet is important for many reasons. It provides you with a snapshot of how successful your business is at a specific point. This information helps you make well-informed decisions to improve the business.

You can also study the financial health of your business to better determine if it can weather the fluctuations and changing revenue that naturally occurs — or decide if it’s time to expand.

And you can get a sense of whether you need to take steps to maximize your cash flow or if you need to address issues with your receivables and payables cycles.

Your balance sheet pairs with your income statement to identify how solid your business finances are over a period of time. This is essential information not just for business owners but for shareholders and lenders as well.

By taking the time to create and regularly maintain balance sheets, you’ll be creating a valuable financial history that you can use to build and strengthen your business.

Send Comment: