What does ACH stand for? It’s one of the most common questions people ask when they hear about ACH payments. ACH stands for the Automated Clearing House, which refers to a network of financial institutions across the nation.

“ACH is the vehicle that moves money electronically where it needs to go,” explains Katrina Brittingham, executive coach and founder of VentureReady.

To get a sense of how widely used the ACH network is in the U.S., consider these 2023 statistics:

- The network handled 31.5 billion transactions totaling $80.1 trillion. Compared to 2022, these volume and value levels increased by 4.8 percent and 4.4 percent, respectively.

- ACH transaction value increased by more than $1 trillion every year for the last eleven years.

- The number of transactions grew significantly in the B2B space (+10.8 percent, or 6.6 billion), among direct deposits (+3.3 percent, or 8.3 billion), and in peer-to-peer activity (+11.9 percent, or 330 million).

But there’s much more to ACH. In this guide, we cover several different aspects of ACH to clear up confusion around the topic and ensure business owners like you are knowledgeable about this popular payment method, which can benefit both you and your customers.

Chapter synopsis

- Introduction.

- ACH terms. Before diving in too deep, let’s get the basics out of the way. This chapter provides a rundown of the key terms you need to know before learning more about ACH.

- ACH number. People often confuse the ACH number with other numbers in their checkbooks and online accounts. We clarify each of these identifiers in this chapter.

- How the ACH system works. Who are the parties of an ACH transaction? Are there any transaction fees involved? Get answers to these questions and more.

- ACH use cases. When is ACH a relevant method of payment? We walk through business, nonprofit, and personal perspectives to find out.

- Online payment security. Online payment security is an important consideration when sharing financial information to buy products and services. Here are a few recent payment regulatory actions in the U.S. and abroad.

- Collecting ACH payments with online forms. We’ll walk through how to get paid via ACH with easy-to-use online forms.

Remember to bookmark this guide for later reference. You never know when you may need to brush up on aspects of ACH.

ACH terms

The ACH payment system can be challenging to wrap your head around. This chapter covers some general terms you should understand before digging deeper into this guide.

ACH debit

An ACH debit, or direct payment, is a transaction through the ACH network that results in funds being pulled from the transaction initiator’s account and transferred to a recipient. (An ACH withdrawal is the actual deduction of the funds.)

The initiator is typically a customer who must authorize the transaction before funds can be moved. For example, someone might use an ACH debit transaction to pay their cell phone bill; in this case, the customer authorizes the cell phone company to pull funds from their account, likely on a recurring basis.

ACH credit

An ACH credit is also a transaction through the ACH network, except that funds are pushed from one account into another. Much of the criteria for an ACH credit is the same as for a debit.

There are a transaction initiator and a recipient, and the initiator must authorize the transaction. However, instead of authorizing the recipient to pull funds, the initiator authorizes their financial institution to push funds to a specific account.

Using the same example of paying a cell phone bill, the customer would use his or her bank’s bill pay option to initiate a payment that’s pushed to the cell phone company’s account. Direct deposits are also considered ACH credits.

ACH transfer

An ACH transfer is any electronic movement of money through the ACH network, which means it encompasses both ACH deposits and credits. ACH transfers include transactions such as direct deposits from your employer or the IRS, external funds transfers, and person-to-person payments.

Transfer providers like banks, PayPal, Venmo, and Zelle all use the ACH network.

NACHA

The National Automated Clearing House Association (Nacha) is the nonprofit organization responsible for establishing, revising, and enforcing the Operating Rules for the ACH network. Nacha is made up of numerous financial institutions and payment organizations. These members influence the governance and direction of the ACH network and its associated Operating Rules.

Operating Rules

Nacha Operating Rules apply to every ACH payment and all parties involved. They define the roles and responsibilities of financial institutions and establish clear guidelines for every network participant. Rules encompass a wide range of areas: same-day ACH dollar limits and processing windows, funds availability, returns, fees, and so on.

Next up is a common aspect of ACH that people get confused about — the ACH number. Learn about its purpose, where to find it, and more.

ACH number

There are a lot of numbers associated with ACH, and each plays a role within the network of payments. For example, ACH trace numbers come into play when tracking specific payments.

What these numbers have in common is that they are identifiers, whether of entities, accounts, or payments. But you’re probably more interested in how they differ from one another. Below we walk through a few FAQs about these numbers so you can understand their unique roles in the ACH system.

5 ACH number FAQs

1. What is an ACH number?

An ACH number is a unique number that identifies banks and their branches. It helps route funds among financial institutions. The more common name for an ACH number is an ACH routing number.

These numbers are often employed for electronic transfers of typically small payments that may be made one time or on a recurring basis. For example, you may provide your ACH number to your electricity provider so they can pull funds from your checking account every month.

ACH routing numbers are standardized. They are exactly nine digits long, and the first two digits often range from 61 to 72.

2. Where do you find the ACH number for your bank?

You can typically find your ACH routing number in one of three places:

- In your checkbook. The ACH routing number is printed on your checks, usually next to your account number. However, your bank may have a special ACH routing number for electronic transfers, meaning the checkbook routing number won’t work for that purpose — although your checkbook routing number and ACH routing number can be the same. To avoid any issues with transfers, either verify the routing number with the bank or use one of the other two methods.

- In your online account. Banks typically include the ACH routing number where customers can access it, so you can log into your account and search for it there. The number is typically labeled as “electronic deposit” or “direct deposit.”

- Online. You can often use a simple Google search to find this number — just combine the search term “ACH routing number” with the name of your bank and the state your account is based in.

3. How is an ACH number different from an ACH trace number?

While an ACH routing number identifies a bank, an ACH trace number identifies a specific payment within a particular batch file. (ACH processes large volumes of debit and credit transactions in batches.)

A trace number is standardized at 15 digits. The first eight digits represent the first eight of nine digits of the initiating bank’s routing number, while the last seven are sequence numbers assigned in ascending order with each transaction.

The trace number can be repeated across batches, so to be a truly unique payment identifier, the trace number must be combined with the associated batch number, transmission date, and file ID modifier.

4. How does an ACH number compare to an account number?

Your account number uniquely identifies the digital holding place for your customer information and funds. This number can vary in length. The ACH number helps route funds between financial institutions and has a standardized length of nine digits. We’ve covered additional distinctions between ACH numbers and account numbers on our blog.

5. What’s the difference between an ACH number and an ABA number?

Both ACH and ABA numbers help move money, and both can be the same number. However, banks sometimes use separate ACH numbers specifically for electronic transfers. Check out several other differences between ACH numbers and ABA numbers in this comparison post.

Now that we have a lot of the foundational information out of the way, let’s explore how the ACH system works. You’ll learn about the parties involved, fees, and transfer times, among other things.

How the ACH system works

The ACH system is a complex web of funds and information that’s passed around, but once you get a grasp of who’s involved and the roles they play, the system makes more sense. Below we describe the main players in an ACH transaction and answer some common questions about fees and timelines.

Understanding the ACH system

Who are the parties involved in an ACH transaction?

Five parties play a part in an ACH transaction, regardless of which ACH transaction types are involved:

- Receiver. This is the person or entity — customer, employee, or company — authorizing the transaction. For example, an employee typically authorizes their employer to make direct deposits into their account.

- Originator. This is the party pushing the transaction, who will be responsible for maintaining the authorization should it be requested at a later date. The originator may be a company, employer, or customer.

- Originating depository financial institution (ODFI). This is the bank that accepts and processes the ACH transaction on behalf of the originator.

- ACH operator. This is the central clearing facility that receives transaction entries from the ODFI. It distributes entries to the appropriate bank (referred to as the receiving depository financial institution, or RDFI) and performs settlement functions for the ODFIs.

- Receiving depository financial institution (RDFI). This is the bank that houses the receiver’s account. It passes the ACH transaction to the receiver’s account by the required date and handles any exceptions such as insufficient funds or unauthorized transactions.

What is the process for the ACH system?

The process differs depending on whether it’s a debit or credit transaction. A debit transaction goes through the following steps:

- The receiver authorizes a deposit from the originator.

- The originator submits the deposit to its ODFI.

- The ODFI verifies the deposit and sends it (and any other ACH transactions) in batches to one of the ACH operators for processing.

- The ACH operator sends the processed transactions to the receiver’s RDFI.

- The RDFI releases the deposit into the receiver’s account.

- The ACH operator settles the transaction between the ODFI and RDFI.

A credit transaction proceeds a bit differently:

- The originator sends the payment information and authorization to the receiver.

- The receiver submits the information to its RDFI.

- The RDFI verifies the information and sends it (and any other ACH transactions) in batches to one of the ACH operators for processing.

- The ACH operator sends the processed transactions to the originator’s ODFI.

- The ODFI debits the originator’s account, and the RDFI makes funds available to the receiver.

- The ACH operator settles the transaction between the RDFI and ODFI.

What transaction fees are required?

In most cases, ACH debit transfers are free. So when your employer deposits your paycheck into your account, or you pay your electric bill through your bank’s bill pay service, you likely aren’t charged. Expedited bill payments may cost a fee, however.

ACH credit transfers, such as transferring funds between accounts you have at different banks, may cost a nominal fee (typically $3). For example, you may have an account at Bank A and want to send funds to a linked account at Bank B. The fee would only apply to the initial push of funds from the source account, not when you receive the funds in your other account. So, Bank A may charge you for sending the funds, but Bank B wouldn’t charge you for receiving them. Many banks don’t charge an extra fee for transferring funds externally.

Merchants may be responsible for certain fees. Brittingham says there may be a transaction fee that’s based on a percentage of the transaction; it may also be a flat amount. “It really just depends on the payment service you’re using to collect payments.”

How do financial institutions handle ACH transactions?

Here a few notable aspects of Nacha’s Operating Rules regarding how banks deal with ACH transactions:

- ACH debit transactions must be processed by the next business day.

- Banks must be able to process payments the same day they’re sent. However, your bank may consider same-day transfers as “expedited” and charge you a fee.

- Banks have some leeway on when they can hold transferred funds and for how long.

- Financial institutions also have a little leeway with ACH credits. They can choose to have them processed and delivered within one business day or within one to two days.

(If you’re interested in the nuts and bolts of ACH transactions, read more about how they are identified using ACH transaction codes.)

How long does an ACH transfer take to complete?

Unlike wire transfers, which only take a few minutes to a few hours, ACH transfers can take a few business days. The exact completion time for ACH transfers varies based on several factors. For one, network operators process ACH transfers in batches only three times per day. In addition, financial institutions can hold transferred funds upon receipt.

“Rules differ from bank to bank. For example, larger amounts tend to take longer to resolve,” Brittingham explains.

Next, we’ll take a look at common payment scenarios when ACH transactions are used. There are several typical use cases to explore, so we devoted an entire chapter to them.

ACH use cases

Now that you know how the ACH system works, you’re probably wondering about the ways it’s used. ACH touches nearly everyone’s business or personal lives, and we often don’t even realize we’re using it. Below are several use cases, including for-profit businesses, nonprofits, and personal instances.

For-profit businesses

Do you run an e-commerce store that sells physical products? ACH payments are a great option to offer your customers, and they are advantageous for you as well because they’re cost-effective, secure, and processed relatively quickly.

While brick-and-mortar locations may deal mainly with cash, credit cards, and checks, online businesses are primed to accept ACH payments, whether directly or through a third-party service. Many third-party payment platforms use ACH as a funds transfer mechanism, including PayPal, Bill.com, and Stripe.

Businesses that use these services can easily offer customers the option of ACH payments in lieu of credit cards. Though the user interface and features differ from platform to platform, each payment solution uses the same ACH network on the backend. Many of these platforms even enable recurring payments for businesses with subscription-based products or services.

You’ll typically be responsible for a small, flat fee for processing these transactions. Though the fee varies from service to service, it’s typically negligible compared to the variable fee for credit card processing. Check the services’ merchant fees web page or documentation to verify.

Crowdfunding

Crowdfunding falls outside the scope of traditional business interactions because it involves raising capital through a combination of contributors, such as friends, family, customers, and investors. When used in the investing world, crowdfunding isn’t just a one-way transaction.

First, investors send ACH payments to a fundraiser with the amount they want to invest. The fundraiser then invests the money in the manner they initially described. After the investment period is over, the fundraiser disburses the return on investment to the investors via the ACH network. If you recall the ACH transaction breakdown from the last chapter, this means the fundraiser — formerly the receiver — now becomes the originator.

Nonprofits

Much like e-commerce transactions, you can collect donations online via ACH payments. Some donors may not want to use credit cards and would prefer to use their bank accounts to pay you directly. This simplifies the process for them and helps you avoid fees. Offering the option to pay via ACH maximizes monetary support for your cause while minimizing the costs involved to secure that support.

You can integrate your website with payment services like PayPal to make the payment collection process easy. Plus, these services typically have discounted fees for charitable organizations.

Personal use

One of the most common ACH transactions is payroll direct deposits. When people submit direct deposit authorization forms to their employer, they’re giving the employer permission to send their paychecks directly into their accounts through the ACH network.

Another personal use case is using your bank’s bill pay service to pay your monthly mortgage, car loan, or electric bill — basically any recurring payment that pushes funds to a business from your bank account. Alternatively, you can set up a recurring payment directly with your service provider to pull funds from your account. Both methods use the ACH network.

Come tax time, you’ll also see ACH in action if you get a tax refund. Assuming you don’t choose a paper check, the funds will be deposited directly into your bank account. You can thank the ACH network (and your tax preparer) for that.

Last, but not least, is the external funds transfer, where you send funds from one account to another account at a different bank. If you have money at Bank A and connect it to Bank B, then send money in either direction, the funds will transfer over the ACH network.

There are plenty of other use cases, of course, since ACH is a very common payment method. Next up, we take a look at security measures related to online payments.

Online payment security

As the previous chapter explained, there are numerous use cases for ACH. Regardless of where and how users employ ACH payments, one common concern is the security of those payments. For example, more than 7 percent of U.S. adults are concerned that organizations like banks and merchants don’t provide sufficient security to protect mobile transactions.

Below we explore different measures countries are taking to make online payments, in general, more secure, along with a few personal payment examples.

Online payment security regulations

EU PSD2 regulation

A leading security regulation in the payments space is the EU’s second payment services directive (PSD2). Effective September 2019, the point of the directive is to improve the EU’s previously established rules for electronic payments and make the international payment process (within the EU) easier and more secure.

PSD2 rules primarily focus on electronic payments, payment services, and users and providers of those payment services. The directive also changes the payments market by allowing more businesses to enter it, enhancing consumer rights, and limiting interchange fees. All these aspects play a part in making the payments space more competitive and giving end consumers a greater variety of payment services.

Another important aspect of PSD2 is the focus on strong customer authentication (SCA) — a security approach that requires two of three verification elements to authorize a payment:

- Knowledge: something only the user knows, like a password or a pin

- Possession: something only the user possesses, such as a mobile phone or a debit or credit card

- Inherence: something that identifies the user biologically, such as facial recognition or a fingerprint scan

SCA seeks to reduce card fraud, specifically in the problematic category of card-not-present transactions (when customers aren’t able to physically present a card to the buyer). This is meant to help build customer confidence in online payment transactions.

If you’re a business operating in the EU or serving EU customers, take a look at our lengthy guide on becoming PSD2 compliant.

U.S. Federal Reserve efforts

In the U.S., the Federal Reserve — the central banking system of the country — is continually seeking ways to improve and foster the efficiency, integrity, and accessibility of the U.S. payment system. Together with public and private organizations in the payments industry, the Federal Reserve has in recent years focused on five outcomes: speed, security, efficiency, international payments, and collaboration.

For security, the main goal is to reduce fraud risk and advance the safety and resilience of the payment system by focusing on payment security vulnerabilities and reducing the cost and prevalence of those vulnerabilities. Like the EU’s PSD2, the Federal Reserve wants to raise public confidence in electronic payments.

Personal payment security

Online payment security isn’t just applicable in B2B and B2C contexts. Many financial exchanges conducted online are personal and don’t involve a business. Those transactions need to be secure, too.

One example is parents collecting payments for their children’s fundraisers. Sales of fundraiser items — toys, car washes, chocolates, etc. — could take place anywhere, from a company event to a friendly gathering, and payments can be made online. Whether your coworkers and friends pay through an app like Zelle or another payment service, they’ll end up going through the ACH network or a credit card processor. Either way, those payments need to be secure.

As another example, consider how often you split the check with friends at restaurants. Whether you decide to do equal shares or exact contributions, their payments to you for their meals through an app should be secure.

With security out of the way, let’s move on to our last chapter, which covers a useful way to collect ACH payments: online forms.

Collecting ACH payments with online forms

Throughout this guide, we’ve talked a lot about ACH and how it works. But as a business owner, your main concerns are finding the best way to sell your products and services and, of course, collect payments. Jotform helps you do both.

Jotform is an easy-to-use online form builder that caters to businesses across many industries. Using Jotform’s thousands of prebuilt templates, you can give your customers a simple way to provide their information and pay you securely.

Jotform partners with a number of payment processors to provide you with a variety of methods to accept ACH and other types of payments:

These are just a few of the processors you can use with your forms. Check out the full list of 30+ payment processors to see whether your preferred processor is available through JotForm.

Jotform + ACH

Payment forms for several use cases

Do you sell unique artwork online? What about T-shirts, custom jewelry, children’s clothes, or phone cases? If you’re an e-commerce merchant who sells products online, you can easily create forms for whatever you sell. Just check out one of our many product order forms.

The same applies to services — whether you’re a marketing consultant, commission-based artist, or photographer. You can use our many payment forms to describe and sell your services to clients, quickly and easily. We also have a number of forms for subscriptions if you sell services on a recurring basis, like consulting retainers.

Serious about security

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements put together by the payment card industry to ensure all companies that process, store, or transmit credit card data maintain a secure environment. The standard was created with the help of major credit card brands, including Mastercard, Visa, Discover, American Express, and JCB.

Jotform is the only online form builder that’s PCI DSS Service Provider Level 1 compliant (the highest level of compliance). And while this designation specifically deals with credit cards, it signifies our commitment to payment security, which extends to ACH payments.We hope this guide has helped you learn more about ACH. Start accepting ACH payments today with a form of your own.

Stripe ACH with Jotform

ACH payments are practical, safe, and convenient. Implementing them into your sales model is a great idea.

Stripe, one of the most popular payment platforms worldwide, includes an ACH gateway that Jotform proudly hosts an integration with. You can use this integration to sell products, collect donations, and receive custom payments online.

How to set up Stripe ACH with Jotform

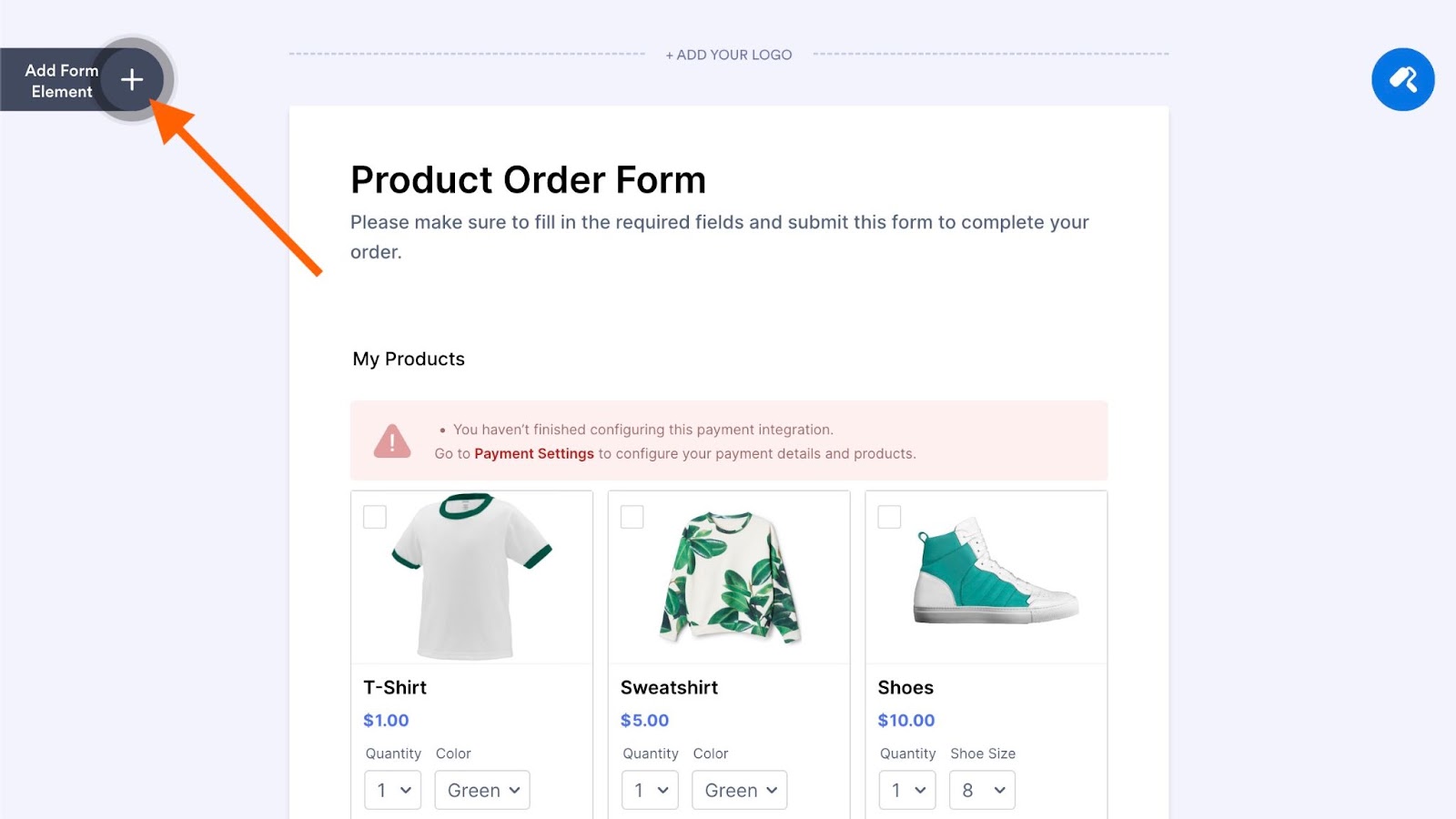

- In Jotform’s Form Builder, click the Add Form Element button to the left.

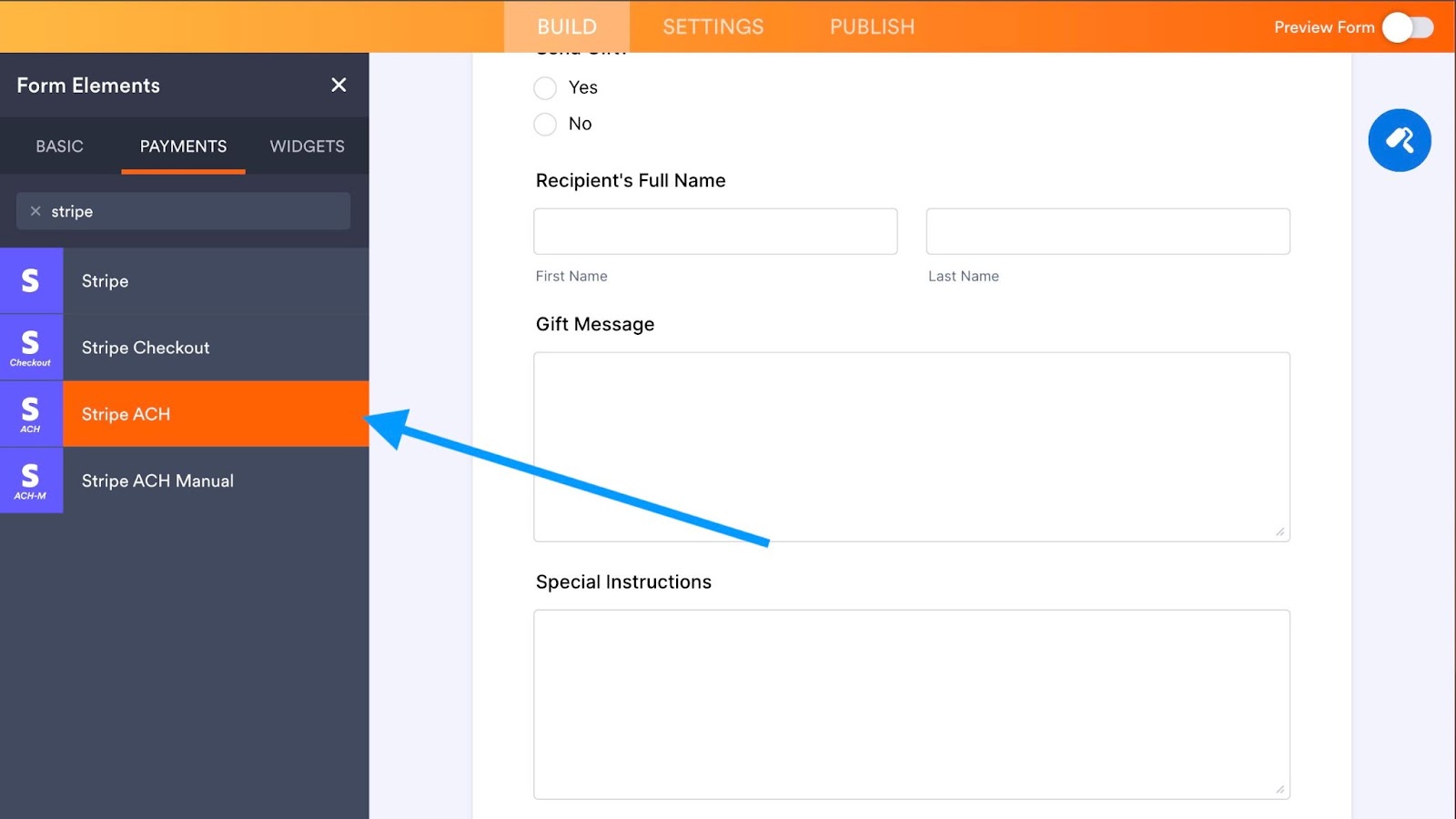

- Once the menu opens, go to the Payments tab.

- Search for and select Stripe ACH. You can also drag and drop it into your form.

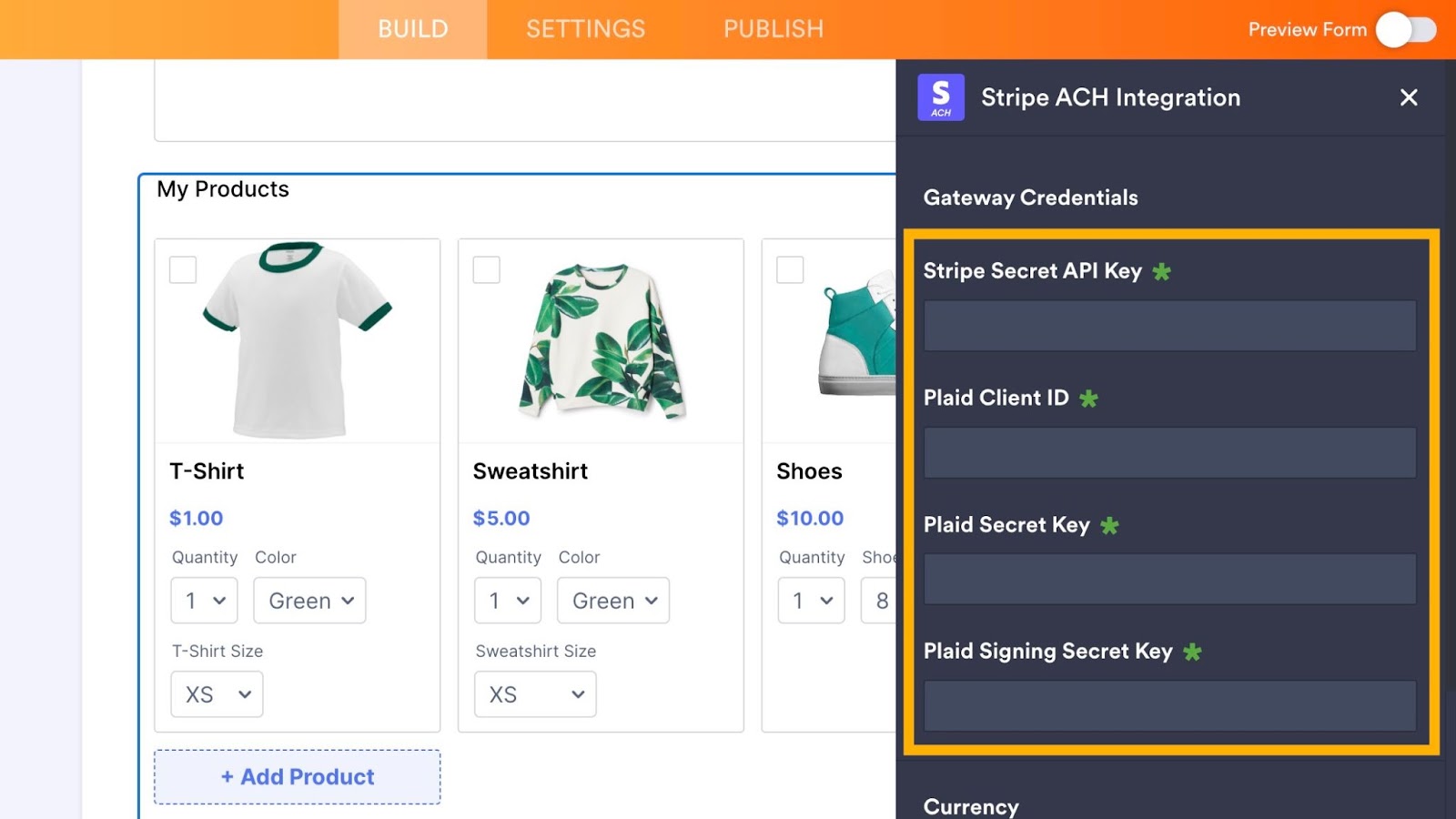

- In Payment Settings, enter the following:

- Stripe Secret API Key

- Plaid Client ID

- Plaid Secret Key

- Plaid Signing Secret Key

- Specify your currency.

- Select the Payment Type, whether it’s Sell Products, User Defined Amount, or Collect Donations.

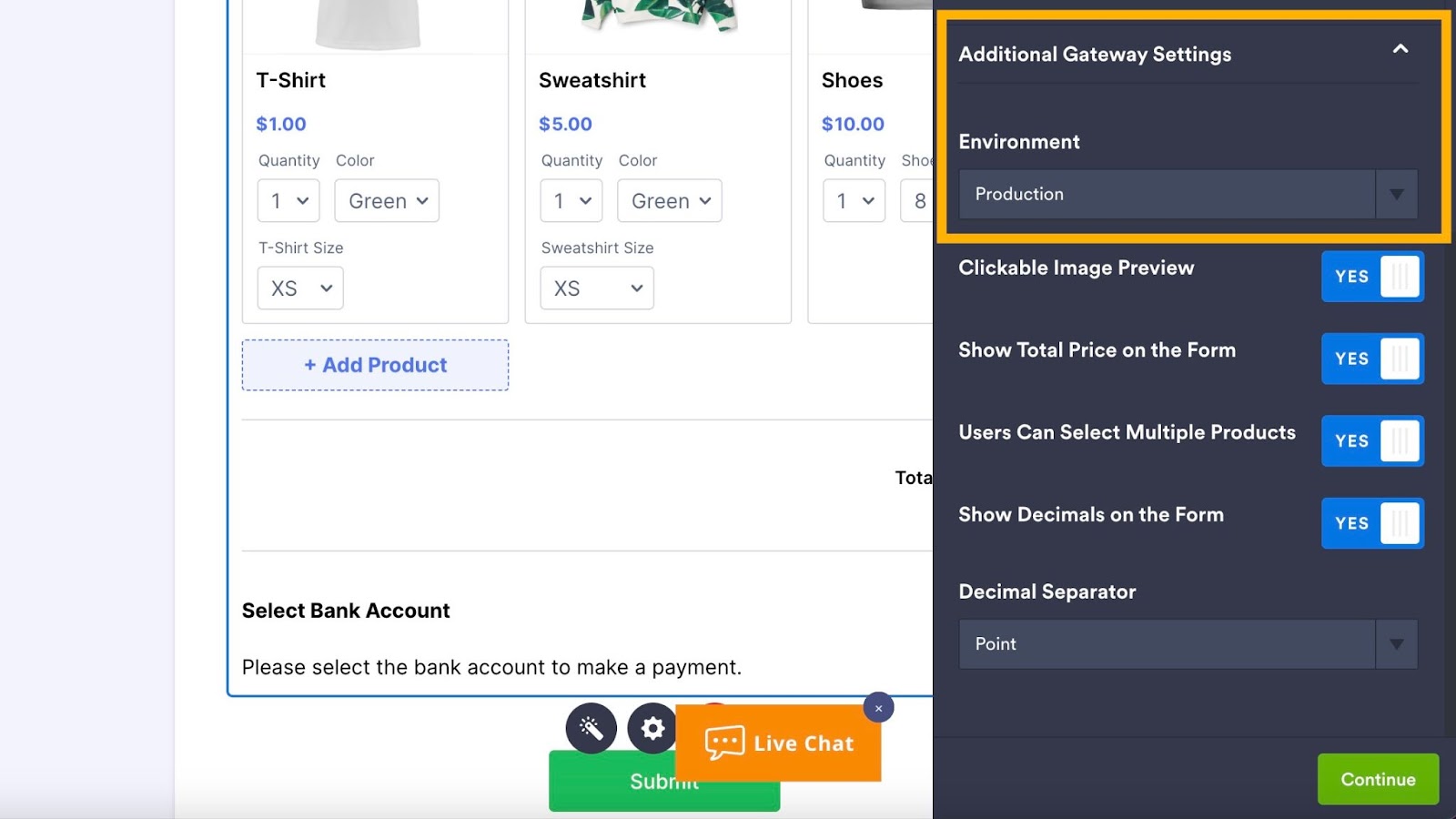

- In Additional Gateway Settings, select Sandbox, Development, or Production for the environment. Learn about the differences between these environments.

- In the same settings menu, toggle on or off additional options such as Clickable Image Preview, Show Total Price on the Form, and Users Can Select Multiple Products.

- Click the Continue button.

The benefits of using Stripe ACH with Jotform

There are many reasons why using our Stripe ACH integration is a great idea. Here are just a few:

- Easy setup. You simply need to add a few details so we can connect your form to Stripe.

- No additional transaction fees. Jotform doesn’t charge you for using our integration; you only need to pay Stripe’s fees.

- PCI DSS Service Provider Level 1 certified. With Jotform’s security features, you can trust that your ACH payments are secure.

Just a note: When you use our Stripe ACH integration, Stripe will connect to customers’ bank accounts using Plaid.

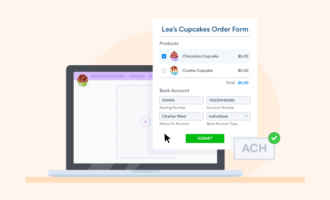

Square ACH with Jotform

Another payment platform that’s great for ACH payments is Square, and fortunately, Jotform also has a Square integration as well. Use the Square ACH option to conveniently sell products, collect donations, and receive custom payments online.

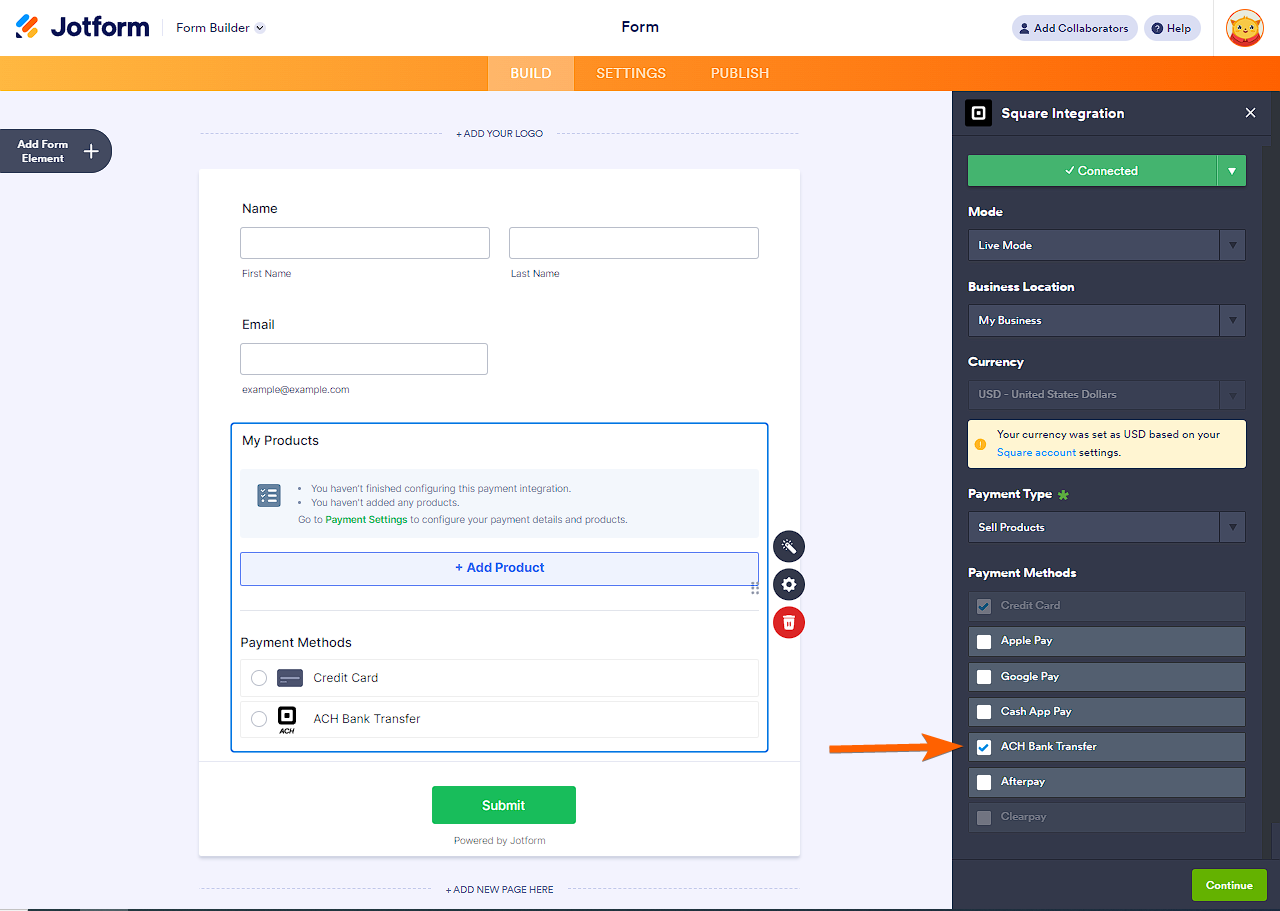

How to set up Square ACH with Jotform

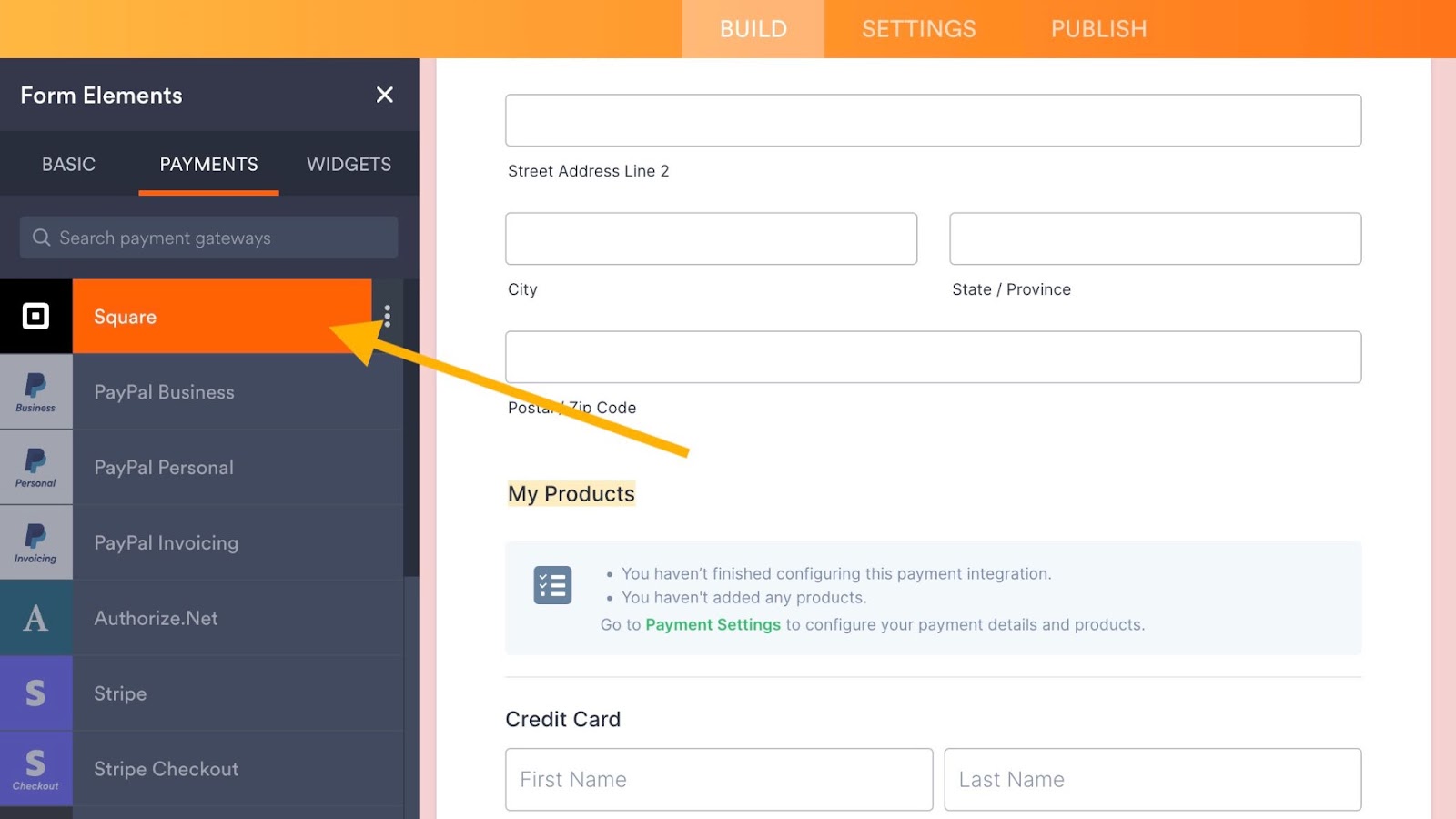

- In Jotform’s Form Builder, go to the Payments tab.

- Search for and select Square. You can also drag and drop it into your form.

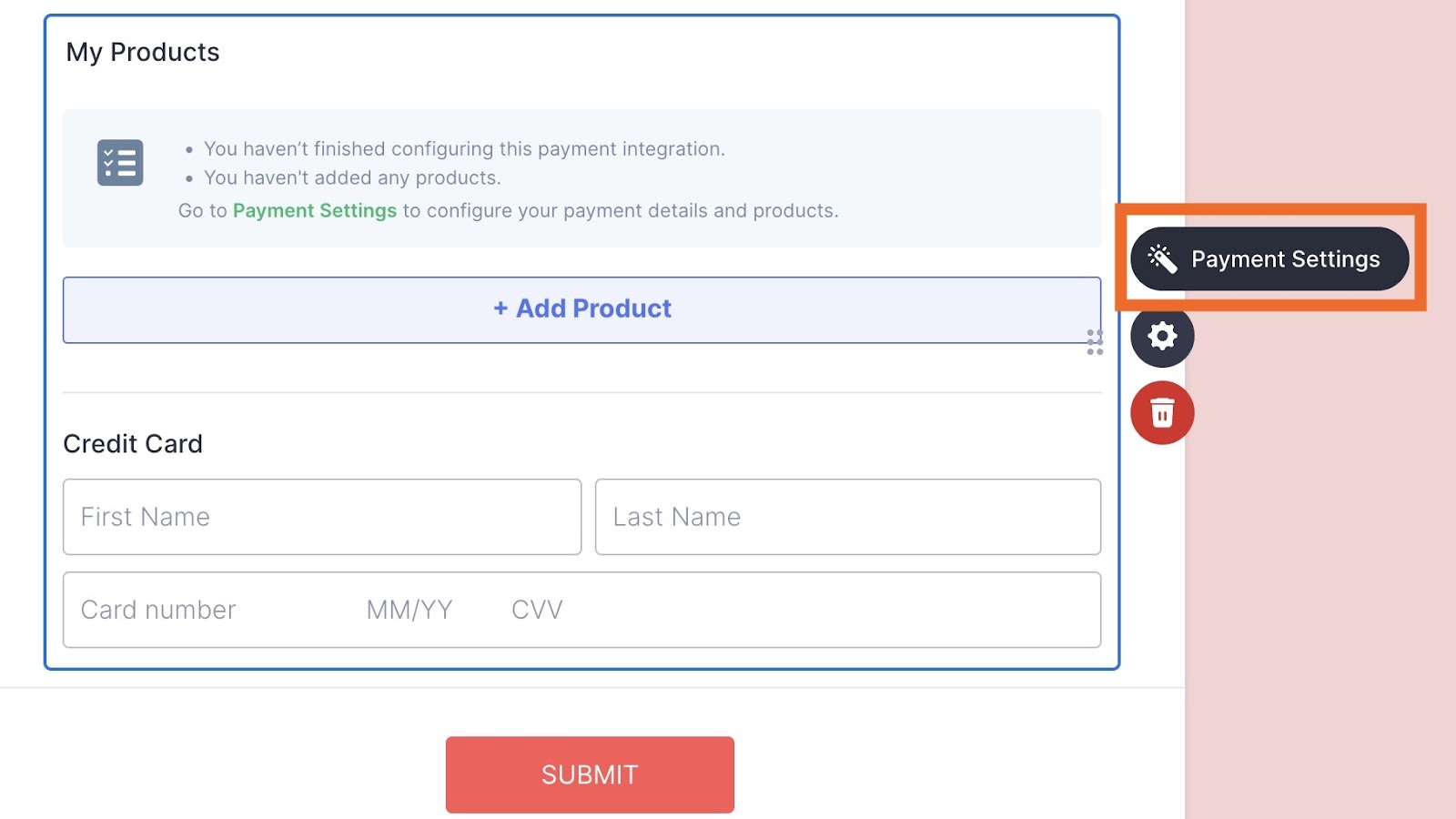

- Open Payment Settings.

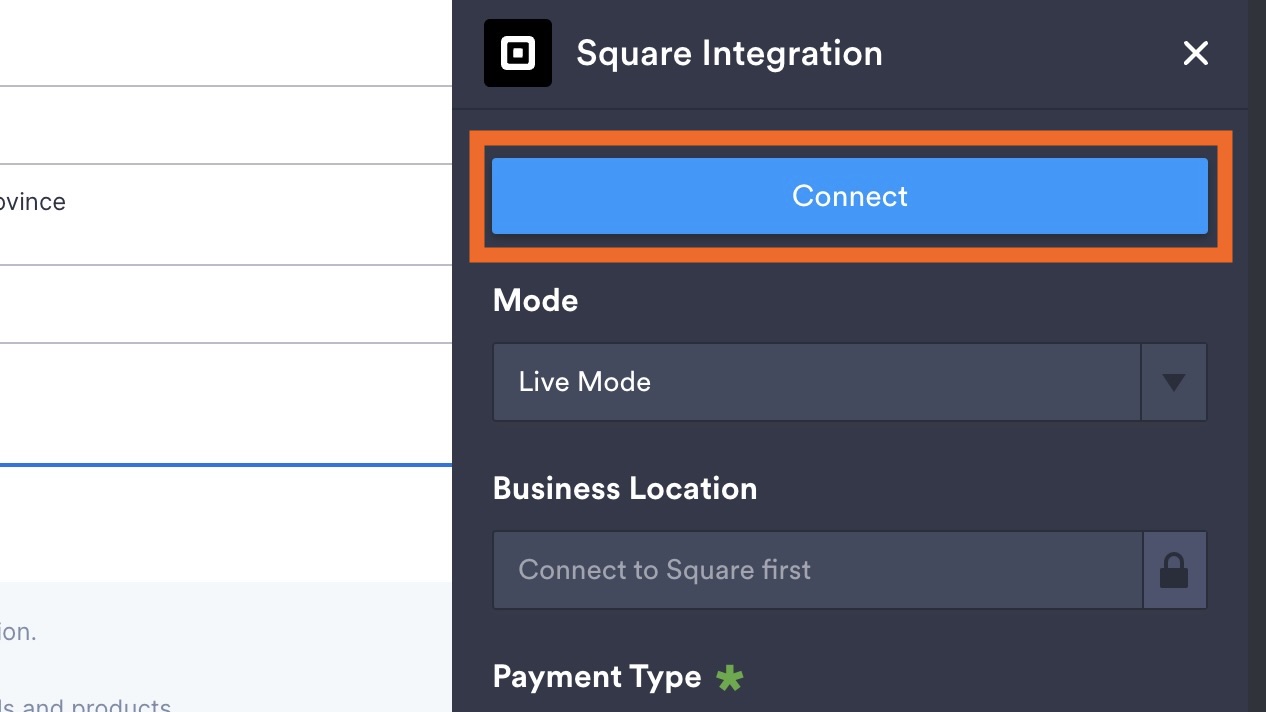

- Click on the Connect button to enter your Square account details and connect it to your form.

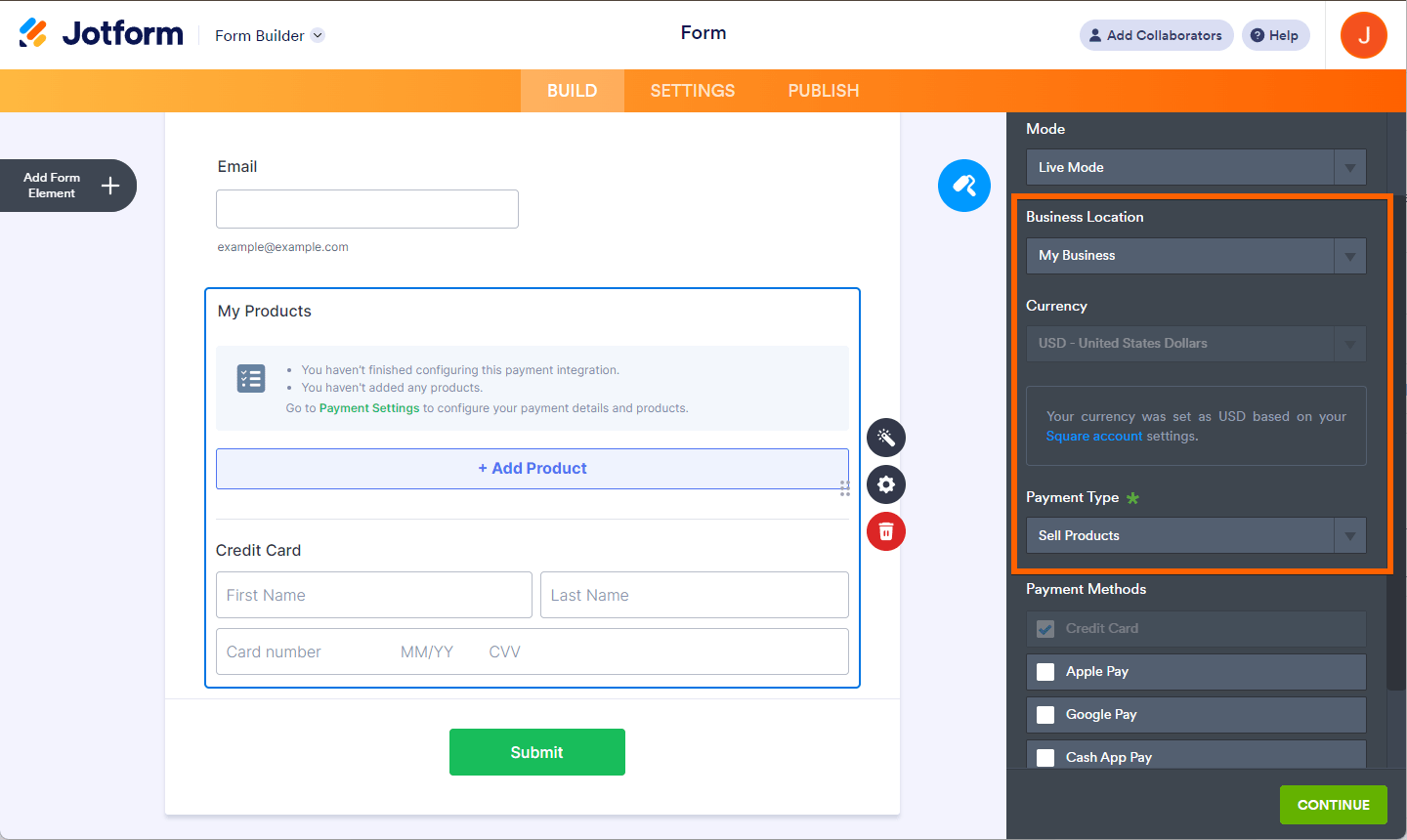

- Set up the following:

- Business Location: Choose the location of your business. (It should match what’s in your Square account.)

- Payment Type: Choose Sell Products, Sell Subscriptions, User Defined Amount, or Collect Donations.

- Under Payment Methods, select ACH Bank Transfer.

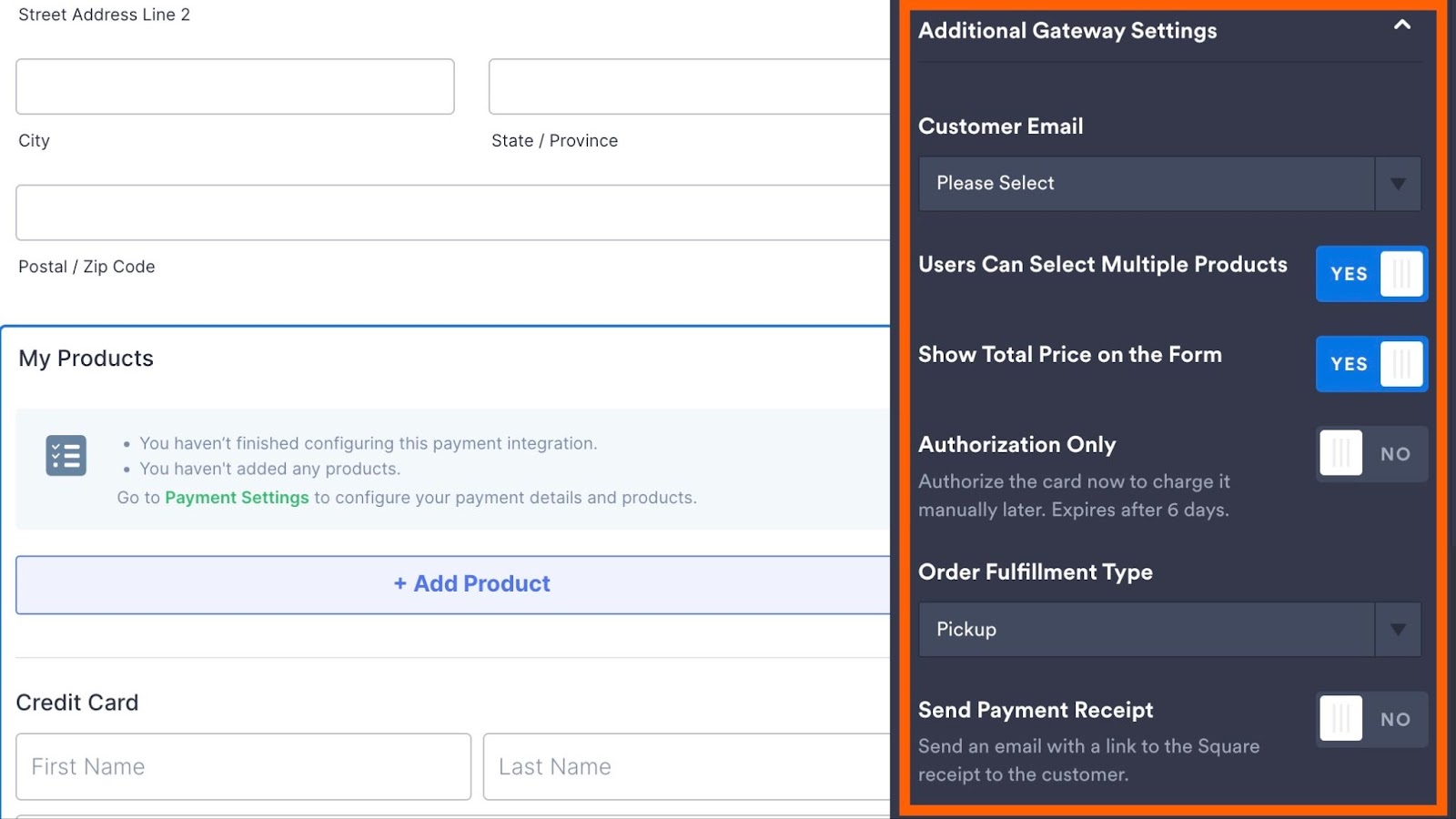

- In Additional Gateway Settings, you can adjust options like Customer Email, Order Fulfillment Type, Send Payment Receipt, Authorization Only, and more.

- If you’re selling products, click Continue to add your products. On the other hand, if you’re gathering user defined amounts or donations, click on Save.

The benefits of using Square ACH with Jotform

Our Square ACH integration can improve the payment process for you and your customers. Here are just a few reasons why:

- Simple setup. Connect your Square account to Jotform and customize your settings in a few easy steps.

- Faster payments. While you can always accept credit card payments from customers, ACH can be quicker since debit transfers must be processed by the next business day.

- Safer and easier for customers. Some customers feel more at ease using ACH than entering card information because less information is at risk. More payment options also give customers more freedom to choose.

Just a note: When you use our Square ACH integration, Square will connect to customers’ bank accounts using Plaid.

Send Comment:

1 Comments:

More than a year ago

I had an email that linked me to your sight from the ach clearing house i filled out subscription and followed all the steps. Then i was contacted by prime fortes bank new york. The funds were deposited into there bank. Then they asked for some code that i didn't have. I tried to get it but in the mean time my account was deactivated becuase of a fee that i dont have the money for inorder to recieve the code . what do i do.