Income surveys can help your organization uncover details about a particular group’s income. For example, the information can be used to determine appropriate pricing for your company’s products or services. However, writing survey questions that people will answer isn’t as straightforward as it seems. After all, not everyone likes talking about how much money they make.

In this article, we share 12 income survey questions you may want to use on a questionnaire, as well as answers to some frequently asked questions about this type of survey. But first, let’s take a look at some scenarios in which income data might be helpful.

Why income surveys are helpful

Businesses of any kind can benefit from conducting occasional income surveys. Gaining a better understanding of your customers’ financial situation can help your organization with everything from product pricing to marketing.

For example, if your company wants to figure out a pricing strategy for a particular product or service, you might ask your target audience how much money they make or how much disposable income they have . Similarly, a bank or lending institution may need to know the income of a client so it can evaluate the level of risk in offering them a loan.

Income surveys can also benefit nonprofits and government agencies. A nonprofit might ask about the income of potential donors to get a better idea of how they can raise more funds for their cause. Public agencies may also conduct surveys to determine specific areas where their services are most needed.

While income surveys can be helpful, it’s important to remember that finances can be a sensitive topic. This means some survey respondents may not complete the survey fully or at all. Worse, they could populate it with false answers that can skew your data.

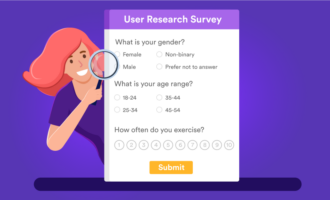

Income questions aren’t restricted to income-specific surveys; sometimes they are included in broader demographic surveys. Regardless of the context of the survey, these questions can offer valuable insight into the finances of a particular group to help you make important decisions.

12 revealing income survey questions

When developing your income survey, you should have a specific goal in mind. What do you most want to know about your survey audience? Tailor the questions to that goal.

For example, if you want to learn more about the sources of income for a particular group, then ask questions on that topic only. Asking too many questions unrelated to your goal may frustrate survey respondents, thereby preventing you from getting the insights you’re looking for.

Here are 12 income survey questions you can use, depending on your survey goals.

- Which of these options best describes your household income for the past 12 months?

- $0

- $1 to $9,999

- $10,000 to $24,999

- $25,000 to $49,999

- $50,000 to $74,999

- $75,000 to $99,999

- $100,000 to $149,999

- $150,000+

- I prefer not to answer

- Which of these options best describes your gross income for the past 12 months?

- $0

- $1 to $9,999

- $10,000 to $24,999

- $25,000 to $49,999

- $50,000 to $74,999

- $75,000 to $99,999

- $100,000 to $149,999

- $150,000+

- I prefer not to answer

- Which of these options best describes your gross income for the past month?

- $0

- $1 to $1,999

- $2,000 to $3,999

- $4,000 to $5,999

- $6,000 to $7,999

- $8,000 to $9,999

- $10,000+

- I prefer not to answer

- How many sources of income do you have?

- 0

- 1

- 2

- 3

- 4

- More than 4

- I prefer not to answer

- Do you have sources of income other than your salary?

- Yes

- No

- I prefer not to answer

- Did you receive Social Security benefits in the past 12 months?

- Yes

- No

- Not applicable

- I prefer not to answer

- Did you receive disability benefits in the past 12 months?

- Yes

- No

- I prefer not to answer

- Did you receive alimony in the past 12 months?

- Yes

- No

- I prefer not to answer

- Did you receive child support in the past 12 months?

- Yes

- No

- I prefer not to answer

- Did you receive any monetary gifts in the past 12 months?

- Yes

- No

- I prefer not to answer

- Did you receive any income that is exempt from federal tax in the past 12 months?

- Yes

- No

- I prefer not to answer

- Did you receive any income from investments such as stocks or properties in the past 12 months?

- Yes

- No

- I prefer not to answer

Jotform: A great way to conduct income surveys

Jotform is a leading survey maker that you can use to create income surveys, demographic surveys, finance surveys, and so much more.

With thousands of survey, form, questionnaire, and poll templates, it’s easy to create the data-gathering tool you want within minutes. Just select a template and customize the text, structure, colors, images, and more to align with your specific needs. Or you can build your form from scratch with Jotform’s easy-to-use drag-and-drop builder.

You can also distribute surveys with Jotform via email, link, or QR code. You can even embed a survey on your website with an auto-generated code.

To analyze your survey responses, use Jotform Tables, a powerful spreadsheet software that enables you to see, track, and manage all your survey data. If you want visual reports from the survey data, Jotform Report Builder can help you create graphs and charts. Jotform also offers a number of other useful tools, such as Jotform Apps, a no-code app builder, and Jotform Sign, an e-signature tool.

Whether you’re creating income surveys or something else, Jotform has you covered so you can get the insight you need to make important business decisions. Get started today!

FAQs about income survey questions

Be sure to state how you will use the data, because many people feel nervous about sharing their personal financial information with others. For example, if you’re going to use the data to determine how to set your prices for a new product line, let your survey respondents know that at the top of the survey.

In addition, keep the survey short and direct so respondents don’t feel overwhelmed when filling it out. If your survey is too long, respondents may abandon it midway through.

The best way is to give them an option to opt out of answering a particular question. This way, they may answer some questions but opt out of the ones they don’t feel comfortable with. If you require answers to all questions, you run the risk of not getting any answers at all.

It depends on the reason you’re undertaking the survey and the goals you want to achieve. Survey respondents may not feel comfortable providing exact figures, or they may not know them off the top of their heads. It’s usually best to go with ranges in an income survey to encourage responses from your audience.

There are many different sources of income: employment, self-employment, property, investments, royalties, transfers, and more. Ask only about the types of income that are relevant to your goal to avoid giving respondents survey fatigue.

This guide is for survey builders, marketers, pricing analysts, lending and compliance teams, nonprofits, and public agencies that require dependable income insights.

Send Comment: