Jotform’s payment integrations allow you to add sales tax to any product or service you sell.

This feature is available for the following payment gateways:

- All *PayPal* Payment Elements

- Square

- Square ACH

- Stripe

- Stripe Checkout

- Stripe ACH

- Stripe ACH Manual

- Afterpay

- Clearpay

- Authorize.Net

- 2CheckOut

- Purchase Order

- CyberSource

- BluePay

- eWay

- PayU

Before proceeding, please keep in mind that this feature is unavailable for Subscription and Donation based payment types.

Below are the steps to add a tax rate to your payment form.

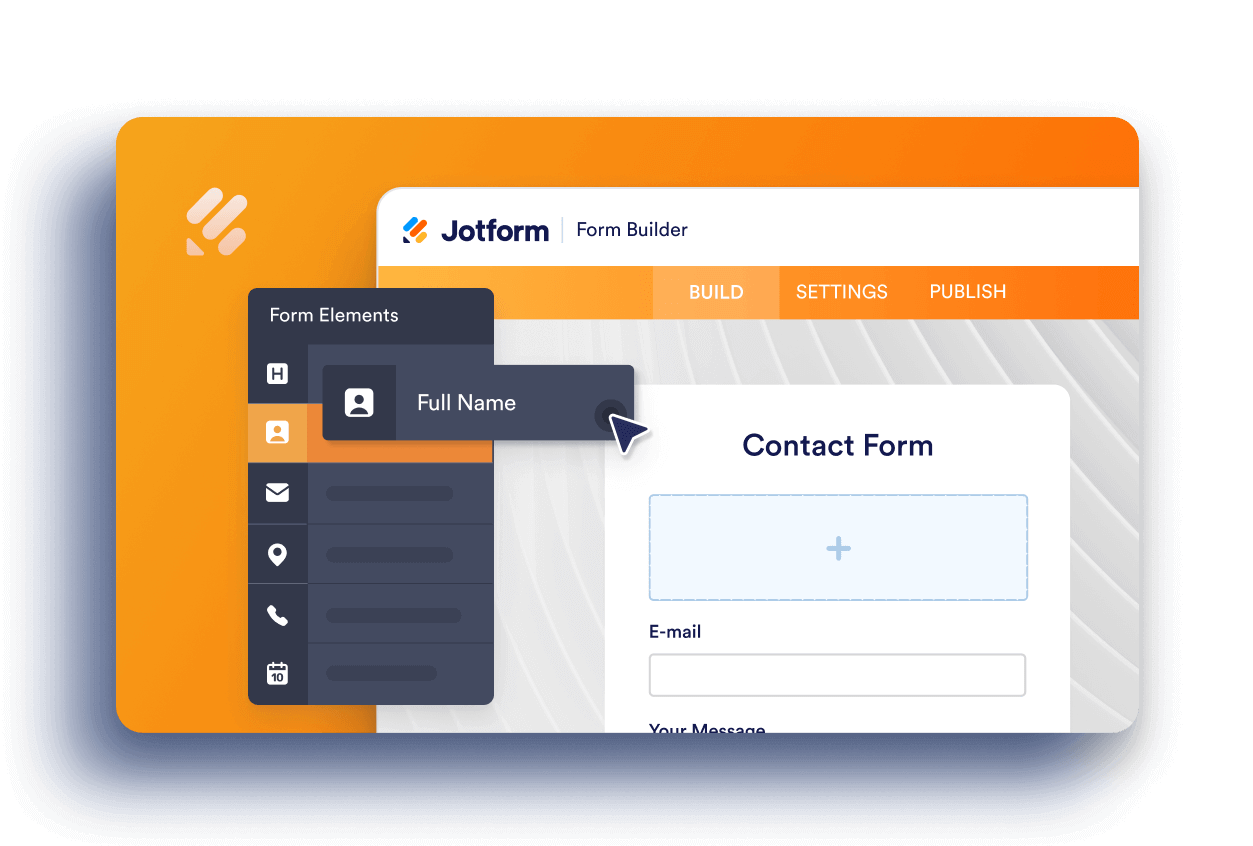

- In the Form Builder, click the payment element.

- Click the Payment Settings (wand icon).

- Go to the Tax tab and set up the following:

- Base Tax Rate

- Exempted Products. Uncheck the product items that you wish to be excluded from being taxed.

- The Tax Text on the Form

- Set Tax Options from a Location Field

Set Tax Options from a Location Field

This option allows you to tax product items based on a location field. You can use and select a dropdown element on this option or an address element. If your form doesn’t have any of these elements, the option is disabled for you.

When selecting the dropdown element or the address: Country options, the dropdown options or the states/provinces are listed, and you only need to enter their tax rates, but when selecting the address: State / Province option, you must enter both the states’ full name and tax surcharge rates.

Send Comment:

4 Comments:

150 days ago

Some of my products are taxed, but many of my buyers have tax exempt status. How do we include a tax exempt option with certificate upload for verification? I am using Authorize.net

More than a year ago

Are you going to be adding functionality for different tax amounts on different product types. E.g. all products in British Columbia Canada have 5% GST, but only some products also have an additional 7% PST - right now it doesn’t seem like your settings allow for this??

More than a year ago

Hi, thank you for the tutorial.

How do I add different taxes for different products?

Because I tried using the option Set Tax Options but I am not sure how it works.

Can you please help me?, thank you!

More than a year ago

I see that the only possibility is to enter your product prices EXCLUDING tax (which added on the total).. is that correct? Because I would like to have my product prices including tax. Otherwise you have strange prices (not rounded off) which means the coupon price will be different too.