Salesforce is a powerhouse in the world of customer relationship management (CRM) software, boasting a substantial market share. The platform enables businesses of all sizes to optimize their sales processes, manage customer interactions, and drive growth. One of the key contributors to Salesforce’s success is its ability to integrate seamlessly with various third-party applications, including payment gateways.

Salesforce payment gateways serve as a link between Salesforce Billing and the customer’s bank during payment transactions. They facilitate the secure and efficient transfer of payment information.

Here’s a breakdown of how to add them, as well as a look at the top Salesforce payment gateways available.

Steps for adding payment gateways in Salesforce

Salesforce payment gateways ensure that payments for an account’s invoices flow with ease from customers’ banks to the designated records in Salesforce. While developers usually handle the technical aspects of setting up these connections, it’s important to know the basics of how Salesforce payment gateways work.

Understanding Salesforce payment gateway integration

First, your developers will need to configure Salesforce Billing’s application programming interface (API) to enable communication between Salesforce Billing and the payment gateway. This setup allows Salesforce Billing to send customer payment information to the gateway and record the results of the gateway-bank interaction within Salesforce Billing objects.

There are two scenarios in which Salesforce Billing contacts the payment gateway:

- When an electronic payment run includes at least one eligible invoice

- When a user submits a payment through the Salesforce Payment Center

Next, you’ll need to create a payment gateway record and assign it to a payment method. The specific fields and values required vary according to the external payment gateway being linked. If you’ve installed a payment gateway package, you’ll see fields tailored to that package’s requirements.

In Salesforce Billing, you can see a Salesforce Billing payment gateway object in the “Payment Gateway” field. This object doesn’t directly communicate with the customer’s bank or handle payment data storage, but it tells Salesforce Billing which external gateway to contact — passing on the necessary data for the communication.

Understanding the payment gateway communication process

So, what does all this mean? Here’s an overview of the communication process that occurs in Salesforce payment gateways:

- Initiating communication: Salesforce Billing initiates communication with the external payment gateway when a payment is triggered, either through a payment run or in the Payment Center.

- Payment run vs Payment Center: During payment runs, Salesforce Billing creates the transaction before initiating communication with the gateway. For Payment Center transactions, the transaction is created following the gateway’s response.

- Transaction handling: While your developers maintain the payment gateway integration, you’re responsible for ensuring that funds are allocated correctly after a successful transaction. You’ll also need to take corrective measures if a transaction fails.

Ultimately, integrating payment gateways into Salesforce involves setting up API configurations, understanding when Salesforce Billing contacts the gateway, and using integration packages, if needed. By following these steps, you can ensure a smooth payment process within your Salesforce Billing system.

Top 3 Salesforce payment gateways

Salesforce has partnered with some of the most reliable and well-known online payment gateways. Here are three of the best ones:

1. Stripe

Stripe has global reach, with a foothold in over 40 countries. What’s more, Stripe facilitates payments and currency transfers in more than 135 currencies. Known for its user experience (UX) and user interface (UI), support for recurring payments, robust security measures, and extensive checkout customization options, Stripe is often considered the developer’s choice of payment gateway.

2. PayPal

As one of the pioneers in the payment provider industry, PayPal is available in over 200 countries and regions and supports 25 currencies. In addition to receiving and sending payments, PayPal also schedules payments, facilitates the creation of online invoices, and more — making it a versatile option.

3. Square

Square initially gained recognition as an in-store payment service provider, later expanding into online payments and point-of-sale systems. The platform offers exceptional options for marketing and loyalty opportunities and doesn’t require coding to set up. But there’s one catch: Although the platform is accessible in eight different countries, Square doesn’t allow you to accept multiple currencies.

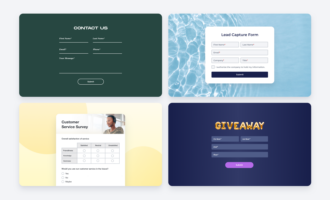

Integrations for even more efficient payment collection

A Salesforce payment gateway is just one of the many tools you can use to make your payment processes more efficient. Jotform, a versatile form-building and data-collection solution available on the Salesforce AppExchange, can further enhance payment processes. You can use Jotform to create custom branded forms to collect orders, event registrations, and more.

With Jotform’s Salesforce integration, you can automate your workflows even further, eliminating the need to manually enter data for product orders, event registrations, and more. Jotform also integrates with 25-plus payment gateways, so you can use it to collect payments right from your forms as well.

Salesforce payment gateways done right are a secure and efficient way to handle payments by helping simplify payment collection, streamline operations, and strengthen customer relationships.

Photo by cottonbro studio

Send Comment: